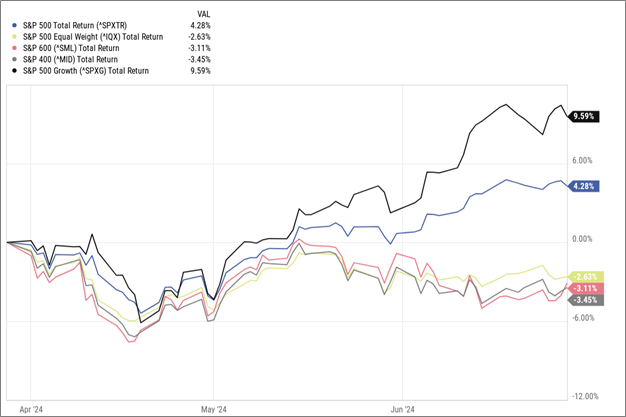

The second quarter of 2024 proved to be a strong period for the US stock market as the S&P 500 posted a 4.3% return over the period. Driven by AI euphoria and strong corporate earnings, US stocks led, with technology, especially Nvidia, reaching new highs. Major indices hit records as economic growth remained resilient and inflation resumed a downward trajectory, ending three months of higher price pressures. Despite the strong market performance, it wasn’t necessarily a good period for individual equities as the average stock as measured by the equally weighted S&P 500 fell 2.6% over the same period. Small and mid-cap stocks also lagged the market by falling over the quarter. This phenomenon proved to be a quandary for diversified investors as every dollar not allocated to large cap growth, generally, proved to be detrimental to relative performance.

Source: YCharts, TPCM

Source: YCharts, TPCM

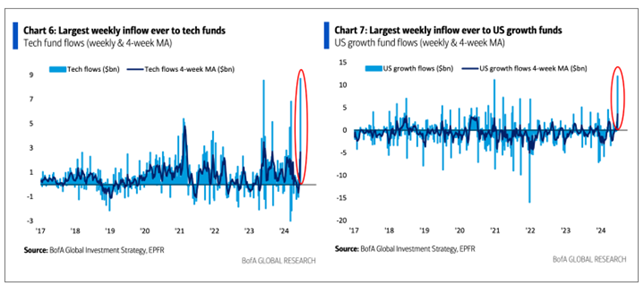

In fact, Microsoft, Apple and NVIDIA alone accounted for 3.2% of the 4.2% quarterly rise in the S&P 500. Given these performance trends, investors clamored to increase their exposure to large cap growth and technology stocks at quarter end.

The big question is are investors too late to the AI party or will this trend of concentrated returns continue? But first things first. An evaluation of the fundamental economic and market environment is needed, and as we enter the third quarter, we continue to see a backdrop that is conducive for investors as the economy and earnings continue to grow and inflation continues to improve.

3Q24 Economic and Investment Drivers

| DRIVER | STATUS | COMMENTARY | |

|---|---|---|---|

| Real Economic Growth | Stable | U.S. economic growth trajectory has remained resilient yet some slowing pressures are becoming evident. A meaningful slowdown or recession is a very low likelihood event. | |

| Inflation | Falling | Inflation has improved across virtually every metric and now is approaching the Fed's target of 2% Core PCE. Improvements should continue, yet future declines will be less pronounced. | |

| Real Interest Rates | Falling | Anticipating the recent ease by the Fed, market traded interest rates fell sharply over the recent quarter. Real interest rates remain high, however. The trajectory of future monetary policy across major central banks is towards lower interest rates. | |

| US Dollar F/X Value | Falling | The dollar has remained the king currency among global competitors yet concerns over deficit and falling rates in the US may take some of the momentum away from the greenback. | |

| Taxes & Regulations | Falling | The Supreme Court's recent decision on the Chevron Deference may significantly reduce the power of federal agencies to interpret laws, impacting how regulations are crafted and enforced. | |

| P/E Ratios | Falling | S&P 500 earnings growth is expected to slow and US large cap growth remains at very full valuations. Small cap, international and other market segments trade at meaningful discounts. | |

| Fixed Income Risk Premium | Stable | High yield spreads have tightened over the past year reflecting overall economic resilience and strong corporate balance sheets. Corporate America continues to deleverage impacting new issue supply. We expect spreads to remain narrow. | |

| Volatility | Stable | Volatility has reached cycle lows as both the economic and market environment has exceeded earlier expectations. Periodic spikes are always a risk. | |

| Source: TPCM | Bullish | Neutral | Bearish |

Given the above, we believe the fundamental environment remains positive for equity investors, but we need to determine where investments will be best compensated considering relative valuations and growth potential.

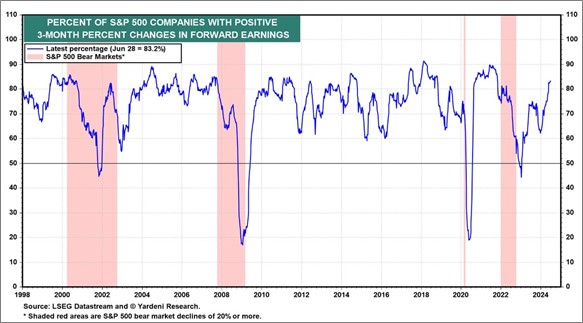

Despite the recent market trends, we remain underweight large cap and growth-oriented stocks and favor down capitalization and value stocks and sectors. We believe a plausible scenario where the shift in earnings leadership from the growth segment of the S&P 500 could lead to lagging stocks overtaking the current market leaders. This market leadership rotation may occur as investors notice that, despite the narrowing breadth of the stock market’s price rally, the percentage of S&P 500 companies showing positive three-month changes in their forward earnings is rising. At the end of June, more than 80% had rising earnings expectations whereas a year ago that number was less than 50%. We believe this is a positive sign for a broadening of the stock market rally. The second quarter earnings reporting season is about to start. So far, 2Q estimates have remained strong, indicating that the guidance provided by company managements during 1Q was mostly positive. This optimism has contributed to the significant increase in forward earnings breadth. Additionally, we anticipate that as 2Q results are announced more management teams are likely to elaborate on how they are leveraging AI to enhance productivity and boost earnings.

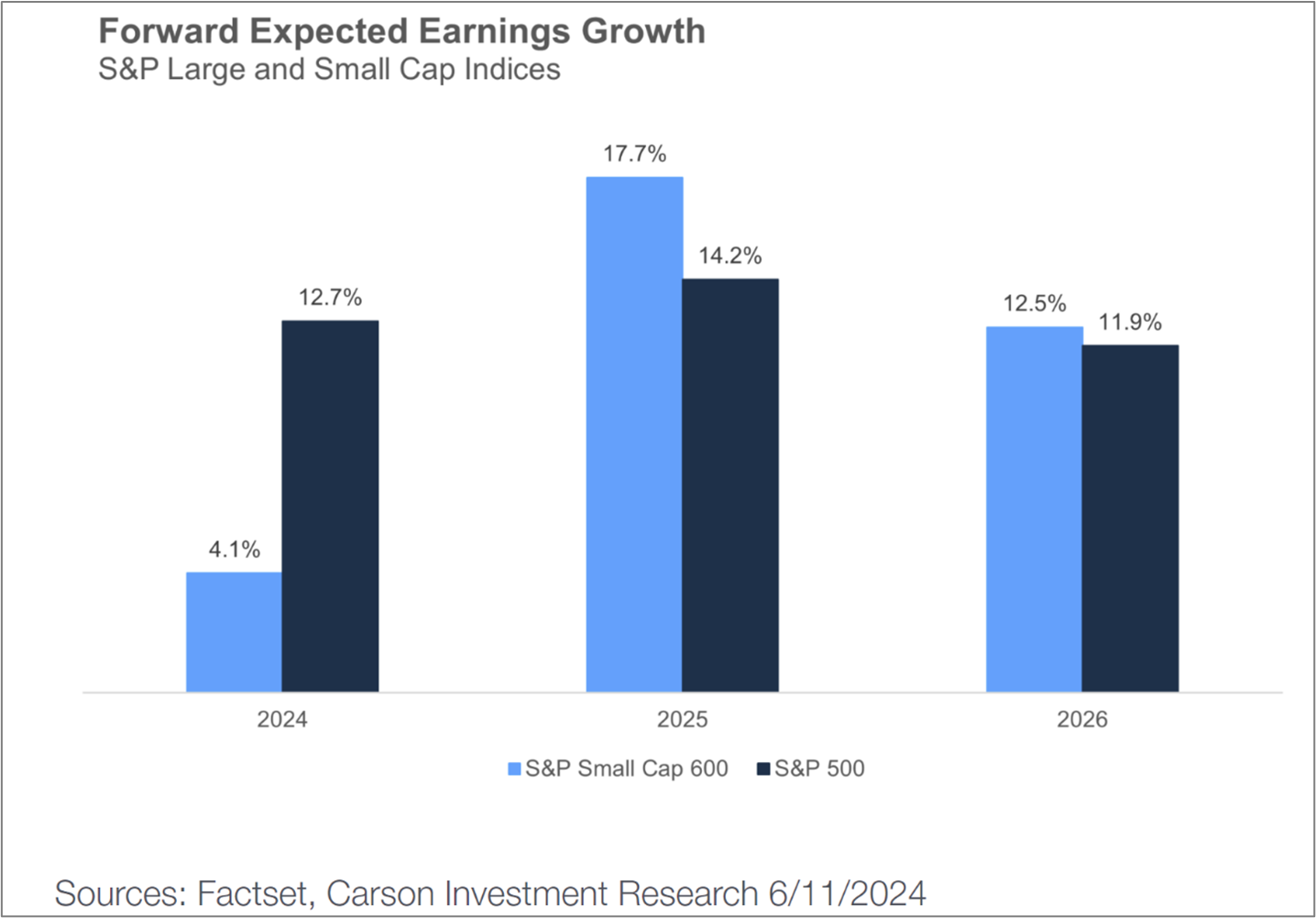

Additionally small cap earnings, which have lagged significantly over the past several years, are now showing signs of rejuvenation which may prove to be the catalyst for the unloved asset class.

Beyond the US, international markets remain mostly unattractive to us as the persistently strong dollar is an indication that global capital continues to favor US equity and debt investments. The Japanese yen, in particular, has been under extraordinary pressure as the 30-year experiment in zero interest rate policies has now begun to reverse, putting negative pressure on the yen and creating a significant headwind for global investors considering Japanese investments. In Europe, long tenured economic policies have favored stability and equality over growth, limiting dynamic opportunities across investment markets. Bonds offer low interest rates and equities offer little growth. Yet, recent elections across several European nations have resulted in the promotion of more populist leaders who generally favor pro-growth economic policies. It is still early but the proposed changes could be promising for European economies and markets. Emerging markets remain a mixed bag. The China growth story has stumbled again, and other markets offer limited opportunities. We have long felt that investment prospects overseas are cheap but not so intriguing as major policy headwinds limit our enthusiasm. Opportunities exist but one must be selective.

Lastly let’s touch on politics. In the already unconventional presidential election of 2024, the political landscape in the United States shifted meaningfully as the debate between Joe Biden and Donald Trump, held on June 27, was marked by a notably weak performance from Biden. The 81-year-old President appeared diminished and incoherent throughout most of the 90-minute debate. His poor showing, sparked a full-blown panic among Democrats concerned about heading into the election with a weakened candidate. As the election approaches, Biden’s lackluster debate performance has intensified the challenges facing his reelection bid, with many questioning whether he can recover from this significant setback. As such, calls for his resignation of the presidency have sharply increased, particularly from Democratic circles and the prospects of a replacement candidate have increased. Notably Vice President Kamala Harris’ odds of being the Democratic nominee have increased sharply while Biden’s have collapsed.

Typically, election years are good for the US stock market and to date 2024 has lived up to that reputation. At this writing, it does appear as if Donald Trump has the greatest likelihood of being the next president. Given his previous administration, we have a template to draw upon in terms of expected economic policies and market action. Trump is not a laissez-faire politician. He is an economic tinkerer who favors lower taxes, trade protectionism and infrastructure spending. Generally speaking, those policies were positive for investors during his first term until the existential Covid crisis occurred in 2020. Biden too has been an economic activist generally favoring a tax and spend approach which has resulted in economic growth but also a meaningful spike in inflation from which we are just now recovering. We can infer that Harris’ economic policies would be similar to Joe Biden’s but we do not yet know. The uncertainty around Biden’s candidacy and a potential Harris replacement may become a source of concern for markets in the months to come.

Also, somewhat quietly, amidst the debate over presidential golf handicaps, the recent Supreme Court decision to overturn the Chevron doctrine is an impactful reform on the regulatory framework in the United States. The Chevron doctrine, also known as Chevron deference, was a Reagan era court ruling which designated the interpretation of ambiguous laws to Federal administrative agencies. The recent Supreme Court’s 6-3 decision to overturn Chevron marks a significant shift in regulatory power. The ruling reduces federal agencies’ authority, such as the SEC and EPA, and increases judicial control over law interpretation. This change offers businesses more opportunities to challenge regulations and is seen by some as a means to block costly rules and protocols, reflecting conservatives’ long-standing goal to overturn Chevron for better balancing regulatory oversight with corporate profitability and growth.

The political scene in the US (and elsewhere) may ultimately prove to cause near term volatility to markets yet we do not believe investors should fixate on politics alone. Yes, policy matters and good economic policy will further propel growth. Washington DC has been dysfunctional for some time yet the virtuous cycle of technological innovation as well as the vibrancy and resilience of the US economic system will ultimately prove to be more important than who will be the next president. We remain optimistic that despite future political machinations, the dynamic US economic system will continue to provide profitable opportunities for investors.

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. TPCM does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio.

Investment advice is offered through Fortis Capital Advisors, LLC, 7301 Mission Road, Suite 623, Prairie Village, KS 66208

Recent Comments