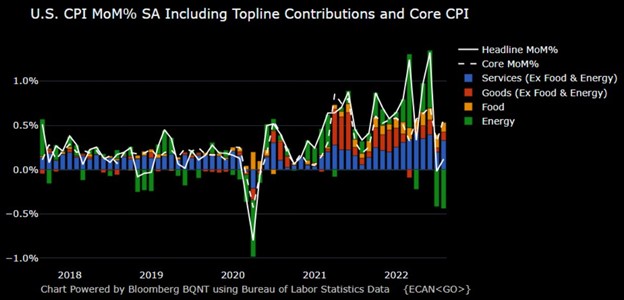

August CPI report surprises investors shows persistent inflationary pressures

- Headline CPI rose .1% vs consensus estimate of (.1%)…energy prices lower as expected, but food and shelter continue to negatively impact

- Core CPI ran much hotter than expected, up .6% vs .3% expected…Anticipated declines in energy are offset by gains in owner’s equivalent rents and food

- Peak inflation and Fed pivot narrative is over for the time being…long duration growth stocks, homebuilders and consumer discretionary feeling the most pain

- No question the Fed will tighten at least 75bps in September, 20% odds of a 100bps increase

- Powell will continue his tough talk from Jackson Hole until inflation signals prove otherwise

- Recession fears are back front and center

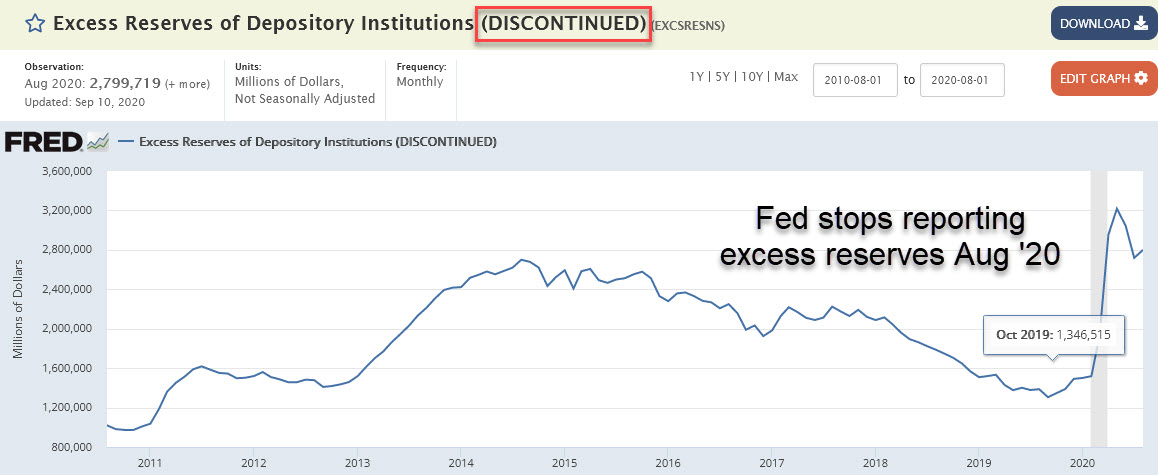

Quantitative tightening (QT) ramps up…what impact will it have?

- Fed’s QT steps up to $95B in Treasury and MBS roll off this month…the bond market is nervous

- Impact on economy may depend on “excess reserves” being withdrawn

- Excess reserves are interest bearing assets held by banks

- The Fed used to provide excess reserves data, but it stopped reporting the data in mid ‘20

- In August ’20, excess reserves were $2.8T compared to a then Fed balance sheet of $7.0T

- Powell has suggested QT will continue for 2.0 – 2.5 years for ~ $2.5T of balance sheet reduction

- This is only the second QT we have experienced (2017 – 2019)

- Bottom line, excess reserves could help mute the economic impact from the Fed’s balance sheet reduction – but estimates of impact vary wildly

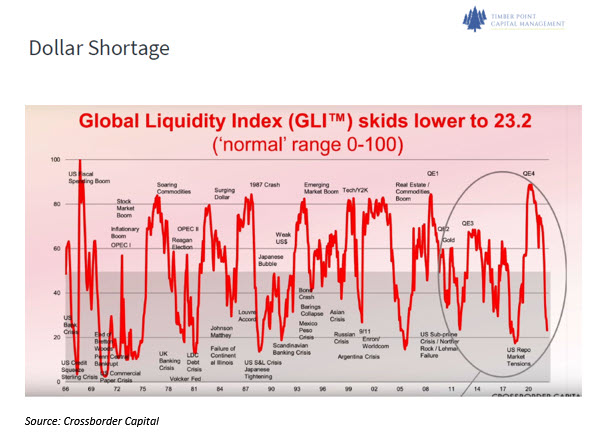

Long live the USD King…ROW seeks safety, US bond market is the relief valve…

- Global liquidity index is reaching extreme low levels as the Fed and other central banks tighten and remove pandemic-era liquidity from the market

- Additionally, global treasury holders are selling Treasuries as they seek the safety of the USD…which continues to rise

- Despite negative US economic growth prints in Q1/Q222, US is still the best house in a generally poor neighborhood

- Historically, aggressive Fed tightening cycles and liquidity crunches have led to crises in Emerging Markets

- However, current EM dollar reserves at higher levels than in past…exceptions are turkey and Argentina…which is not a surprise

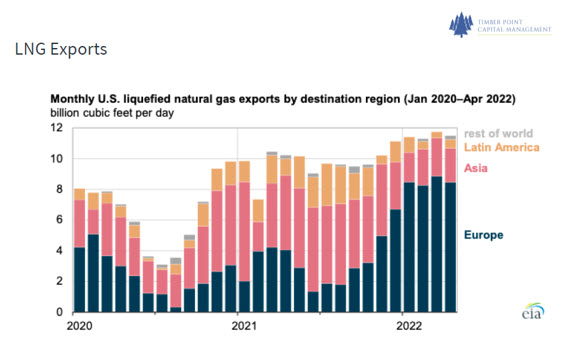

How does Europe solve its energy predicament before winter…?

- Europe’s existing and expected energy situation is a real conundrum for Euro economies

- Recent Ukraine advances against Russia incursions, while welcome, does not undo bad energy policy over the past decade on the Continent

- Russia likely continues to play politics with Nord Stream deliveries to increase pressure on EU

- LNG deliveries are ~ double in ’22 vs. levels seen in ’21…there is little excess supply to add

- Adding more pain – the ECB raises rates 75bps as inflation hits 9.1% in August…

- This is a potential double whammy for the EU which has 2x the unemployment rate of the US

- We believe the EU will have to cut a deal with Russia or go back on sanctions as reduced energy usage will not keep people warm in the winter

- Will the EU become a perceived systemic risk for the markets ala Greece in 2013…?

- On the bright side…new UK PM Truss talks like a Thatcher disciple…will a new Reagan emerge in US?

- We remain underweight the EU and have short exposure to the weaker EU economies

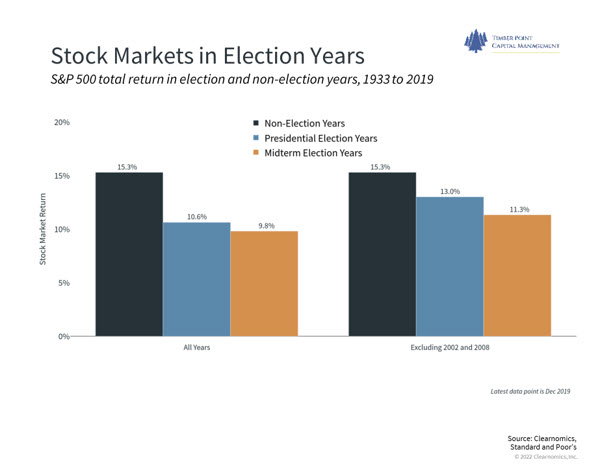

Mid-term elections may not bring much hoped for relief for investors

- A Republican sweep of Congress brought hope for a reprieve from Bidenomics liberal agenda

- But passing of the Inflation Reduction Act calls into question what Republican stand for

- Even if Republicans take the House (likely) and Senate (unlikely), they will not have the numbers to override a presidential veto

- Biden likely ramps up the administrative state via executive orders and increased regulation

- Economic gains are secondary to administration goals of social justice and economy altering climate policies

- Recent Phil Gramm article in the WSJ points out how income inequality claims do not account for welfare benefit to lower incomes and tax consequences to middle class…

- Non-farm labor sector productivity declined by 4% in 2Q22, unit labor costs up 10% per BLS…!

- Atlanta Fed GDPNow estimate for 3Q22 economic activity now 1.3% vs. August ending 2.5%

- Employment remains strong (IUC’s stable) but anecdotal evidence suggests firing activity is picking up

IMPORTANT DISCLOSURES The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s’ opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor. This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments