The Timber Log is a quick overview of Timber Point Capital’s weekly investment meeting. If you would like to join the call or have questions about the content, please reach out to Patrick Mullin at pmullin@timberpointcapital.com

The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

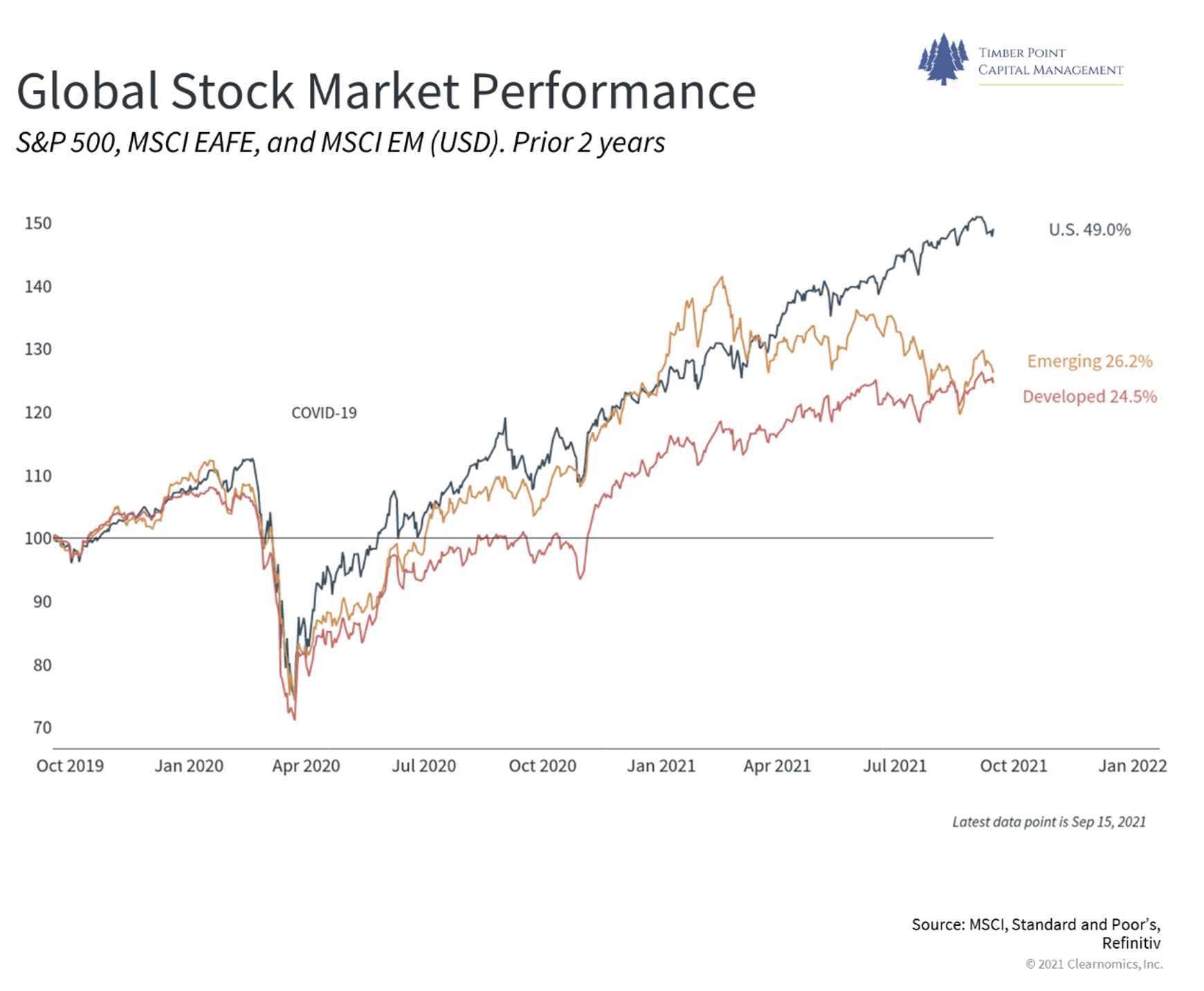

Rotation from US to International markets – Does that make sense?

