The Timber Log is a quick overview of Timber Point Capital’s weekly investment meeting. If you would like to join the call or have questions about the content, please reach out to Patrick Mullin at pmullin@timberpointcapital.com

The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

“Transitory” inflation sticking around longer – but still expect CPI/PPI to cool off

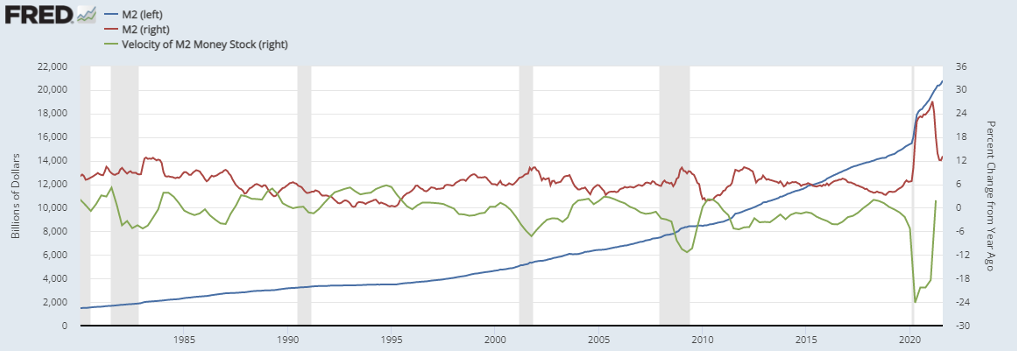

- Money supply continues to grow but y/y increase is slowing, this will continue

- Velocity of M2 had been deeply negative, now flat – argues for tame inflation

- FRED stopped reporting excess reserve levels – they were growing thru late ‘20

- “Financial suppression” is real – Fed money at banks not flowing to real economy

- Stimulus drivers are over or are abating – fiscal programs and Fed tapering acceleration

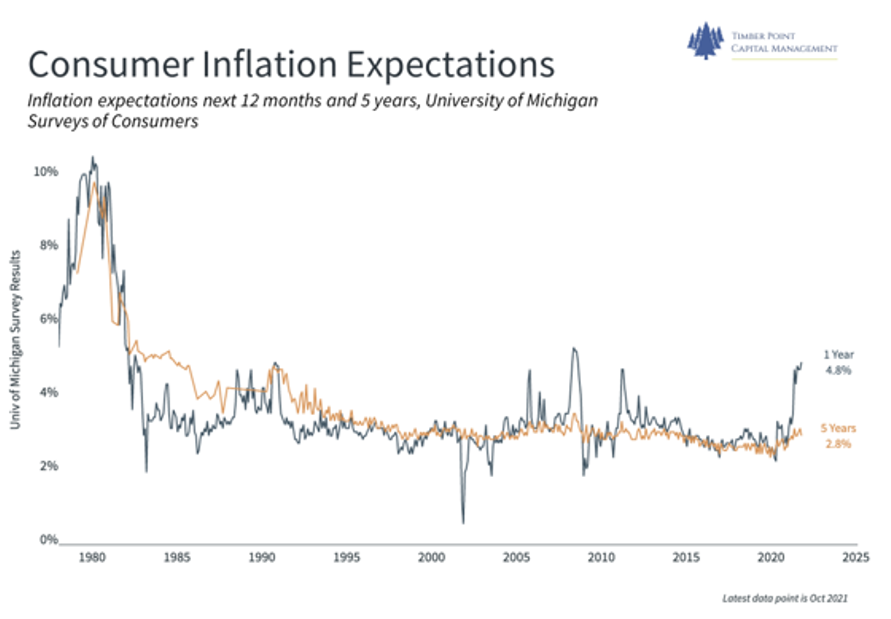

- Inflation expectations near term (1 year) are elevated, still subdued longer term (5 year)

- Look for our first “Vic-Talk” on Tuesday morning when Victor Canto, PhD will discuss this topic more in depth

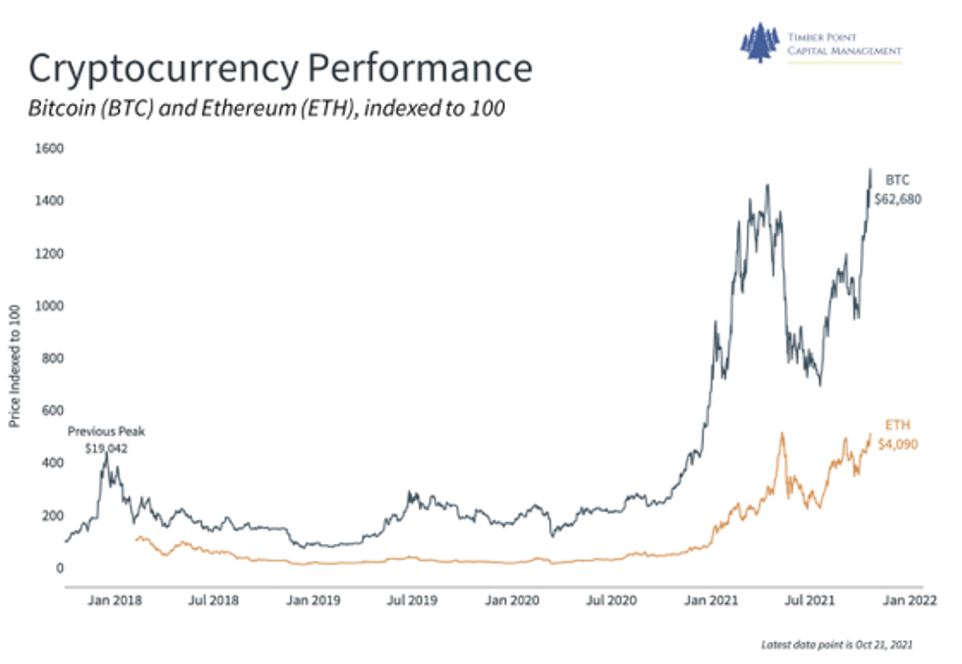

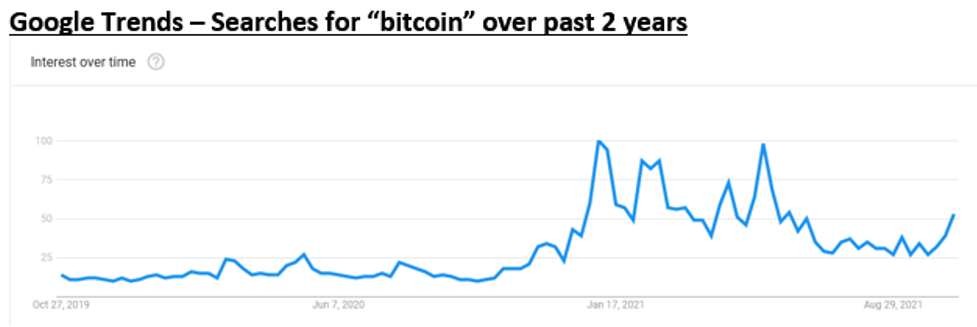

Cryptocurrencies are growing mindshare…two new ETF’s in past week will help

- Inflation increases should benefit gold but flows likely moving to crypto currencies

- Negative real rates likely with us for some time – should be tailwind for gold…?

- New Bitcoin ETF (BITO) driving bitcoin higher, how big will it become? Likely very big!

- Gold ETF’s are currently ~ $100 bln, BITO raised $500 mln on first day

- Institutional sponsorship continues to grow…Grayscale, world’s largest digital asset manager, now at $50bln.

- ETF structure is futures based, bitcoin trades in contango – “roll forward” is expensive

Inflation drivers are energy, shelter and used cars – expect supply response

- See our Timber Log from last week on Energy – net net, this is a supply phenomenon

- OPEC took ~ 8 mln bbls/d off the market for Covid – now feeding supplies into market

- Private drillers now 55% of rigs working, have more capital flexibility than public drillers

- Housing starts now back to 40 yr long term average after severe decline from GFC

- Housing and OER y/y price increases have bounced hard off the bottom…supply coming

- Manheim used car index hits new highs in mid-October – plan ahead for rental cars!

- New auto production hampered by semiconductors – OEM’s very vocal about the issue

- Is this a set up? How long until we hear first news of double bookings – look out below for chip stocks when we do!

We are watching corporate earnings closely this quarter…you should also!

- Analysts estimate negative sequential qtrly SPX eps growth…not realistic in our opinion

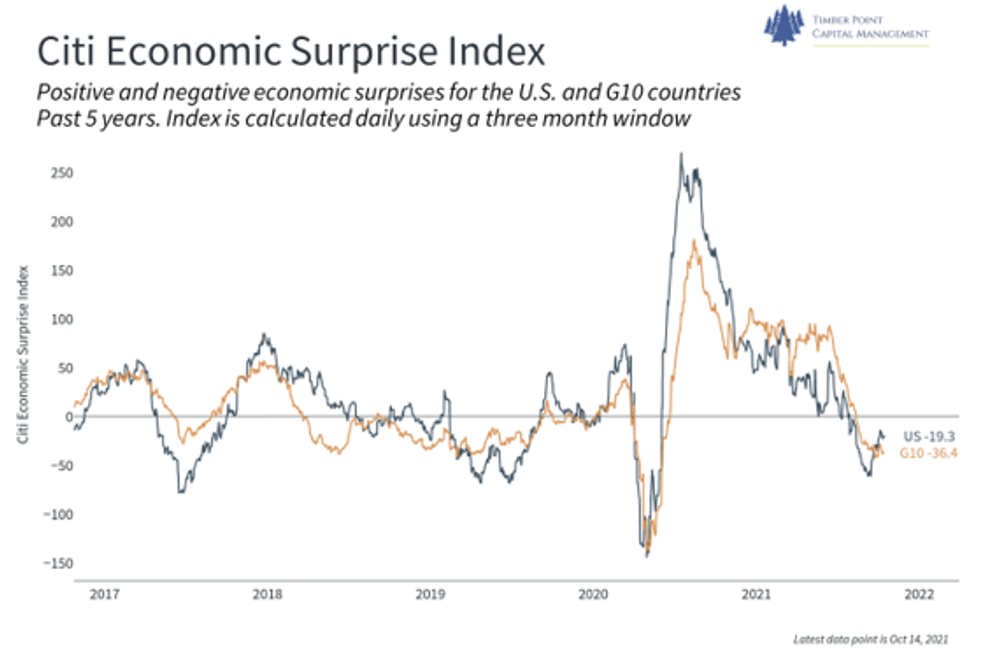

- Citi surprise index implies analyst estimates of econ activity have caught up to reality

- Global economy is slowing into ’22, what is reasonable eps growth rate for ’22?

- Bull case is that economy experiences greater productivity by doing more with less labor

- Bear case is that revenue growth suffers from Covid stimulation comparisons

- Bear case also assumes inflationary increases are not fully protected via pricing actions

- We remain constructive on equities – expect inflationary pressures to moderate and advantaged companies to grow revenues mid-high single digits in ‘22

Politics aside, Democrats in a bind to push through progressive legislation

- Bi-partisan deal ($1.5bln) slowed by progressives to achieve larger package ($2bln+)

- Manchin and Sinema refusing to bend to progressive push for reconciliation bill

- McConnell extending debt limit timeline to jam up timeline for reconciliation bill

- Republicans hope to achieve further “discovery” on reconciliation bill to derail it

- Biden unpopularity with electorate expanding beyond just moderate democrats = lame duck already?!

Recent Comments