The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin.

The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

Meet Validus Investment Advisors, TPCM’s global growth equity partner…

- Founded in 2012, led by Mark Scalzo; based in San Diego and Truckee, CA; $500 mln AUM/AUA

- Manage growth SMA’s, asset allocations, and sub-advise close-end mutual fund in alt’s space

- Mark spent 20 years in investment banking, has different lens on identifying growth companies

- Validus seeks to identify inflection points where/when growth dynamics are changing

- Portfolios have high active share, are designed to be truly differentiated from the standard benchmarks

- Tracking error vs. standard benchmarks is high but historically resulted in alpha

- Upside capture potentially in the 90th percentile while downside capture in 70th percentile

- Global Growth portfolio focused on highest conviction ideas, can only own limited # of names

- Focused on buying behavior, growth thesis, balance sheet, valuation, and company specific risks

- PSN Top Guns Award in 1Q20, 2Q20 and 3Q20

- Visit the Validus website to learn more at www.validusgrowth.com

The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security. Past performance is no guarantee of future results.

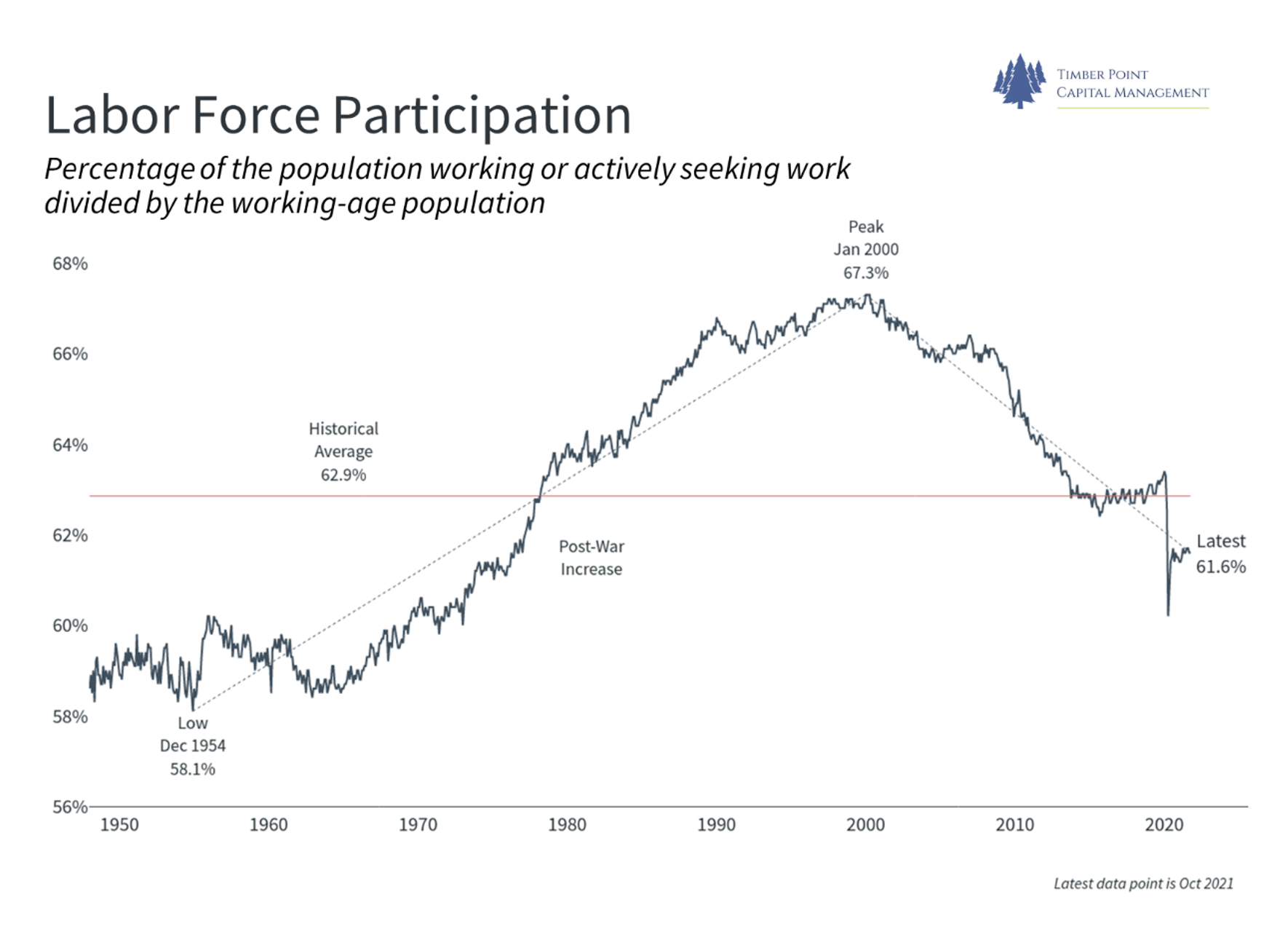

At TPCM, we still question economic growth prospects going forward…

- Recent nonfarm payroll data showed 531K increase in October vs. 312K in September

