We all may be tired of hearing about Covid-19 but it remains important to monitor as we believe it continues to drive the direction of incremental dollars in the marketplace, specifically the ongoing appetite for “work from home” stocks in lieu of the more cyclically oriented “reopening” stocks. We decided to take a deeper dive into the Covid-19 situation and how the “second wave” in several states (TX, CA, FL) is now playing out. Our conclusion is encouraging given that the three states appear to be experiencing drastically lower hospitalization rates in their respective “hot spots” which should eventually result in lower mortality numbers for the U.S. overall. In turn, this could provide the opportunity for beleaguered sectors to return to more normal levels of economic activity.

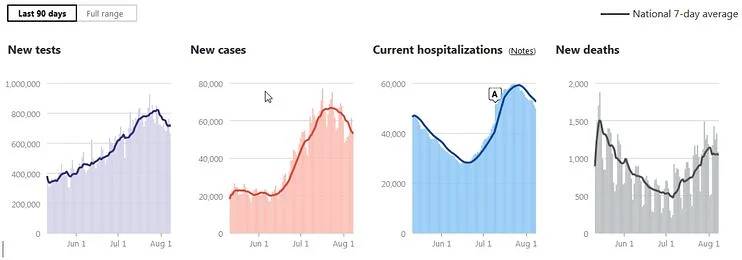

The U.S. appears to have hit a recent peak in terms of widely followed metrics including tests, new cases, and current hospitalizations, as seen below. Bucking this trend is mortality, which has shown a steady increase since July 1st. This increase in mortality is largely a function of three states – Texas, Florida and California – which by our calculations, account for ~ 45% of deaths in the month of July and greater than 100% of the increase in mortality in the month of July over June. Thus, the progression of Covid-19 in these three states is key to watch.

Source: COVID Tracking Project

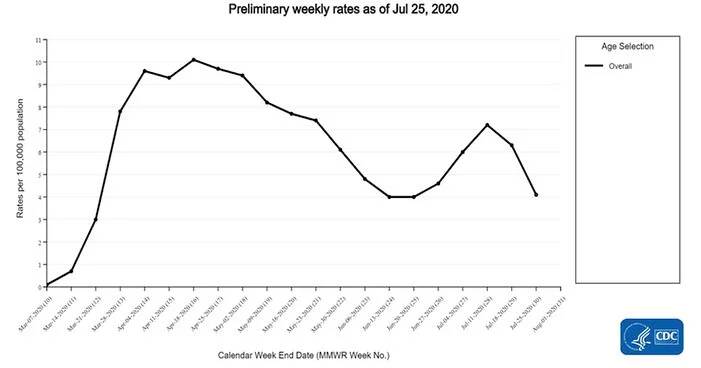

We focus on hospitalizations as a leading indicator of Covid-19 mortality as looking at positive test cases confuses the issue with people taking multiple tests, asymptomatic positive testers, and those with only minor illness. Common sense dictates that hospitalizations could lead to death and these figures create angst, or potential opportunity, for politicians tasked with making decisions related to erecting barriers to increased economic activity.

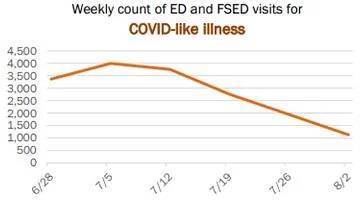

On the hospitalization front, the news is encouraging. National figures on visits to ER departments due to Covid-19 have almost halved since their peak in mid-July and are almost back to mid-June levels. Likewise, CDC is reporting a dramatic decline in the number of Covid -19 confirmed hospitalizations which has also returned to early June levels.

Laboratory-Confirmed COVID-19-Associated Hospitalizations

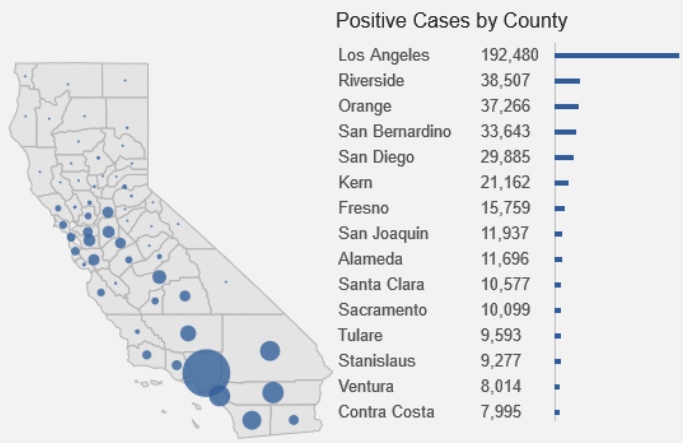

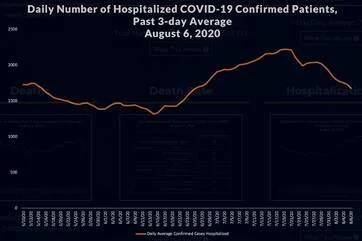

National trends are supported by data we have found on TX, FL and CA websites related to Covid-19 hospitalizations. Below we see information on California, and hospitalizations specific to LA County, which as shown on the map is the “hot spot” in CA. The 3-day average of hospitalizations in LA County has been on the decline for the past two weeks albeit it still has a way to go to return to the levels of mid-June.

Source: LA County Department of Public Health

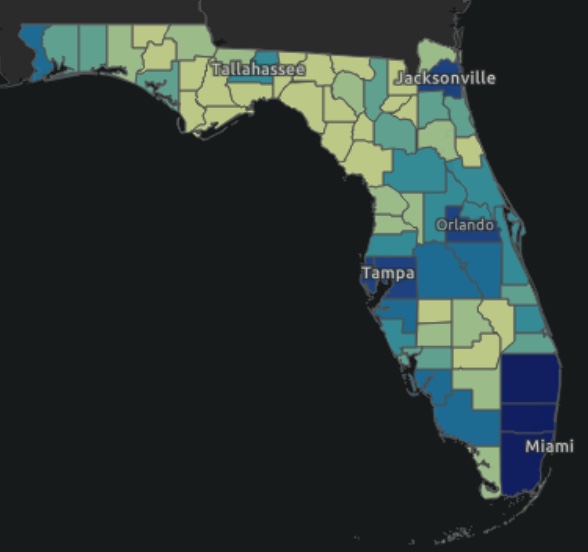

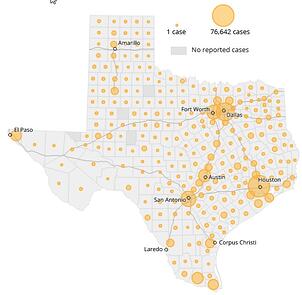

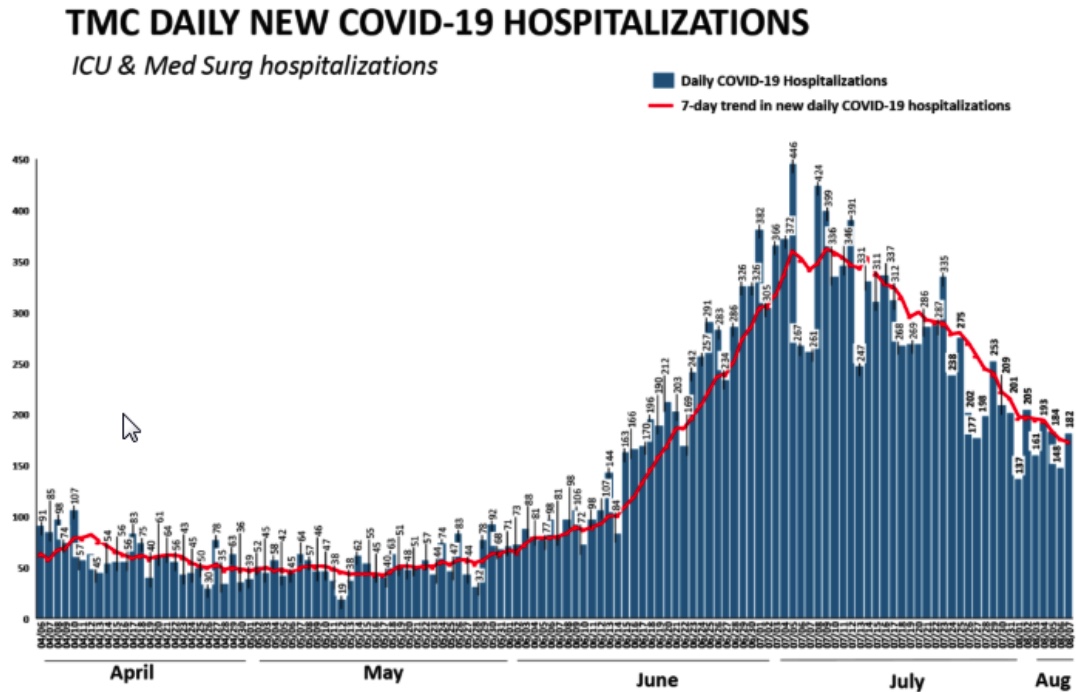

In Florida and Texas, we see similar declines in emergency room visits and hospitalizations. Florida’s Miami-Dade County represents 25% of Covid-19 cases in the state and has seen lower Emergency Dept (ED) and freestanding ED visits. In Texas, Houston represents almost 20% of statewide cases and its flagship hospital, the Texas Medical Center, has seen a dramatic decline in Covid-19 specific hospitalizations.

Source: Florida Department of Public Health

Source: Texas Medical Center

So, what do we make of this? We don’t want to underestimate the impact that Covid-19 has had on the technology sector in terms of accelerated adoption cycles for new technologies – that message has come through loud and clear this earnings cycle – and in the stock prices over the past four months! And there are other pieces to the economic puzzle that will impact the stock market going forward namely the ongoing stimulus discussion, the pace of rebound in unemployment figures and let us not forget the upcoming election.

However, we are heartened that hospitalizations appear to be on the decline on the national front as well as in “hot spots” of those states that have driven the so called “second wave”. From an investment perspective, greater clarity around this outcome could provide investors with increased willingness to search out those sectors that have been disproportionately impacted by the shutdown of various parts of the economy. Think entertainment, lodging, travel, and a whole host of other areas that could see funds recycled from the frothy technology and “work from home” names that have brought the Nasdaq to new highs. We do not know if the above trends will continue but they do offer a bit of encouraging news that could provide the impetus for investors to rethink where they position portfolios the second half of the year and into 2021.

We will continue to monitor the above data and will dig further into the investment implications in our next blog piece.

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments