The Timber Log is a quick overview of Timber Point Capital’s weekly investment meeting. If you would like to join the call or have questions about the content, please reach out to Patrick Mullin at pmullin@timberpointcapital.com

The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

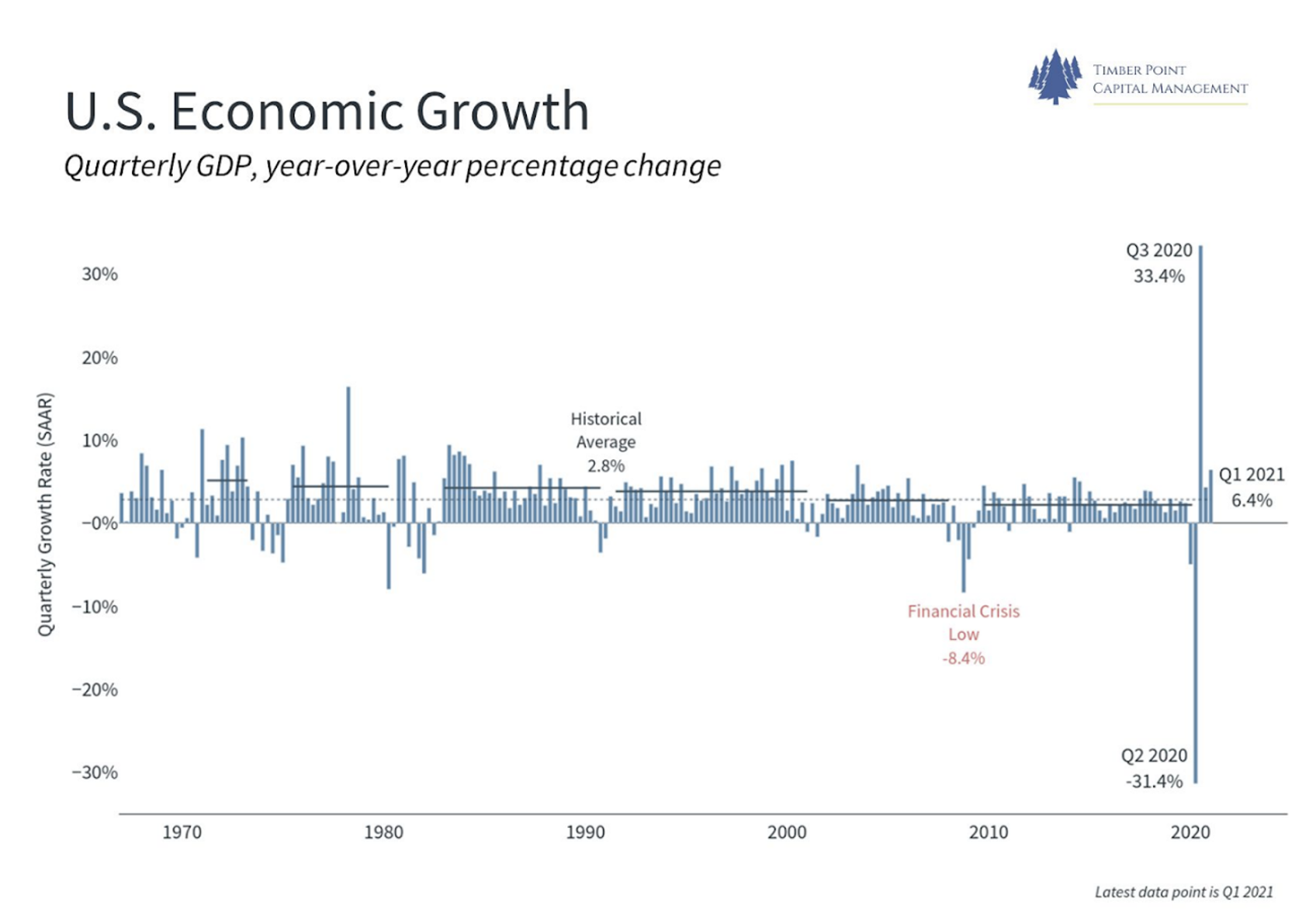

Continued V-shaped recovery in real economic growth and labor market expected

- Real GDP increased at an annual rate of 6.4% in 1Q’21; compares to (4.8%) decline in 1Q20 and 4.1% increase in 4Q20.

- Current estimate of 3.4% for GDP growth in 2Q21 (FRED)

- Unemployment rate fell 0.3% to 5.8% April ‘21 vs. 14.8% year ago (peak) and 6.8% Dec. ‘21 end

- Unemployed people fell by 496,000 to 9.3 million people; prior peak was 23.1 million people in April ‘20.

- Labor Participation Rate is currently 61.6%, compares to pre-pandemic high of 63.4 in Jan ‘20.

- Labor market participation recovery will be the driver of economic growth

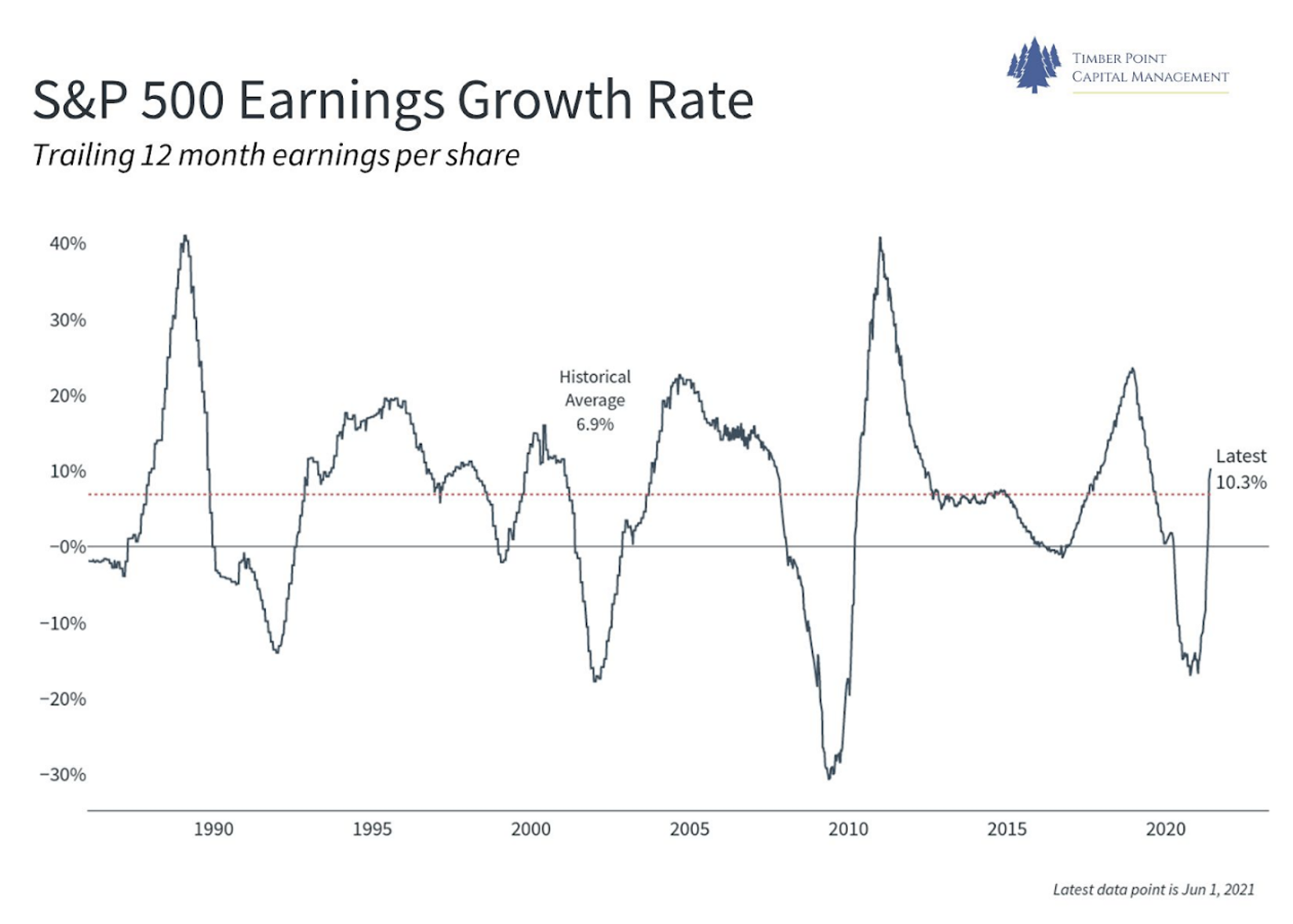

We continue to see V-shaped recovery in earnings benefitting cyclical sectors

- SPX earnings remain strong and continue to improve…current estimate for 2022 SPX earnings of $208 vs. $188 on 4/1/21 and $185 on 1/1/21

- V-shaped earnings recovery should benefit cyclical sectors – technology and small caps have caught a bid recently…commodities outperformance continues.

- Recent defensive outperformance of REITS and Staples likely short-lived

- Despite V-shaped recovery, 10-year yields continue to back up; FOMC meeting June 15-16 and Powell press conference

- Modest Increase in inflation is transitory, 10-year bond in rally mode post last CPI print

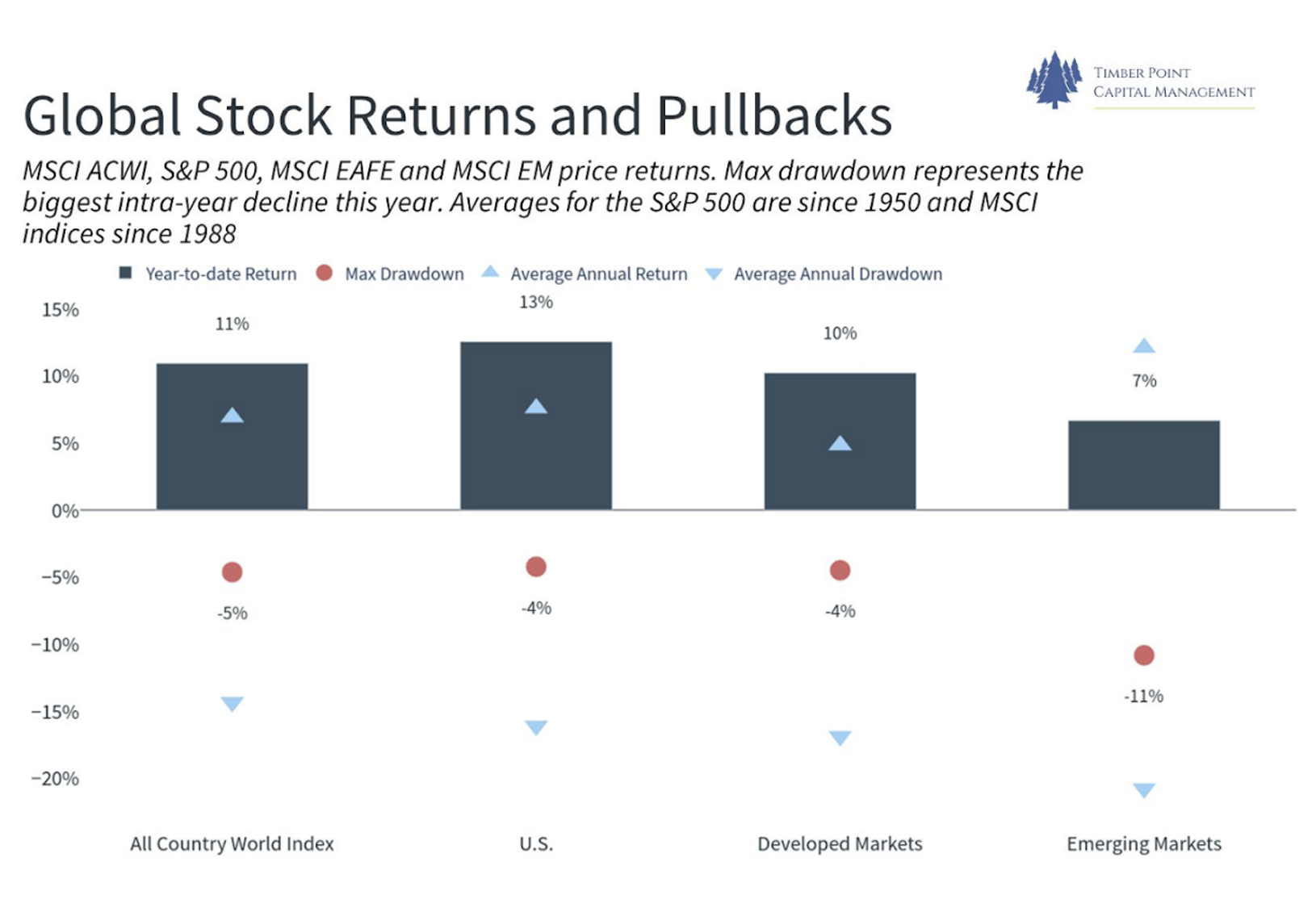

International market performance (EAFE and Emerging markets ) bears watching

- U.S markets continue to trade at meaningful premium to ROW

- U.S. vaccine rollout continues to meaningfully outpace ROW, justifying valuation premiums relative to international markets

- ROW may post strong economic growth relative to U.S. as they emerge from longer stricter lockdowns vs. U.S. growth normalizing

- TPCM asset allocation skewed to US risk assets, growing ROW allocation

TPCM asset allocation continues to favor risk assets though mindful of policy risks

- Consensus view is that rates will move higher at the margin but not impede economic recovery figures in ‘21 as cycle vs. ‘20 compares…

- Big question around estimates for ‘22 GDP growth estimates; Biden admin using 4.3% in latest budget proposal

- Tax and regulatory policies coming out of DC and the Biden administration are concerning if they gain additional traction

- Split Congress a major positive factor in preventing meaningful policy changes that may be detrimental to a favorable business environment

- Biden administration will likely be more successful on regulatory front – this will impact economic growth in medium term – market will discount before that

Recent Comments