Despite lingering concerns and anxiety regarding the Delta and Omicron variants of COVID-19, a multitude of supply disruptions and meaningfully rising inflationary pressures, the economy continued its expansion in 2021 and US equity investors were compensated handsomely for remaining committed to the recovery story. For the year the S&P 500 rose nearly 30% without a meaningful correction. Astonishingly, the three-year annualized return of the benchmark equity index exceeds 25%. So much for the detrimental effect of COVID on equity investing. Much has been made of the policy boost, particularly monetary policy, which clearly has been a tailwind for markets during the COVID period. Yet one needs to give credit where credit is due. Corporate America has executed extraordinarily well in this recovery period and earnings per share for the S&P 500 are now at all time highs.

Productivity enhancements and earnings ultimately drive equity prices and US corporations have again proven their resiliency which justified the rally which we have experienced. The S&P 500 started 2021 trading at roughly a 23x multiple yet given the increases corporate profits, the current P/E ratio is now closer to 21x next year’s earnings.

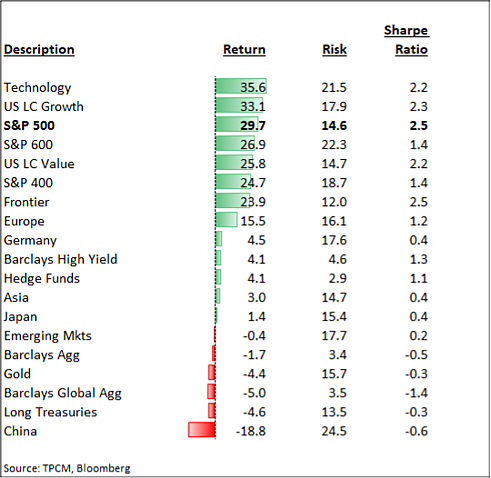

Given that, it is no surprise that the S&P 500 proved to be the investment of choice as virtually all other asset classes and investments types underperformed the benchmark index. Small caps which started 2021 strong, weakened on a relative basis throughout the latter half of the year as the Delta scare impacted smaller companies more so than larger companies. International equity markets again proved underwhelming as the economic growth and profit trajectories remain very weak overseas. China, in particular, underperformed sharply as government crackdowns on the private sector continued to inhibit economic growth. For the year the Chinese equity market fell by over 20%! Fixed income returns were predictability flat to negative as the effects of central bank policy impacted rates and bond returns.

So, the only return enhancing, asset allocation decision to be made in 2021 would have been to own more growth stocks and particularly more growth oriented, large cap, technology companies. Given this narrow opportunity set for adding excess return, roughly 85% of active equity managers underperformed the S&P 500 this past year.

As we enter 2022, investors are asking themselves can this paradigm continue? Obviously, it has not been a bad paradigm. In most respects it has been very good. Economic growth, expanding profits and rising stocks. What’s not to like? Yet the concentration of returns is troubling to many and it portends that a change could be at hand.

Our opinion to this dilemma lies in our fundamental viewpoint of economic variables and relative valuations. If nothing changes fundamentally one should expect that return patterns should remain similar. To the extent that the drivers are changing one should expect a different return pattern for investors.

