The Timber Log is a quick overview of Timber Point Capital’s weekly investment meeting. If you would like to join the call or have questions about the content, please reach out to Patrick Mullin at pmullin@timberpointcapital.com

The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

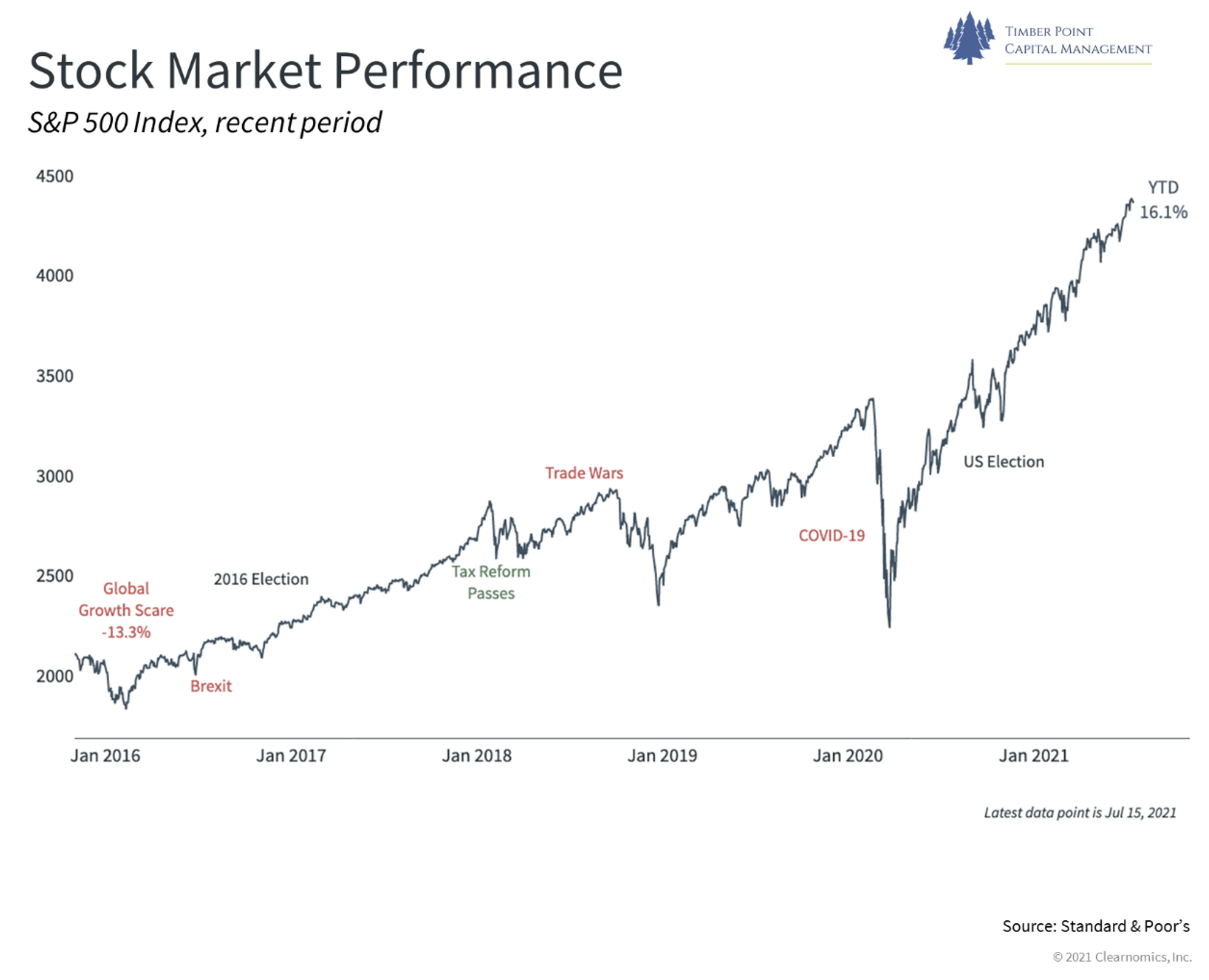

Largest 8 stocks by weight in SPX 500 account for ~50% of YTD return of 16%…

- Market no longer broadening out, large cap tech returns to favor and driving SPX 500

- “Tech Staples” – large cap tech winning in higher inflation/slower growth environment

- Rates casting doubt on economic growth post easy pandemic compares = recovery names falter

- $ rally due to ROW inability to vaccinate, increasing delta variant cases and return to lockdowns

- ’22 EPS estimate clarity needed – supply chain will crimp sales (F), margins (CAG & GIS) in 2Q21

- US still preferred equity allocation – will remain so until ROW delta variant cases under control

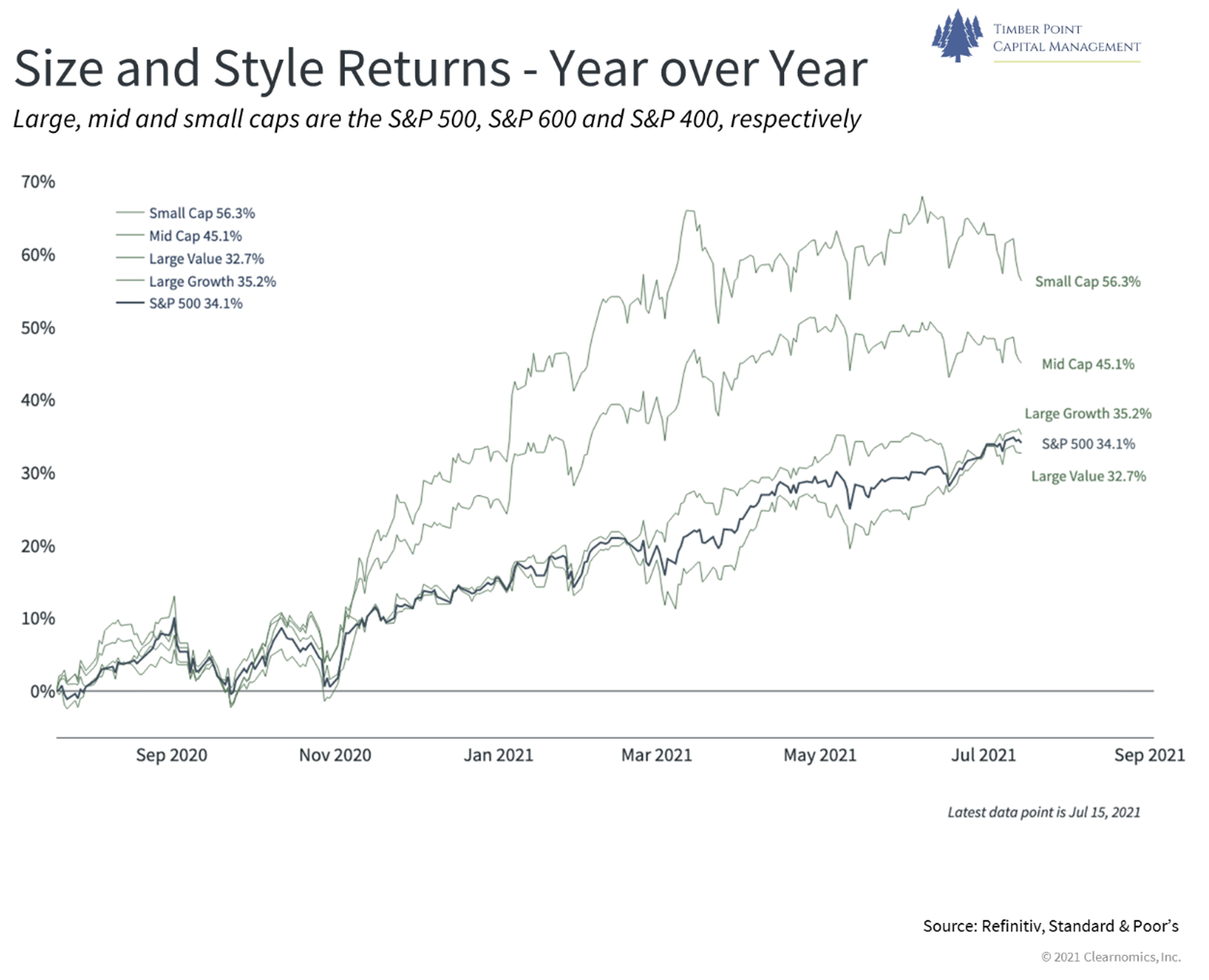

Small and Mid-Cap stocks look to have peaked again…for the time being

- Small caps being impacted by economic growth concerns and rise in delta variant cases

- Given ROW struggling with delta variant we think > domestic exposure of small caps is attractive

- Yield backup has stopped the financial rally in its tracks; stronger dollar hurting cyclicals

- Huge inflows into small cap in latter part of ’20 and ’21 have now subsided

- Are record IPO volumes to blame for small and mid-cap underperformance? Yes.

- We think small caps are nimble enough to sidestep possible increasing regulation – market does not agree with us currently.

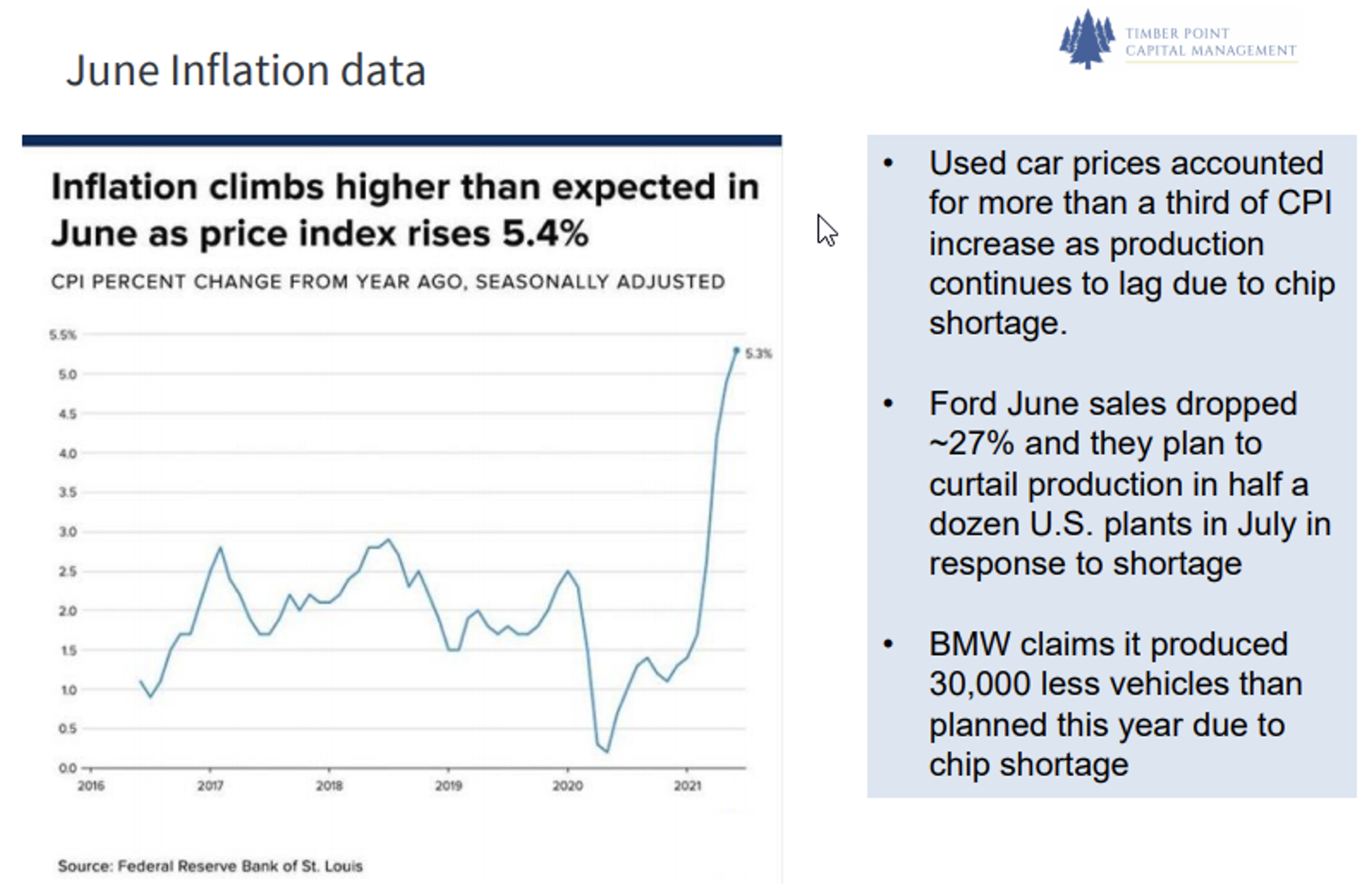

Inflation: Transitory or Structural? We think transitory…

- Supply chain issues continue to impact inflation prints – June report highlighted rental car prices

- Lumber prices continue to ease…easier to cut down trees than build semiconductors

- Velocity of money still very low, increased money supply not making its way to the economy

- Fed should start to talk about reducing bond purchase program…but when? Later in ’21.

- Until supply constraints are normalized, inflation prints will not worry the Fed

- Recent WSJ article never mentioned money supply in inflation article…how can that be?

