The Timber Log is a quick overview of Timber Point Capital’s weekly investment meeting. If you would like to join the call or have questions about the content, please reach out to Patrick Mullin at pmullin@timberpointcapital.com

The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

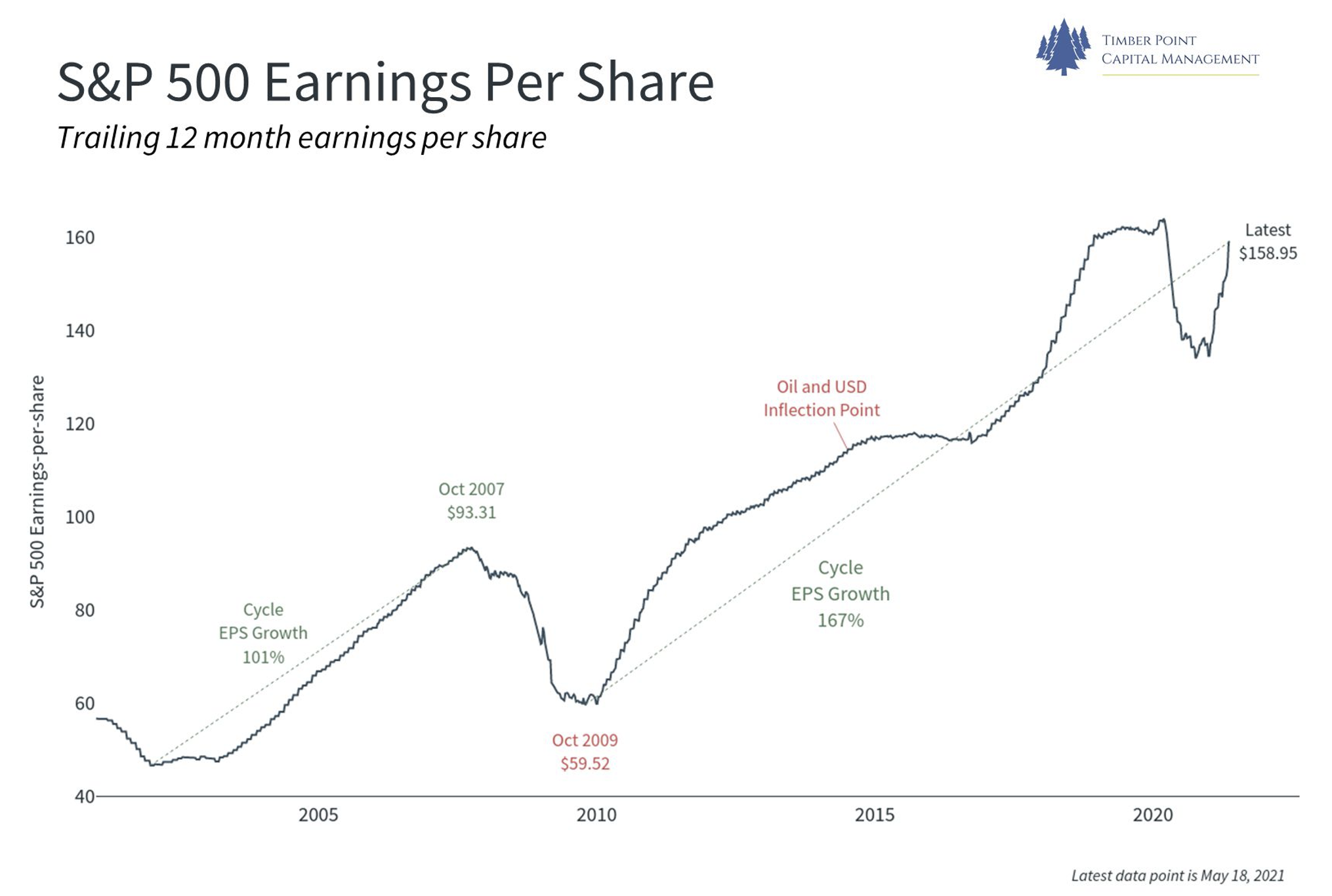

SPX 500 EPS back to longer term trendline reaching back to Global Financial Crisis in 2009

- Unprecedented monetary policy support has been in existence for vast majority of this period

- EPS bounced from GFC bottom then flat/decline during Obama, reaccelerated during Trump

- Trend growth illustrates that EPS growth can be impacted by potential regulatory burden

- Positive on vaccine but worried about policy mistakes, i.e. Keystone Pipeline, rapid EV shift

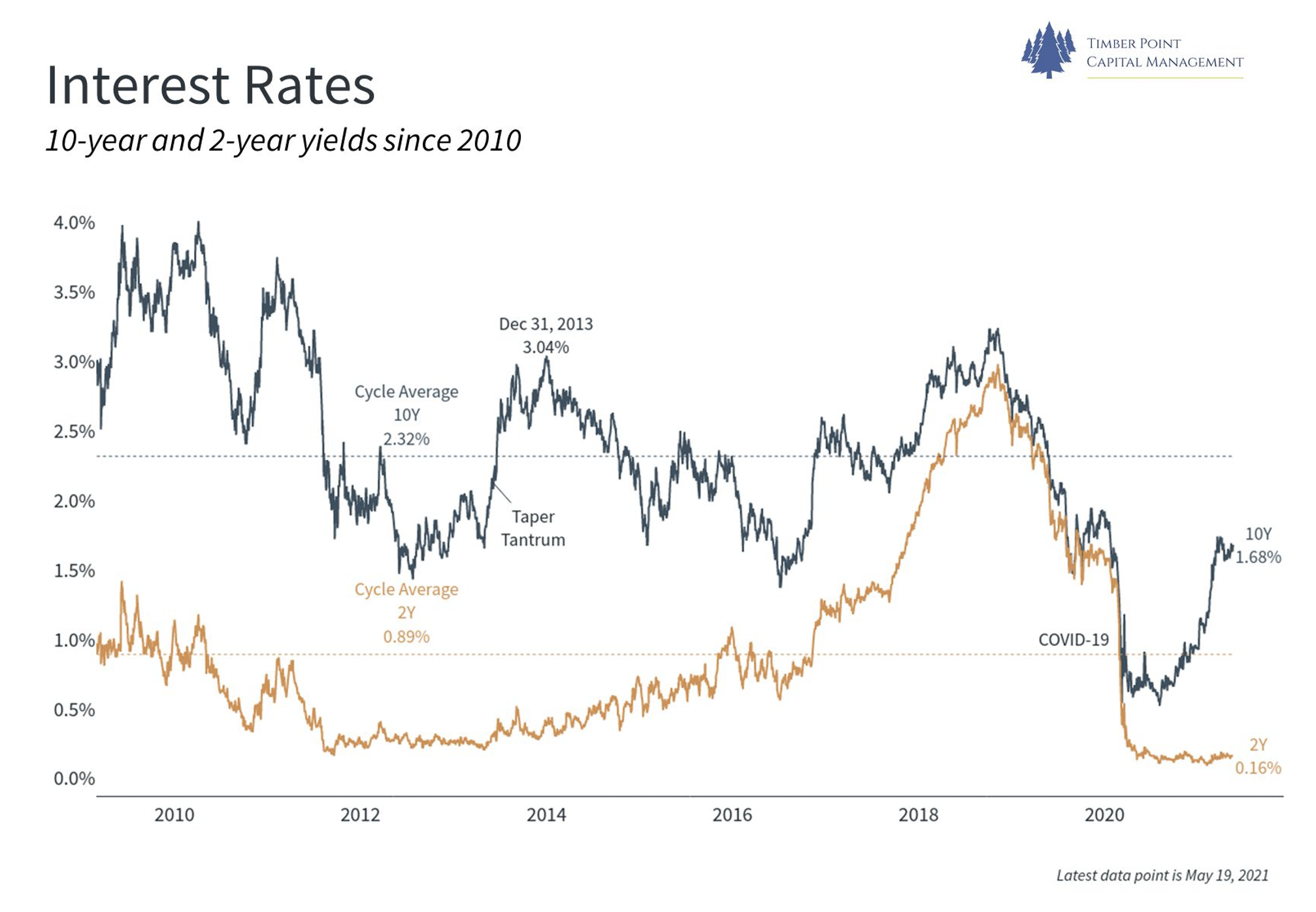

Fundamentals of economic growth justify higher rates, monetary policy anchors rates in near term

- Fed sees “transitory” inflation, recent weak unemployment figures keeps policy dovish

- Believe corporate America has largely termed out debt now = subsidy for corporate America

- Fed holding the line of monetary policy; market will want to test their resolve, as in 2018

- Credit spreads very tight, defies analysis…keep risk levels low, not a market to be chasing yield

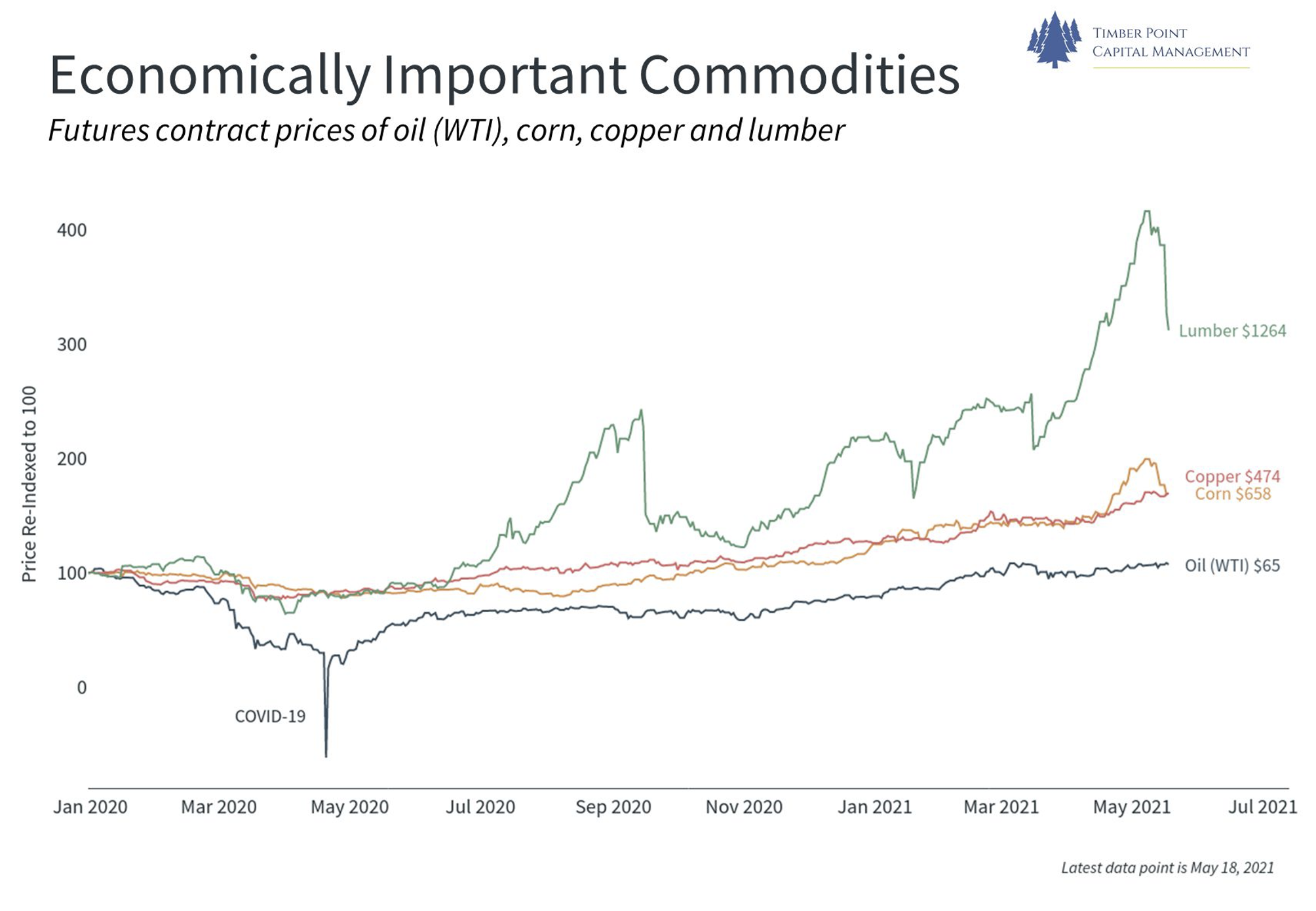

Commodities the latest sector to get whacked after stunning runs….

- Risk off as CTA stops have been hit, multi strat’s derisk as major indices roll over and vol spikes

- Copper, lumber, soybeans – everyone trying to get through exit door at same time

- Expect more commodity correction if major indices continue to struggle

- IEA lower oil demand forecast for balance of 2021, supply restraint at current prices in question

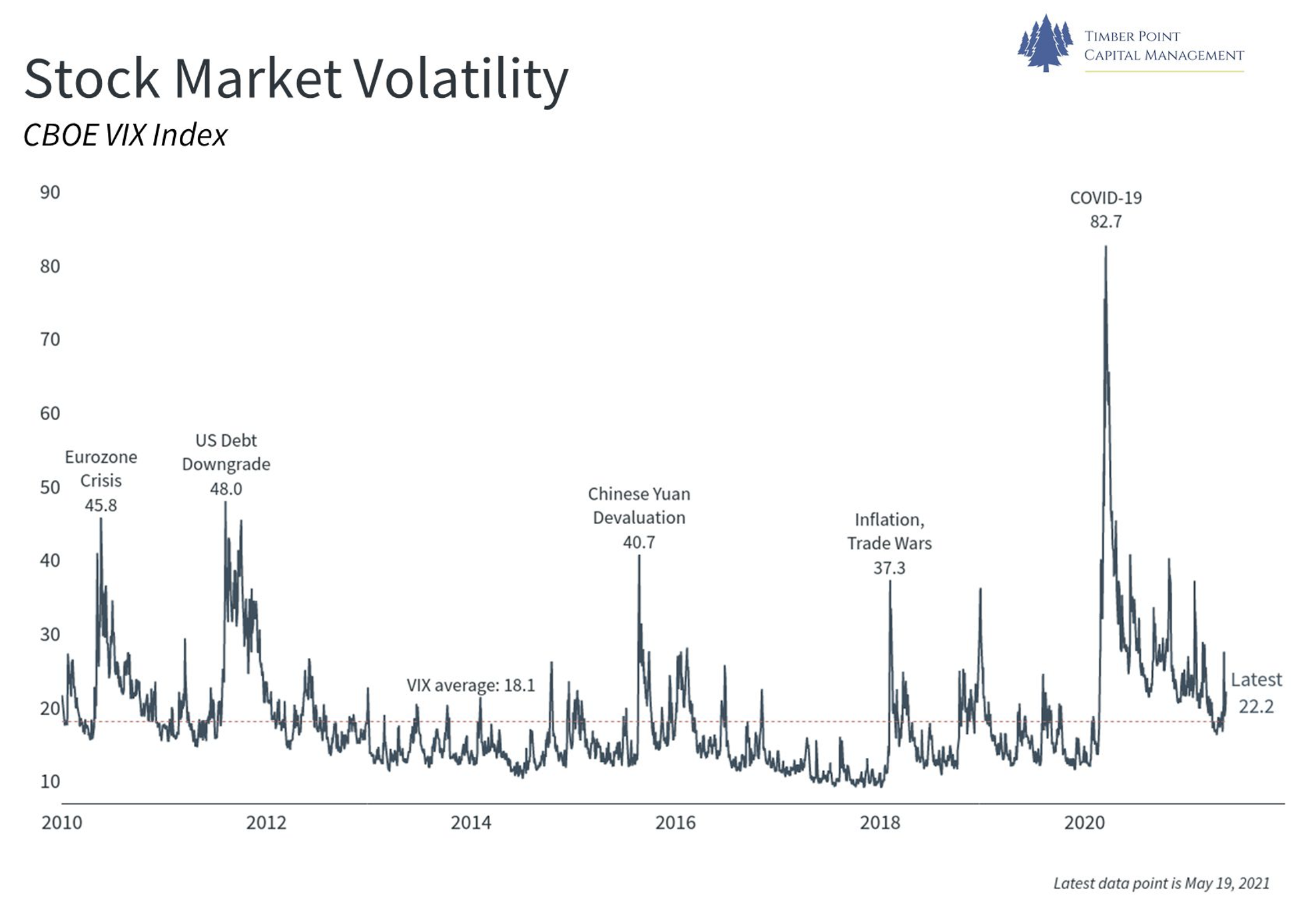

Should we be worried about the equity market despite improving economic fundamentals?

- Earnings have exceeded consensus estimates in vast majority of SPX 500 names and numbers likely low for remainder of 2021

- Small Cap stocks continue to underperform despite evidence of “green shoots” in US economy

- Ark ETF’s, Archegos, Bitcoin/crypto, SPAC’s, EV’s/green plays all taken to the wood shed for now

- Credit spreads and 10 year stable over past week; traders focused on moving average violations of SPX and Nasdaq

Recent Comments