The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin.

The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

Are we reaching/have we reached peak inflation rates?

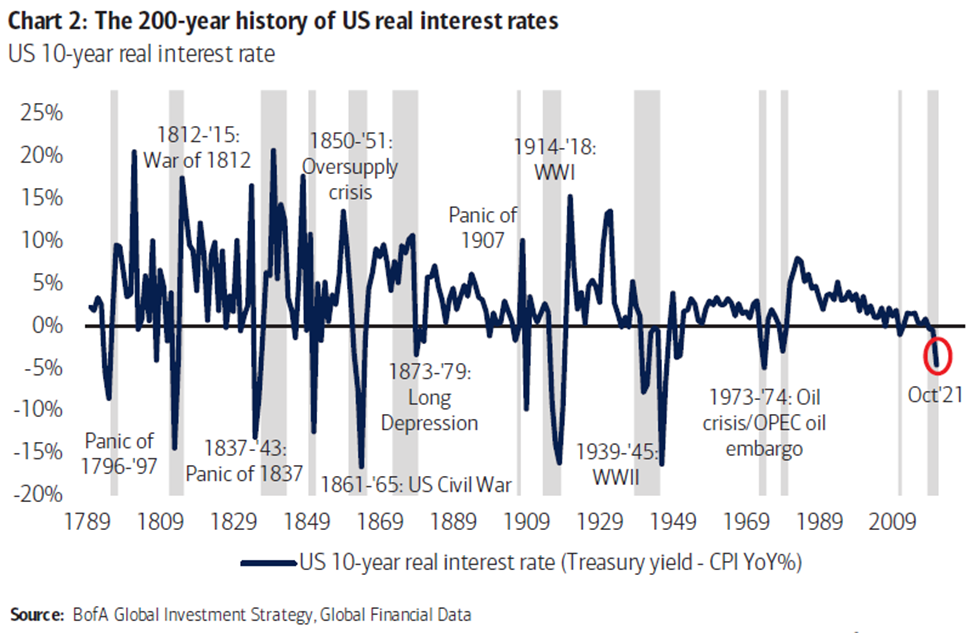

- REAL US 10-year bond rates now at -4.6%, a level associated with panics, inflationary periods, wars, and depressions over past 200 years

- Inflationary pressures have persisted longer than many (Powell/Fed) expected

- The Fed has capitulated in its characterization of higher prices as transient

- Tapering of Fed purchases now ahead of prior plan and rate hikes from 2 to 3 in 2022

- Supply chain/logistics issues have played a key part in higher prices across the economy

- Housing continues to be strong, but data from containers and shippers is constructive

- FDX quarterly EPS report supportive of supply chain normalization

- We expect to see REAL rates move higher as inflation eases into 2022 and 2023

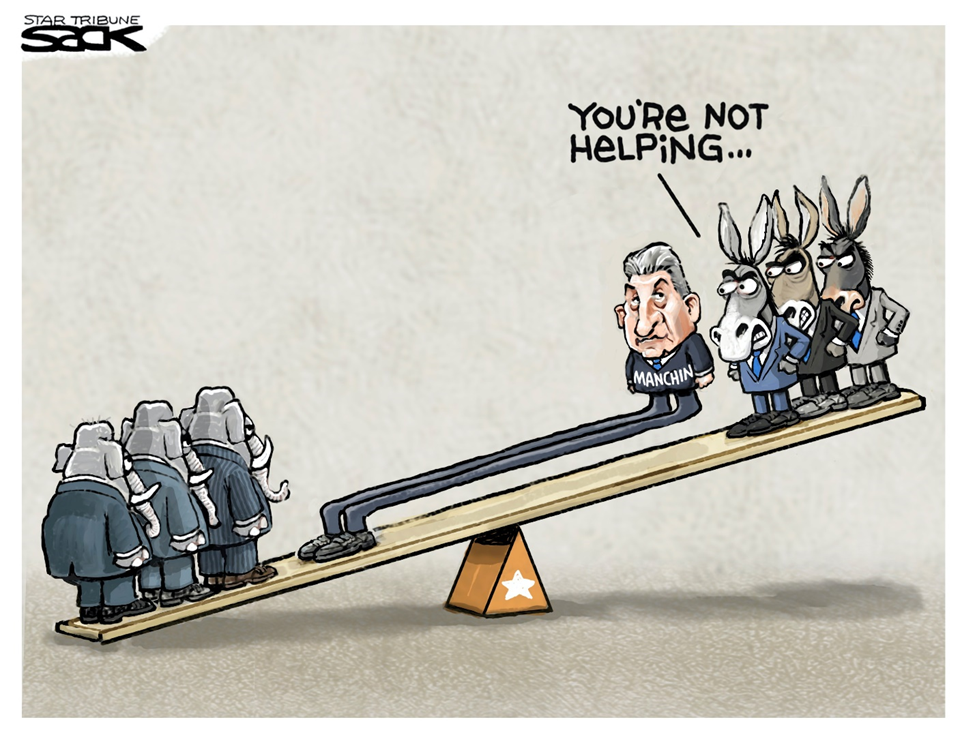

Government policy risk remains high despite Manchin’s “NO” vote on BBB…

- Biden administration gets unexpected Christmas “present” from Sen. Manchin

- We chalk up market reaction to Omicron transmission rates vs. Manchin’s “NO” vote

- We have been negative on BBB and believe its scuttling lowers (somewhat) policy risk

- Anticipated passage of BBB would result in > exercise/sale of stock options by mgmt. teams – we have not seen that

- Dem’s will attempt to resuscitate BBB in smaller package, will still be difficult

- In past, Fed was only focused on inflation but now has added employment to mandate

- Way to support employment and gov’t policy is to finance the deficit by selling bonds

- Fed policy moving forward remains unclear….how will it react to changing economy?

- We grant that Powell renomination is a positive; aggressive reaction to Covid, albeit slow to undo positive actions

- Covid/Omicron government response will be telling over next few weeks…will continue to be a battle between tightening restrictions on movement vs. individual liberties

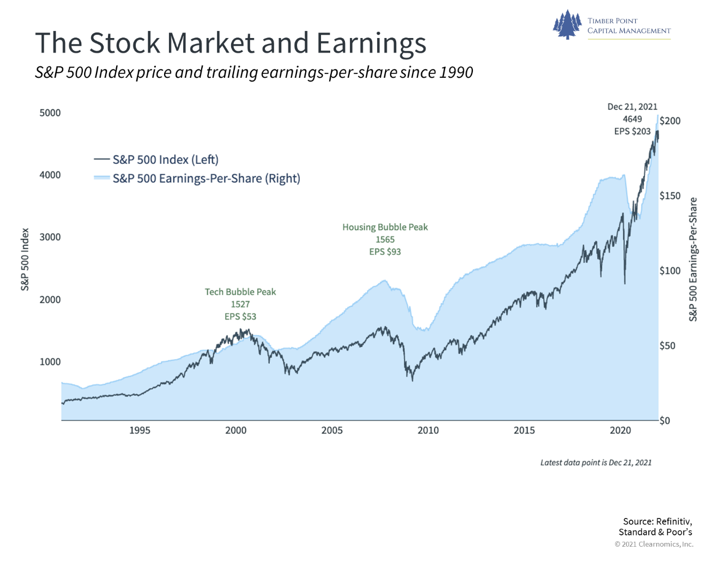

The U.S. earnings juggernaut continues to fuel the stock market

- Earnings are expected strong in ’21, estimates of 45% increase after 10% decline in ‘20

- Consensus (Factset) estimates for revenue/earnings growth in ’22 are 7%/9%

- Profit margins of 12.6% in ’21 are above pre-pandemic high of 11.5% (2018)

- 2022 eps estimates of ~ $222 for SPX 500 equates to 21x forward P/E multiple

- Pull forward of WFH revenues has likely occurred, what will be the next rev/eps driver?

- Company commentary likely conservative on guidance, Omicron will be an influence

- Thus, don’t expect big eps “surprises” in 4Q21 earnings reports or big estimate increases

- Inflation will help top line growth in ’22 but more of a headwind as move through ’22

- Pricing actions taken during the pandemic will be rolled back but only sparingly…

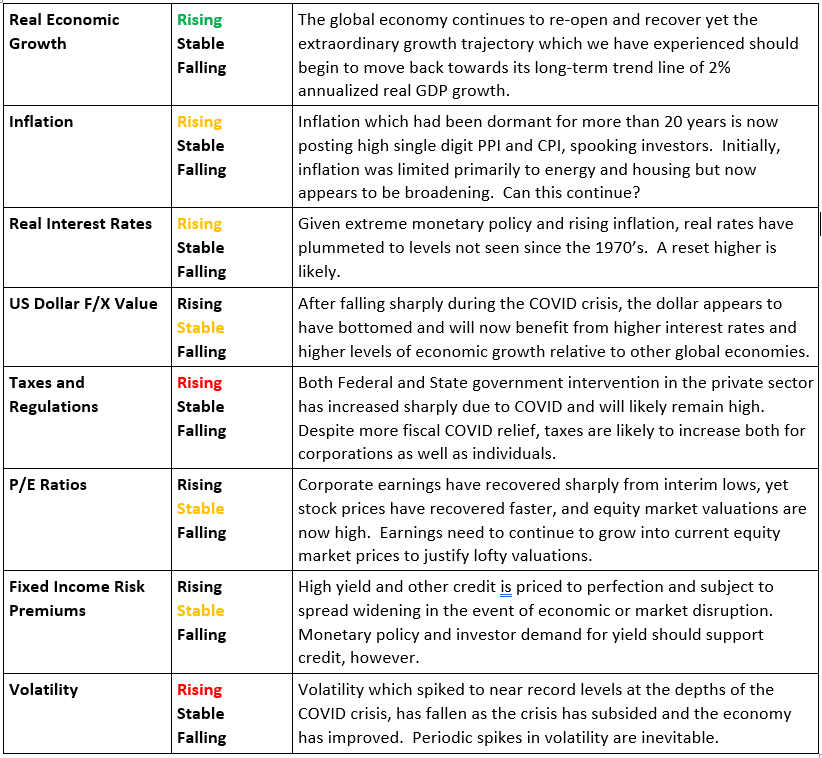

2022 1Q Key Economic and Investment Drivers

TPCM discusses 2022 economic and investment driver outlook…

- Economic growth is slowing from torrid pandemic recovery rate, but remains strong

- Inflation persists but likely peaking from elevated rates seen in ‘21

- Expect greater volatility to continue into ’22 owing to gov’t policy initiatives

- Mid-term election expectations could positively influence multiples in stock market

- Supply chain normalization should benefit domestic equities, esp. small/mid-caps

- Foreign markets remain largely unattractive…shutdowns and political risk in ROW

- ROW economic policies have negative impacts on economic growth and markets

- Expect cyclical sectors to be relative outperformers….shutdowns in U.S. not likely as expect Omicron to spread rapidly but be more “flu-like” for vaccinated

- 1Q22 allocation:

- Overweight equities, particularly U.S. equities

- Minimum fixed income allocation; inflation will cool as will economy

- Neutral weighting in non-traditional alternatives – can help mitigate interest rate risk (TPCM Alt. Income Fund (AIIFX) up 1.90% vs. AGG -1.59% YTD)

Recent Comments