We’d like to thank our summer analyst interns, Max Persico, John Schreiber and John Hufnagel for all their help this summer and putting this important research piece together for us and our clients.

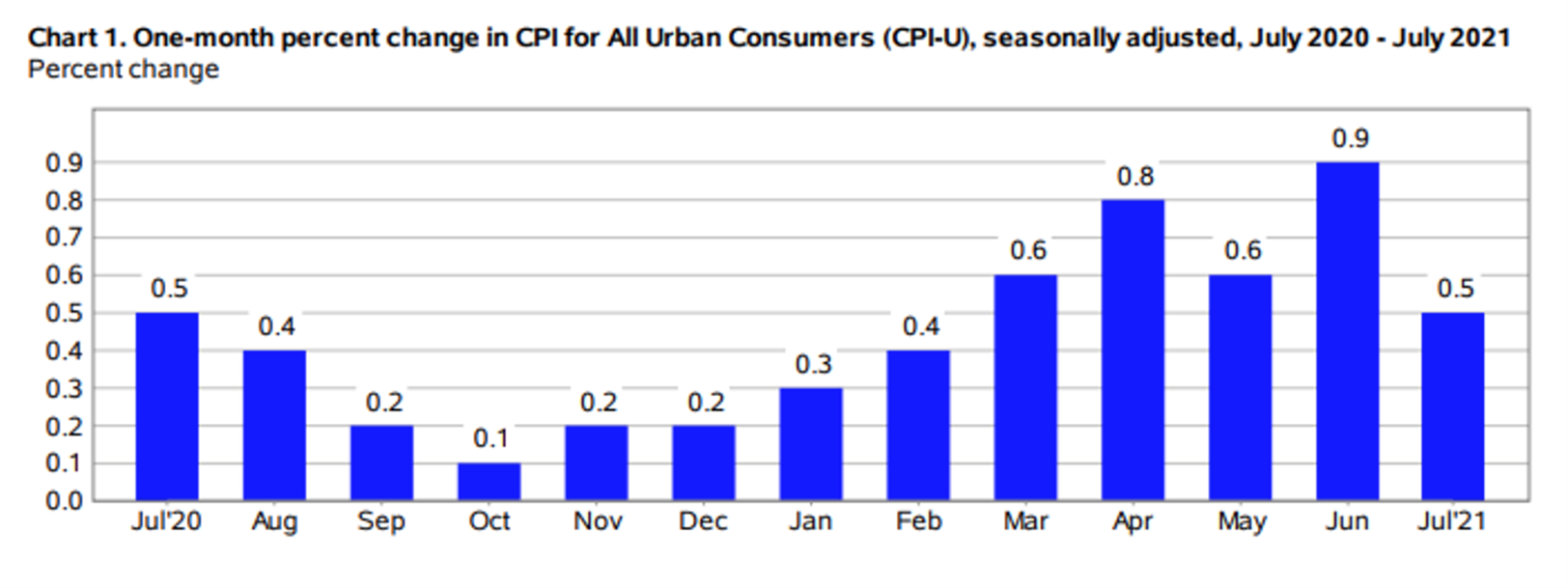

Inflation concerns continue be at the forefront of investors’ minds, and rightfully so. The CPI and PCE data over the past few months suggest inflation is a legitimate threat to the strong economic recovery. While Fed Chair Powell has stated that recent inflation strength is reflective of temporary pressure from supply chain constraints, he has also stated, “As the reopening continues, bottlenecks, hiring difficulties, and other constraints could continue to limit how quickly supply can adjust, raising the possibility that inflation could turn out to be higher and more persistent than we expect.” At TPCM, we continue to believe the inflation scare will be transitory, and the bond market rally over the past few months appears to agree with us. We have examined the July CPI and PCE reports to identify key drivers of recent inflation prints and then delved into recent company commentary for further clues as to when we can expect supply shortages to sort themselves out.

While CPI data is more widely detailed by the financial press, the FOMC focuses on PCE inflation to make its quarterly economic forecasts. There are subtle differences between the two indices, but suffice to say on a line item basis, PCE price index data is far more opaque than CPI data. Therefore, we have opted to use recent CPI data to identify the key drivers of inflationary pressure. The July CPI report showed a 5.4% (all items) Y/Y increase, with key drivers of the July CPI print being 1) new vehicles which increased 5.4% over the last 3 months; 2) energy, driven by the gasoline index increasing 42% over the past 12 months; and 3) food away from home which jumped .8% in July, its largest monthly increase since February 1981. Interestingly, the price index for used cars and airline fares both fell in July after rising sharply in recent months. Components of the CPI data can be by clicking here.

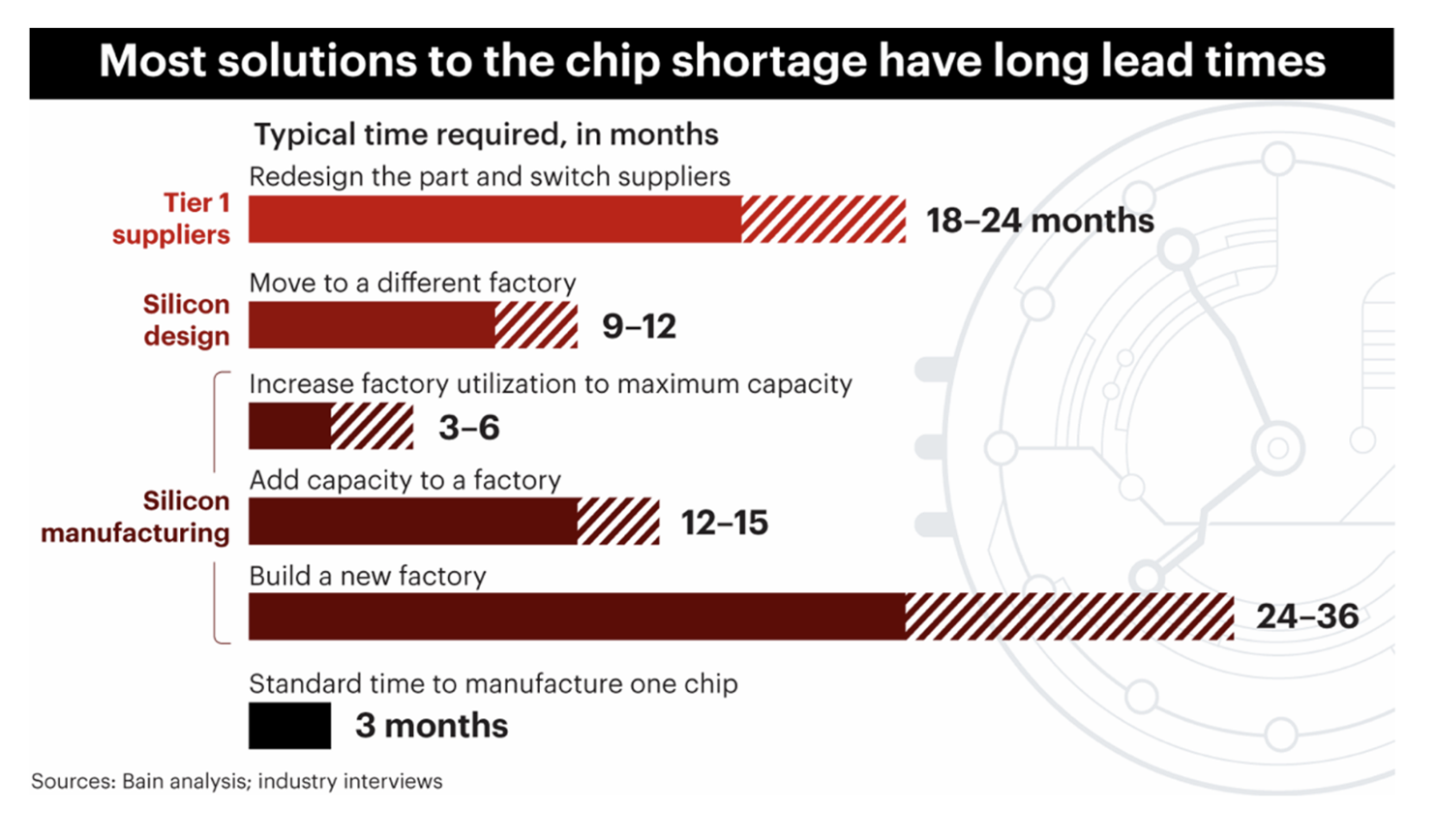

New vehicle production has primarily been impacted by semiconductor shortages. Among the major auto manufacturers, Ford Motor Company reported a June sales drop of 27% Y/Y, Stellantis noted production losses of 20% or 700K vehicles, Volkswagen noted that passenger car sales in China were impacted by semiconductor shortages, BMW stated it produced 30,000 less new vehicles than planned while the China Passenger Car Association recorded new car sales of 1.58 million in June, down 5.1% from the previous year. On the positive side, GM noted they were able to pull forward some semiconductor supply into 2Q which resulted in greater May and June volumes vs. budget while Toyota noted that only 1% of production volumes had been impacted due to tight semiconductor supplies. As can be seen below, incremental semiconductor capacity solutions will take time though many have already been in the works for months.

