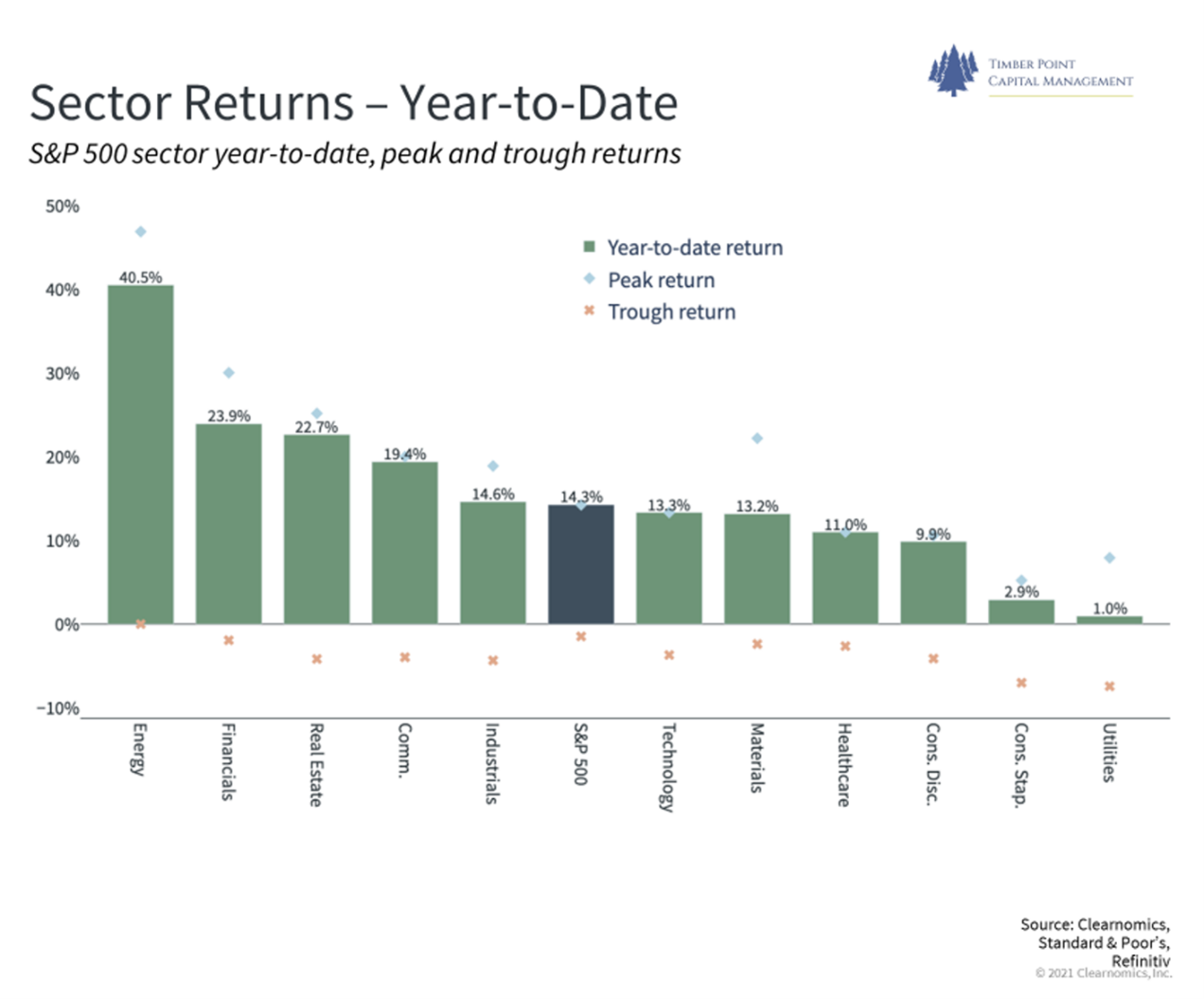

As often is the case, the equity market overcame a litany of worries this past quarter as many of the more macroeconomic and policy-oriented concerns quickly dissipated and investors focused on the re-opening of the global economy. Continued improvement in economic growth and increases in corporate profitability have buoyed investors and justified the lofty valuations of equity investments. For the quarter, the S&P 500 rose by 8.5% pushing the year to date total return to greater than 15%, surpassing many investor’s initial expectations.

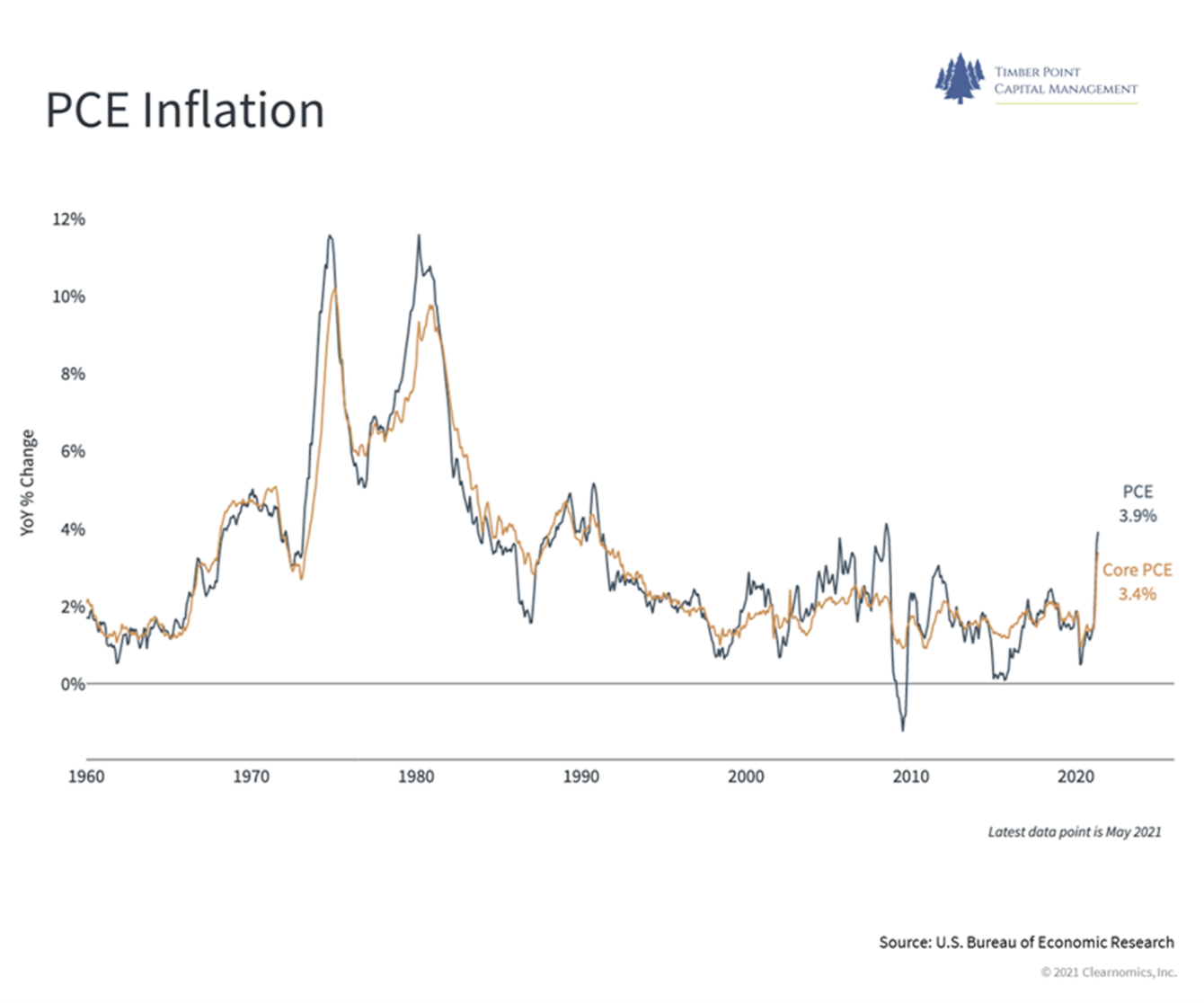

The greatest concern that investors faced over the past quarter was that of rising inflation. Since the financial crisis of 2008, inflationary pressures, globally, have been virtually non-existent. In fact, disinflation was the predominant trend and monetary policy inflation targets of 2% proved elusive. Yet, on the back of the COVID driven expansion of Central Bank balance sheets and the subsequent economic recovery, inflation began moving up meaningfully.

Yet, our viewpoint on inflation at TPCM has been more muted as we have fallen in the camp that believes that the recent spike in inflation is transitory. In as much as we do believe inflation will rise over the near term as a function of the economic re-opening, longer term inflation should normalize closer to the trendline of 2%. Additionally, we believe a fair amount of the inflation has been caused by temporary supply disruptions across the economic spectrum. We have long quipped that the solution to high prices is high prices, particularly in commodities. When prices spike, consumers look for alternatives or defer purchases and producers take advantage of the high prices by providing additional inventory to the marketplace. The lumber phenomena over the past several months is a perfect example of a supply crunch ultimately met with new inventory to the market, in order to meet housing driven demand with the resulting impact on prices. We believe that further post-COVID normalization of the economy and labor force will result in a reduction of the many supply disruptions, which will diminish inflationary pressures, going forward.

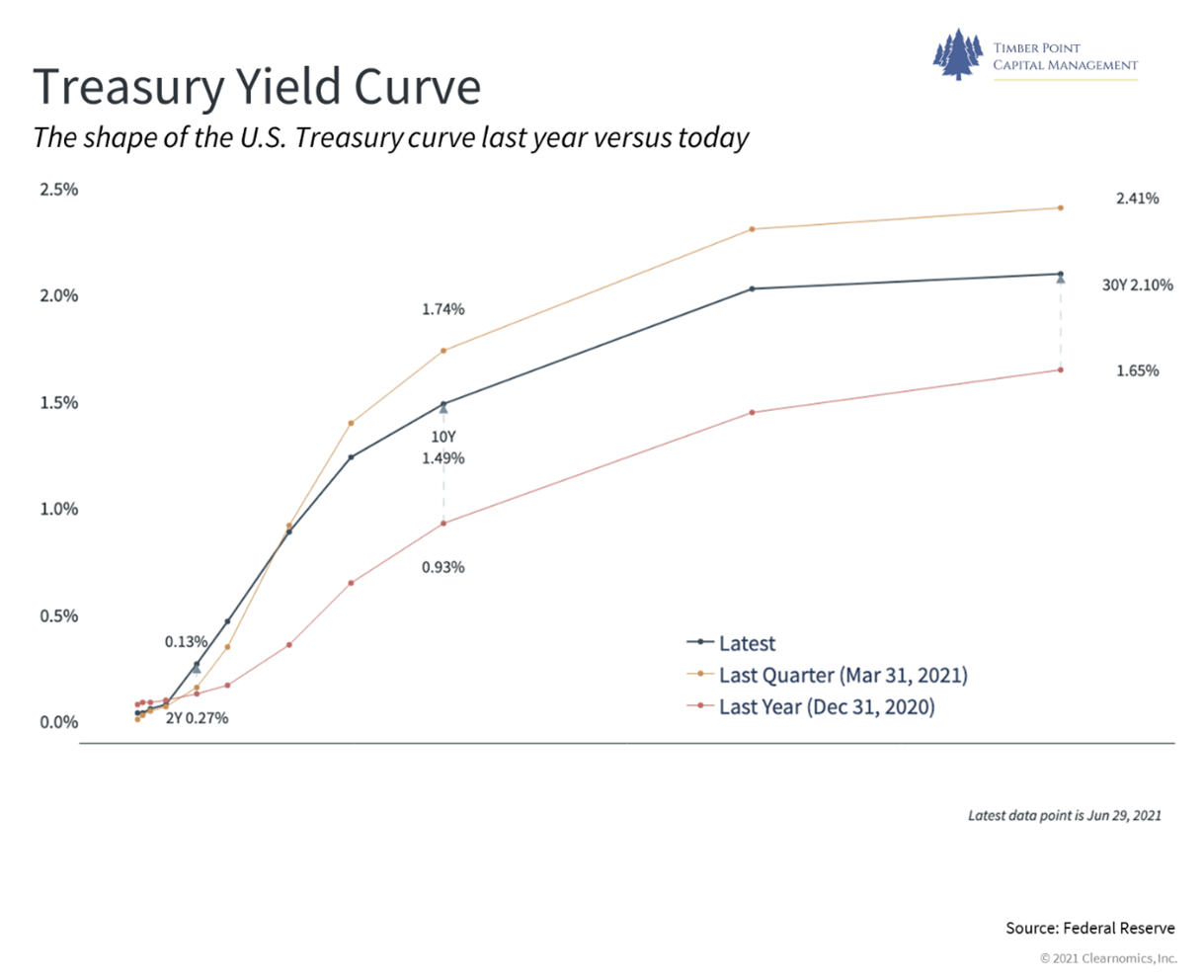

Extending from the inflation concern, the second greatest worry of the previous quarter revolved around rising interest rates and a falling bond market. At the beginning of April, it was a consensus view that US Treasury rates would continue to rise and possibly cause volatility in the equity market. Yet, with diminishing inflationary concerns, interest rates fell across the yield curve and the bond market rallied meaningfully. In fact, long maturity US Treasuries, for example, posted a 7% return for the quarter!

Lastly, fiscal policy risk was on the forefront of many investors’ minds as the prospect for higher tax rates and a greater regulatory burden seemed imminent with the newly elected Biden Administration and Democratic Congress. Yet, those risks also diminished over the quarter as the very even political split in both the House and the Senate has reduced the likelihood of meaningful legislation being passed, particularly on the tax front. Suddenly, Democratic Senators Kyrsten Sinema and Joe Manchin are now the most powerful people in Washington, representing the swing vote in key legislation. The old saw that the stock market loves political gridlock proved accurate over this past quarter.

The investment implications for these changing risk variables were muted but nonetheless significant over the quarter as US large cap stocks, particularly technology and other growth investments outperformed sharply. Recovery asset classes, sectors and securities underperformed over the period. Notably, small cap and value stocks underperformed posting returns in the 4-5% range. Whereas technology stocks roared back gaining over 11% over the three months.

As we enter the new quarter, we believe these market signals give us insight into what may be in store for the economy, going forward.

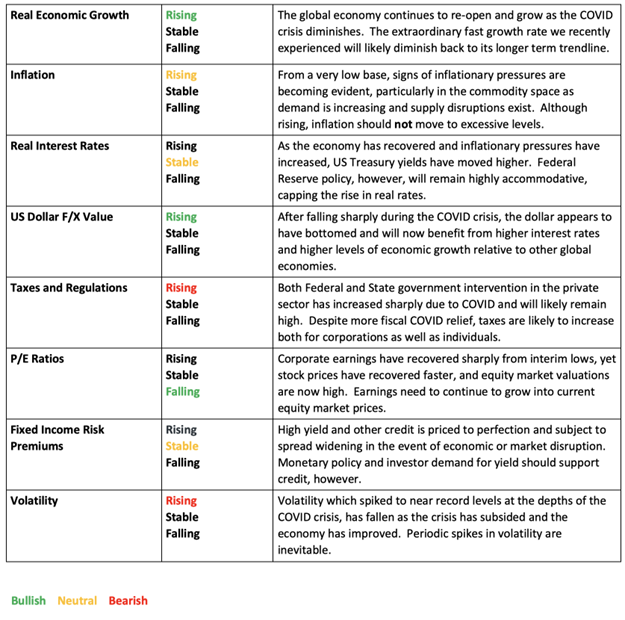

2021 3Q Key Economic and Investment Drivers

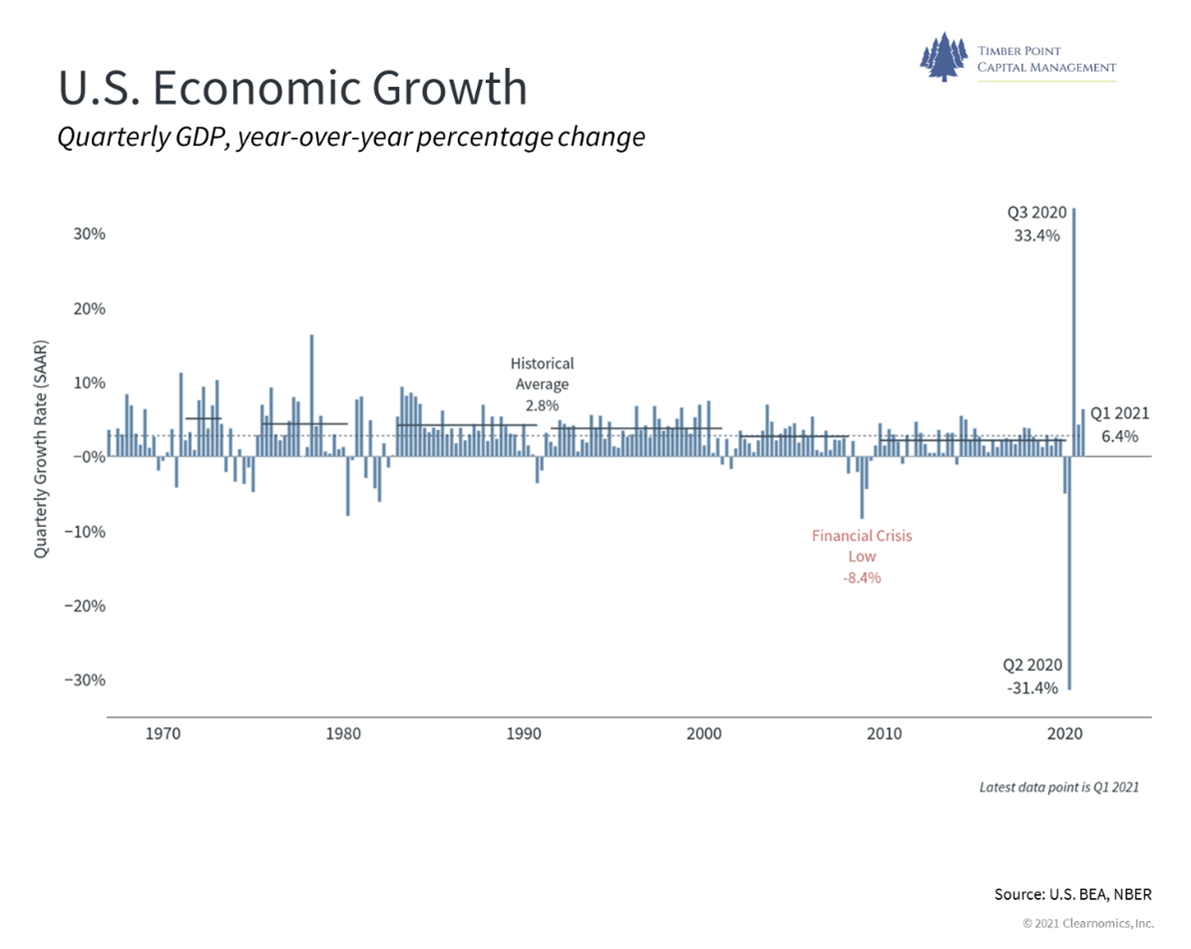

As outlined above, our outlook for key economic and market drivers remains mixed but overall optimistic, particularly around economic and earnings growth in the United States. Yet, it is important to understand that the extraordinary growth rate which the US economy has experienced over the past several quarters is likely to revert back to its long-term trend line of 2-3% real GDP growth with a more modest inflationary impact. We believe investors are beginning to discount the prospect of a lower growth rate and subsequently a lower inflation rate thus initiating the rally in US Treasuries and more growth-oriented sectors of the equity market.

The extended investment implications of this economic environment lead us to remain overweight equity investments. In as much as we do believe the US GDP growth rate will slow, re-opening continues to drive economic activity and earnings. In fact, S&P 500 earnings continue to surprise to the upside, justifying both current valuations as well as a positive forward outlook for stocks. The outperformance of recovery names, value sectors and small cap, however, is not assured. Several quarters ago, these investments were very attractive but if economic growth rates slow to the long term trendline, technology and other growth sectors may continue to maintain a leadership position.

Looking across the global spectrum, the US investment opportunity set continues to look most promising. The dollar, which had been weak on the back of the COVID crisis and initial recovery period, appears to have bottomed as global investors look at a recovering US economy, rising stock market and relatively high interest rates as good reasons to park capital in greenbacks. Additionally, the COVID crisis, outside of the United States, is not diminishing rapidly. Brazil, India and other emerging market countries continue to lead the globe in new cases and deaths. Many European countries have not experienced vaccination rates equal to that of the United States thus slowing the pace of reopening. This all factors into a somewhat uninspiring investment opportunity set outside of the United States.

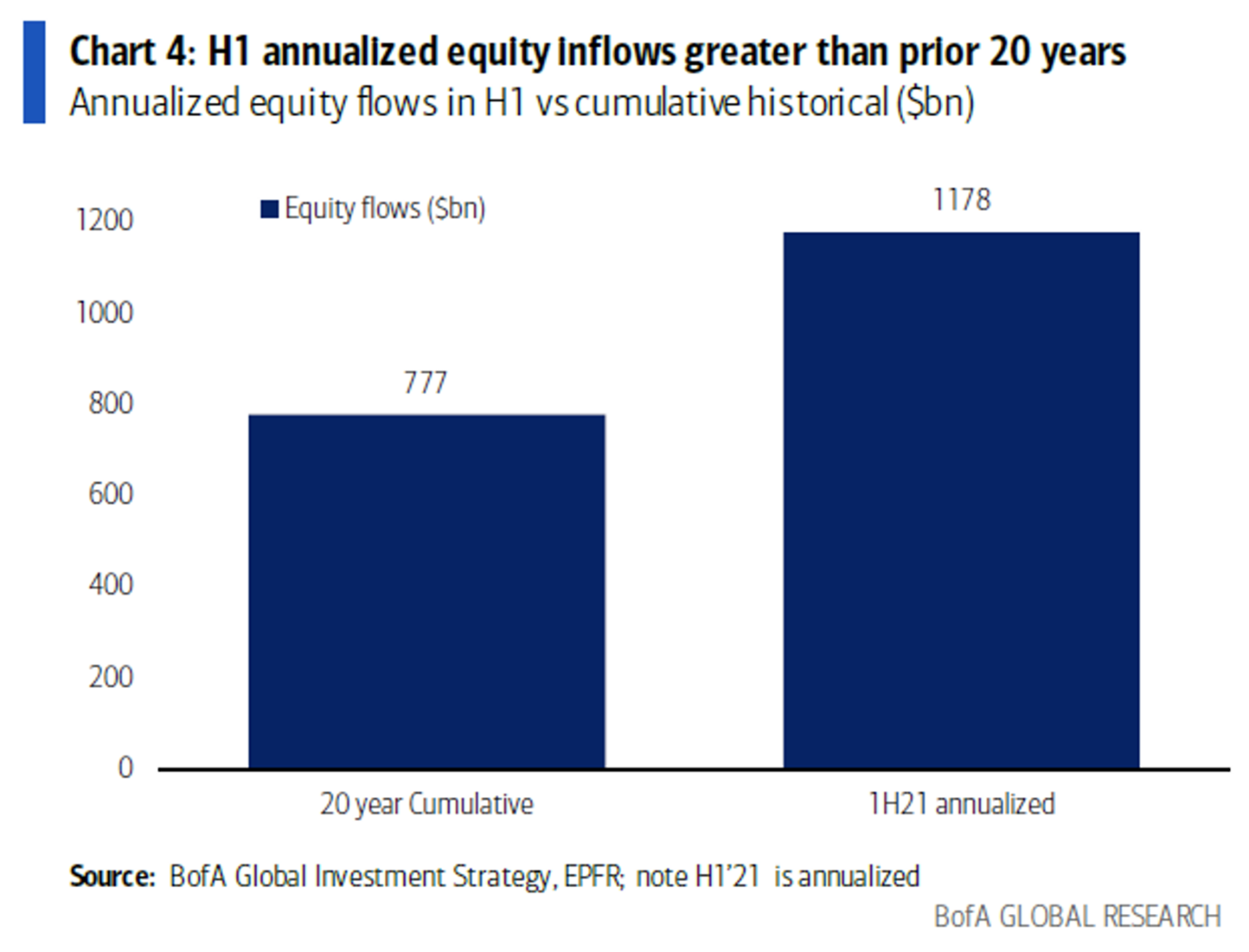

Despite our optimistic viewpoint, investor overconfidence and complacency are variables worth monitoring. Volatility as measured by the VIX, is now back to pre-pandemic lows and investor flows into equities are at all-time highs. Many investors have taken David Portnoy’s viewpoint on the directionality of equity markets quite literally. In fact, Bank of America recently reported that annualized dollar flows into equities in the first half of 2021 have exceeded cumulative flows of the past 20 years! Put/call ratios and other investor sentiment indicators are additionally stretched.

In isolation, investor sentiment indicators are not variables which would discourage us from the equity market. Yet, they do indicate to us that some insurance may be worthwhile in portfolio construction. Fixed income, written off as an asset class by many, and other diversifying investments remain important parts of the portfolios which we manage for our clients; allowing us to participate in the economic recovery while providing protection for the bout of volatility which we will inevitably experience.

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments