The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

Relief rally quickly exhausted by inflation and Ukraine concerns…where next?

- Equity relief rally short lived as bond yields blew out again, 10 yr yield breaks 2% level

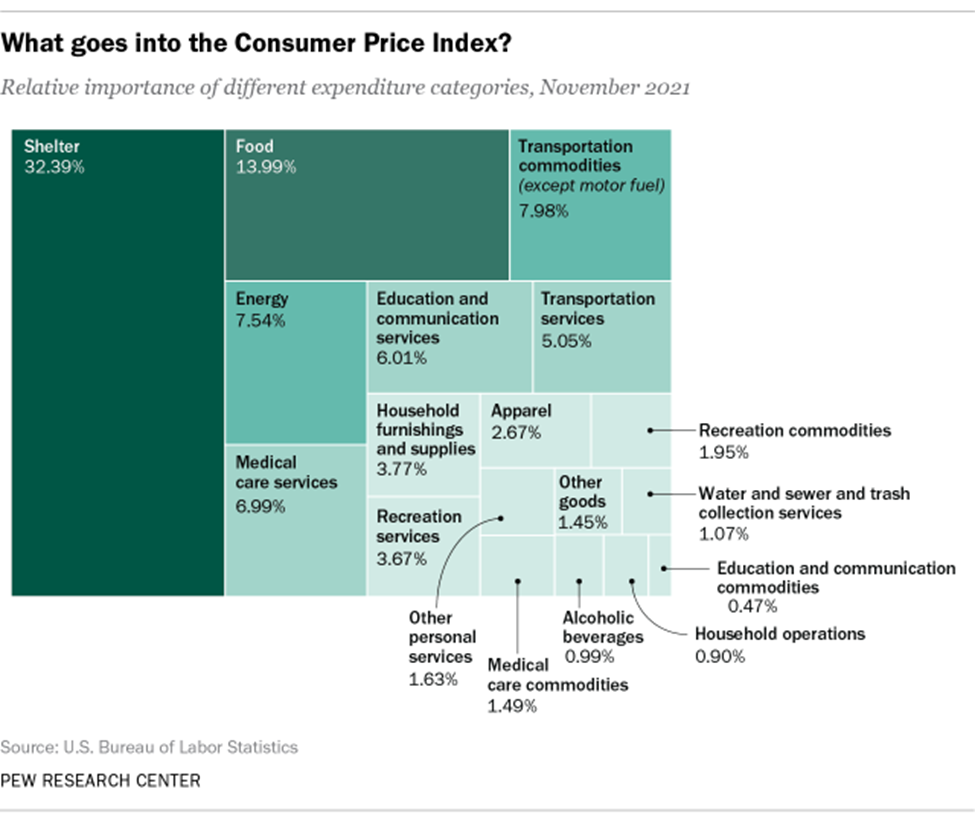

- Inflation concerns continue post latest CPI print of 7.5% increase, highest since Jan 1982

- CPI print highest in 40 yrs – driven by usual suspects – used cars, gasoline, home goods, food

- Shelter is largest component of CPI, owner equivalent rent; is still fairly subdued, up only 4%

- Inflation figures lead to concerns of Fed policy mistake – rate hikes, taper, M2 reduction

- Credit spreads are widening finally – high yield ETF (HYG) down 5% YTD vs. AGG off 3.8%

- In 2016, spreads widened as energy companies came under pressure from lower oil prices – this is different with crude at $90!

- Trucker freedom convoy in Canada and proposed US convoy will further impact supply chain

- Fed will see one more inflation print before next meeting in mid-March…

- Will the first hike be a buy the rumor, sell the news event…feels like bond market participants are all on one side of the boat for higher rates…

Earnings are behaving despite bouts of single stock volatility…

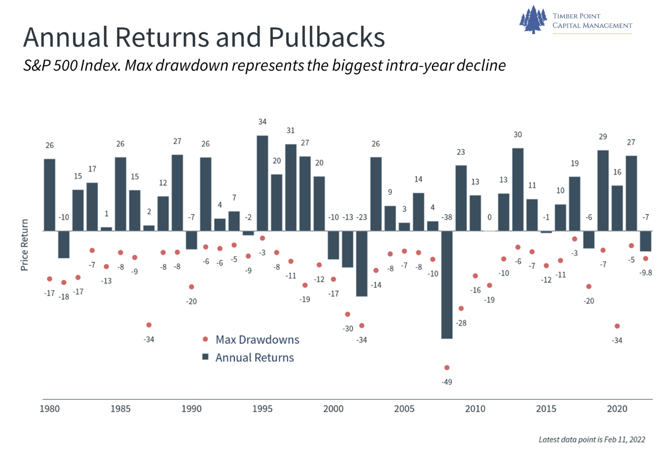

- Negative sentiment provided support for quick 9% rebound in SPX 500 off 1/24 intraday low

- Inflation prints and Ukraine concerns took steam out of rally…as did resistance at 50dma

- Earnings continue to impress…as of 2/11, 72% of SPX 500 has reported, 77% beating earnings estimates by avg 8.6%…(Factset)

- Both numbers above are in line with 5-year averages of 76% and 8.6%

- EPS growth for 4Q21 estimated at ~ 30%, if holds will be 4th straight quarter of eps growth > 30%

- FAANG earnings a mixed bag – Meta (FB) impacted by iOS privacy standards, NFLX lower sub’s

- FAANG: GOOG strong search/Youtube results, AMZN strong profits, AAPL #’s solid in all areas

- We are interested in FB…near term growth impacts and capex increases reflected in valuation

- Interesting questions: can homebuilders perform in a higher interest rate environment?

- Can financials continue outperformance in rising but flattening yield curve environment?

- What does SPX 500 eps growth look like in 2022 – we know it is slowing, to what level?

- Energy is up 25% YTD?? With crude approaching $90, is good news baked in…Ukraine wild card

- Bitcoin bounced with equity market post 45% decline in 3 months…not an uncorrelated asset

- We see US equity market being pulled by Fed action, inflation prints and earnings guidance

- Ultimately, investors need to gain confidence that Fed can engineer soft landing for economy

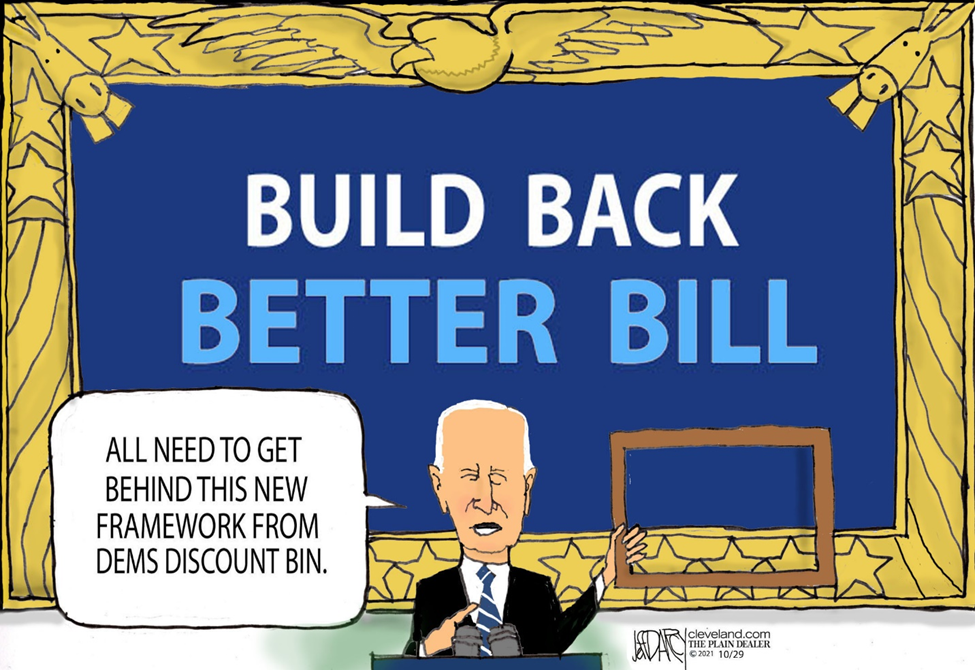

US Politics: BBB is now “Biden Better Bend” if he wants legislation…

- Ukraine has taken the focus off D.C. legislative efforts…focus now turning to spending bill

- Ukraine threat is real, but expect to have only short-term market impact; crude rally continues

- Gov’t funding set to lapse 2/18, the “can” will be kicked down the road via continuing resolution

- Bite-size “BBB” items appear to be the new strategy, will require rework and Manchin buy-in

- Progressives will not warm to Manchin; Republicans will do no favors before mid-term elections

- Will Biden “bend” ala Clinton or “double down” ala Obama post their mid-term routs?

- Biden looking for new issues to connect with electorate…visits NYC to talk guns and police

- Republican’s “Contract with America” could be in the offing from House leadership

- China and Russia show growing cooperation…Taiwan threat is real, would have market impact

International markets showing resilience YTD…a change in the offing?

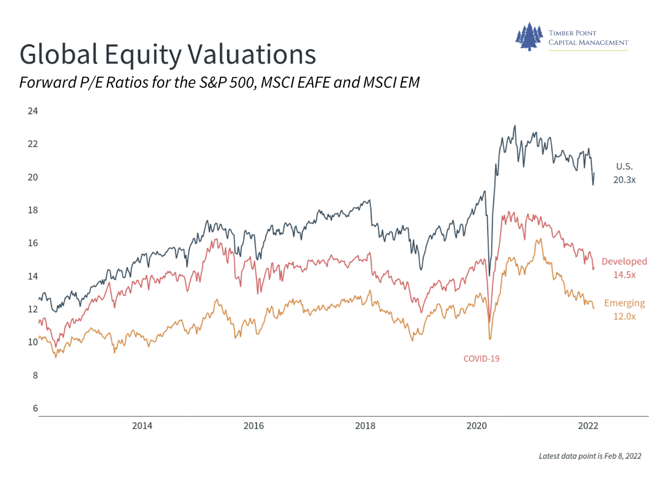

- US markets continue to trade at valuation premium to developed and emerging markets

- YTD, Intl markets have outperformed US: SPX (7.3%) vs. EEM .7%, EAFE (2.4%), ACWI (5.2%)

- China market is 30% of EEM, was big detriment in ’21, stable thus far in ‘22

- China gov’t actions/statements vs. technology companies have slowed in ‘22

- European tech weights are less than SPX – Europe 9%, UK 1%, Germany 14%, France 7%

- Commodity led markets are outperforming on oil price – Russia, Brazil, Chile, Peru

- Monetary regime in US is supportive, but Japan/Europe have had near zero/negative rates

- Global economies are moving past Covid, expect cross border transactions to increase

- Dollar appears stable, Fed has been behind the curve vs. other major economies on rates

- EM central banks are focused on exchange rate and defending the currency

- US is the innovation economy…valuation is important, but investors want eps growth also

Recent Comments