We reiterate our belief from our last blog that the Covid-19 pandemic is on the wane in the U.S. based on the decline in national and state Covid-19 hospitalization figures that we continue to monitor. As a reminder, we focus on hospitalizations as a leading indicator of future deaths associated with Covid-19. Hospitalization rates across the U.S. continue to decline and totals in the three “hot” states of California, Florida and Texas are no exception. Given that these three states account for ~ 50% of the daily U.S. deaths over the past few weeks this is important. With fewer deaths at the state and national level, we believe that elected officials will gain more latitude to further open local and state economies. In turn, this could lead to a rotation in the U.S. equity market to “reopening” stocks from the “work from home” stocks.

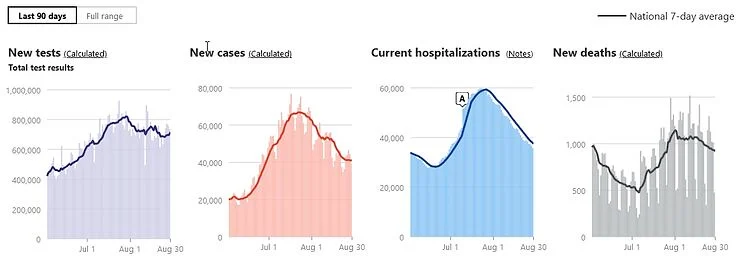

Below you can see national figures for the past 90 days on specific Covid-19 metrics published by the Covid Tracking Project. Tests, cases, hospitalizations, and now deaths, are all on the decline.

National Overview

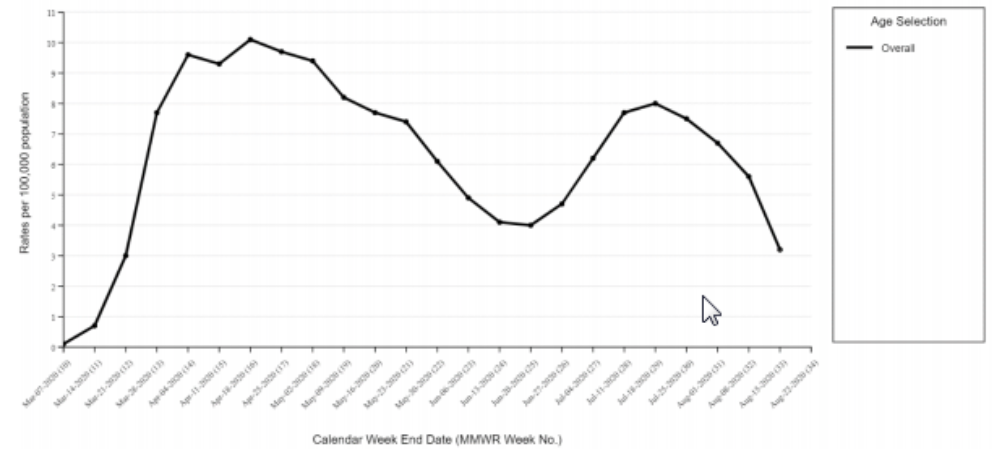

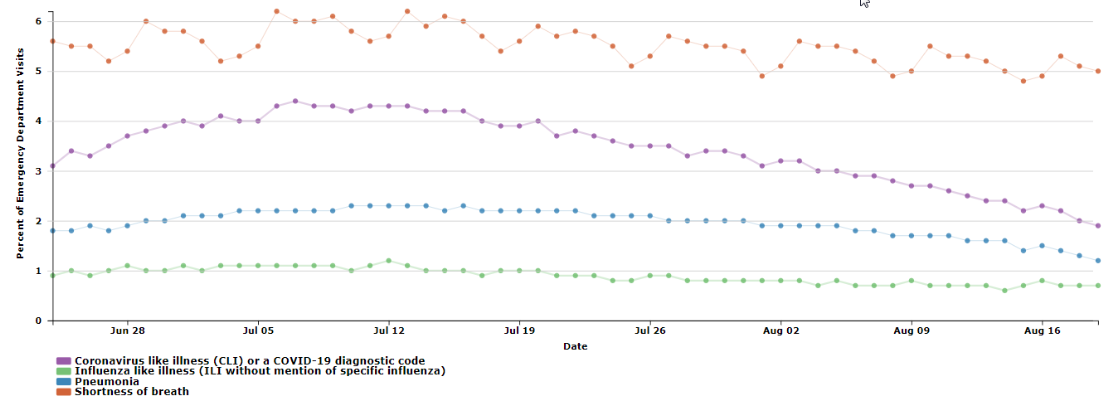

Likewise, CDC data confirms that Covid-19 associated hospitalization rates have slipped below their prior June lows and visits to the ER for Covid-19 like symptoms have been halved since their mid-July peak and are at the lowest level since the data series began.

