The Timber Log is a quick overview of Timber Point Capital’s weekly investment meeting. If you would like to join the call or have questions about the content, please reach out to Patrick Mullin at pmullin@timberpointcapital.com

The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

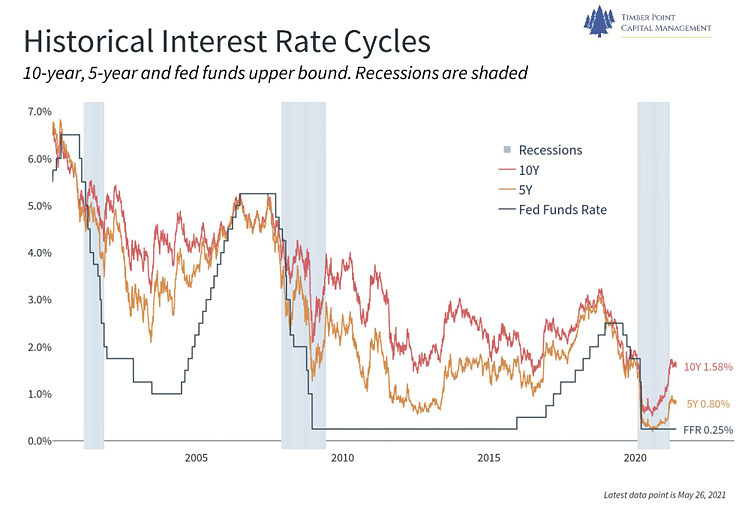

Even with inflation concerns ebbing, change in monetary accommodation could spike yields

- Big CPI print on 5/12 met with a yawn, followed by rally in the 10 year bond

- Discussion of less aggressive monetary policy could begin at June meeting

- 2013 Taper Tantrum – Bernanke speaks of reduced purchases in May ‘13

- 10-year yields doubled May ’13 to Dec ’13 from 1.5% to 3%

- 2013 was Powell’s first full year on the Fed…he approved of taper “by year end”

- Yellen’s Fed raised Fed Fund rates starting in late ’15…

- Powell took over early ’18, raised Fed Funds 4 times in 2018, ending at 2.5%

- Fed Funds rate raised 25 bps nine time between late ’15 and end 18…

- Fed very predictable…but criticized for pushing normalization too hard…

- 10-year yield peaks at 3.20% in 10/18 vs. 4% pre-GFC

- Recommend short duration, long credit; preferred’s have interest rate risk

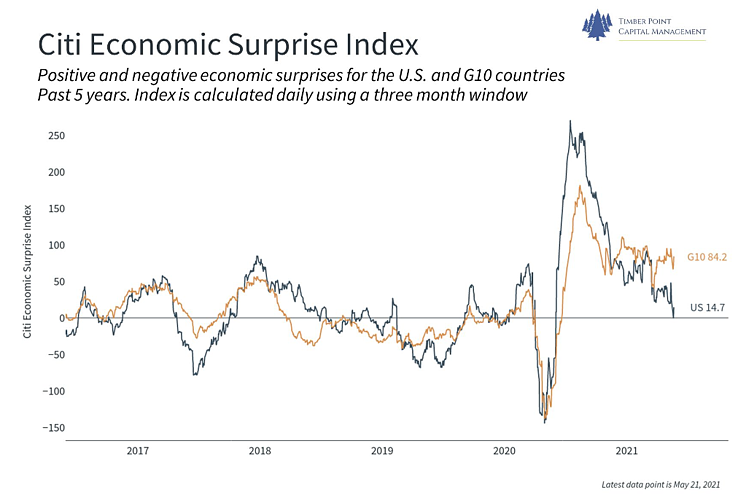

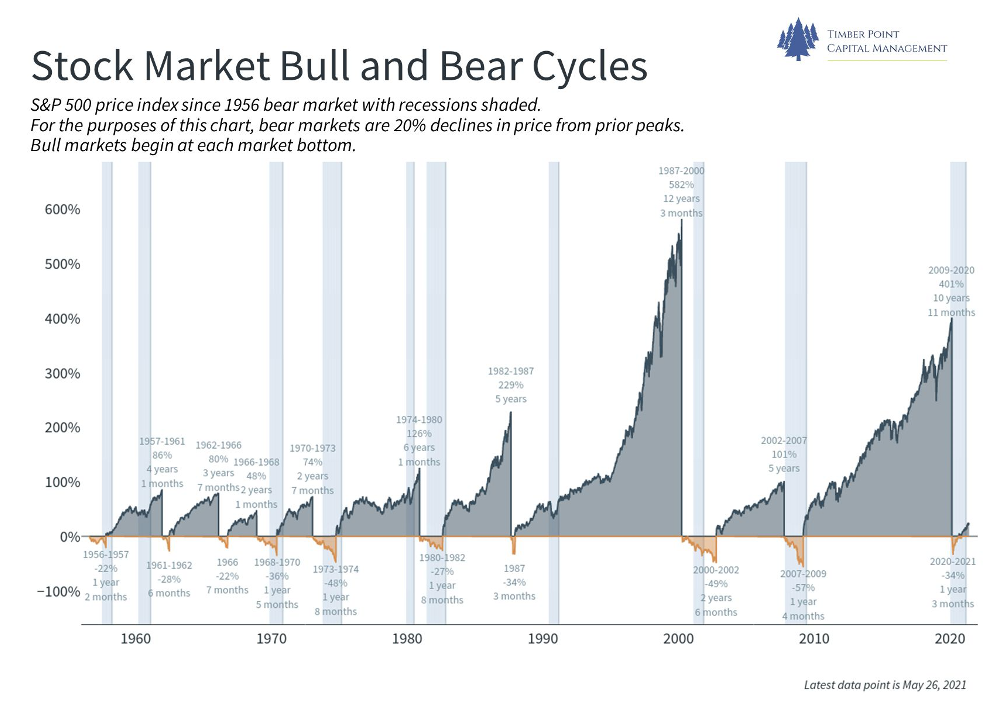

Recovery trade less productive and comfortable, easy money been made…

- Rotation back into tech…however, not into China tech yet = political risk

- Bond market rally quiets recovery trade, secular growers/small cap benefit

- Company execution being rewarded; fewer surprises, price action subdued

- Homebuilder activity strong…input costs increasing but pricing to maintain GM

- See value in industrials and materials on pullback as economy recovers

- Cash levels high, seeking non correlated asset = KRBN, Global Carbon ETF

- Will we get a pullback? We think pain trade is higher into June and Fed meeting

- Synchronized global recovery a function of Covid vaccine availability in EM/Asia

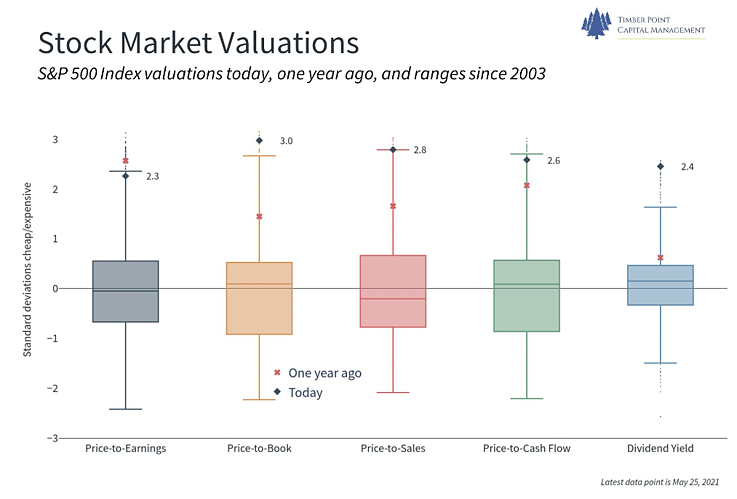

Stock price valuation concerning, what can we expect from growth in ’22?

- Expect strong 2H21 growth against easier compares, market is a discounting mechanism and starting to look at ’22 estimates

- Trendline growth of 2% – 2.5% in ’22, don’t believe we should expect more

- S&P 500 valuations on all metrics at high end of range going back to 2003

- Cannot look at valuations in a vacuum, financial returns in S&P 500 have improved markedly also

- Want to find consistent growers (secular) at reasonable prices vs. companies experiencing transitory rebound in fundamentally challenged industry

- Comparing ’22 earnings estimates to 2019 levels could provide some clarity

What could go wrong? Supply chain, digital currency, and Fed mandate confusion

- Chip supply shortage brings Senate legislation on chips = dangerous precedent in cyclical industry

- GM and F cancelled orders and now lowering production; Toyota the opposite

- Chips a corollary to lumber where mills shut down but plenty of wood available

- JIT planning can be risky if one piece of chain goes down = Suez Canal

- More on-shoring, storage infrastructure and inventory will be required

- Will Treasury issue digital currency? It will happen…

- Believe digital currency issuance could have big impact on banking, credit markets and credit allocation…

- Fed should not be involved in digital currency…is a Treasury function

- Fed mandate is price stability and employment not climate change and income distribution

Recent Comments