The Timber Log is a quick overview of Timber Point Capital’s weekly investment meeting. If you would like to join the call or have questions about the content, please reach out to Patrick Mullin at pmullin@timberpointcapital.com

The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

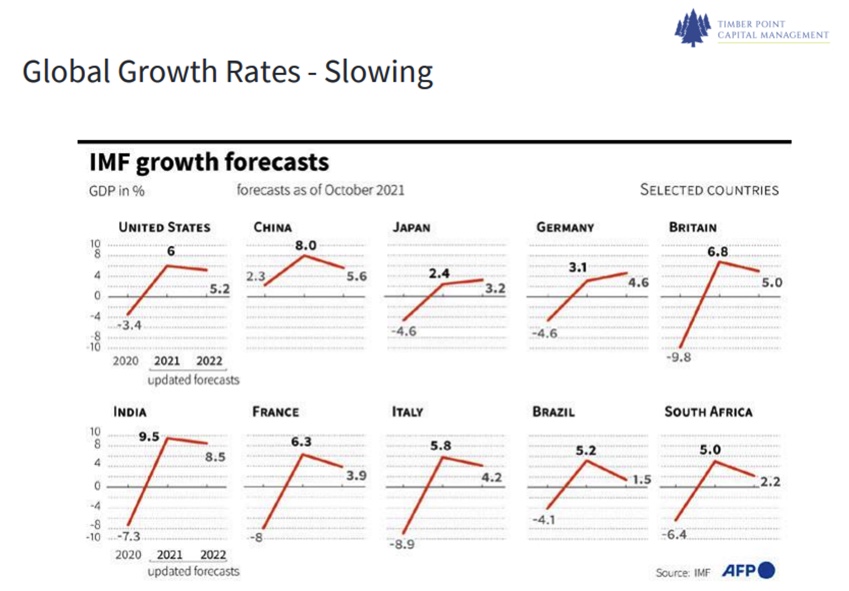

Easy growth comparisons vs. Covid-19 lockdowns are in the rear-view mirror…

- Estimates of 2022 global growth rates are now declining for most major economies

- Japan and Germany only major economies expected to see growth acceleration in ‘22

- This is largely a function of more muted economic recovery vs others in ‘21

- Will the U.S. be able to sustain a 5% GDP figure in ’22? We think that is optimistic…

- Highest ’22 growth rate expected out of India…over 50% of population now with at least one vaccination shot vs. just 5% in April ‘21

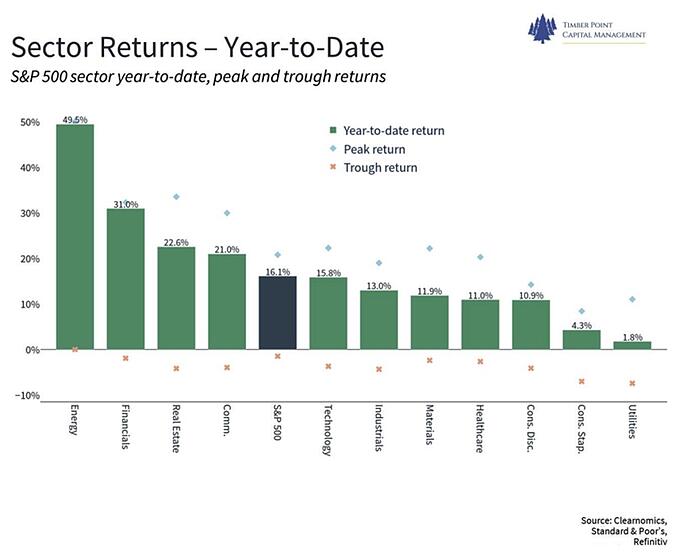

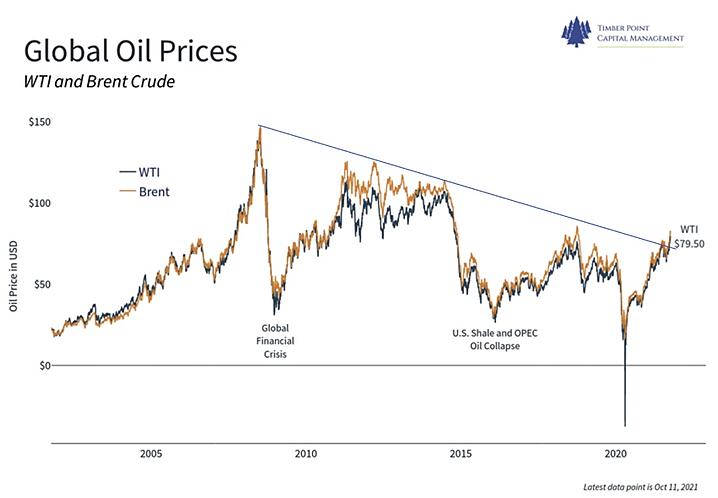

Energy the best performing sector in ’22 thus far…but only 3% of the S&P 500…

- Energy sector up 50% YTD, but was down 37% in 2020…over 3 years sector down 20%

- Energy sector recovering from pandemic price levels and in spite of gov’t regulations

- Sector is cyclical, of course…do you recall prices were LESS THAN ZERO in spring ’20?

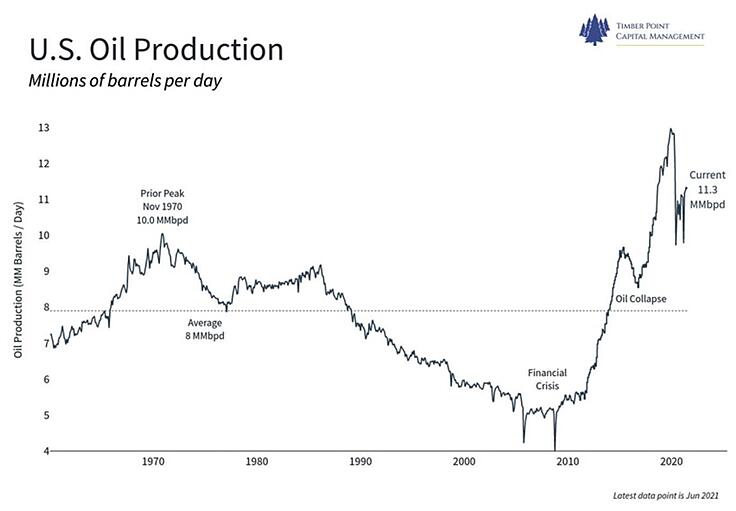

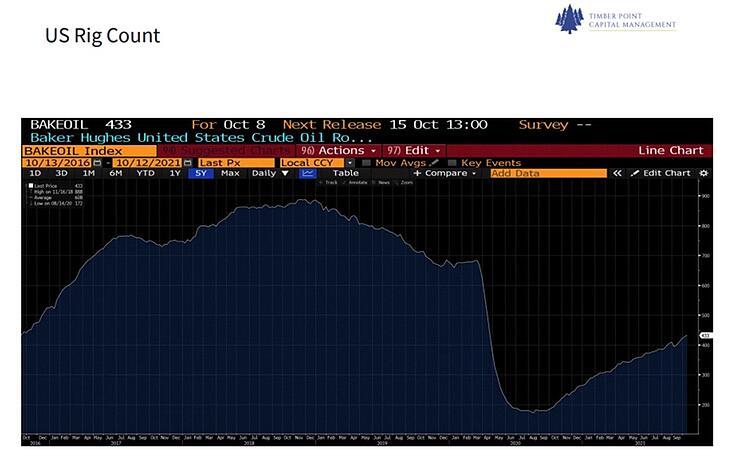

- Cash flows will increase from commodity price hikes but capx growth will be muted

- Energy companies with variable dividends will see increasing payouts next 12 months

- Growth estimates will be on the rise but companies are wary of ramping production too quickly as OPEC brings additional volumes to market