- Our thesis has been that US vaccination rates in excess of ROW have helped drive relative market returns

- Vaccination rates in Europe now in excess of US; EM continuing to play catch up, US stagnating

- Delta variant in US showing early signs of abating; this could refuel “re-opening” play in US

- London, Paris, and Milan now all have traffic levels above 2019 pre-pandemic levels

- China has specific set of issues – are we close to the end? Perhaps, but over levered property development and Macau now taking center stage

- El Salvador adopting bitcoin as legal tender – botched and volatile rollout – others are watching

- Valuation differentials are wide and favor non-US equities

- Structurally we like the US markets still, but are watching ROW markets closely

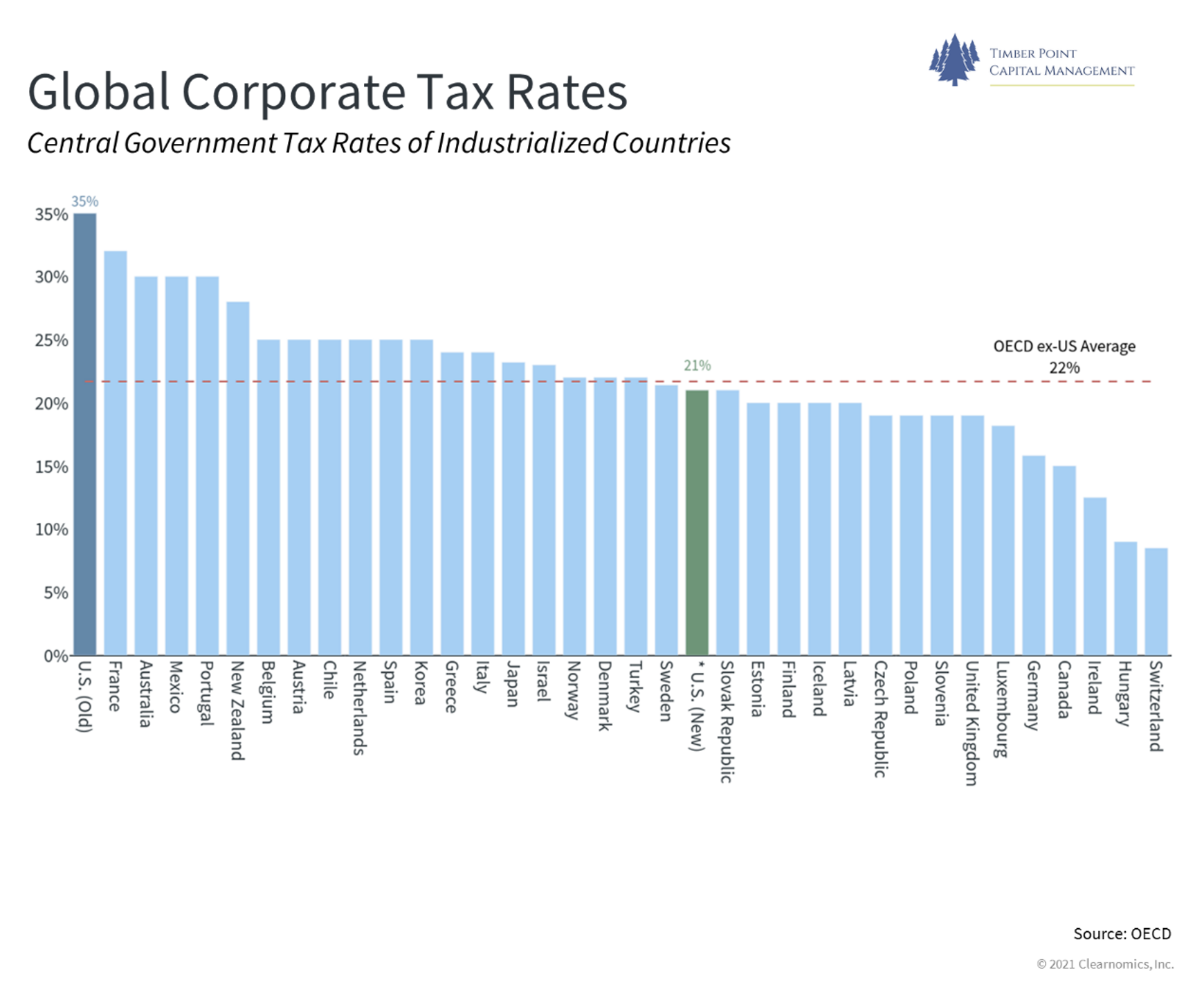

U.S. tax proposals not as bad as feared, Biden wanted more to offset spending

- Corporate rate to 26.5% vs. current 21%, individual to 39.6% vs. 37%, cap gains to 25% vs. 20%

- Democrats aim to pass legislation via budget reconciliation – still need every Dem Senator vote

- A few Democrats pushing back on cutting prescription drug prices – interesting!

- ~ $75 billion will be invested in IRS tax enforcement, rate increases retroactive to date proposed

- Europe and Latin Am countries also increasing taxes, so while US plan not good, it is still a relative winner

- Short-term impact of higher taxes is minimal but will have substantial impact longer term

- Growth estimates for 2022 likely too high if tax increases go through, provide further boost to Republicans in mid-term elections

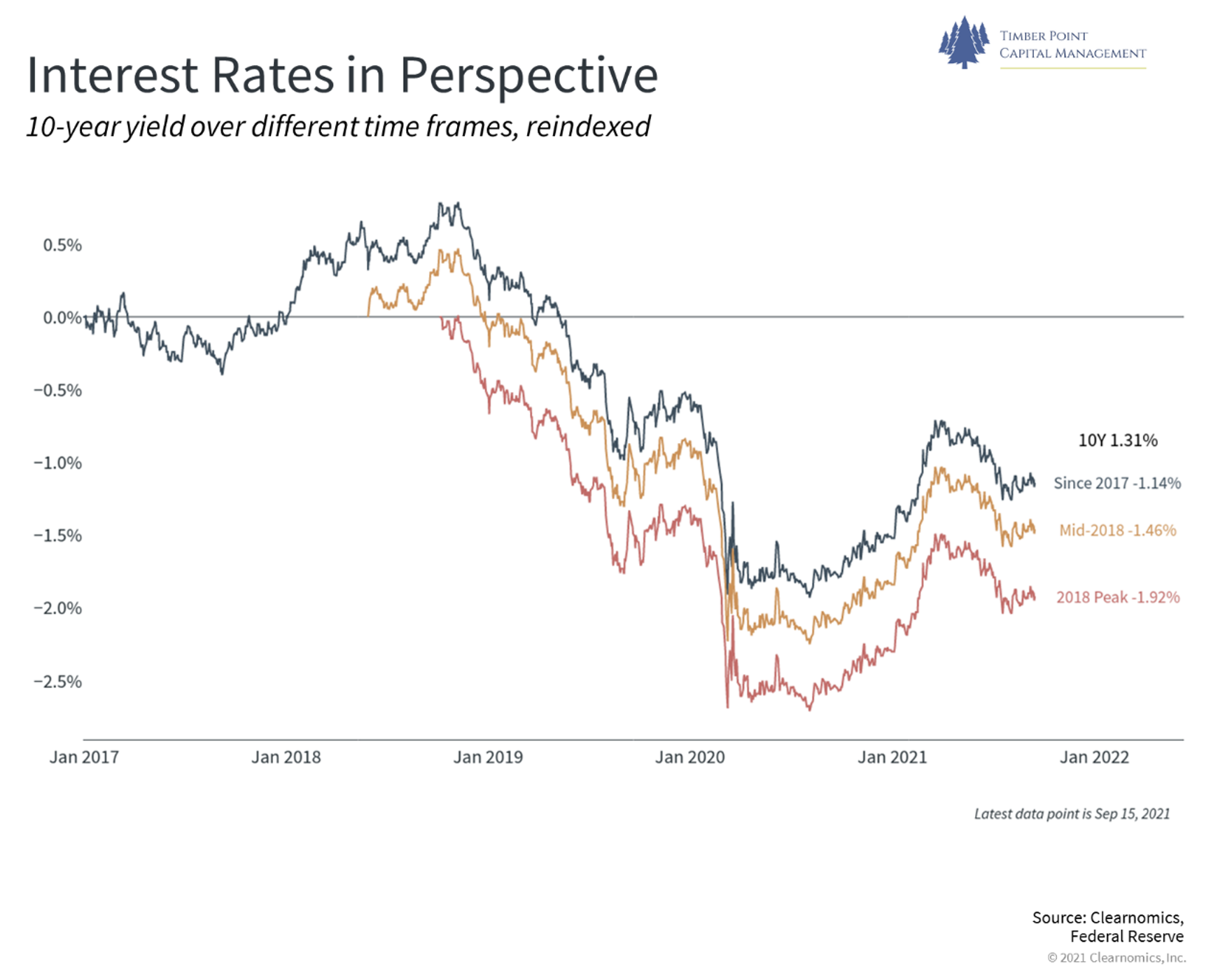

The US economy is slowing, and budget deficit is increasing…tricky time for the Fed!

- As noted last week, Fed will play ball with the administration, Powell wants to be re-nominated

- Fed must balance financing gov’t expenditures, tapering and keeping inflation under control…??

- How does Fed do this? Greater financial suppression that restricts M2 from entering economy

- M2 velocity continues to decline, suppression is working</li>

- T-bills rates are already lower, long end of curve flattish and high yield spreads still tight

- Inflation thesis as temporary continues to play out in latest dataset (August) = gives Fed a pass

- Financial markets are not overly concerned with size of Fed balance sheet – AT THE MOMENT!

- Shadow banking companies will do very well in the near and medium term

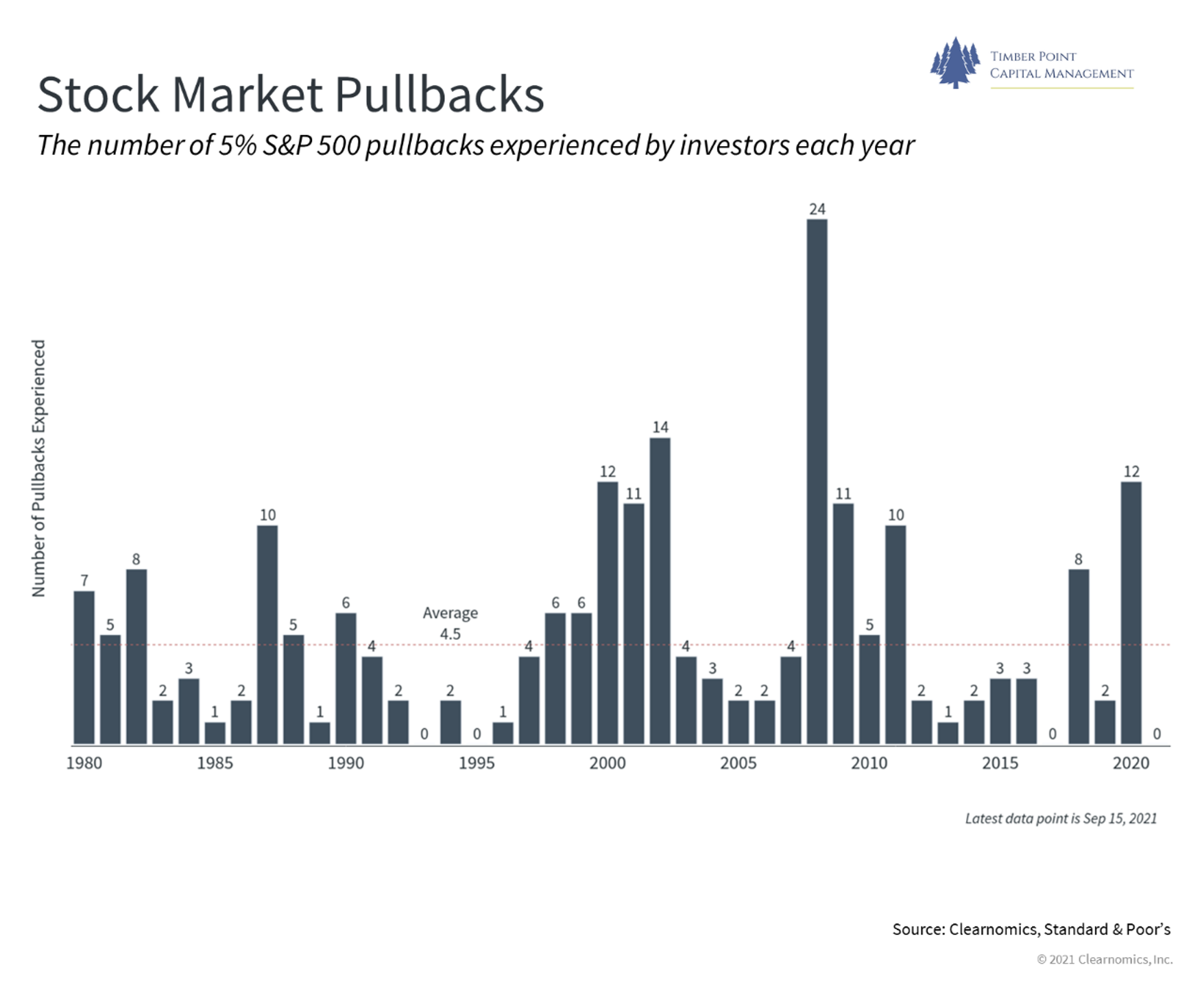

September and October are upon us…still no 5% pullback in the market!

- Fed’s aggressive monetary stance and earnings recovery supporting asset prices

- TINA, there is no alterative…money flowing to stock market – better than residential RE..?!

- AMC and GME meme stocks hold steady, Uranium and Natural Gas now join the party

- Meme ETF, NextGen AI Sentiment Leaders Index (BUZZ), up 50%+ TTM (thru 9/16)

- Robinhood now targeting college students to open accounts

- Of course, we will see a 5% pullback again…probably even in 2021!

Recent Comments