- Payroll data is first data point after end of extra $300 pandemic payments

- Question of sustainability – when will we start to see labor force participation rebound

- Growth comparisons are difficult – 4Q20 GDP growth 4.1%, 1Q21 at 6.4%

- Infrastructure bills will only help so much, take longer to be implemented vs. estimates

- JOLTS (Job Openings & Labor Turnover Survey) data is interesting – job openings, hires and total separations were all steady

- Within total separations, “quits” are highest in history of the series at 4.4 mln (+164K)

- “Quits” increased in arts/entertainment/recreation, other services, and state/local gov’t

- Common perception is that higher “quits” is based on worker belief of better

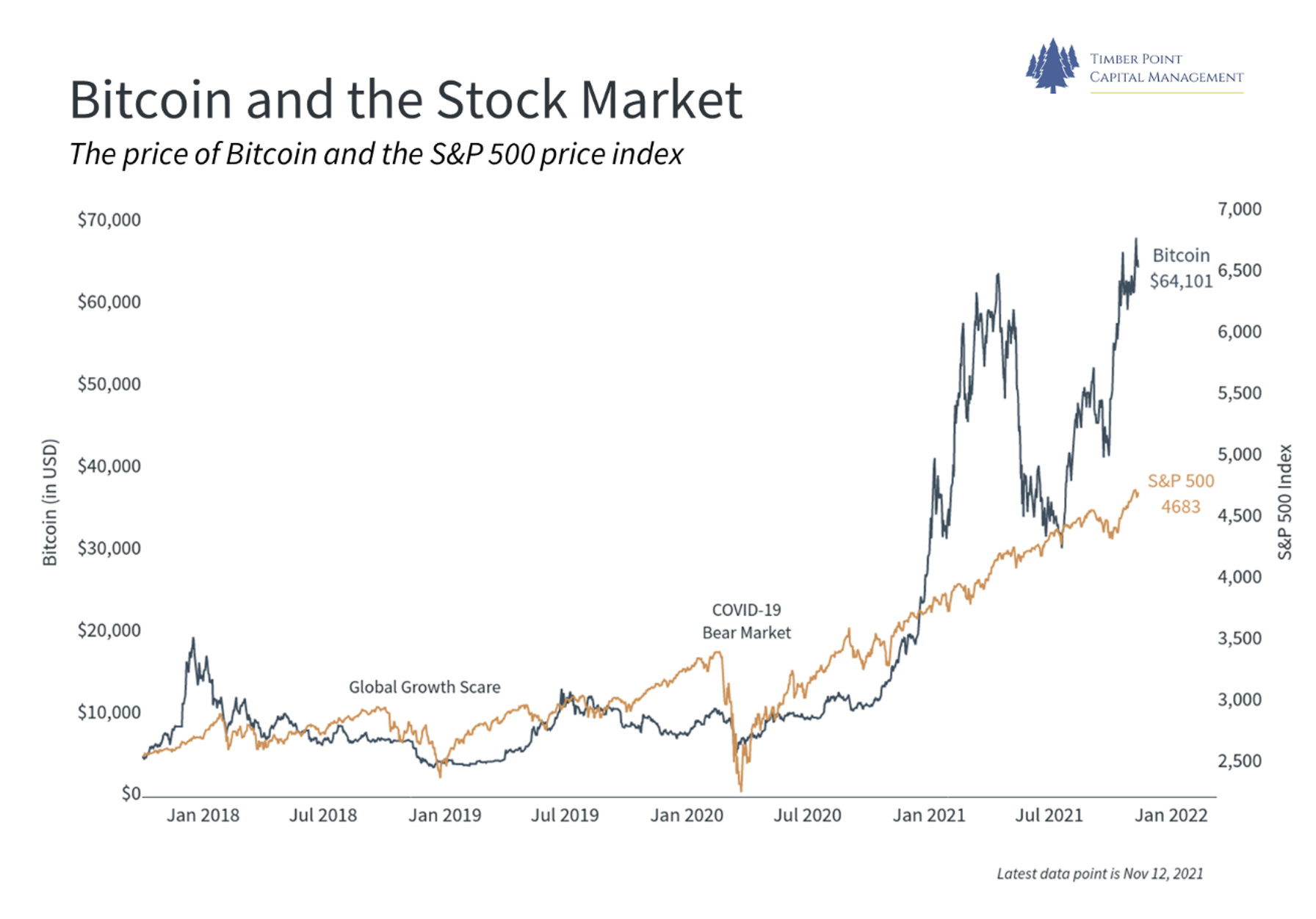

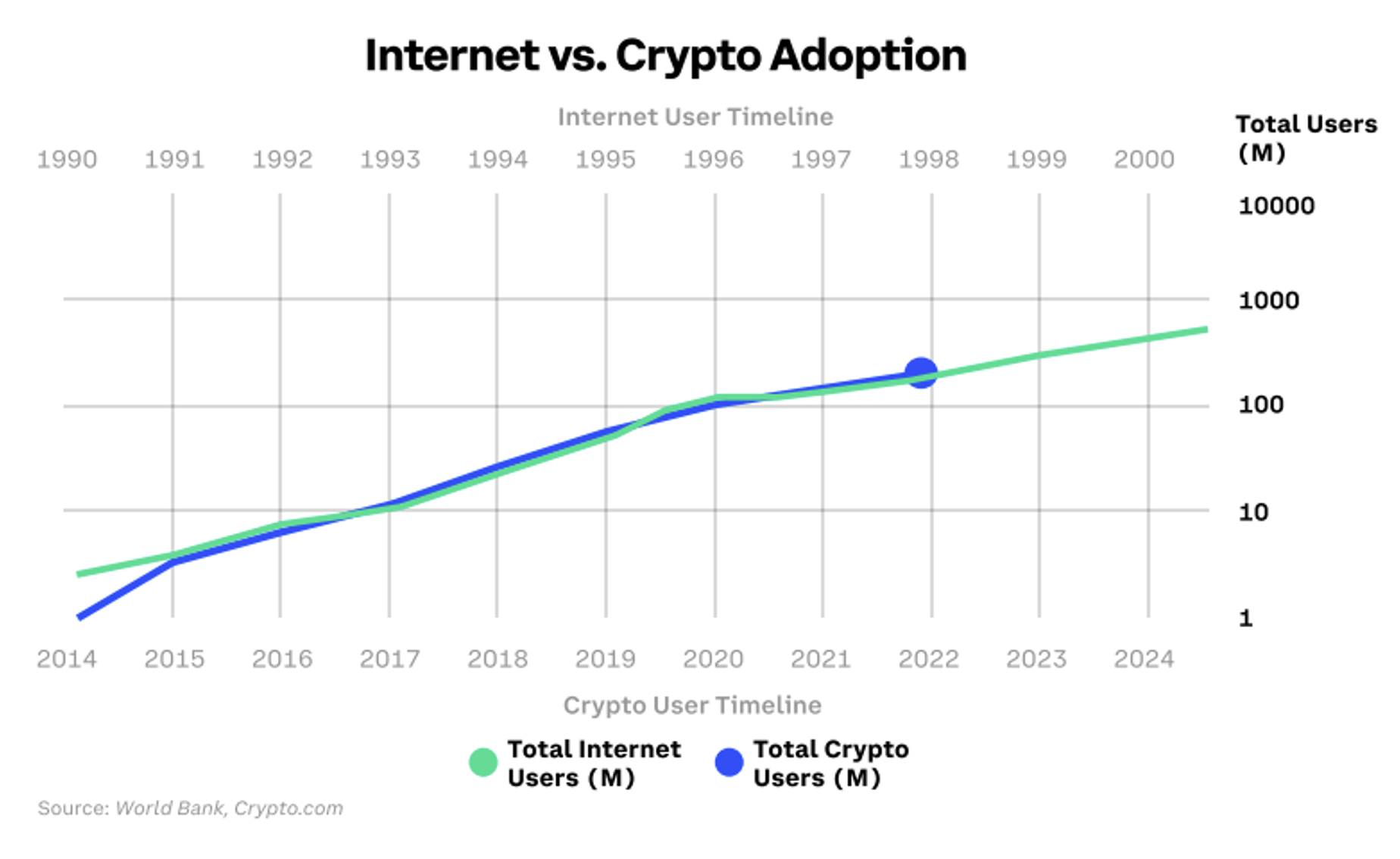

We struggle with how to view Bitcoin adoption – is it a new asset class?

- Bitcoin adoption rates similar to early formative years of internet

- Adoption is not usage in traditional sense – to date, Bitcoin is a trading mechanism

- Coinbase 3Q20 earnings report shows institutional trading volumes up 700% y/y

- Blockchain is the biggest contribution – could be utilized for gov’t spending, taxation

- Will we have a US treasury backed cryptocurrency? Yes, but can we trust it…?

- Will energy consumption needed for crypto mining make it a non-starter with ESG…

- Two Bitcoin ETF’s recently approved, BITO and BTF, both based on bitcoin futures

- Potential approval for spot-based Bitcoin ETF sponsored by VanEck expected near term

- Grayscale Bitcoin Trust, ticker GBTC with AUM $35 bln, is a closed-end guarantor trust

- GBTC issues fixed number of shares that trade OTC…trades at 18% discount to spot

- Crypto ownership vehicles? ETF’s, COIN, publicly traded miners, direct crypto account

- If have low vol strategy, crypto’s could be managed…if believe fiat currencies at risk, crypto’s could be a hedge

- Ultimately, how does one value cryptocurrencies? Is this all just price momentum…

Recent Comments