The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin.

The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

Meet CWC Advisors, TPCM’S US Value equity partner…

- Founded in 2000, led by Thane Cleland, principals from Crabbe Huson, $150 mln AUM

- Manage Value SMA’s with large and small cap exposure in core and value mandates

- Focused on GARP situations, fundamental stock pickers and disciplined contrarians

- Long only, concentrated portfolios with ~ 30 names, diversified asset allocation

- Out of favor growth names with low expectations and reasonable relative valuation

- Deep dives on business fundy’s, investment thesis plays out over 24-36 months…

- Weekly portfolio meetings; can raise price targets if tracking well; only 1x average down

- Sector weight rules – Large Cap no > 100% over/under sector weight; 10% any sector

- Absolute size limits, winners run only so far – max 5%/7% position for small/large

- Performance…1 year in line thru 9/30 vs. R1000V…3 year up 440 bps, 5 year up 400 bp’s

The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security. Past performance is no guarantee of future results. Performance described herein is captured gross of fees and expenses.

Powell removing the word “transitory”…buy the rumor, sell the news?

- Long bonds rallied (TLT) Long treasuries +5.30% QTD in spite of inflation concerns….

- 30 Year now at lowest level of 2021, 10 Year fast approaching lows

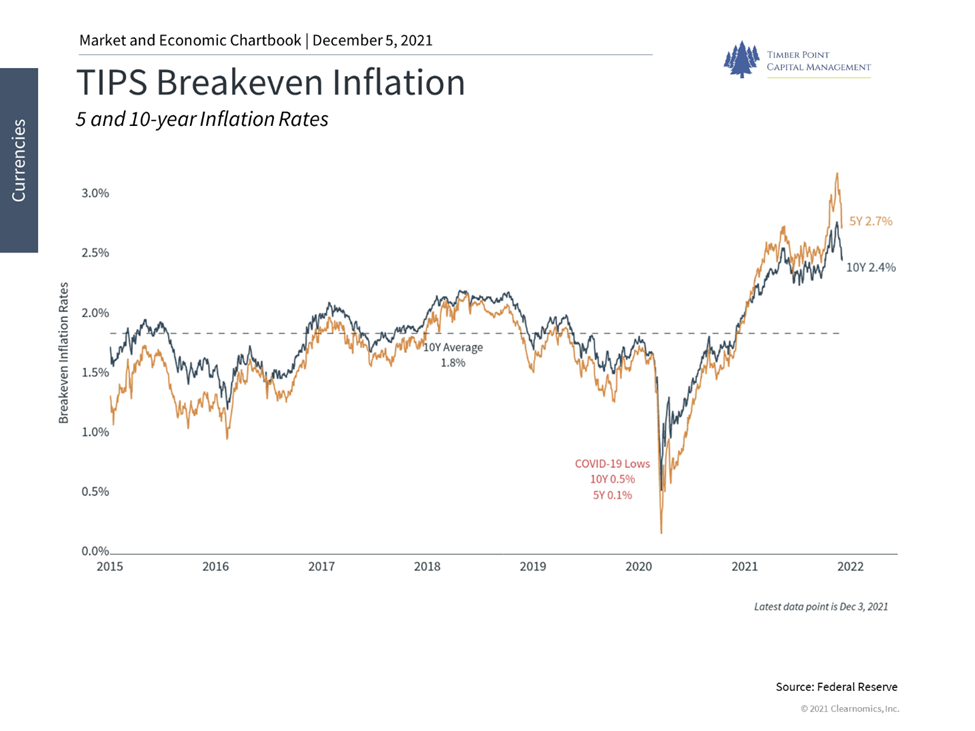

- TIPS breakeven inflation rates (5yr and 10yr) are in decline, yield curve is flattening

- Counter intuitive to what would be expected if FED were to hike rates

- Markets focused on slowing economic growth and/or supply chain disruptions abating

- Re: BBB plan…how does Powell balance taper policy with the need to purchase debt

- FED likely to finance the infrastructure bill in some shape or form

- FED has no experience reducing the balance sheet…none. Meaningful risk to markets…

- While market has moved on from inflation for now, FED policy could see banks releasing reserves into the economy and velocity increase leading to inflation

- Shadow bankers could take share if banks continue to be suppressed…KKR,BX, APO

- Risk likely to manifest itself in equity markets from policy miscue

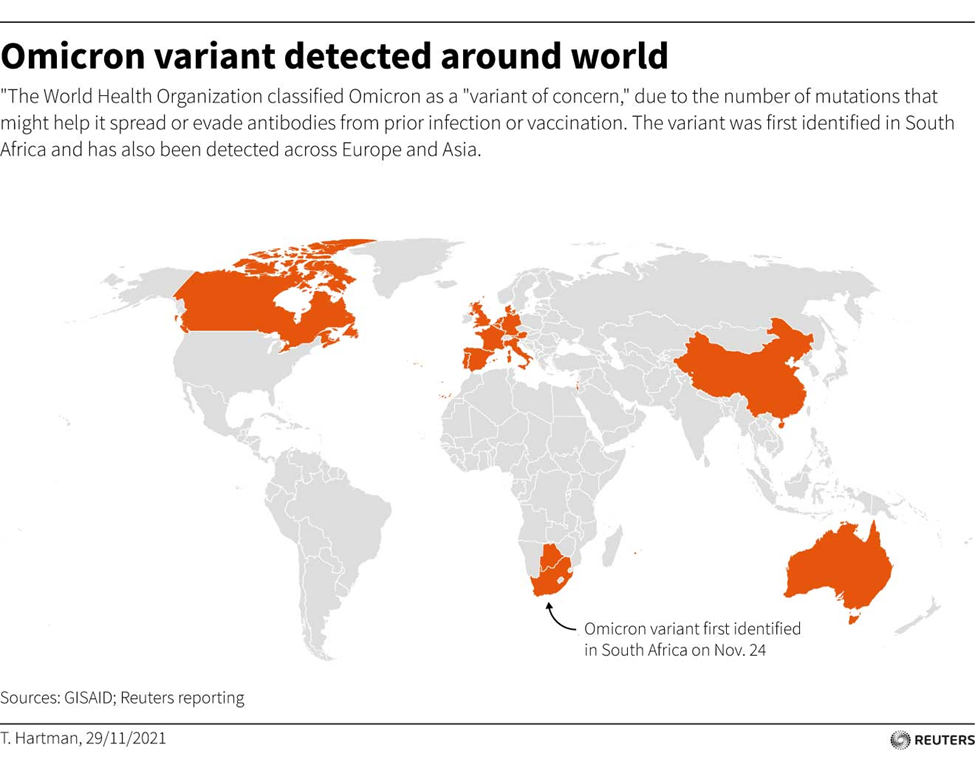

New Covid variant major market concern….are we ignoring other things?

- If omicron were a real issue, U.S. should be outperforming ROW and see dollar strength

- Omicron now in almost 40 countries, but appears benign to date based on severity and death statistics…

- US markets and dollar not outperforming as expected based on high vaccination rates

- Small caps have been bludgeoned…our thesis is they are nimble operators in periods of higher taxes, regulation…another signal that something is wrong…

- Long duration tech plays are collapsing despite rate moves that in past were supportive

- Supply chain seems to be resolving – BDRY (supply chain proxy) has seen only marginal rebound after 50% decline thru October/early November

- Oil prices as proxy for commodity price pressure are in decline, OPEC adding supply

- We worry that the political and legislative process is not favorable for US risk assets…

- Possible worry over threading the needle of tapering policy and need for FED to fund BBB plan…

- Maybe this is just aggressive tax loss selling after strong gains and anticipated higher tax rates in ’22…if so, should see rally into year-end, wait and watch…

Recent Comments