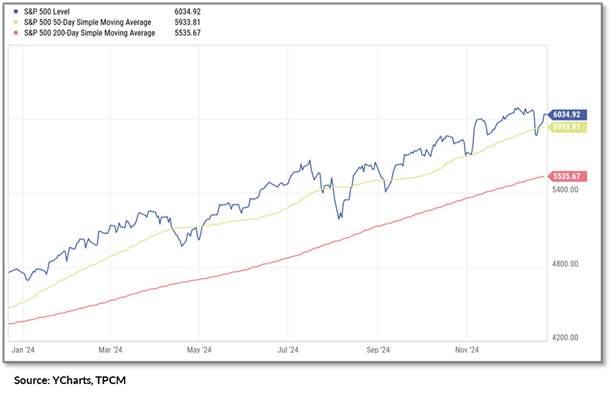

Investors enjoyed a profitable 2024, as the S&P 500 experienced nearly a 25% return fueled by durable economic momentum, moderating inflation, and the transformative rise of artificial intelligence. Major gains in Big Tech and innovative sectors such as quantum computing, space exploration, and digital assets highlighted the market’s preference for forward-looking themes, with AI standing out as the year’s most pervasive growth driver. Elevated interest rates and mixed bond market performance tempered broader market enthusiasm.

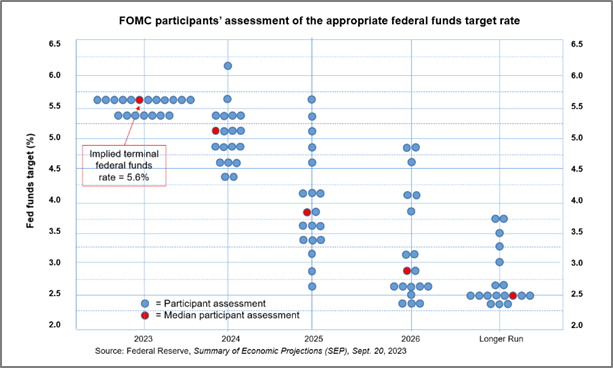

The Federal Reserve played a key role in shaping market dynamics in 2024. After a prolonged period of aggressive rate hikes to combat inflation, the Fed shifted its stance in September, marking its first rate cut since 2020. This policy pivot signaled the start of a more accommodative approach aimed at supporting overall economic and job growth. The baseline assumption for this newly accommodative policy stance is that the 2022 inflation was truly transient and is no longer a systemic problem. We’ll see.

The most dramatic act of 2024 saw the reelection of Donald Trump, alongside full Republican control of Congress, creating ripples across investment markets. Investors reacted with optimism to the prospects of potential tax cuts and deregulation as a broad-based rally ensued after the election. Despite some uncertainty around potential tariffs and an open-ended government efficiency plan (DOGE), investors have reacted positively since November 5; anticipating an overall business friendly fiscal policy prescription which could lead to an increase in animal spirits across the economy and markets.

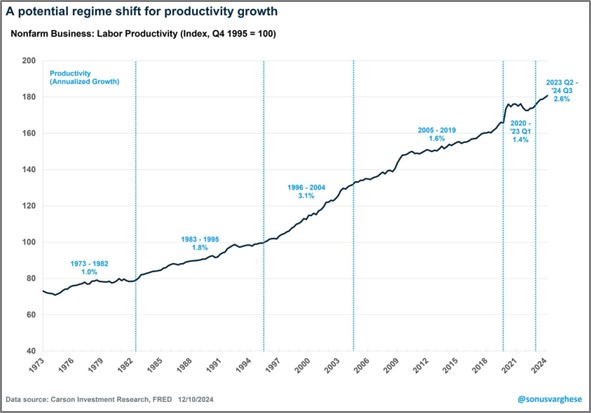

As much as these macro factors and policy initiatives have captivated investor’s attention, we continue to believe that artificial intelligence and other technology-driven productivity enhancements have had a more profound and longer lasting impact on investment markets and the broader economy. The rise of generative AI, quantum computing, and advancements in electric vehicles and space exploration fueled optimism across various sectors. Companies leading these innovations saw substantial stock price increases as investors recognized their transformative potential. AI-driven efficiencies boosted corporate profitability and reshaped industries, making technology the central theme of the year’s market rally. This wave of innovation not only elevated tech-heavy indices like the S&P 500 but also underscored the critical role of disruptive technologies in driving economic growth and shaping investment strategies. From our perspective, the 40+ year virtuous cycle of productivity enhancement driven by technological innovation which ultimately leads earnings and stock prices higher, remains firmly in place. In fact, as it applies to AI, we believe that we’re still in the early innings, and its effects will likely broaden across the economy.

Pullbacks and corrections were a natural part of 2024’s bullish narrative, with the S&P 500 weathering two notable declines before resuming its ascent. Despite interim volatility, the S&P 500 hit nearly 60 new all-time highs over the course of the year. Meanwhile, valuation metrics proved unreliable as predictive tools, as investors rewarded companies like Nvidia and Tesla for their future earnings potential despite high P/E ratios. This marked a continuation of the trend where U.S. megacaps — Apple, Microsoft, and others — dominated, significantly influencing the index’s performance while leaving small caps and international equities struggling to keep pace.

Global markets, particularly in Europe and emerging economies, lagged the U.S., hindered by structural challenges, policy missteps, and limited exposure to high-growth technology sectors. Valuations of international markets relative to US have reached historically wide levels and investors seem to have lost interest in overseas opportunities.

Despite improving inflation and an accommodative change in monetary policy, 2024 proved to be difficult for bond investors as returns across major bond indices were unexciting. The Bloomberg Aggregate Bond Index only rose about 1.5% for the entire year. Over 2024, the US Treasury yield curve steepened as long-term rates rose approximately 75bps while the Fed lowered short term rates. Credit sectors sharply outperformed government bonds as the resilient overall economy supported corporates. For the year, high yield bonds posted roughly an 8% return. The recent rise in interest rates is a confounding risk for both bond and equity investors as we enter 2025.

Our expectations for the US economy remain generally optimistic going into the new year and our outlook on key drivers set the framework for investment decisions which we will make in portfolios.

1Q25 Economic and Investment Drivers

| DRIVER | STATUS | COMMENTARY | |

|---|---|---|---|

| Real Economic Growth | Rising | The economic growth trajectory in the U.S. has remained resilient and growth expectations have recently risen above 3% due to anticipated changes in fiscal policy. International growth rates continue to lag. | |

| Inflation | Stable | Inflation improved throughout most of 2024, allowing for a pivot in monetary policy. Money supply has resumed growing and more recently broad inflation pressures have become evident again. Continued increases in inflation represent a risk for markets. |

|

| Real Interest Rates | Stable | Despite a pivot in monetary policy, real interest rates rose throughout 2024 and are now at 10-year highs. Both increased expectations for GDP growth and inflation as well as concerns over the federal debt and US Treasury issuance contribute to higher real rates. | |

| US Dollar F/X Value | Rising | The dollar has remained the king currency among global competitors and will likely remain so relative to international trading partners due to economic weakness overseas. The dollar has weakened relative to gold and digital currencies, however. | |

| Taxes & Regulations | Falling | The 2024 elections may be the catalyst for meaningful change in the tax and regulatory structure in the United States. The 2017 tax cuts are likely to be extended and DOGE has the potential to effect an unprecedented reduction in bureaucracy and red tape. | |

| P/E Ratios | Stable | S&P 500 earnings growth is expected to modestly increase in 2025. US large cap growth remains at very full valuations which may result in a re-rating. Small caps, international and other market segments trade at meaningful discounts | |

| Fixed Income Risk Premium | Stable | High yield spreads tightened over the past year, reflecting overall economic resilience and prudent corporate balance sheets. Corporate America now faces a refinancing challenge as debt issued several years ago needs to be rolled over. Overall, we expect spreads to remain narrow. | |

| Volatility | Stable | Volatility has reached cycle lows as both the economic and market environment has exceeded earlier expectations. Periodic spikes are always a risk. | |

| Source: TPCM | Bullish | Neutral | Bearish |

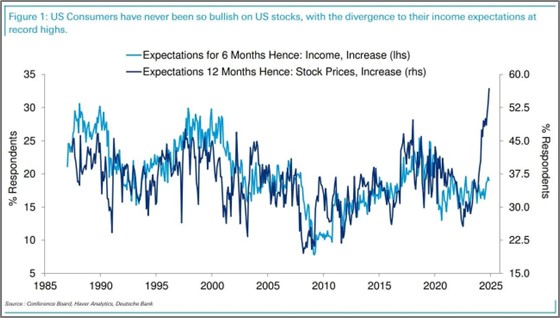

As outlined above, the fundamental environment in the US remains solid and there is a growing enthusiasm about the fiscal policies which the Trump administration will likely enact in 2025. Yet investor expectations are high, and much good news is built into the US equity market with certain sectors and securities at very full valuations.

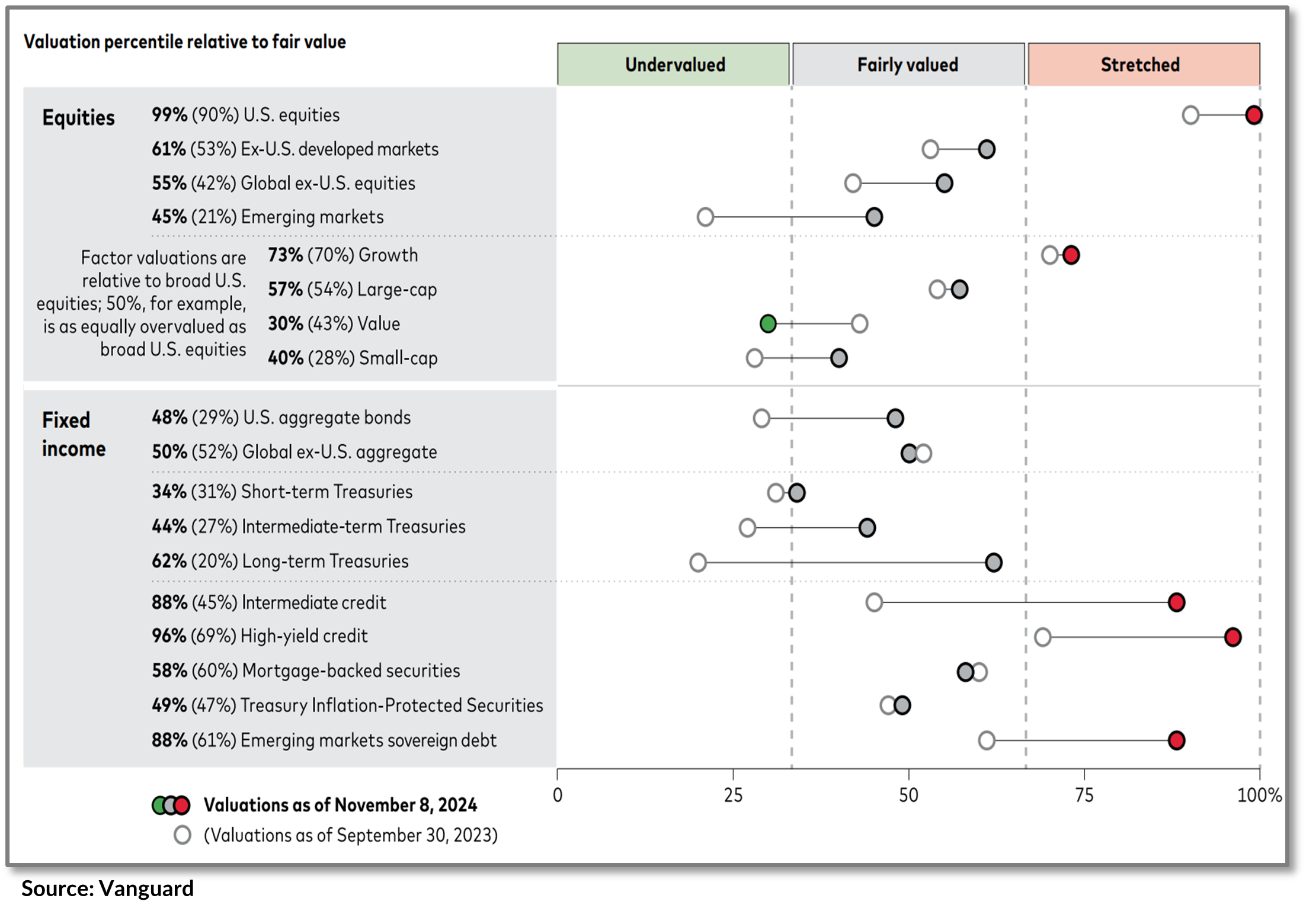

Historically, high valuation starting points have correlated with lower forward-looking returns, warranting some caution. While some pockets of the market feature elevated earnings multiples, the equity risk premium remains at its long-term average, implying that equity investors are still compensated for taking additional risks. Higher interest rates have made fixed-income assets more attractive, yet equities continue to offer relative opportunities. The current bull market, while not unprecedented in length or strength compared to past cycles, benefits from solid economic underpinnings and the potential for further maturity. Frequent new all-time highs, alongside unprecedented corporate profits, suggest that companies could “earn into” high valuation multiples, delaying the risks of a valuation correction.

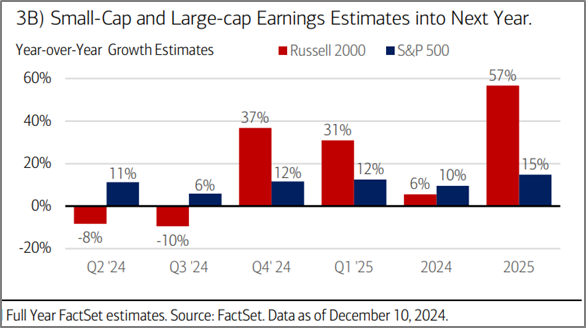

Among opportunities in the U.S., large cap equities do appear expensive, but, again, strong fundamentals and superior earnings growth have justified their outperformance relative to other asset classes. Yet, value stocks and down capitalization equities present compelling valuations and improving earnings trajectory relative to large caps. Potentially, the dispersion between value and growth stocks, and between small- and large-cap stocks, presents opportunities for mean reversion and potential outperformance, particularly if U.S. policy shifts on deregulation and corporate tax cuts materialize.

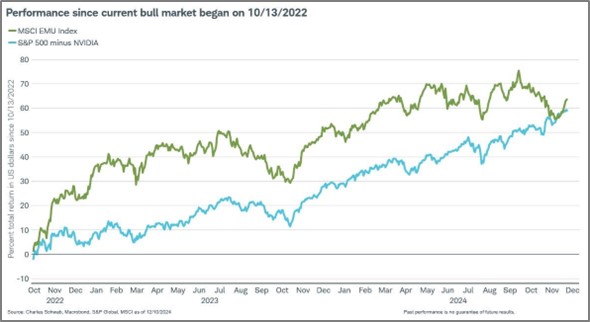

International markets have proven difficult for investors as broad macro fundamentals remain challenging. Yet opportunities do exist and there are a multitude of strong global franchises and companies to consider. For example, in Europe where government policies often seem to fight against the private sector, equity performance has been resilient. In fact if one stock, Nvidia, was not part of the S&P 500, Europe’s stock market would be outperforming the S&P 500 since the current bull market began.

While valuation is an important variable to us, we do not exclusively use it to make investment decisions. In fact, valuation can often give false signals. Investments often can be “cheap” or “expensive” for very compelling reasons as economic fundamentals and company performance justify the market’s viewpoint of worth.

When undergoing our investment process, beyond valuation, we additionally evaluate broad economic fundamentals as well as earnings growth to determine which asset classes, sectors and securities may outperform and what the likelihood of outperformance may be. Going into the new year, we remain generally optimistic about investor’s prospects but possibly across different asset classes and investment types that have underperformed for so long.

Entering the first quarter, we anticipate a period where economic fundamentals and valuations may favor underappreciated investments in the United States. Within equities, our methodology points to large weights of smaller capitalization stocks and value-oriented sectors and companies. While we remain positive on the long-term prospects of technology companies, we believe that relative valuations may be currently elevated, making more compelling opportunities likely outside of large-cap tech. Additionally, earnings growth is expected to accelerate in the small-cap space while slowing somewhat in large-cap. Notably, the regulatory burden that has disproportionately affected smaller companies may ease with the Trump Administration and the DOGE assuming control in Washington.

International markets, particularly in Europe and Asia, continue to offer attractive opportunities due to their relatively low valuations. However, a strong dollar may present a headwind, and the impact of China’s recent stimulus measures has been limited. While we plan to allocate some funds to foreign markets, our primary focus will remain on the U.S., with a selective approach to international investments.

Lastly, the U.S. bond market, which has experienced nearly a five-year bear market, may finally be approaching fair value as the effects of inflation, tight monetary policy, and interest rate normalization largely subside. While we continue to view equities as offering better opportunities, traditional fixed income — which we have significantly underweighted for an extended period — will begin to see an increased weighting in portfolios.

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. TPCM does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio.

Investment advice is offered through Fortis Capital Advisors, LLC, 7301 Mission Road, Suite 623, Prairie Village, KS 66208

Recent Comments