Recent semiconductor company commentary from Taiwan Semiconductor Manufacturing Co. (TSM), TE Connectivity (TEL), and NXP Semiconductors (NXPI) can provide some guidance on future supply chain shortages. TSM, the largest semiconductor foundry in the world, increased its output of automotive chips by 12% Q/Q, helping to ease shortages of automotive MCUs. TSM CEO C. C. Wei stated that “TSM increased its production of MCUs by 30% in the first-half of 2021, and is on its way to increasing auto chip capacity by 60% for the year. TE Connectivity, a manufacturer of connectors and sensors for the automotive industry, stated that, “…ongoing challenges with semiconductor supply continue to impact our customers’ ability to produce…the situation will probably get fixed in 2022 at some point.”. NXPI, perhaps the largest semiconductor supplier to the auto industry, raised its guidance for the September quarter noting, “During quarter 2, based on the orders and all of the various actions we took over the last 6 to 9 months, we began to see wafer supply from our foundry partners and internal fabs improve.”

A recent forecast from IHS Markit suggests that the chip shortage should begin easing in the fourth quarter of ‘21 as MCU suppliers expect to have the capacity to meet forecasted demand. That said, very recent production cuts by Toyota, Ford and GM suggest a new culprit in rebounding semiconductor supplies – the re-emergence of Covid-19. It remains to be seen if optimism on recent quarterly calls from Ford, “…we are now spring-loaded for growth in the second half and beyond because of those red-hot products, pent-up demand and improving chip supply.(Ford)” and GM, “we believe that as we get into the fourth quarter, some of the underlying semiconductor challenges are going to start to abate.” will pan out. In our opinion, while full supply recovery may have been pushed another quarter or two out, the worst of the semiconductor shortages are behind us.

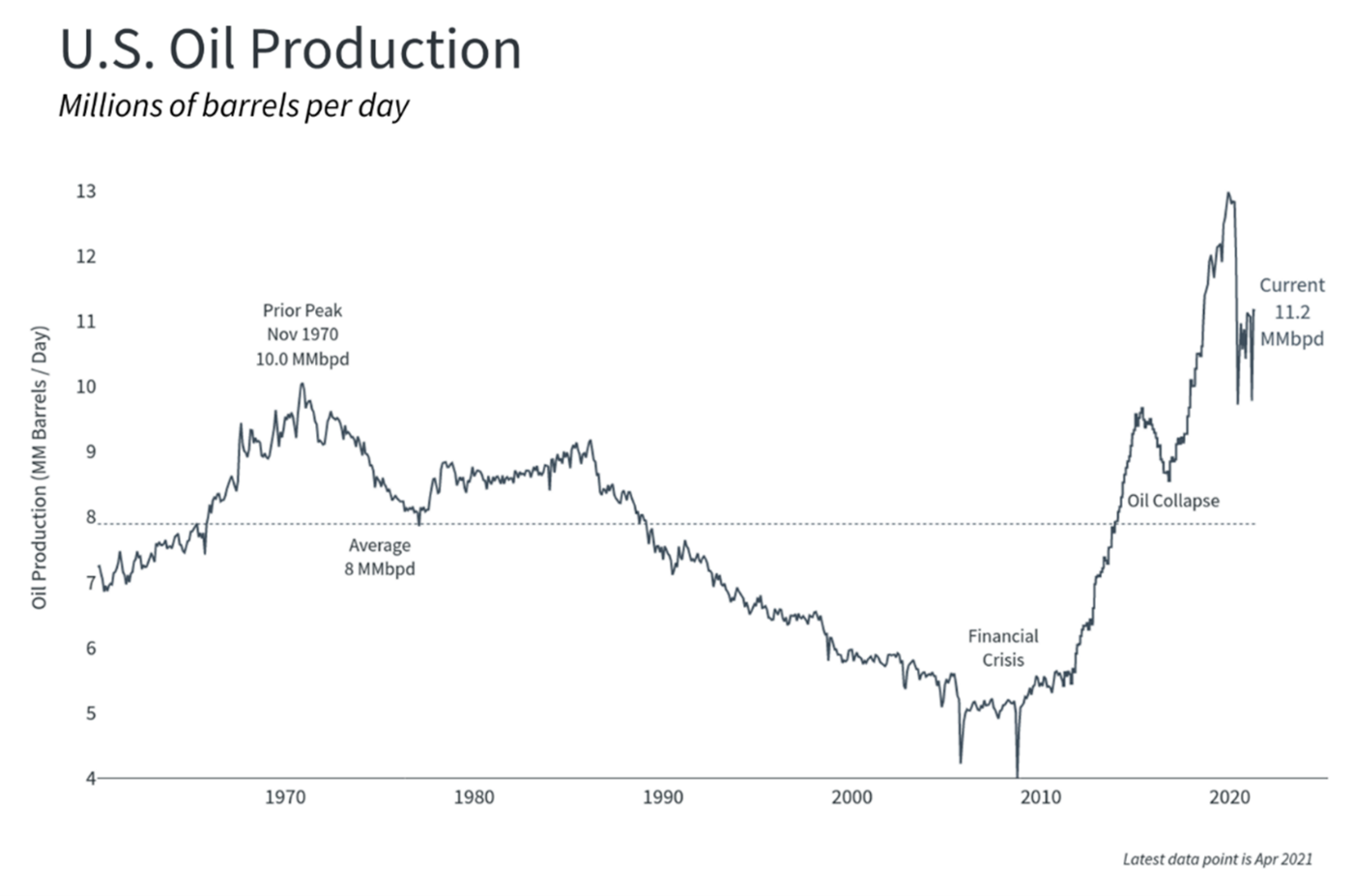

Americans have felt the pressure of increasing energy costs at the pump reflected in the CPI for energy which increased by 23.8% Y/Y, as gasoline (all types) and fuel oil increased by 41.2% and 41.8%, respectively. Higher energy prices are a function of surging demand as economies re-open while supply has lagged owing to company’s slashed capital expenditures and OPEC’s reduction in supply. In the US, the Baker Hughes rig count data declined from 683 active crude oil rigs in March 2020 to just 172 active rigs in mid-August 2020 and has only recovered to 500 as of mid-August, 2021. Consequently, crude oil domestic production in the U.S. has increased from a low of 9.7 MMBD in November 2020, to 11.2 MMBD for the week ending Friday July 31st , albeit still below pre-pandemic levels of 12.7 MMBD in February 2020.

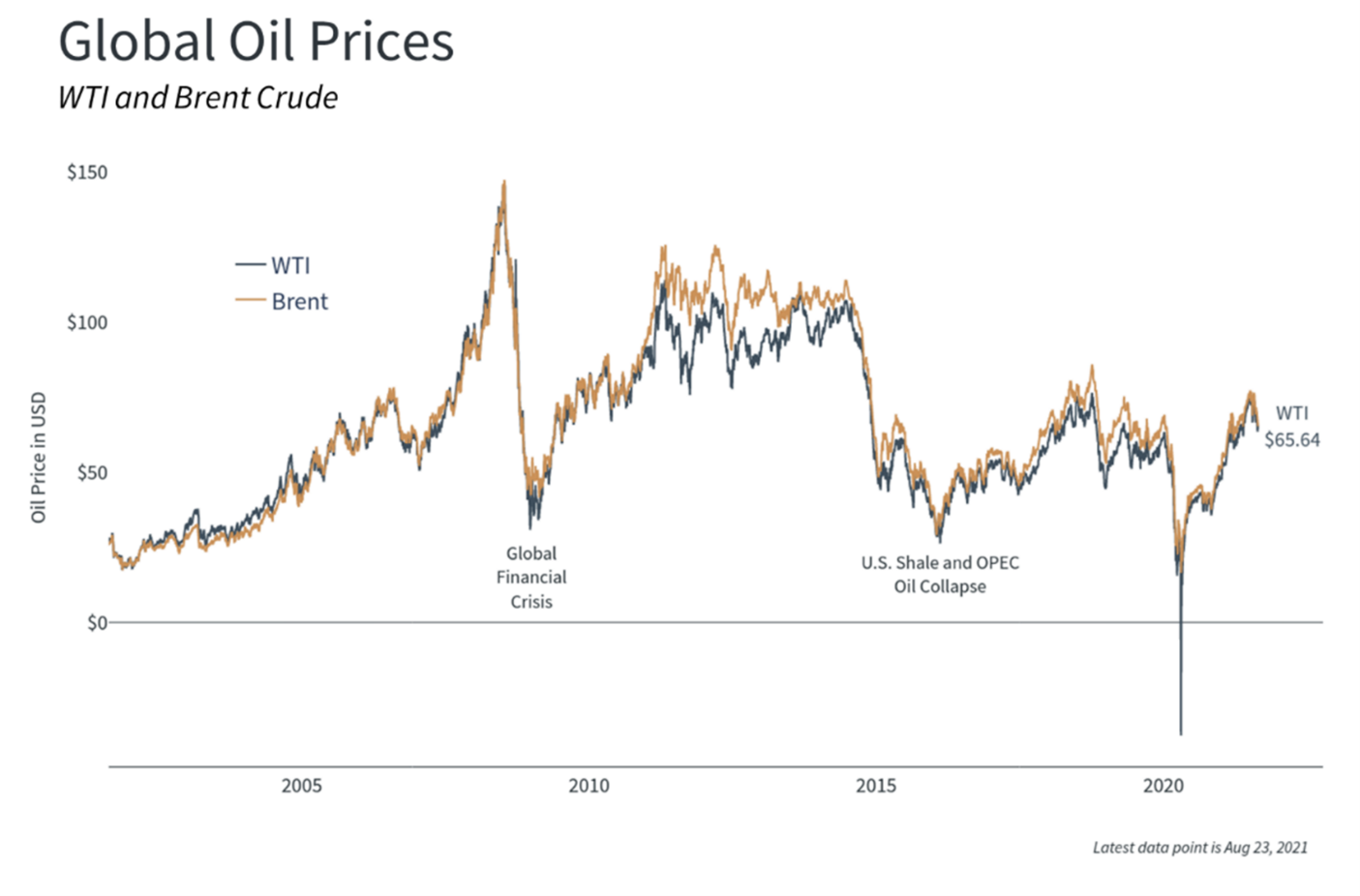

On the international scene, OPEC and its allies reached an agreement to phase out 5.9 MMBD in production cuts by September 2022 by increasing production by 400,000 barrels per month. OPEC spare capacity, an indicator of how quickly supply can be increased to meet demand, totaled 8.02 MMBD in mid-July, indicating significant supply available to come back online. Global oil prices, which rallied strongly from depressed levels, have begun to reflect the reality of additional supply, as seen below.

Earnings call commentary has been encouraging for renewed supply. Chevron (CVX) noted about operations in the Permian basin, “We did add an additional completion crew in July, and we expect to add another one before year end…we currently have five drilling rigs out there and we expect to add at least one or two more in late third quarter and fourth quarter. So, we are seeing our activity levels start to increase in the second half [2021] as we see markets, not in balance, but starting to move in the right direction towards approaching equilibrium.” Exxon (XOM) is also expecting to grow, “We are also benefitting from attractive ongoing upstream investments…especially in the Permian…We produced 400,000 oil equivalent barrels a day this quarter, which was up approximately 50,000 oil equivalent barrels a day versus the second quarter of last year…We expect to grow production a further 40,000 oil equivalent barrels/d in 3Q21.” On a medium-term basis, ConocoPhillips chief economist noted “we expect oil production to grow over the next five years” and that oil prices at the “back end of the curve” could help producers “to repair their balance sheets and build production.”