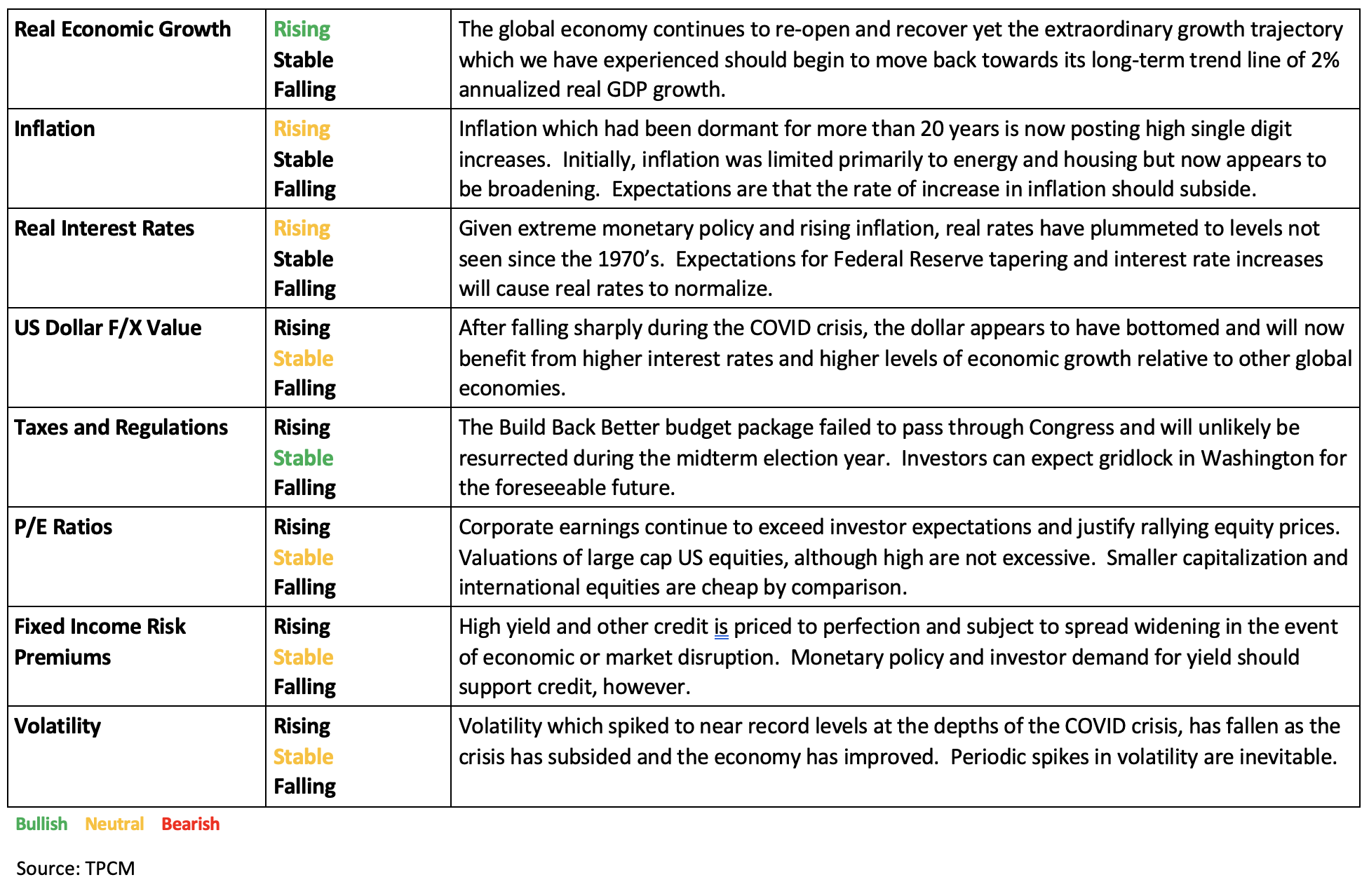

2021 1Q Key Economic and Investment Drivers

As we parse through the drivers, we do believe that there are several issues which will matter going forward and others which will be of less importance or ultimately become non-issues.

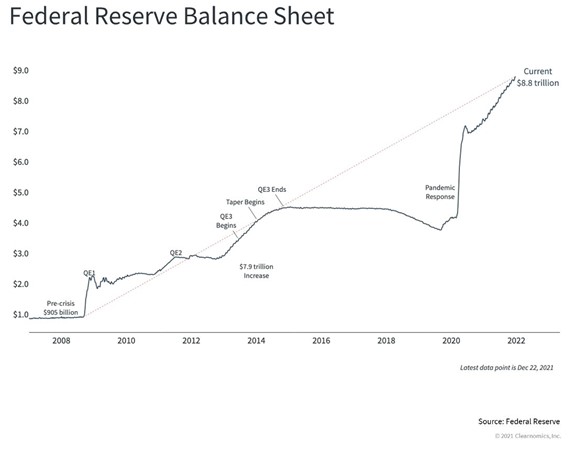

One key issue of importance to us would be the pending changes in Federal Reserve policy and its impact on real interest rates. This past month the Fed announced that it will begin a process of reducing the monetary stimulus which it has provided to the economy in response to the COVID-19 crisis. The central bank will reduce its purchases of US Treasury securities as well as look to raise interest rates in 2022. Current expectations are for three rate hikes over the next several months. Just as we viewed the expansion of the balance sheet and the monetary stimulus provided over the past several years as meaningful, we also view this policy change as significant and do believe that it will impact market returns. As we’ve learned in the past these policy changes are not without risk and markets may ultimately react poorly if the tapering moves too fast. Conversely, if the Fed moves too slow and inflation continues to rise that too would be a problem. The Fed walks a tightrope. Yet so far so good and we do believe the Fed will move judiciously without causing a major volatility shock. This is a changed variable, however, which we believe will impact investment patterns. Clearly, fixed income will be impacted but also equity segments which have benefited from the recent Fed policy regime, such as growth stocks.

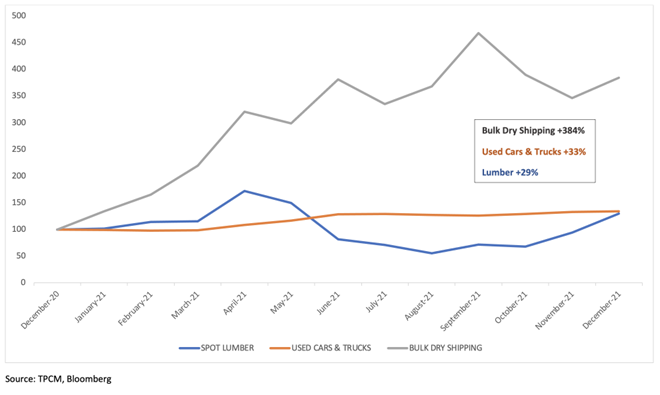

The second issue which we do believe will remain significant is the continuation of labor and supply chain disruptions. As we learned during the COVID crisis, the world’s economic system is fragile and very interdependent. Interruptions of manufacturing or service in one area can have ripple effects throughout an economic ecosystem. We have believed that these disruptions have had a greater impact on inflation than the effect of monetary policy. Obviously, this high inflation regime is bad. Yet, the good news is that the effect of higher prices on a market is usually the solution for higher prices, particularly among commodities. High prices lead to new supply and reduction in supply disruptions. This is more easily solved in some markets and more difficult in others. The price spike in lumber which we experienced last fall quickly normalized whereas the price increases in used cars will likely take some time to work out. Shipping and trucking have been a clogged component of the global economic ecosystem over the past year and as a result many companies are beginning to onshore and localize more production and supply sources. Investment opportunities and risks have developed as a result of the fractured supply chains across industries, and we expect that to continue in 2022.

2021 Notable Supply Disruptions

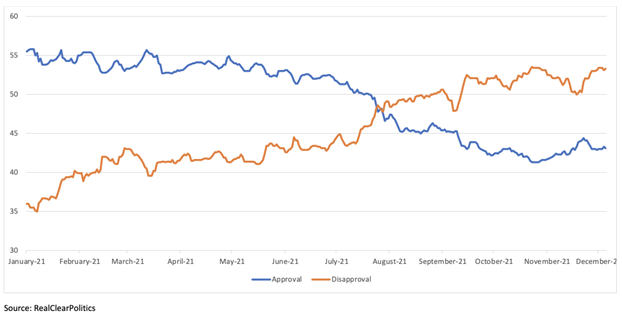

In terms of potential non-issues going into the new year, fiscal policy which loomed large as a risk variable in 2021 will diminish as a key issue in 2022. The failure of Joe Biden’s Build Back Better budget package to pass through the Senate this month was a major defeat for the Administration and one from which they will not likely bounce back. The expansion of government power during the COVID crisis has been well documented and has remained a risk factor for us when evaluating economic landscape. Yet, the failure of BBB likely marks the interim peak of federal government influence on the private sector. It goes without saying the Joe Biden is not a popular president. His first year in office has been plagued by notable failures and a chaotic, ineffective vision. His support among Republicans is non-existent and is increasingly diminishing among Democrats. The likelihood of any major policy initiative passing through Congress, particularly during a midterm election year is negligible. Obviously, the Biden Administration can continue to act via executive order but any new tax and spend initiatives will be dead on arrival. Additionally, as of this writing it appears as if the Republicans will take control of both houses of Congress come November, which will further gridlock policy in Washington. Wall Street loves a split government, and the reduction of fiscal policy risk should become a much reduced issue in 2022 and likely through the remainder of Biden’s presidential term.

Joe Biden’s Presidential Approval Rating

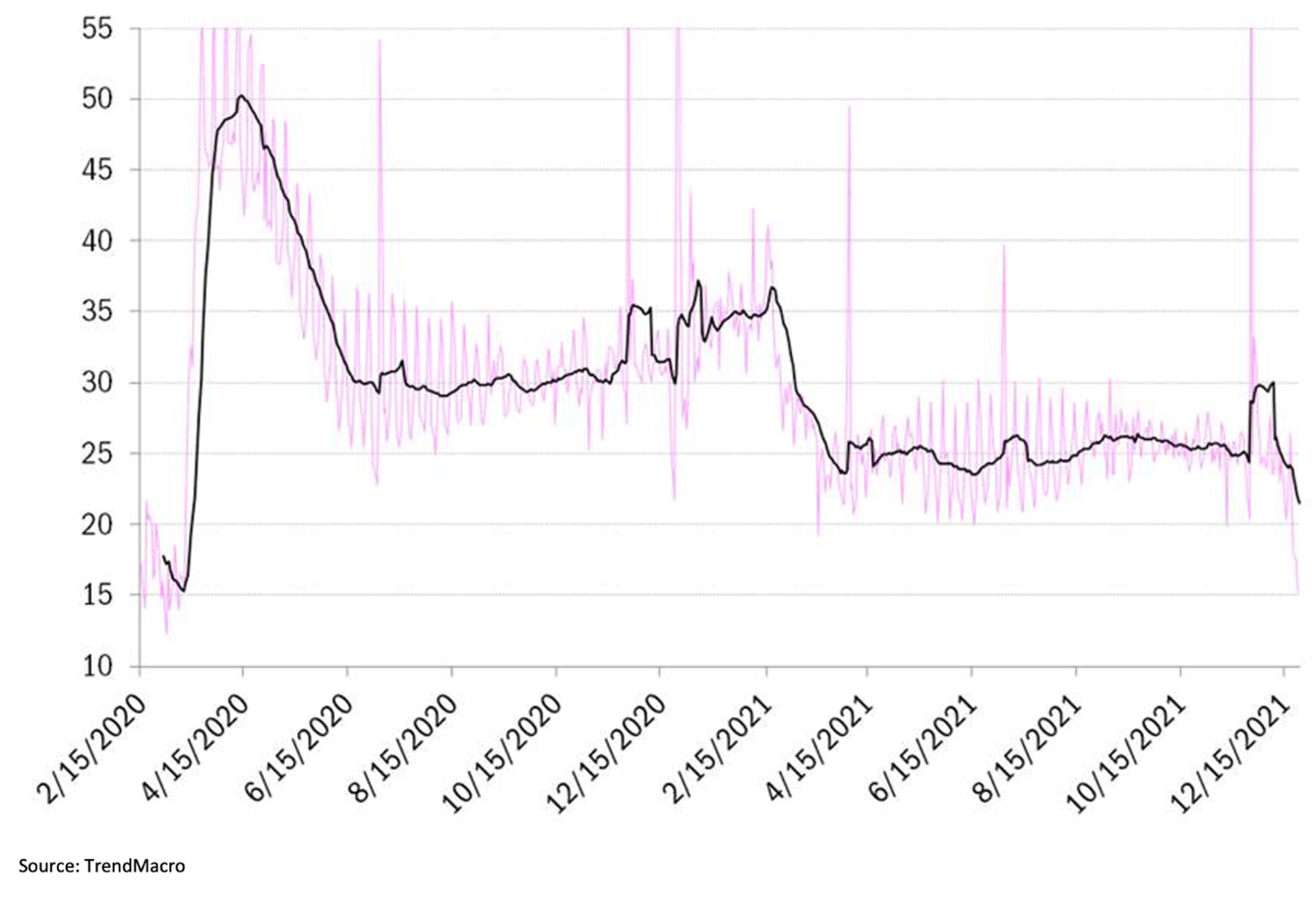

Lastly and most importantly, we believe that Covid will finally diminish as a key issue in 2022. COVID will not go away entirely, particularly overseas, yet it appears as if the US populace is moving on. Despite much media hype regarding the Omicron variant it appears as if the ability to shock the general population has diminished and people are getting on with their lives. Omicron has proven to be very virulent but not nearly as debilitating as the previous variants. As with most things today, COVID has been politicized and red state politicians such as Governor Ron DeSantis in Florida have made much about coping with COVID rather than trying to “control” it. Yet, even Democratic politicians such as Governor Jared Polis in Colorado and newly elected NYC Mayor Eric Adams have recently stated that shutdowns are over. Joe Biden has also changed his tune recently stating that there is no Federal solution to COVID. We are moving forward and believe this is very good news for society and the economy.

Trend Macro Social Distancing Index

Based on cell phone mobility data; lower equals more mobility

We do believe that the overall environment should remain constructive for investors going into 2022. As such, we will remain overweight equities, particularly US equities into the new year. Yet, we also believe that the reduction in COVID risks as well as a meaningfully changed monetary policy framework may lead to new investment leadership away from large caps growth stocks. As such we are increasing weights in smaller cap US equities and value sectors such as financials. We remain meaningfully underweight international equities. In as much as we are encouraged that COVID risks are diminishing in the US, it does not appear to be the case overseas, where many governments continue to remain in shutdown mode, limiting personal and economic activities. We also remain meaningfully underweight fixed income as we anticipate returns to again to be flat to negative across most bond investments as the Fed raises interest rates. In lieu of fixed income we are overweight alternative investments as diversification tools to traditional equity and bond market risk. Risks remain and an overdue correction will occur at some point, yet we do believe that the resilience of the US economy and corporations should lead to another constructive year for investors in 2022.

IIMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments