The Timber Log is a quick overview of Timber Point Capital’s weekly investment meeting. If you would like to join the call or have questions about the content, please reach out to Patrick Mullin at pmullin@timberpointcapital.com

The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

Straw Poll: Will U.S. go into Covid/Delta variant lockdown?

- Most participants do not believe so – small business and muni’s will localize solutions

- Most people will not accept further lockdowns – pol’s want to exert control? Yes.

- Believe will see vaccine passports to restrict people from activities

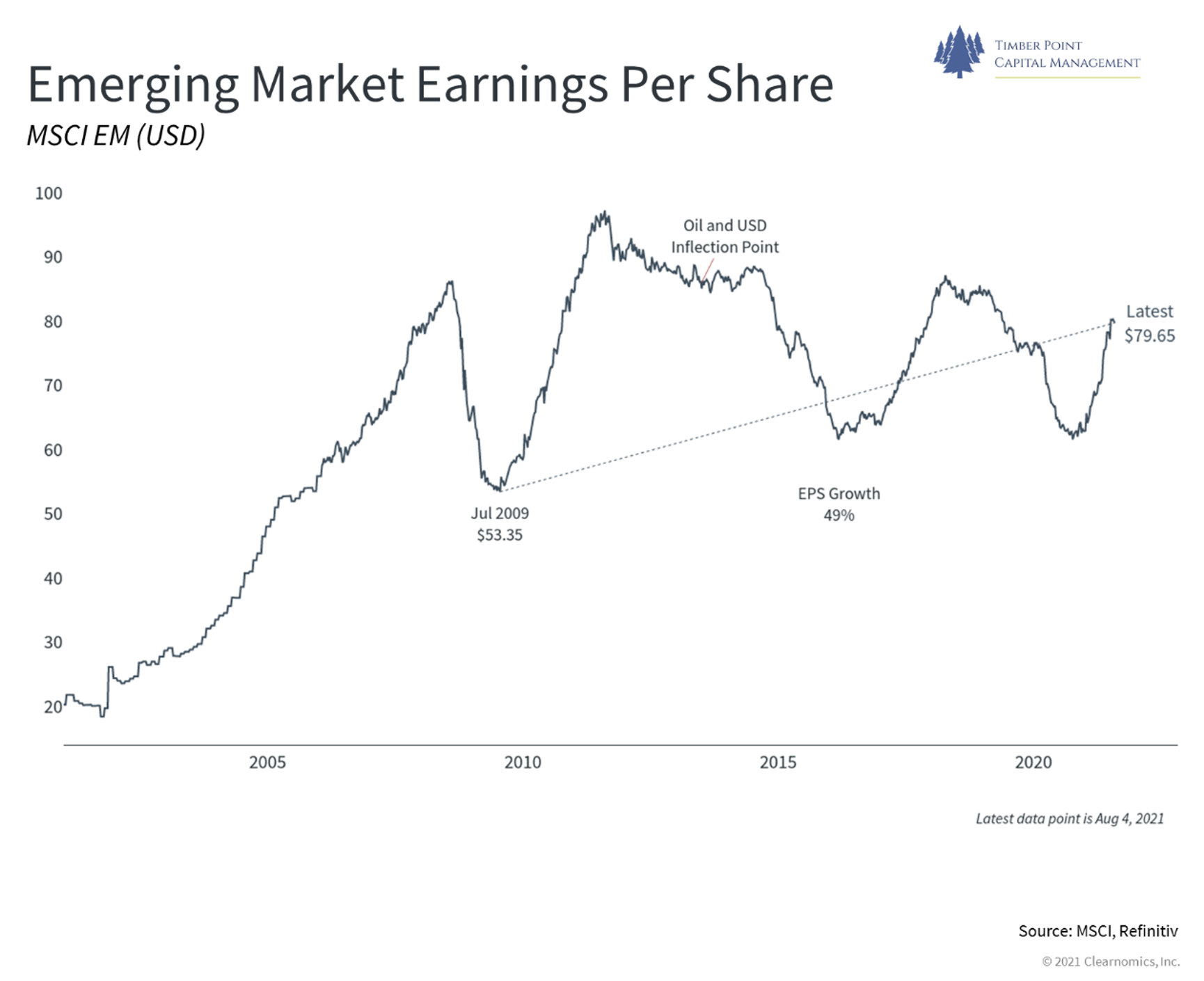

- Need Covid test to return to U.S. from abroad…EM economic recovery at whim of Covid

- This is a Covid/vaccine economic led recovery…policy moves could upset the trajectory

- Pol’s believe that policy measures have driven the recovery so expect more

- Unintended consequences anecdote: 46% of people in US own some form of rental property – know one owner refusing to rent property as not want to get locked into bad tenant

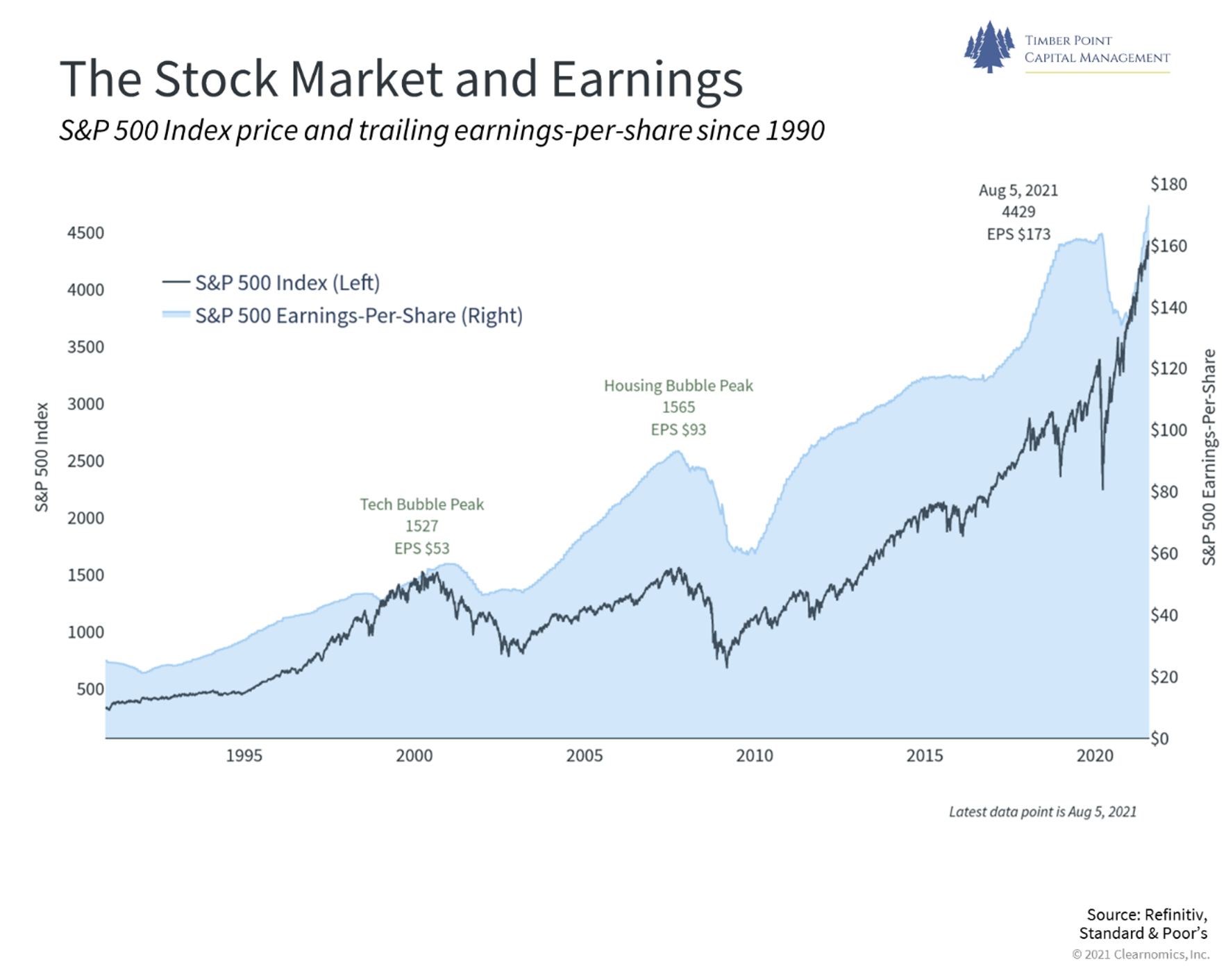

Revenues and earnings are strong, stock reactions not so much…

- Despite difficult labor market for many employers, able to find work around solutions

- As economic growth normalizes, expect to see stock and sector performance separate

- Interesting EPS of the week: JLL big eps beat, global RE, noted record office leasing!