We believe the rebounding rig counts in the U.S. and OPEC adding capacity to the market should continue to relieve pressure on energy prices. The U.S. production response may be more muted than in the past as many public companies have committed themselves to free cash flow generation thereby putting a governor on capex and capital markets, while open, are still circumspect about financing production growth. In any event, we believe that oil prices, which recently surpassed pre-pandemic highs, could be ripe for a continued pullback and are likely to start showing muted Y/Y gains.

Food prices jumped .8% in July, an increase that can be attributed to the food away from home segment which has now increased by 4.6% over the past year. In turn, this was driven by increases in limited-service meals and snacks which rose by 6.2% Y/Y. Demand for food away from home has increased rapidly with the economic reopening as people are eager to venture out, however many limited-service restaurants are struggling to meet that demand. While some food supply chain constraints to do exist, price increases appear to be a function of labor shortages.

The shortage in labor is not a function of available workers, but rather a lack of willing workers. Enhanced state and federal unemployment benefits along with COVID health concerns, and the new Delta variant, have dissuaded many from returning to the workforce. Those that have returned to the workforce have taken advantage of the strong labor market to upgrade their employment position thereby bypassing the restaurant business. This has resulted in competition for workers as evidenced by wages increasing in the June CPI by 3.7% Y/Y.

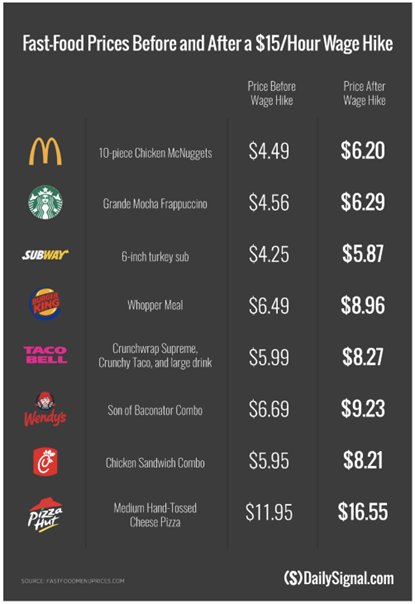

Domino’s Pizza (DPZ) announced additional wage increases in the second half of the year attributing higher wages to a “general supply and demand equation in the labor market”. Starbucks (SBUX) noted that it is increasing prices to “offset the sizable investments in wages and benefits as well as higher supply chain costs”. Chipotle (CMG) similarly increased their prices citing “several industrywide issues, most notably beef and freight costs…and increased wages to combat staffing shortages.” McDonalds has been offering one time signing bonuses to new employees as well as 5% wage increase across the US, which has led to price increases on many menu items. The National Owners Association (NOA), representing McDonald’s franchise owners, has indicated that despite wage increases and added benefits they are still struggling to stay fully staffed. Below one can see the estimated impact on food prices from increased wages.

By July 31st, 24 states will have opted out of the enhanced jobless benefits and many states that aren’t ending their participation have imposed stricter rules to collect unemployment benefits. Enhanced unemployment will end for all states in early September, which should help ease the labor shortage. The most recent non-farms employment report out last week offers, perhaps, a glimpse into a labor market supply recovery with an employment increase of 850K vs. the 700K consensus. The hospitality sector enjoyed the largest gain, 393K jobs, with bars and restaurants notching an almost 200K gain. Unfortunately, this still leaves the hospitality sector more than 2 million jobs shy of pre-pandemic levels which will likely continue to keep wages elevated and, consequently, food prices could remain elevated into 2022.

Supply disruptions were in full force post the Covid-19 pandemic as manufacturing that was taken off-line struggled to come back in a way sufficient to meet near-term demand. While uncertainty still exists as to when demand and supply will normalize, we believe that corporations are already starting to acknowledge that the necessary steps to help alleviate the situation have begun. Sudden and significant government policy responses that further exacerbated the situation are likely to play themselves out over the next few months adding a further element to normalization of supply and demand that likely will start to quell CPI and PCE price increases.

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments