The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin.

The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

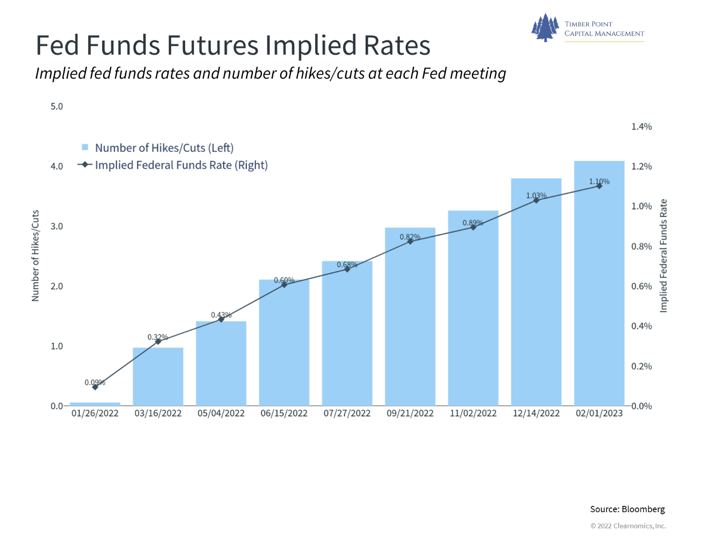

Latest inflation readings largely ignored by the bond market…

- Bond mkt performance post 1st week 2022 ranks 5th worst for full year returns

- CPI print of 7% is largest since June 1982, but largely old news

- CPI forcing Fed’s hand to accelerate rate hikes/tapering…”intentionally hawkish”…

- How long can used cars (up 37.5%) and energy (up 30%) continue higher?

- We believe Fed policy in 2022 may be less hawkish than current sentiments indicate

- Is the Fed being politicized? Dual mandate is price stability and max employment

- Why is Powell noting green energy, climate policy or employment diversity?

- 2013 Fed tapering…mkt freaked for 1 month, stocks ended up 30% for the year

- 2018 Fed tapering…mkt freaked, and they pulled back as economy slowed

- Does the Fed have the resolve to normalize policy if market reacts badly?

- Tough talk from Fed but actions will be slow and methodical and subject to revision if economy pushes back

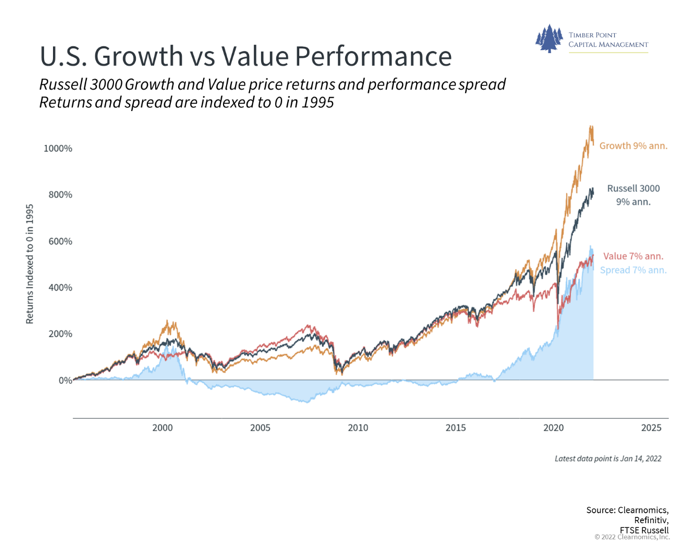

Market rotation continues, moving from growth to value sectors

- Growth outperformance is relatively recent phenomenon, spread started 2017

- Prior periods of outperformance included Y2K (growth) and aftermath (value)

- Recent rotation to value continued last week, despite a few recovery days

- Market appears focused on 10-Year bond for its cue on direction and style

- YTD, Energy up 16.4%, financials up 5%…healthcare and tech down 5%

- Int’l markets catching a bid with $ down…EM and China rebound after poor ‘21

- Reopening boom Part 2? Unlikely, monetary policy reversal and fiscal stimulus over

- If economy disappoints because the Fed oversteps, the value trade will unwind

- FANG stocks are consistent growers – prefer them at market multiples vs. cheap names with big transition paths to growth…

- Commercial RE market is an enigma – how long co’s continue to pay rent, when will they shrink footprint?

Supply Chain dynamics will improve through 2022…

- Drewry World container index bumping along recent bottom, slight recent uptick

- Bulk dry index has sold off in last week…

- Long Beach and LA ports account for 40% of sea freight entering the US

- Aging cargo on docks of LB/LA down 55% since fee program announced

- Recent spate of airline cancellations did disrupt global air freight volumes

- UK Covid cases now down by > 50% from peak reached in early Jan of 193K

- FL, NY, and IL Covid cases rolling over; TX and CA cases ramping

- PFE CEO sees “normal spring”… PFE oral antiviral pill approved, supply delayed

- TSA traffic remains steady despite Omicron, still down from pre-pandemic levels

- EM/China are suppliers to developed world…as Covid eases, they do better

- China zero-Covid policy has hurt manufacturing and GDP numbers

- China “consumer economy” cannot support what they produce, are export nation

- Recent WSJ article suggesting letting mild Omicron infect population = novel!

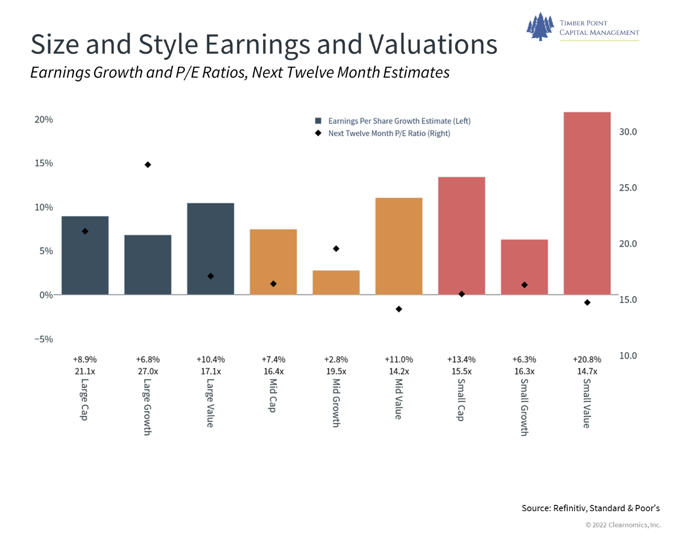

Small and Mid-Caps are washed out…

- Small caps have highest estimates for earnings growth among US style classes

- P/E ratios in small cap sector are not challenging, only mid-value less expensive

- Investors fear a demand pull forward from ’22, scenario appears well discounted

- Difficulty in getting workers and WFH has been an issue, small caps more flexible

- Don’t see any backup in credit spreads to indicate liquidity issues

- Consumer is very liquid and shifting from goods to services as economy opens

- Biotech has been weakest performer, hurt by huge new issuance and IPO’s

- Still think golden age of science is to be respected and opportunities abound

- Growth indices largely driven by tech and healthcare, US innovation still the key

- Very large relative underperformance versus large; if economy hangs in, we think the small and mid-cap space should do well

Recent Comments