- High Yield spreads back to pre-Covid and pre-GFC tights – not paid to go out on the risk curve

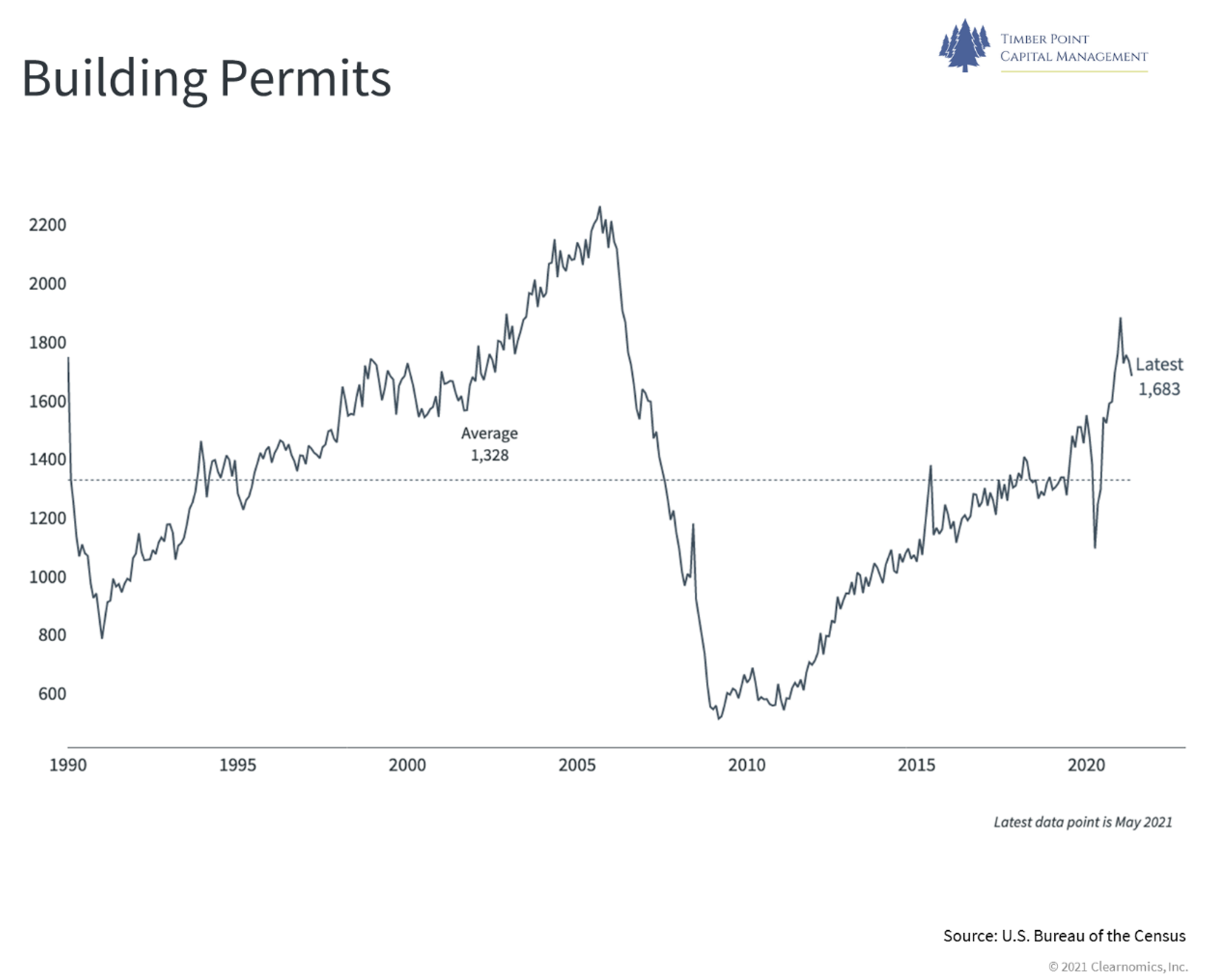

Housing market cools off a bit despite lower rate environment…

- Eviction moratorium for renters ending on 7/31…this is now the “final extension” per CDC

- Corporate ownership (Invesco, Carlyle, Blackrock) of single-family home having impact on prices as ~ 2 million homes are off the market and in rental pool only

- Apartment and multi-family market could get very interesting…will be big bolus looking

- Big question is whether major exodus out of major city centers will reverse any time soon

- Home builders expect to “take” price to increase margins even as lumber prices decline

- Home builder equities are early cycle, now are underperforming despite recent rate decline

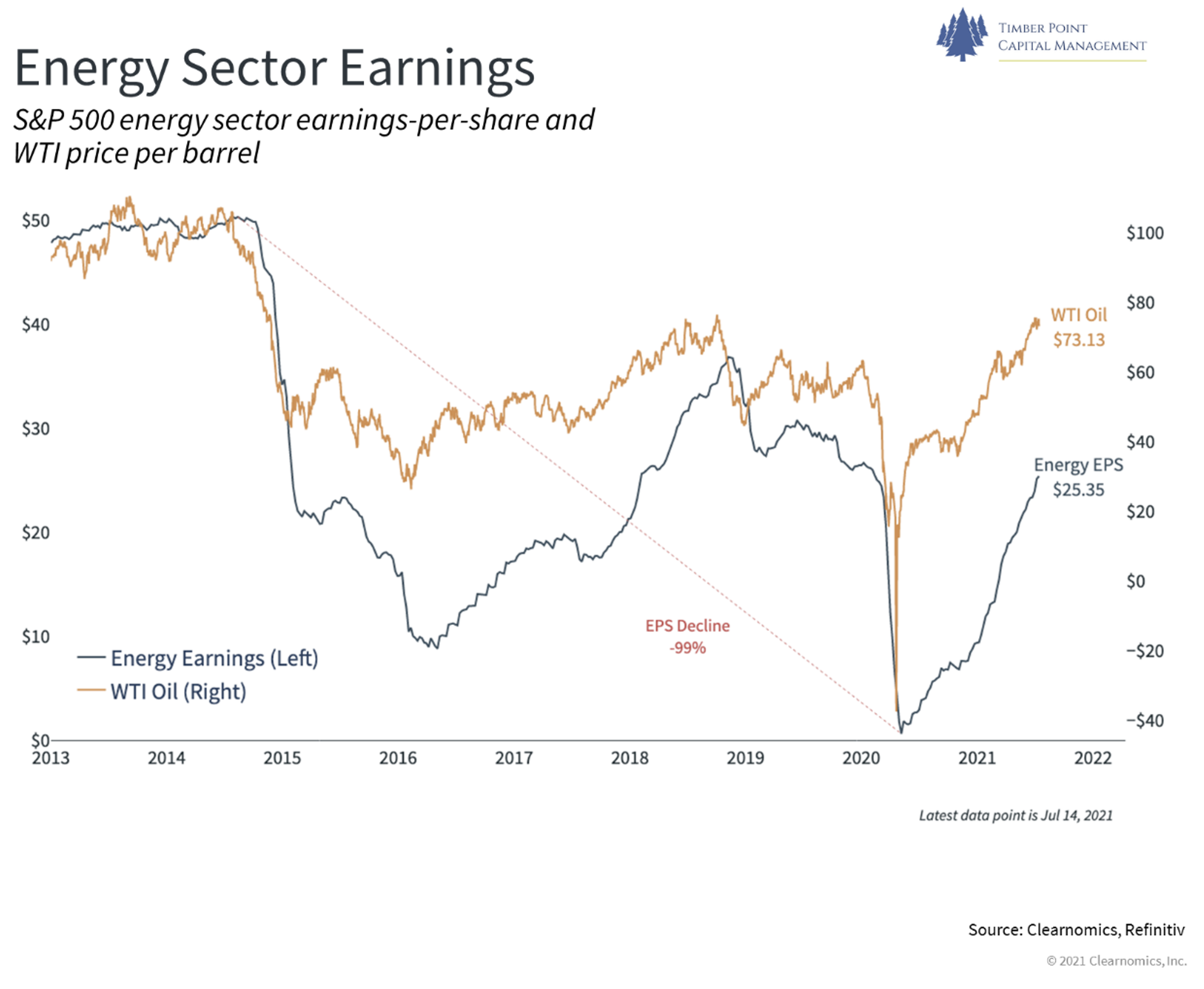

Crude one of the stronger commodities…for how long?

Crude one of the stronger commodities…for how long?

- OPEC wants to pump more barrels, members arguing who gets the benefit – what’s new??!

- UAE has 50+ reserve life but wants to accelerate production into a 30-year window

- US was swing producer – ESG and variable dividend model has made US less responsive

- Regulation matters! In 1970’s, US restricted heavy oil and shifted demand dynamics to light crude that US did not produce, thereby swinging power to OPEC

- 2020’s – US policy, ESG investors and clean energy mandates are helping OPEC + Russia

- US rig count has doubled from ’20 lows, still 50% off 2018 levels

- We understand rebounding demand dynamics, expect supply to offset further price increases

Recent Comments