- Anecdote: know broker at JLL who says “never busier” as people rethink office solution

- Small/Mid cap: cont’d constraints on hiring/supply chain – demand strong across board

- On the downside: AMZN (higher spending) and CLX (less demand, input prices)

- Most companies believe they have pricing power…will that continue through 2021/2022?

China and the global stage – economic sabotage not part of the plan…

- China wants/needs its companies on the global stage, but won’t play by western rules

- “Authoritarian capitalism” means they will exert control over how companies operate

- Fun facts: TCEHY mkt cap = size of South Africa GDP; BABA = Turkey

- Will Yuan become a reserve currency? Possible, all trade partners will transact in yuan

- Consistent economic policy vs. U.S. where elections shift priorities every 4/8 years

- China risks: lack of rule of law, auditing standards (perhaps), violation of human rights

- Will China become Japan of 1980’s which was going to take over the world…

- Bottom line: we still think China equities represent long term opportunity

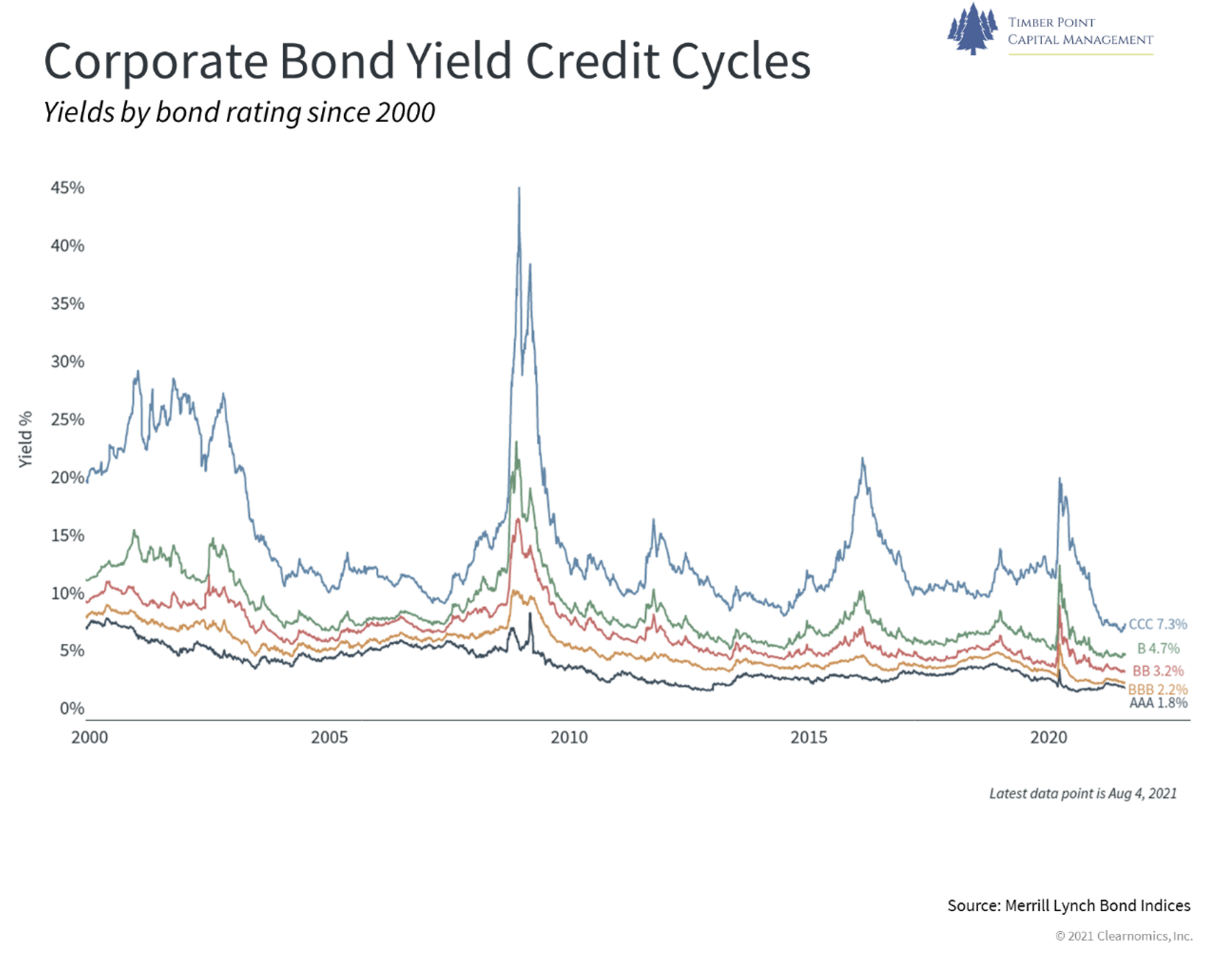

Is there value to be found in Fixed Income? The opportunity set is limited…

- Bonds yields are surreal…economy is strong, rally of past few months confounding

- Have been active in spread product, moving up in quality and picking spots

- Long end is not interesting, have been shortening up duration

- Active in preferred and hybrid market, mostly regulated entities

- Closed-end funds – good buys, sold way too early, some now at small premiums to NAV

- Corporate credit – are still long, and nervous as economic hiccups will hurt

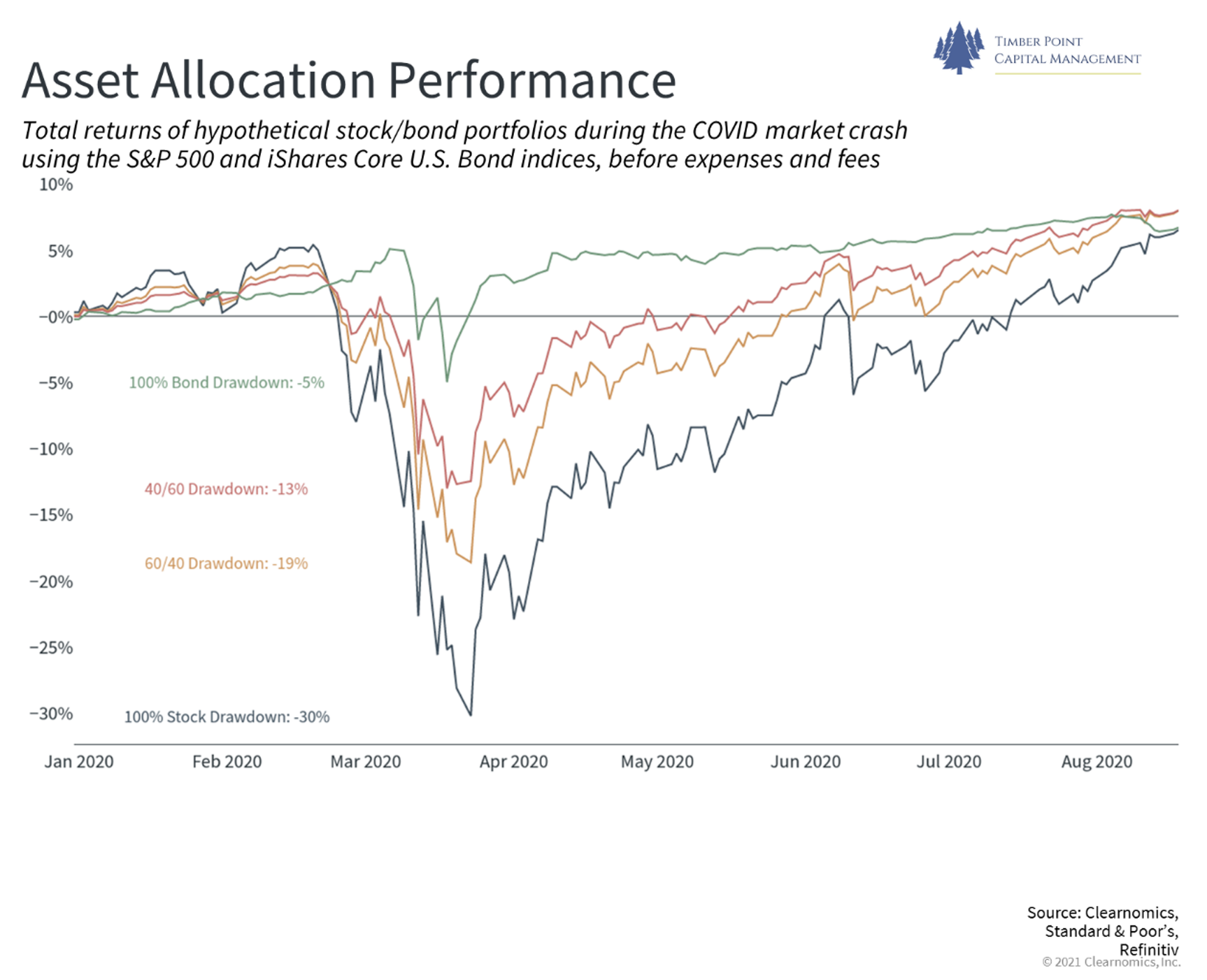

- Realized volatility in portfolio is very low, now running 2%…portfolio performed well

- Bottom line – we believe most everything is expensive in the bond mkt – those out on risk spectrum will get hurt

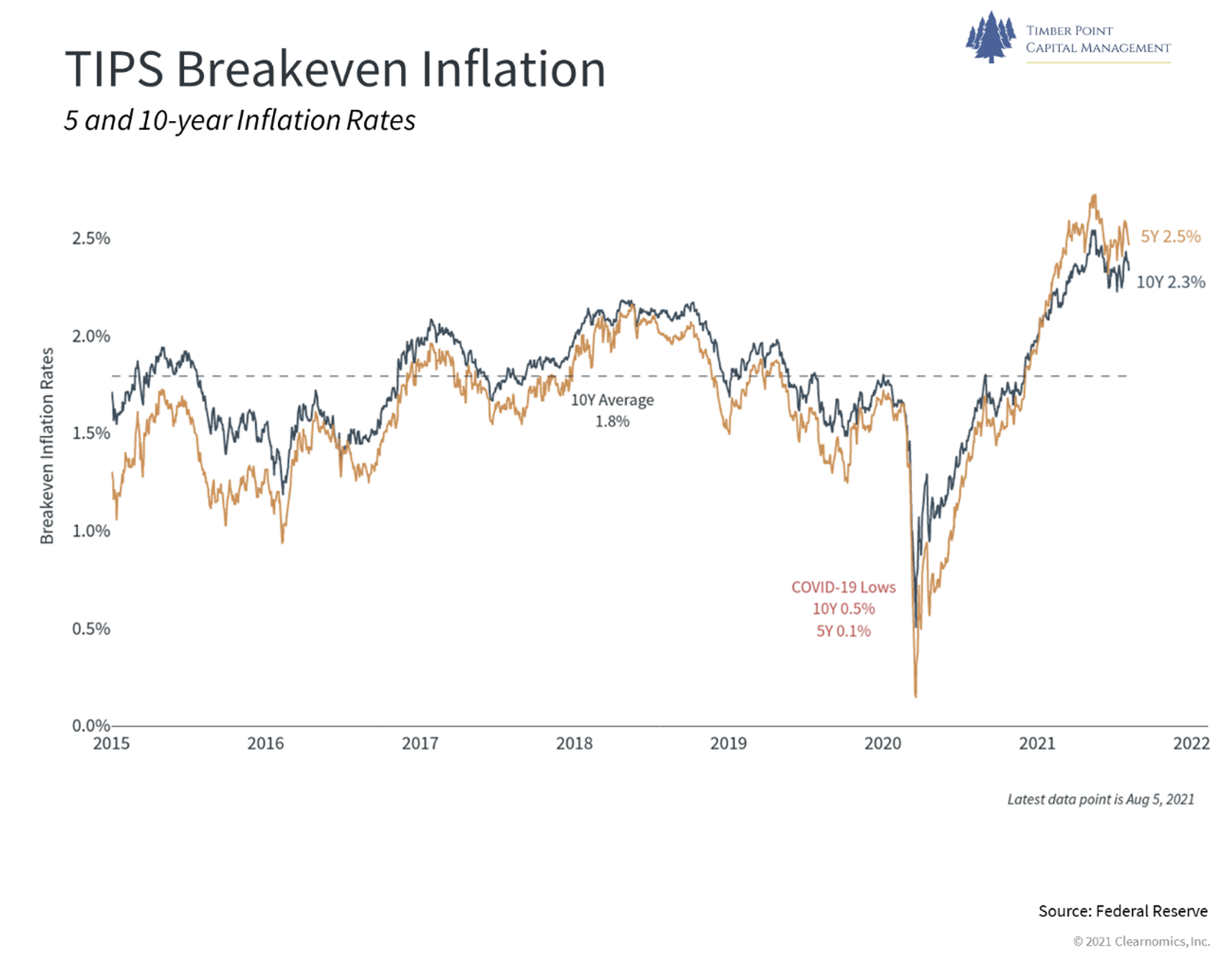

Our thesis on inflation is playing out – we believe it is transitory…

- Who has pricing power? Most companies think they do…not all do, of course

- Read recent Phil Gramm article in WSJ – money supply collapsing from 15-20% growth last year to now 8-10% due to Fed’s reverse repo’s

- Gramm’s data not publicly available any longer on FRED database

- $4.5 trillion held in excess reserves…if buy into that, inflation will not be a problem

- Bond mkt is telling us there won’t be inflation

Recent Comments