Although the presidential election results are not entirely conclusive, the American people have spoken and more so than anything else the election has proven that United States remains a centrist nation and investment markets have cheered that outcome. As of this writing, Joe Biden appears as if he will become the 46th US President of the United States and the Republicans will retain control of the Senate and will have picked up seats in the House of Representatives.

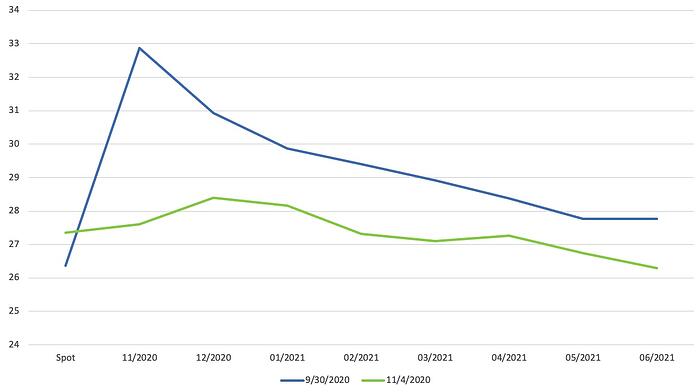

As we wrote in our fourth quarter outlook, markets had been anticipating instability around the election as indicated by the shape of the volatility futures curve (VIX) and the kink which had existed around the November contract. As you can see, following Tuesday, investors have clearly felt that the most extreme risks associated with the election have not been realized and the volatility curve has meaningfully flattened, and markets have subsequently rallied. God Bless America!

4Q Volatility Changes

Source: Bloomberg

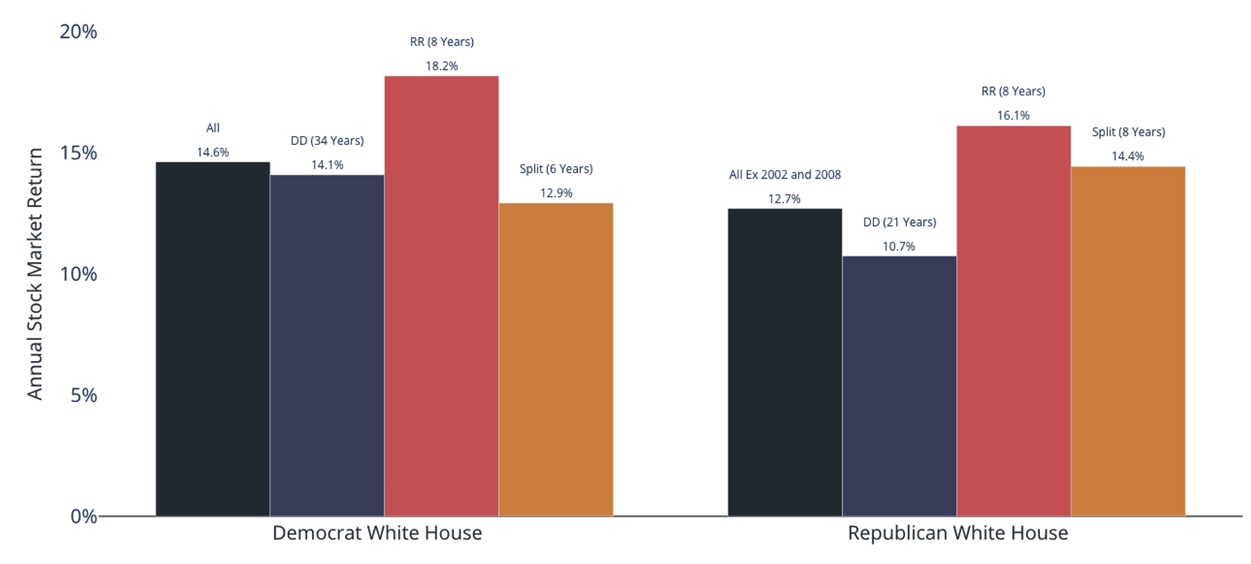

In our opinion, the talking point which many investors reference, that the stock market has historically performed better under Democratic Presidential administrations than Republican administrations is not entirely complete. We believe that one needs to look at the totality of the political spectrum to determine what works best and the below graph clearly indicates that a split government with Democratic control of the White House and Republican control of the Congress has historically been the most beneficial political mix for investors.

Political Parties and Stocks

Source: Clearnomics

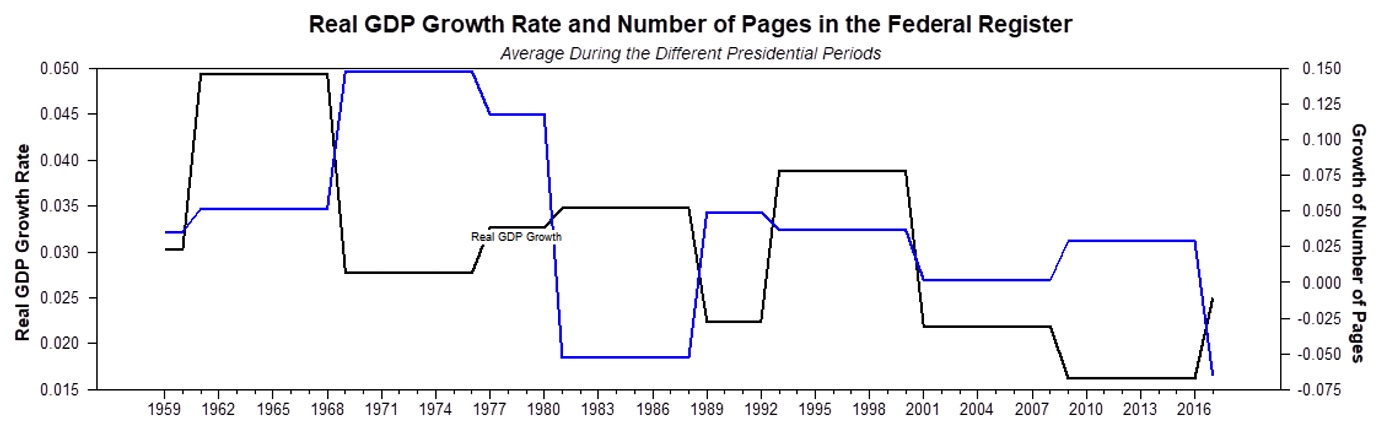

Correspondingly, the post-election rally which we’ve experienced over the past two days is based on the expectations of gridlock in Washington and no meaningful changes from the status quo, particularly in regard to taxes. Yet, when you peel back the onion a bit, Wednesday’s rally was very concentrated with poor market breadth. In fact, small cap stocks posted negative returns. Why would that possibly be the case? In as much as changing the tax code will be a difficult task for a Biden Administration, through executive order the regulatory environment on business is likely to become more onerous. The Trump Administration has spent the last four years rolling back many regulations which lowered administrative costs on businesses. It is likely that a Biden Administration will look to reverse that regulatory reform. To the extent that the regulatory burden increases, this may prove to be a headwind to economic growth and may have a more meaningful negative impact on smaller businesses.

The Effects of Regulation

Source: St. Louis Federal Reserve

Having said that, it is too early to begin to fully dissect the policies of the new administration. On the campaign stump, Joe Biden was notoriously vague on what he actually is going to do as President. He has promised to be a centrist and be an advocate for all Americans and currently the stock market appears to be taking that promise at face value.

More contention and volatility may be ahead in the near term, as the Trump campaign is in the process of implementing a legal fight to ensure a fair and accurate count of ballots across key states. For our part, we encourage the transparency that will result from these election lawsuits as it will allow the nation to acknowledge and validate the election and hopefully move forward in a constructive and more unified manner.

Once the election outcome is clear, as investors we will then begin the process of evaluating the new political regime and how it will impact the economy and what the resulting investment opportunities and risks will be. We remain encouraged by the fact that, as noisy as it may be at times, the unique American political system, filled will checks and balances, appears to have ultimately worked again and the divided government, which will likely take office in Washington next year, may be a constructive and effective outcome for our economy and our nation, as a whole.

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments