The new year began with a great deal of enthusiasm amongst the investor class. The election of Donald Trump was expected to unleash animal spirits in the economy and Wall Street strategists sharply increased 2025 US equity market targets. January was a bullish month, and the S&P 500 hit an all-time high on February 19th, only to quickly experience a bumpy 10% drawdown.

After an initial bout of post-election enthusiasm, the realities of Trump 2.0 began to kick in and investors started to evaluate the potential effect of tariffs, DOGE, budget reconciliation, Ukraine and other important policy initiatives. Given this firehose of Trump Administration proposals, the policy uncertainty variable increased and when uncertainty increases economic and market participants tend to retreat and pullback on risk.

Corrections are a normal part of investing, and market participants should not be overly surprised when they occur. In fact, 10% declines are somewhat routine, occurring once every 1 to 2 years with a recovery time that typically occurs within 6 months.

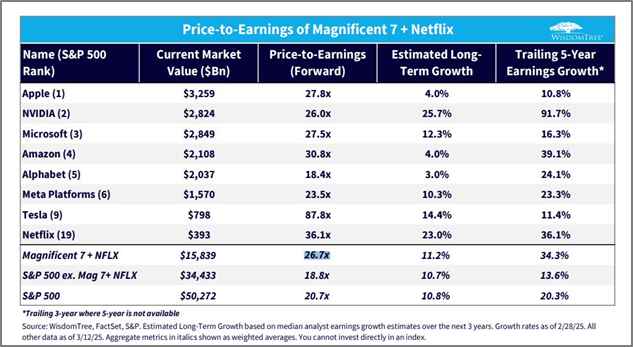

But what surprised investors most during the February-March decline was the darling stocks of the Magnificent Seven as well as other technology and AI growth companies got hit hardest, sharply exceeding the interim 10% decline in the broad index. For most of the last 10 years, large cap growth stocks led the overall market as the innovation driven by these companies led to sharp increases in earnings. Often, the large cap growth segment outperformed during down markets due to strong balance sheets and recession proof business models. Investing became an easy game by owning the largest and most recognizable market leaders.

So, what changed? Was it Trump tariffs and the market uncertainty or was it something much more straight forward? Trees don’t grow to the sky and large cap growth stocks had gotten quite expensive over 2024 and their long-term prospects have diminished as earnings growth estimates have fallen. Additionally, given their outperformance, these growth darlings have reached epic proportions within indices and correspondingly their price action dominates index returns.

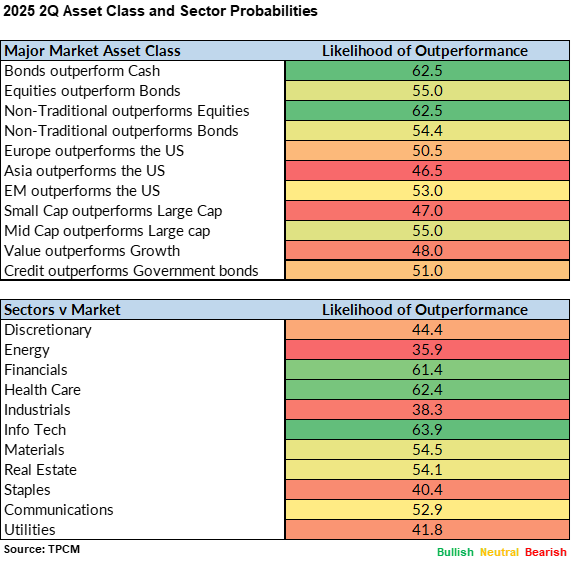

Meanwhile, as US equities fell, other asset classes and investment types experienced a revival. Fixed income rallied over 2% as GDP growth estimates and inflation declined. European stocks, left for dead by many, posted double digit returns over the quarter and China rallied over 17% as various government stimulus measures have begun to have a positive impact. Gold and silver were also up nearly 20%.

Our overall takeaway from the first quarter is that a significant rise in policy uncertainty triggered a valuation adjustment among large-cap US growth stocks, pulling broader equity indices lower. That said, diversification benefits kicked in and well diversified portfolios generally performed better than the S&P 500, which was down about 4% for the quarter.

As always, valid questions and concerns exist and it’s critical to assess the key variables to determine if the environment will be attractive for investors to take risk and where that risk will be best compensated.

2Q25 Economic and Investment Drivers

| DRIVER | STATUS | COMMENTARY | |

|---|---|---|---|

| Real Economic Growth | Falling | According to the Atlanta Fed, the economic growth trajectory in the U.S. deteriorated dramatically over the last several months. We believe that while slowing, the US economy will avoid a recession in 2025. International growth rates are showing some improvement due to stimulus. | |

| Inflation | Stable | Inflation improved throughout most of 2024, allowing for a pivot in monetary policy. Continued improvements may occur but will be more difficult going forward. The impact of pending tariffs could meaningfully sway the inflation trajectory. | |

| Real Interest Rates | Falling | Real interest rates fell over the course of the quarter but remain near 10-year highs. A slowing economy and more accommodative monetary policy would result in lower real rates. | |

| US Dollar F/X Value | Falling | For many years the dollar has been the king currency among global competitors but trade uncertainty couples with falling interest rates and a slowing economy may result in a weakening of the greenback. | |

| Taxes & Regulations | Falling | The 2024 elections may be the catalyst for meaningful change in the tax and regulatory structure in the United States. The 2017 tax cuts are likely to be extended and DOGE has the potential to effect an unprecedented reduction in bureaucracy and red tape. | |

| P/E Ratios | Stable | S&P 500 earnings growth is expected to modestly increase in 2025. US large cap growth remains at very full valuations which has resulted in a re-rating. Small caps, international and other market segments trade at meaningful discounts | |

| Fixed Income Risk Premium | Stable | High yield spreads have widened out and represent a greater risk of economic slowdown and individual company stress. Although wider, we anticipate spreads remaining in a manageable range. | |

| Volatility | Rising | On the back of Trump's tariff announcement, volatility spiked and will remain high until markets become comfortable that trade resolutions are developing. | |

| Source: TPCM | Bullish | Neutral | Bearish |

Unmentioned above but critical in evaluating the forward-looking investment landscape is the Trump administration’s ambitions regarding trade and tariffs. On April 2, the President gave a Rose Garden speech which outlined a sweeping set of tariffs against 90 different countries intended to level the global trade playing field in an effort to rebuild American industry and reduce reliance on imports. This move represents a significant escalation of Trump’s new global trade policy that hopes to protect the US from unfair foreign competition while also generating federal revenue.

Specifically, Trump has proposed the following:

-

- A baseline 10% tariff on all imports from every country, effective April 5, 2005

- Additional tariffs on ~ 90 nations deemed “worst offenders” with significant trade imbalances effective on April 9, 2025

- A planned 25% tariff on all imported vehicles to be implemented in early April

- Additional sector specific tariff increases that will be announced at a later time

By major trading partner:

-

- China: Trump had already placed a 20% tariff at the beginning of his 2nd term; will now add additional 34% tariff bringing total to 54%; potential for additional 25% tariff if continue to buy Venezuelan oil

- Canada and Mexico: exempted from 10% baseline tariff and exemption applied to USMCA compliant goods; subject to previous tariffs of 25% on steel and aluminum imports and imported vehicles; a 25% tariff on specific goods until fentanyl and immigration flow curtailed; if fentanyl/immigration issues resolved, non-compliant USMCA goods face a 12% tariff

- Europe: 20% tariff on all imported goods from 27 member countries; 25% tariff on all imported vehicles

In calculating the tariffs charged by other countries the US has included not just the stated tariff rates of other countries but also added a calculation for foreign currency manipulation as well as other trade related barriers that added to the cost of selling US exports. While discounting this total by 50% to arrive at the new tariff rate, the net effect was that the tariffs proposed were much higher than what most had expected.

The broader economic outlook remains uncertain, with rising concerns that trade disruptions could lead to a significant US slowdown. While European markets have shown more resilience, historical patterns indicate that a downturn in the US could ultimately weigh on global growth, particularly in export-dependent economies like Germany, Japan and the UK. Investors remain cautious about the risk of stagflation, given the Federal Reserve’s uncertain capacity to offset the impact of trade tensions through monetary policy. However, we believe that Trump’s trade and tariff policies will remain flexible, leaving room to prevent a full-scale trade war.

From our vantage point the end game is still being played out as it appears the Trump administration has left themselves a very narrow window in which to further negotiate rates lower with specific countries until the April 9th deadline arrives. While there will undoubtedly be tough public talk from all countries, there will also likely be behind the scene discussions on how to move forward now that the US framework has been announced. Already we have seen that Israel has agreed to remove tariffs on US imports , Vietnam is in discussions to lower tariffs and India is in discussions to lower duties imposed on US goods. We would expect additional conversations will take place at a frenetic pace.

In addition, Trump’s threat of tariffs to this point has resulted in an unprecedented number of announcements of investment into the US by foreign and US companies. While some of this may have occurred without the tariff threat, there is little doubt that many companies have chosen to invest directly in the US rather than Mexico or Canada or elsewhere to fully avoid future tariffs. Trump’s ability to bring investment into the US is a direct repudiation of the “globalist” view on trade which shipped jobs overseas in return for much cheaper goods. Below is a list of recent announcements.

We believe these capital investments, coupled with the likely extension of tax cuts from the first Trump administration, will sustain economic momentum and help stave off a recession. However, recent tariff announcements introduce a significant new risk for investors. Recession? Inflation? Stagflation? The landscape remains uncertain, but there is a pathway to policy success.

With Trump, nothing is ever static. As he wrote in The Art of the Deal, “If you’re going to be thinking anyway, you might as well think big.” His tariff strategy and other proposals clearly reflect that mindset. The success of fiscal policy will hinge on the timing and execution not just of tariffs but also tax cut extensions, regulatory reform, and DOGE initiatives. Thinking big, indeed.

So far, investing conditions have certainly been challenging but not yet catastrophic. Investors must take an objective approach to identify opportunities aligned with their goals. Volatility is the price of excess returns. As such, our forward-looking investment strategy considers policy developments, relative valuations, and growth potential across asset classes.

Despite everything, we do not believe this is the time to significantly reduce risk. While policy and related economic uncertainty remains high, much of those risks have already been priced in during this recent correction. Sentiment is now deeply depressed, hovering near the lows of March 2009. More importantly, portfolio positioning and leverage are at very defensive levels.

Markets have clearly adopted a “shoot first, ask questions later” mentality since Trump’s tariff announcement last week. The focus has largely been on potential downsides, with significant time and energy spent analyzing what could go wrong. But at current levels, it may be worth taking a more balanced view—one that weighs both risk and opportunity. Just as markets quickly priced in the economic threats of the tariff policy, they could just as rapidly respond to any signs of easing tensions or movement toward a resolution.

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. TPCM does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio.

Investment advice is offered through Fortis Capital Advisors, LLC, 7301 Mission Road, Suite 623, Prairie Village, KS 66208

Recent Comments