Laboratory-Confirmed COVID-19-Associated Hospitalizations

Preliminary weekly rates as of August 22, 2020

Percentage of ED visits by syndrome in United States: COVID-19-Like Illness, Shortness of Breath, Pneumonia, and Influenza-Like Illness

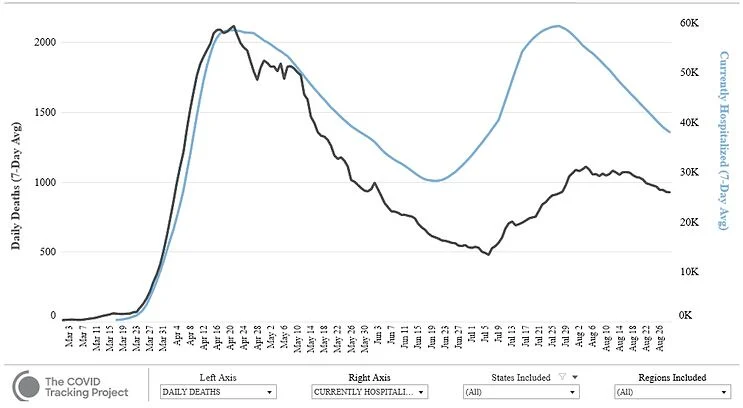

The relationship between national daily hospitalizations and deaths (7 day average, chart below) has been fairly strong, as seen below. Hospitalizations and deaths both peaked in early May following the initial surge in the Northeast states. Hospitalizations then began to rise in late June and were followed higher by deaths in early July as other states, primarily CA, FL and TX, experienced surges. More recently, we have seen deaths turn slightly lower although hospitalizations have declined by almost 30% from peak. Common sense tells us that fewer people hospitalized should result in fewer people dying especially given the improvement in treatment regimens that has transpired over the ensuing four months.

Daily Deaths & Currently Hospitalized. 7-Day Average Lines

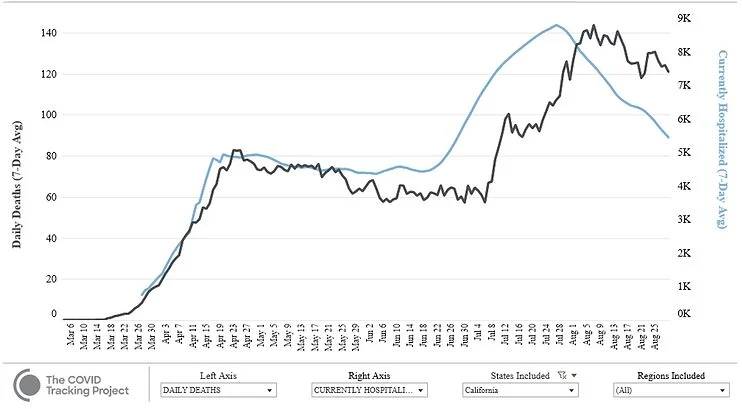

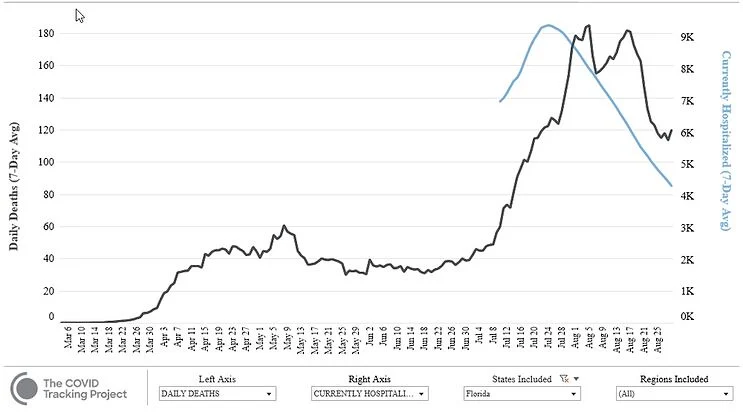

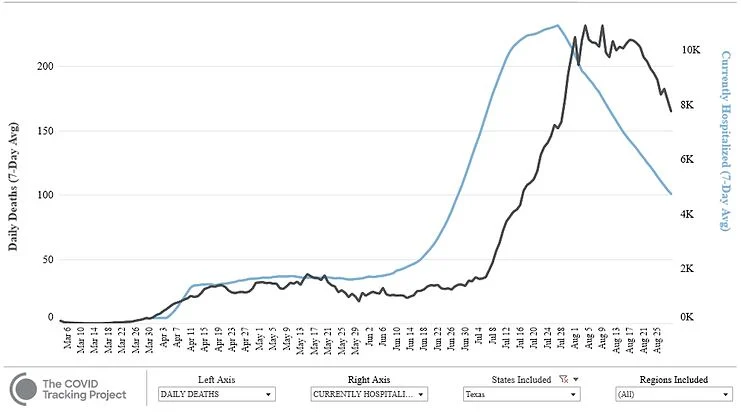

Not surprisingly given their outsized impact on national figures, California, Florida and Texas charts look similar to the national chart as hospitalizations have declined in all three states. While the number of deaths has remained stubbornly high in CA, FL and TX death rates are falling in line with the decline in hospitalizations. The major “hot spots” in each state that we detailed in our last blog all show further hospitalization declines. We went deeper to look at the top three “hot spot” counties in CA, FL and TX and hospitalization trends in all 9 counties continue in downtrend from the July peak. Thus, we are confident state-wide totals will continue to move lower and drag national totals along with them.

Daily Deaths & Currently Hospitalized. 7-Day Average Lines

Daily Deaths & Currently Hospitalized. 7-Day Average Lines

Daily Deaths & Currently Hospitalized. 7-Day Average Lines

Looking at U.S. state activity more broadly, the top 10 states in Covid-19 cases for the past 7 days (CA, FL, TX, GA, IL, TN, NC, MO, AL and OH), which account for ~ 2/3 of U.S. cases, all show hospitalizations on the decline. The sole exception is Illinois which has seen only a small uptick after a more than 70% decline from the start of May.

Thus, we expect to see encouraging news on the Covid-19 front shortly and turn our focus to those stocks that could potentially benefit from a “reopening” of the economy. Below we have charted YTD returns from a basket of “Covid-19” (purple) and “reopening” (blue) stocks as well as the SPX 500 (red) against the backdrop of Covid-19 daily deaths. As can be seen from the respective slopes of the lines, the three buckets largely moved in tandem from the SPX market bottom in late March through mid June when the decline in hospitalizations began to bottom out. From mid June through early August it is apparent that the “work from home” stocks handily outperformed the “reopening” stocks (and the SPX 500) as the daily death numbers increased again.

If we are correct that hospitalizations, and consequently deaths, will be in decline shortly it could be time to rotate to stocks that benefit from state economies returning to a more normalized operating environment. The Federal Reserve has taken unprecedented steps and provided ample liquidity to backstop credit markets while Federal and state governments have provided generous unemployment benefits to help those who have lost their job and appear to be ready to agree on further payments. Consequently, personal savings levels have spiked during the pandemic as there were far fewer places for individuals to spend their money. If economies become freed up and consumers are more inclined to spend across different areas of the economy, there could be new beneficiaries in the U.S. stock market.

Our basket of “recovery” stocks are focused on companies that have been disproportionately hurt by the closing of the economy but have strong balance sheets and business models with competitive advantages that Covid-19 will not impair over the medium and long term. It may take a bit of time for these stocks to recover to pre-pandemic levels but we think from current levels we will be paid for our patience as most of our names are still trading well below pre Covid-19 levels. Below we provide some brief commentary on five names that we have added recently.

JP Morgan (JPM) is trading nearly 30% off its most recent highs in January and should benefit from an improving economy that lifts loan growth, stabilizes net interest margins and provides greater clarity around the need for ongoing loan loss provisions. Unlikely this will occur in the next quarter but expectations remain low for financials in general and valuations are even lower with the sector yield at the highest spread level vs. the SPX 500 since the global financial crisis. In 2Q20, JPM earnings surprised to the upside despite sizable reserve builds as a result of robust capital markets driven activity. We expect the back half of the year to be largely the opposite – less robust capital markets activity but less provisions for credit, as well. JPM has improved statutory capital ratios since the beginning of the year despite building reserves to record levels. Arguably the most dominant banking franchise in the United States, JPM sports a 3.7% dividend yield and is well positioned to benefit from an eventual economic recovery.

Las Vegas Sands (LVS) gaming properties in Macau, Singapore and Las Vegas are all in various stages of phased reopenings and limping along with travel limitations and quarantine issues (Macau) that have kept a governor on attendance and hence profitability. Thus, recent decisions to suspend the dividend and pass on the pursuit of a Japanese casino license highlight management’s discipline and focus on maintaining a strong balance sheet ($3bln cash) in these difficult times. Recent commentary from Chinese officials suggests a resumption of tourist visas for both individuals and group tour travel to Macau starting with Guandong province in late August and all of China in late September. Prior rules regarding two week quarantines post Macau visits were lifted in mid-August. Given that Macau represents ~ 60% of LVS pre-pandemic adjusted Ebitda these are meaningful steps to getting LVS back on the path to profitability. With the stock off 30% from prior highs in early 2020 LVS’ market position remains strong and a return to even semi-normalcy across its properties should lift shares higher.

Walt Disney (DIS) is one of the most iconic companies of our time with franchise businesses galore in its mix. Unfortunately, DIS is also one the companies hit hardest by Covid-19 and attendance is still limited at their parks, including Disneyland, which has yet to reopen its main theme park. The positive is that this is well known by investors who shrugged off an 85% revenue decline from Disney’s Park segment in 2Q20. Instead, investors chose to focus on Disney’s accelerating streaming efforts which includes almost 60 million subscribers at Disney+ and the announcement of a new international streaming effort, under the Star brand, which was purchased in the 21st Century Fox acquisition. DIS has shored up its cash position by taking on approximately $20 billion of debt over the past several months which will enable it to continue to invest in its growth assets through the pandemic. DIS stock rallied post 2Q20 results as the market is starting to look through the pandemic and again focus on its strong brands and we believe it can rally back to pre-pandemic levels near $150.

Vail Resorts (MTN) owns and operates eleven mountain resorts as well as luxury hotels, condominiums and lodges across the U.S., Canada and Australia. Stowe, Heavenly, Beaver Creek, Park City, Whistler Blackcomb and its namesake property are all a who’s who of resort properties for the affluent destination, as well as drive-up, traveler. Covid-19 had a partial impact on F3Q results (April) as operations were shutting down during the quarter and Ebitda dropped by almost 40% y/y. F4Q (July), already a seasonally light quarter, will likely provide few rays of sunshine and F21 revenue growth will be held back to some degree by credits issued for the shortened ‘19/’20 season. That said, the management team at MTN knows how to execute as it has shown over the past several years by shifting its revenue mix to almost 50% advance commitment via the EPIC pass and raising Ebitda margins by 50%. MTN has stated that it is planning for a fully operational North American ski season. With Covid-19 concerns abating, we believe that consumers, both destination and drive up, will provide pent up demand to fuel MTN shares higher.

Vulcan Materials (VMC) is the largest producer of construction aggregates (crushed stone, sand and gravel) in the U.S. with end markets evenly balanced between public and private infrastructure. Unlike the other stocks above, VMC’s stock price has held up fairly well during Covid-19 bouyed by hopes for a renewed national infrastructure spending as well as the reality of a robust residential housing market. VMC’s dominant position in the southern corridor of the U.S. provides them with favorable growth markets to sell into and management has successfully grown volumes and pricing in the mid-single digits with operational efficiencies boosting Ebitda growth to a high teens cagr over the past five years. In VMC’s most recent quarter volumes declined 2% while pricing increased 3% with Ebitda posting a 10% gain. Yes, the stock can bounce around owing to headlines around national infrastructure spending as well as state budgets but with the stock 20% off early 2020 highs we believe in the long term demand story and management execution and would be buyers on weakness.

In part three of this blog we will again update Covid-19 conditions and provide a look at additional “reopening” names in our portfolio. We don’t want to minimize the potential threat of a “third wave” this coming fall and winter, but It is our belief that the real “risk” is waiting for the all clear signal from Covid-19 and not owning high quality “reopening” stocks that should benefit from what we believe will be a gradual, but extended, reopening. With the ongoing decline in hospitalizations, Fed backstop and consumers eager return to a greater sense of normalcy we believe “reopening” stocks present an interesting investment opportunity.

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments