The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin.

The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

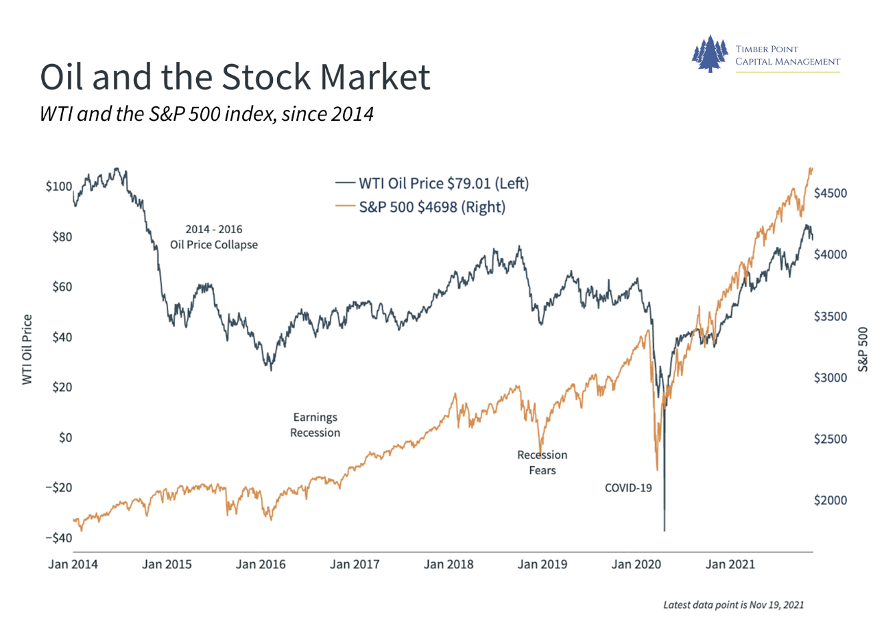

US oil production starting to respond to higher prices…

- Permian production expected to hit record next month (4.95M bbl/d) according to EIA

- Permian is largest producing basin in the US with the lowest breakeven prices

- PXD, OXY, XOM (XTO Energy) and CVX big players…FANG, CXO, APA and EOG also…

- EIA predicts oil market will be over supplied next year….supply 101.4M bbl/day vs. demand 100.9 M bbl/day

- OPEC+ lowered demand forecast for demand growth this year by 160k bbl/day

- Why? Higher fuel prices crimp demand(!), new covid lockdowns, slowing global GDP

- Oil dependent countries (Russia, Saudi )have been stronger market performers

- Demand remains strong in U.S….better to have owned XLE/USO vs. oil levered countries and far less political risk

- Will be interesting to watch companies’ capex response over next few quarters…

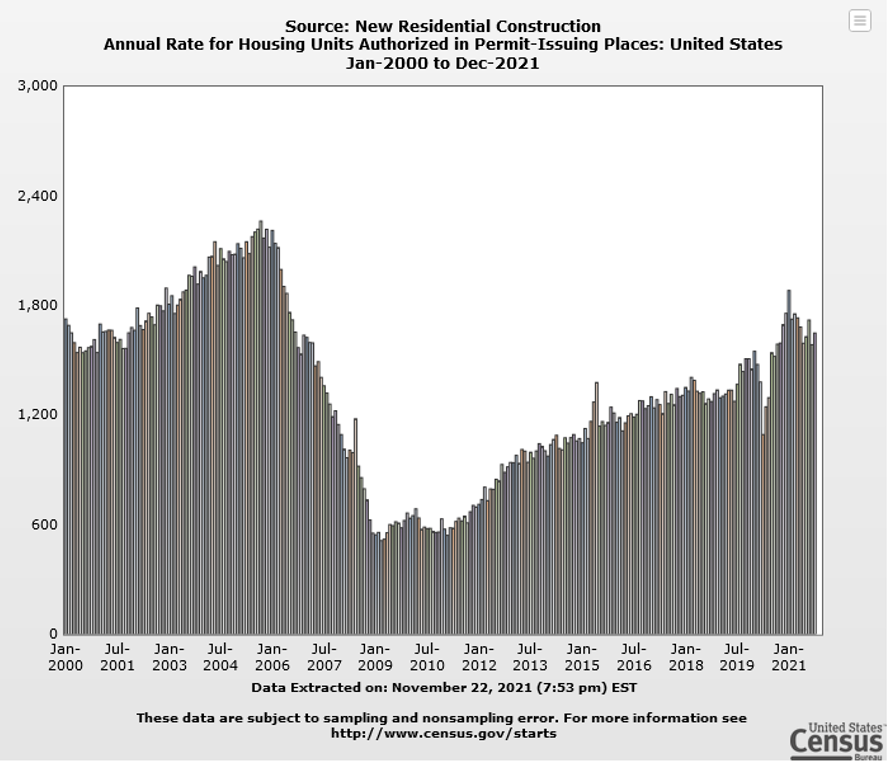

New residential construction rebounds but still down from early ’21 peak…

- Supply chain continues to hamper ability to accelerate new residential construction

- Limited inventory of existing homes and increased prices should spur new supply

- New home sales still down 30% from January ’21 levels…they did rebound m/m in Oct

- But total housing inventory declined to 1.25 million units in October, down 0.8% m/m

- Existing home sales trying to pick up the slack, highest level since January ‘21 (6.34M)

- Median existing-home price was $353,900, up 13.1% y/y, prices climbed in each region

- Higher housing rental prices and limited rental supply continues to push renters to seek permanent housing alternatives given attractive mortgage rates

- “U.S. Census Data shows an increasing share of new sales are for homes yet to be built or still under construction…” i.e., existing home market is tight and buyers stretching to get any new supply they can…

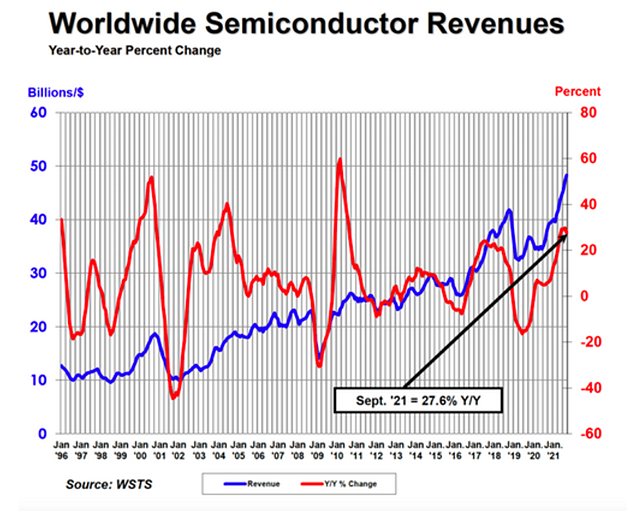

Semi supply remains tight, per recent reports from NVDA, QCOM and AMAT…

- Recent EPS reports from NVDA, QCOM and AMAT were all well received

- Stock prices for each and the SOX index broke out early November and are now vertical

- Commentary on inventory levels, supply chain, logistics and pricing suggest continued strong environment into 2022…

- We queried the transcript from each company on “supply”…see commentary below…

- QCOM – “And we said that we expect to see material improvement in our supply towards the end of the calendar year. That’s reflected in the Q1 guide, our ability to have supply”.

- QCOM – “We look at the first half of 2022. We still have some shortage. But as we get to the second part of the year, I think, in general, supply and demand are going to be aligned.”

- NVDA – “While we continue to increase desktop GPU supply, we believe channel inventories remain low.”

- NVDA – “In networking, revenue was impacted as demand outstrips supply.”

- AMAT –“ I believe we will see permanent changes in the way supply chains are designed and operated”; “As the digital transformation of the economy accelerates, demand for semiconductors continues to grow and is significantly outpacing supply.

- AMAT – “We expect supply shortages of certain silicon components to persist in the near term, meaning that we don’t expect to fully meet demand in Q1.”

- Anecdotally, we did talk to a small drone manufacturer who stated that semi supplies for flight control chipset arrived from a major supplier much earlier than expected…

- For now, overwhelming evidence suggests this is the exception and not the rule…

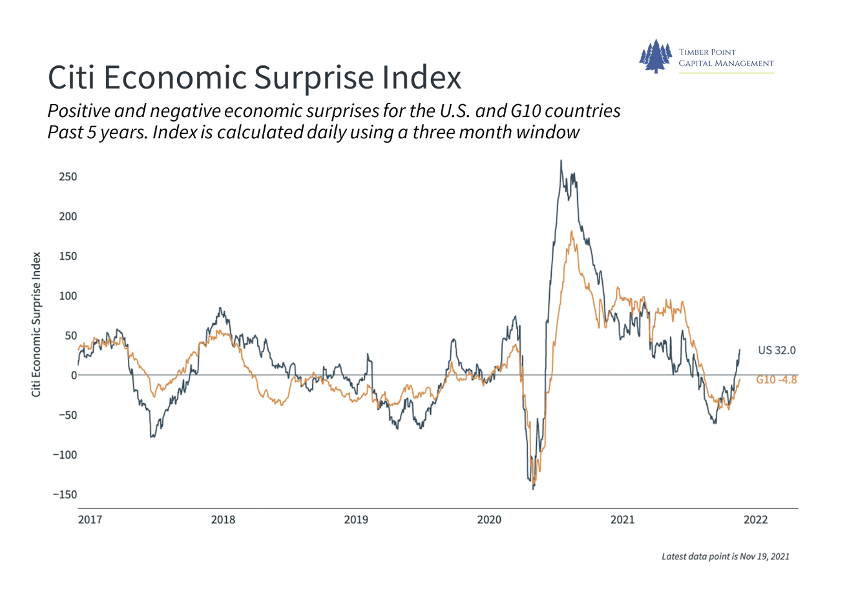

Citi Economic Surprise Index accelerates to the positive in the United States…

- The CES index is an objective and quantitative measures of economic news

- Measures weighted historical standard deviations of data surprises (actual releases vs Bloomberg survey median)

- U.S. bottomed earlier, rallied harder and now positive when compared to G10

- Historically, the US and G10 index have tracked each other closely

- US Retail sales (+1.7%) and non-farm payrolls (+571K) for October better than expected

- We expect retail sales to continue strong as shoppers get in front of supply chain issues for the holidays

- Non-farm payrolls report is first after $300 stimulus ended…will this continue? Will see.

- Reemergence of Covid in Europe not helping EU economic data…ECB also tapering

- Japan economic surprises have been lacking for the better part of the past 20 years…

Recent Comments