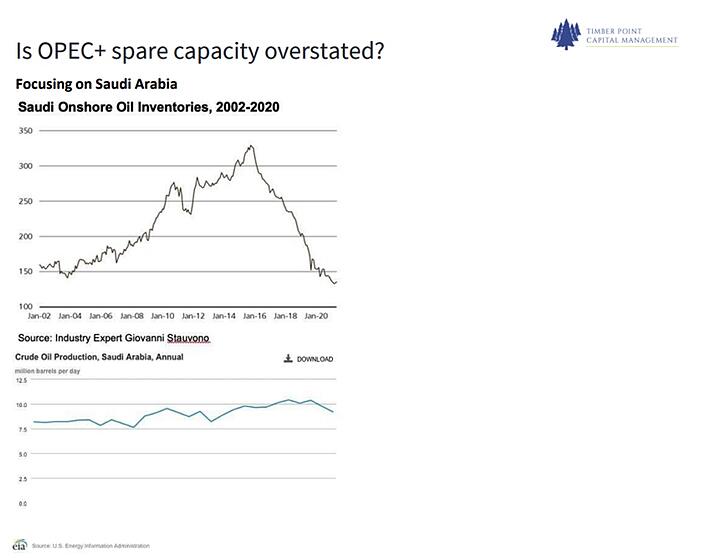

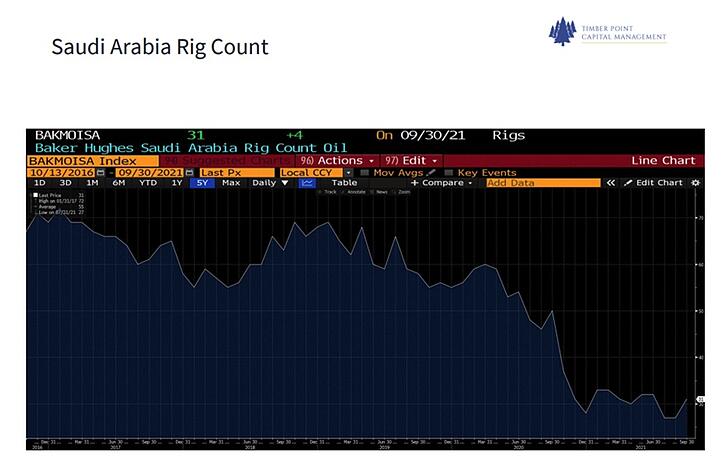

Saudi production has declined in pandemic, but has production capacity also…?

- Saudi officials continue to insist that they can ramp production to beyond 12 mln bbl/d

- When OPEC flooded the market in 2015 Saudi volumes only pushed past 10 mln bbl/d

- Saudi inventories have been in decline since 2016, exacerbated by downtime following terrorist attack in September, 2019

- OPEC announced cuts of 10 mln bbl/d in April, 2020…realized only 6 mln bbl/d cuts

- OPEC returning 400k bbl/d to market each month through Sept 2022 to eliminate cuts

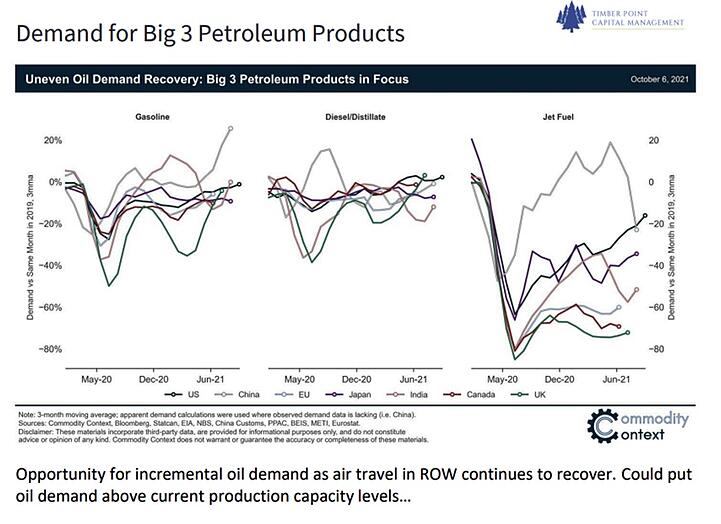

- OPEC now predicts oil demand to reach pre-pandemic levels in 2022

- China and India, 10% and 5% of world demand, estimated to be at greater than pre-pandemic demand levels

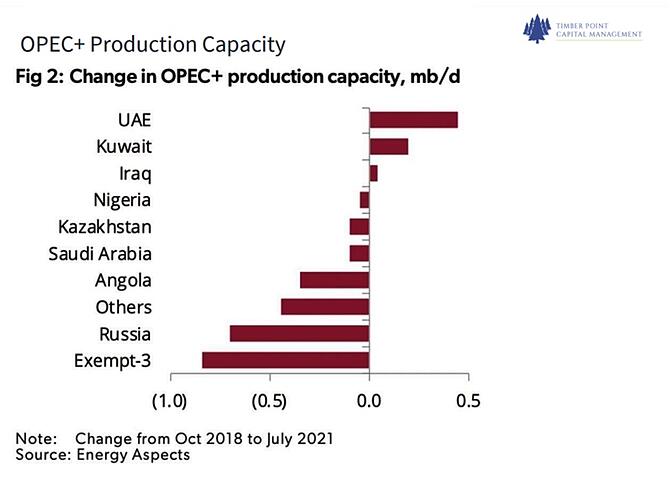

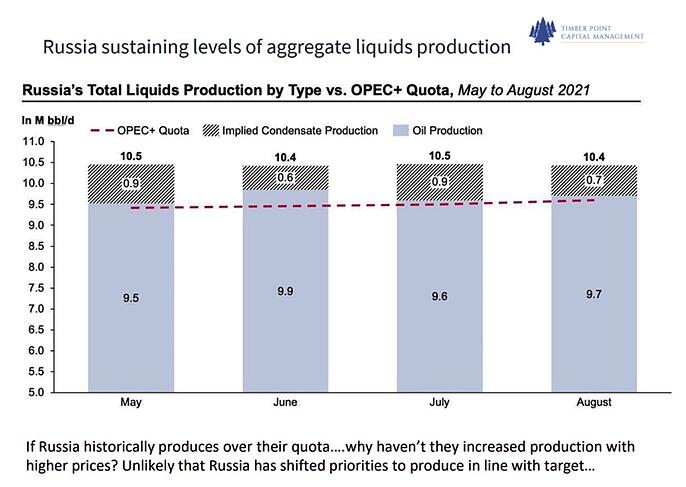

Where will incremental barrels come from if OPEC and US are constrained…

- Annual production capacity for most OPEC+ countries has declined over past 3 years

- Only the UAE has meaningfully added to production capacity over the past 3 years

- This explains why UAE was asking for higher baseline production in new agreement

- US sanctions and geopolitics have restricted investment in global infrastructure

- OPEC+ needs higher prices to sustain economic policies while try to make transition to post-carbon future

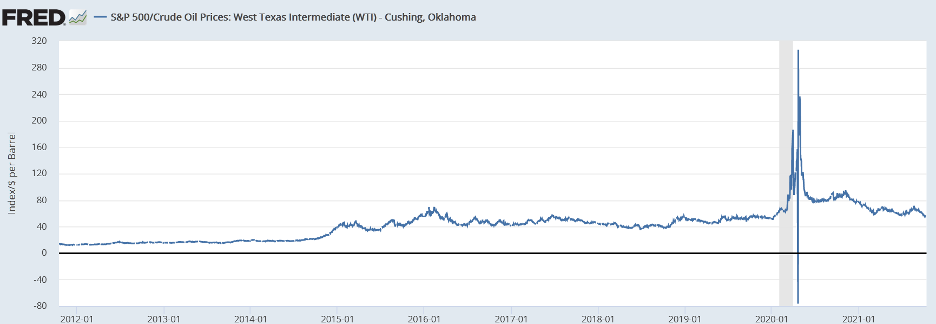

Can crude prices go higher? Yes, if recent history relative to SPX 500 is a guide…

- Since 2015, SPX 500 ratio to a barrel of WTI crude has been in the approx. 40x range

- Pandemic levels pushed this ratio significantly higher as WTI crude prices collapsed

- Current ratio of 55x is still elevated versus pre-pandemic levels of 2018 and 2019

- If assume SPX is fairly valued, and 40x is correct ratio, then WTI can go to > $100/bbl

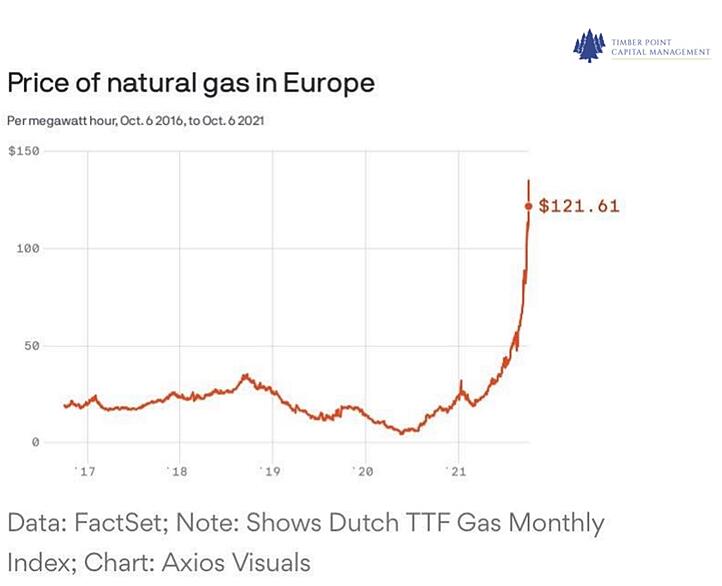

Other Energy sector charts of interest…

Recent Comments