The Timber Log is a quick overview of Timber Point Capital’s weekly investment meeting. If you would like to join the call or have questions about the content, please reach out to Patrick Mullin at pmullin@timberpointcapital.com

The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

Infrastructure bills roll through Congress…Pelosi trying to assuage progressives

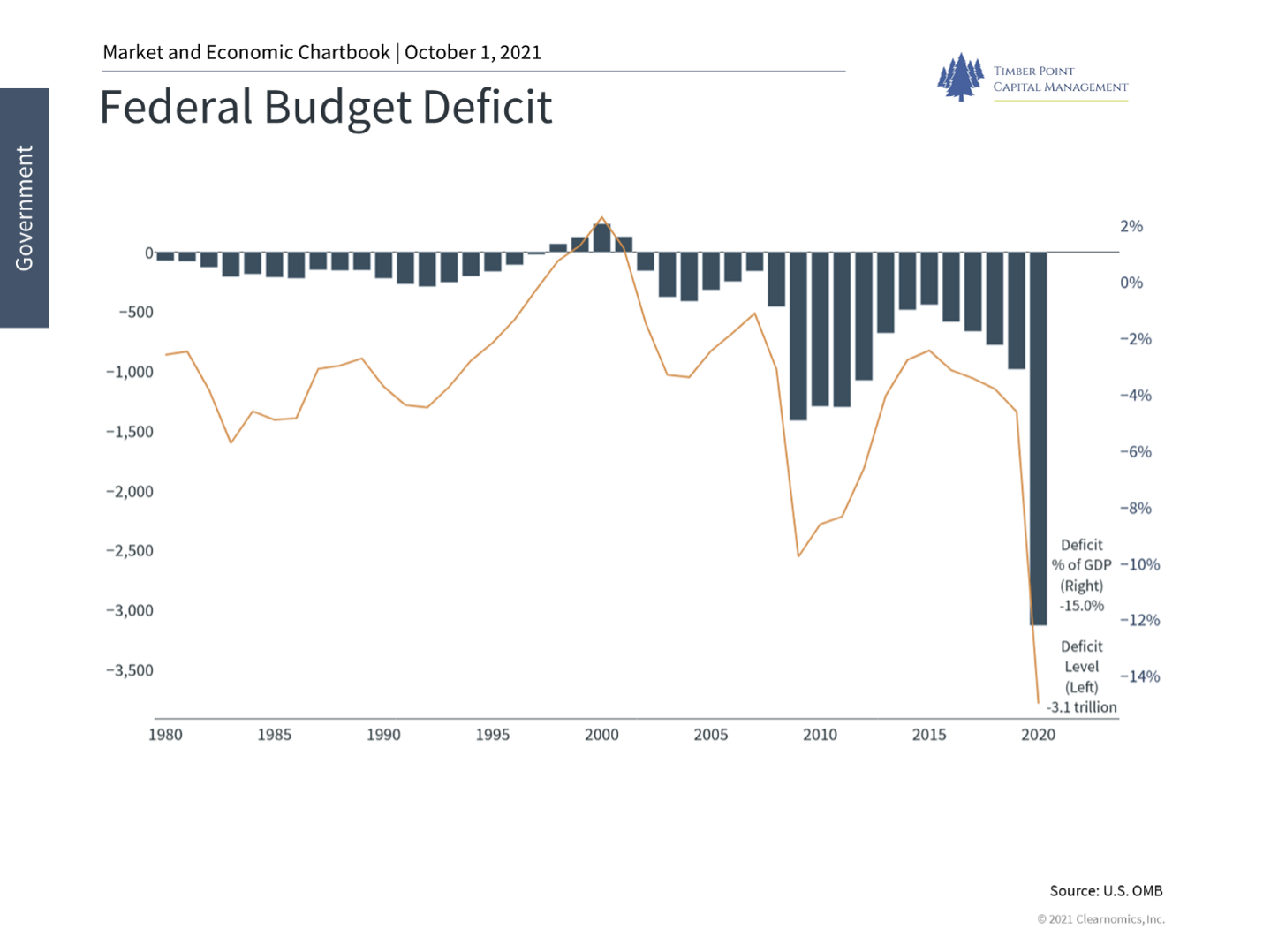

- Bipartisan Infrastructure Act (BIA) and Build Back Better Act (BBBA) wait for House votes

- BIA likely passes House, gives moderate Dem’s a win – BIA is popular in swing districts

- Dem’s know they need something to campaign on heading into ’22 mid-terms

- BIA has 4 committed GOP votes – 7 progressive Dem’s can vote nay and bill still passes

- If BIA passes, moderate Dems have little motivation to vote in favor of unpopular BBBA

- Progressive Dem’s insistent on two bills being voted as single package

- Odds are that Biden’s $3.5T proposal passed only if $’s are drastically reduced

- IF BBBA passes, we believe the spend over time is more like $5 – $7 trillion

- Fed will finance by issuing new bonds…more money creation and inflation pressure

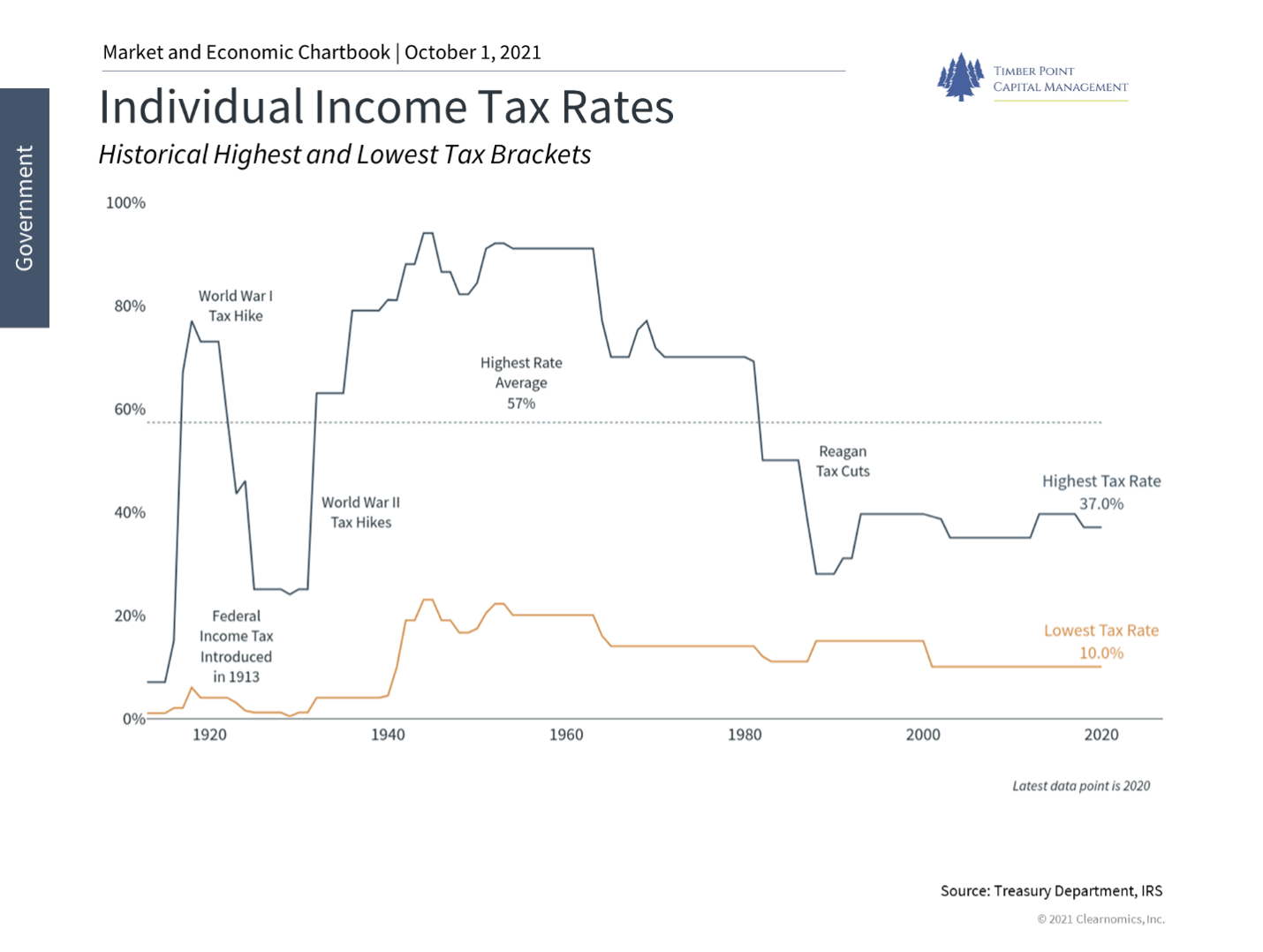

Tax policy will be the next debate in DC…worst case scenario likely averted

- If BIA lives, the BBBA likely dies…AND tax hikes on corporations/individuals are muted

- Extreme policies getting traction…taxing unrealized gains as income? Won’t happen

- Seeing downward revisions for economic growth and earnings – > regulation and taxes

- IF tax policy more onerous than anticipated, corporate earnings and risk taking in general become impaired and stock market will take notice…

- Republicans no shoe-ins for ’22 mid-terms – look at Newsom’s landslide victory in CA

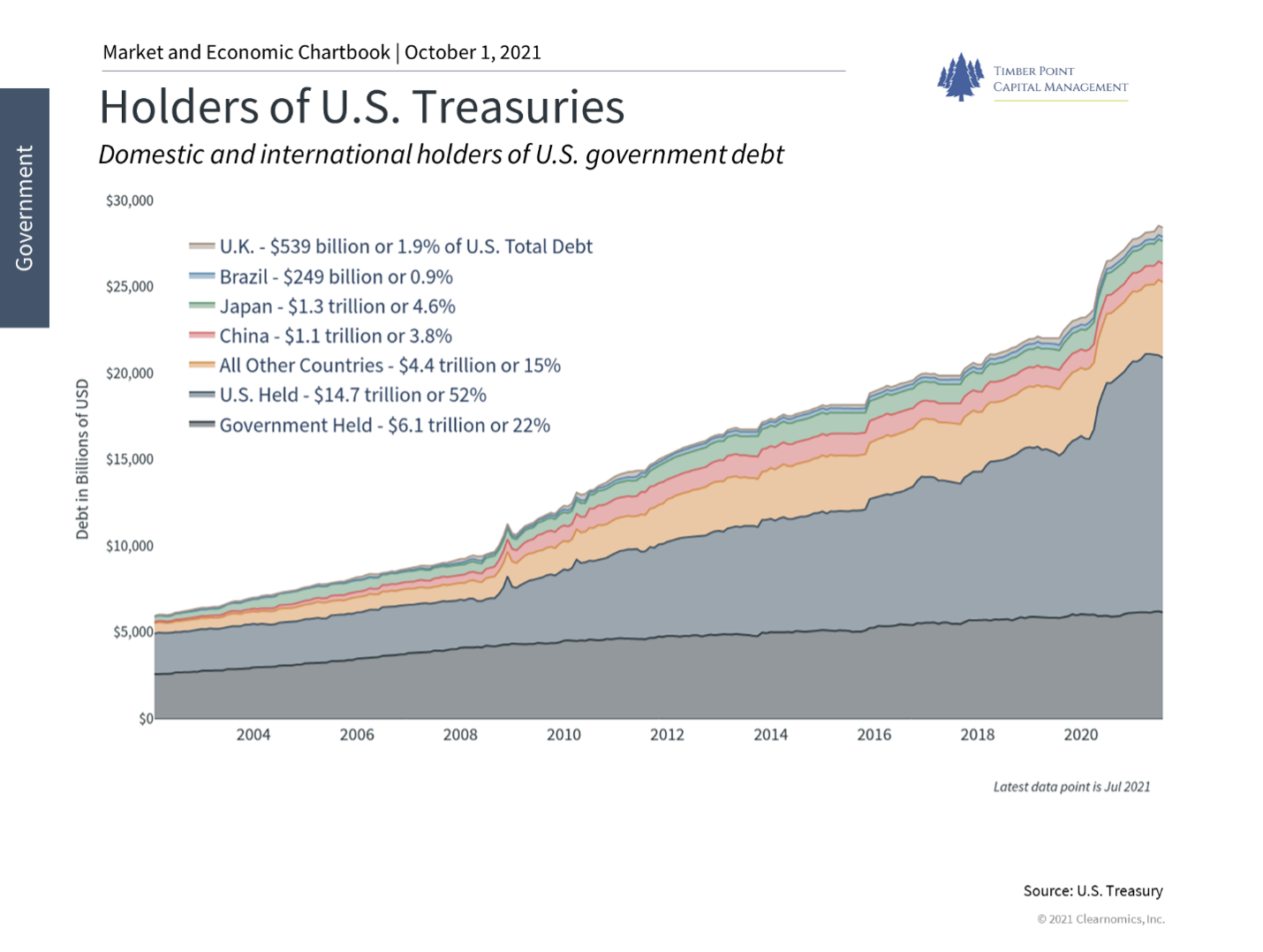

Should investors be concerned about debt ceiling? We are not…

- Debt ceiling negotiations typically cause only near-term volatility (next few days/weeks)

- There have been 6 previous government shutdowns longer than 1 day since 1990

- Data suggests that markets DO NOT react meaningfully to government shutdowns

- Shutdown, if occurs, will be very short as Democrat’s can resolve issue on their own

- Given Afghanistan debacle, do Dem’s want to further global confidence in US? No.

- Extended shutdown will increase the search for alternatives to US $ as reserve currency

- Q3 earnings/economic growth forecasts are fundamental drivers of asset prices in medium term

- Why are analysts lowering 3Q earnings estimates? Likely supply chain worries…

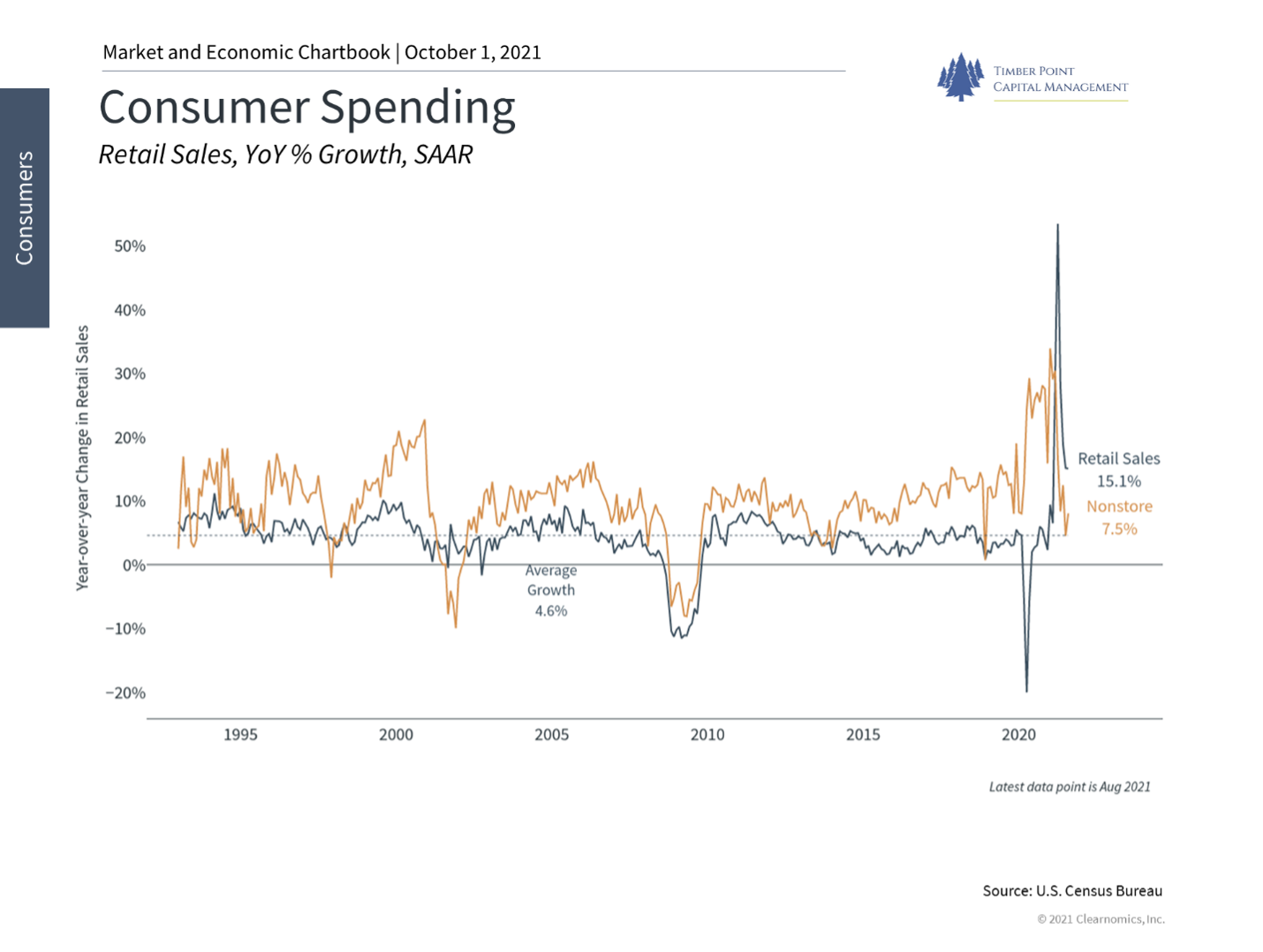

Consumer spending strong heading into Q4/holiday season…but issues exist

- Port congestion increasing…container ships awaiting LA and Long Beach port entry has doubled to 73 ships in past few days

- Average wait times for ship entry are now ~ 3 days longer than August levels

- Double Trouble: unprecedented demand at ports AND transport Co’s struggling to hire

- Flowing through to companies: FDX , NKE and now BBBY

- Bulk shippers benefitting – Dry bulk shipping ETF (BDRY) +23% QTD and 362% YTD

- Employers concerned about vaccine mandates for businesses with 100+ employees…

- Holiday season blues: employees quit amidst holiday season? Implications for retailer’s revenues and earnings in busiest part of year?

Recent Comments