The Timber Log is a quick overview of Timber Point Capital’s weekly investment meeting. If you would like to join the call or have questions about the content, please reach out to Patrick Mullin at pmullin@timberpointcapital.com

The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

A 5% SPX correction remains elusive…we believe caution is warranted

- SPX down only a bit more than 5% intraday on 9/20…algos kick in to support market

- Evergrande no longer a risk? China will nationalize the problem, or will they? Not likely a systemic problem

- Fiscal considerations in US – debt ceiling, infrastructure bill, higher taxes = deemed not a risk….for now

- Fed policy – market relieved to hear of tapering and rate liftoff in ’22 – for how long?

- But where will US rates go if Italy trades at 60bps?

- EU effectively trades on confidence in Germany backstopping any EU financial issues

- Higher taxes and regulation is not just a US issue…it is global!

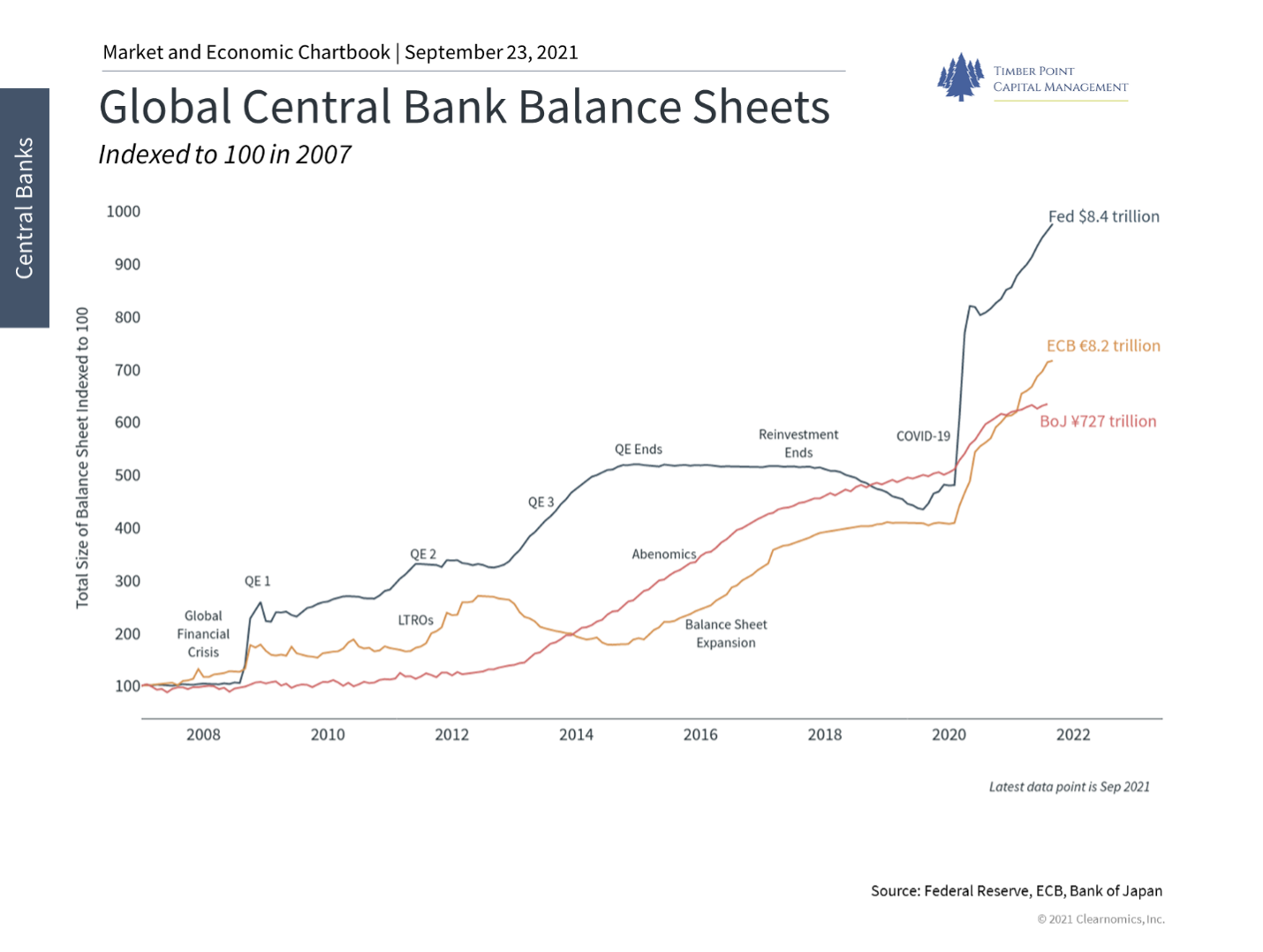

Despite tapering talk, we see Fed balance sheet continuing to expand

- Market doesn’t know the details yet but > spending and taxes likely higher next few years

- More spending is effectively redistribution of income, the pie only growing slowly

- Higher taxes reduce incentives for production and risk taking, budget deficit will increase

- Supply dislocations continue = FDX and truckers warn still difficult to find workers

- Covid stimulus and earnings recovery will slow, and compares difficult: 3Q20 GDP up 33% y/y

- US economy beyond pre-pandemic earnings levels, transitioning to slower/steady state growth

- Net net, US long term economic growth will return to 1% – 2% range

- Should we expect ROW economies to grow faster than US? No, and we know China is slowing

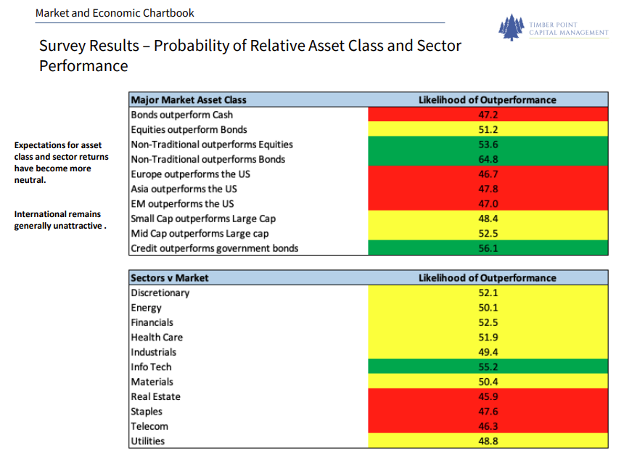

4Q21 Survey results are in…we believe equities slightly outperform bonds going forward

- Caution is the order of the day as denoted by yellow shading, conviction low…this is a change!

- Policy concerns are real and potentially ominous – question is how best to structure portfolio

- Opportunity sets become limited as equity expected returns decline to low single digit range

- Equity vs. Bond conviction is low; Bonds expected to underperform cash

- Fixed Income – increase high grade FI yet remain o/w to credit sectors

- High conviction in non-traditional (alternatives) outperforming bonds…bonds may be negative!

- Info Tech favorite sector going forward…the only place to find growth?

- RE, Staples and Telecom are all interest sensitive and deemed underperformers going forward

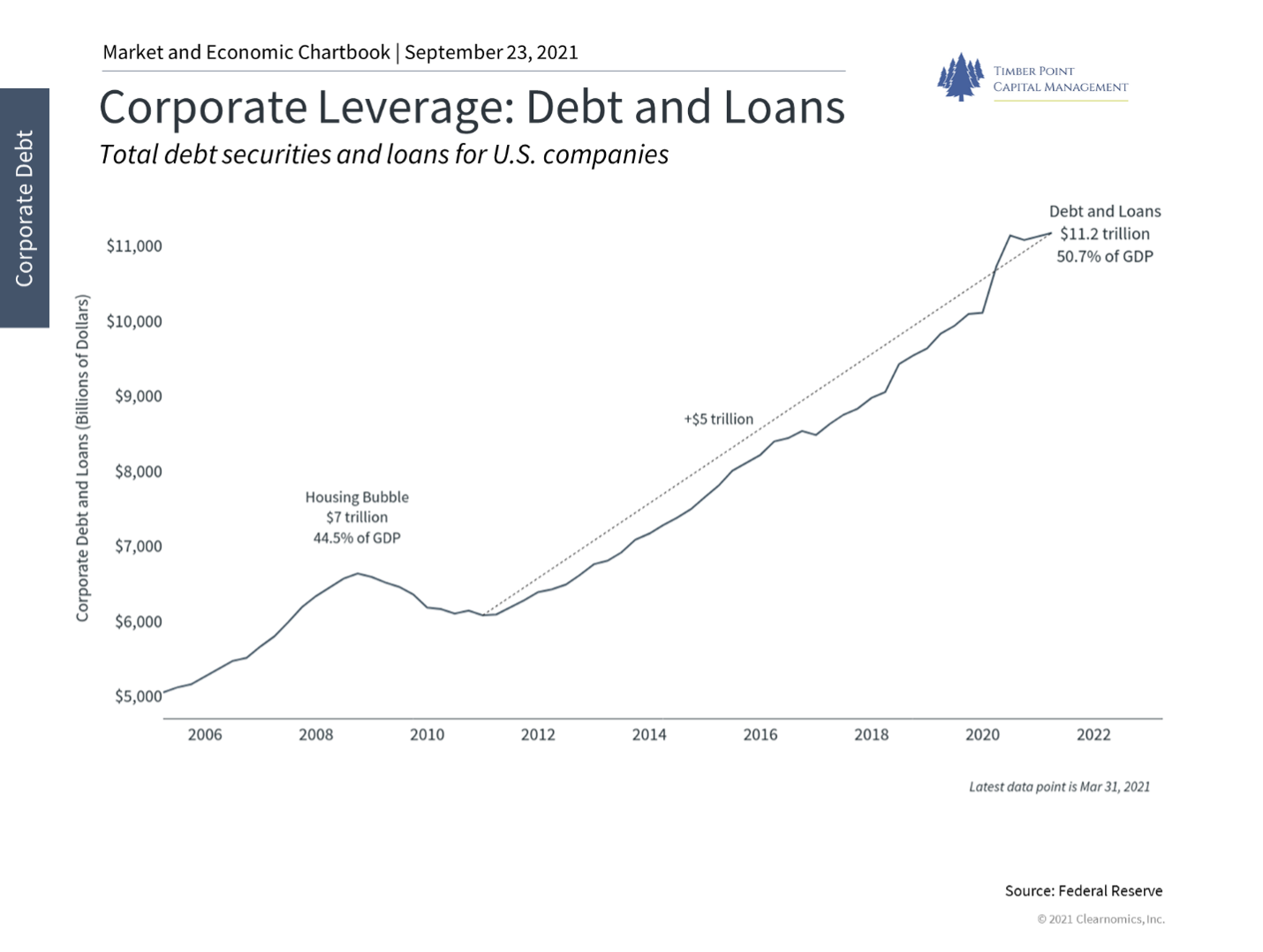

Emergence of “Shadow Banking” makes us rethink risk in global debt markets

- PE firms reshaping financial markets and lending, taking over the role of traditional banks which have been regulated into submission

- Banks no longer entirely control money supply and flow of credit, is why M2 continues decline

- PE firms and hedge funds are now liquidity providers but not operating under gov’t regulations

- “Shadow” market can raise funds, get inflated credit rating and flows onto corporate balance

- This is all over insurance industry via structured credit…regulators not concerned about this

- Insurance co’s grow in low interest rate env…attach to PE firm and fund premium growth/liabilities…only so much that can do…

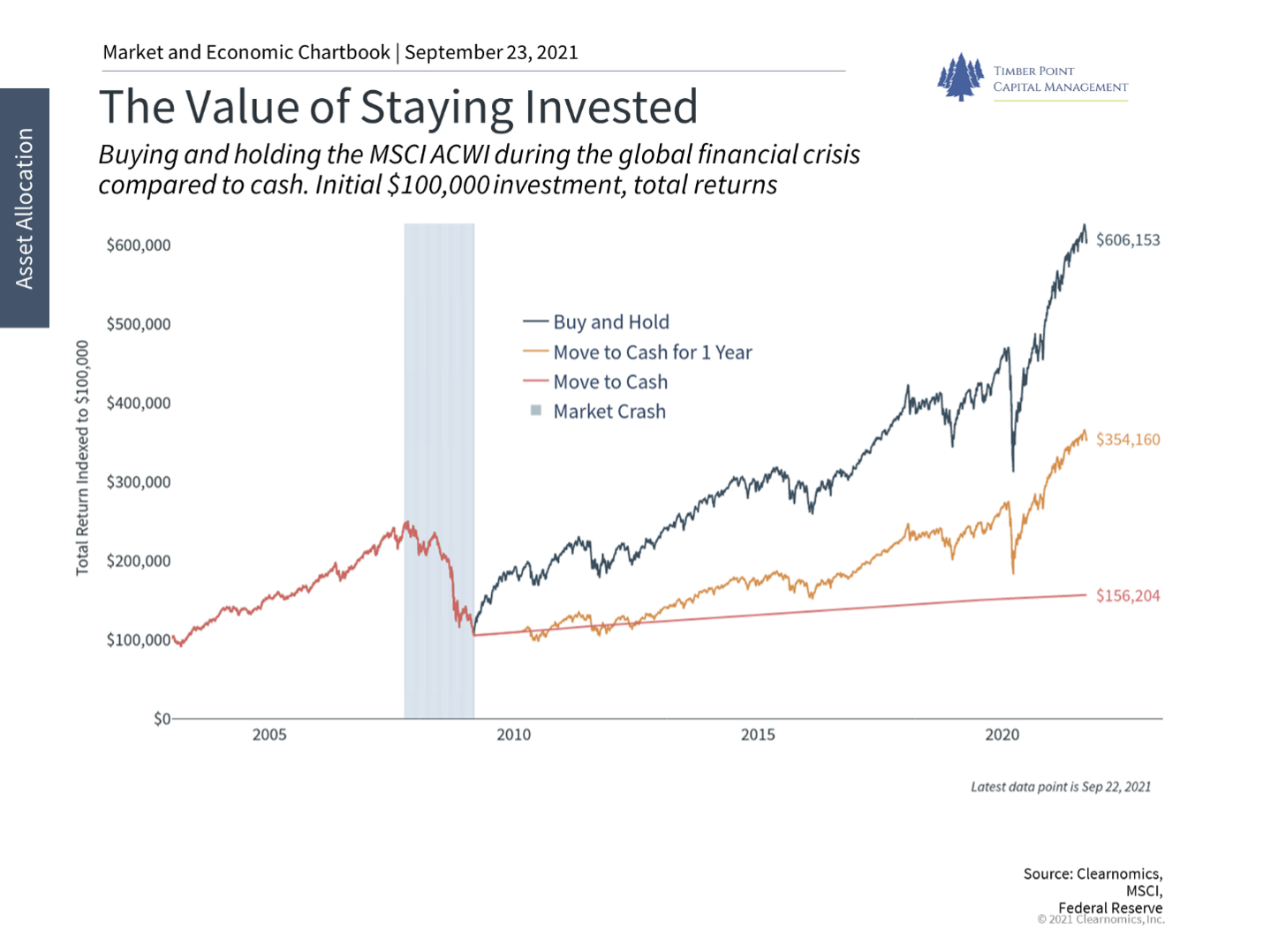

A gentle reminder: Caution warranted does not mean head for the hills!

- The GFC is in far in the rear-view mirror at this point but can still provide instruction

- As can the pandemic earnings recovery…

- Drawdowns are painful and can be severe – far more than 5%, 10% or 20% “corrections”

- But opportunities arise despite the intense and negative drum beat from pundits/press

- Asset allocation is key – have you reviewed equity holdings and weights?

- Fixed income – what is duration and credit exposure?

- Alternatives can provide diversification of return streams, keep your eyes open!

Recent Comments