The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

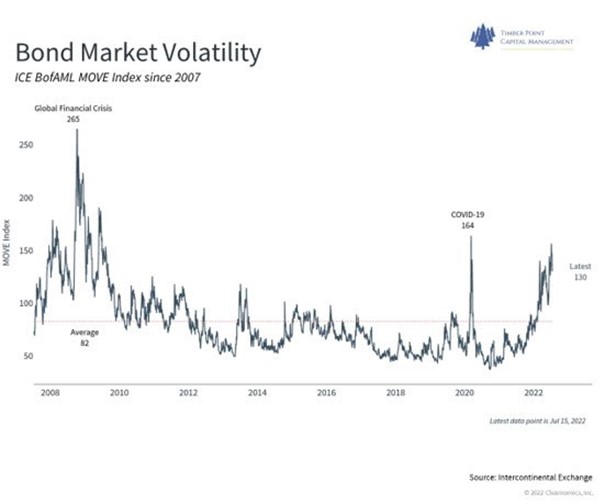

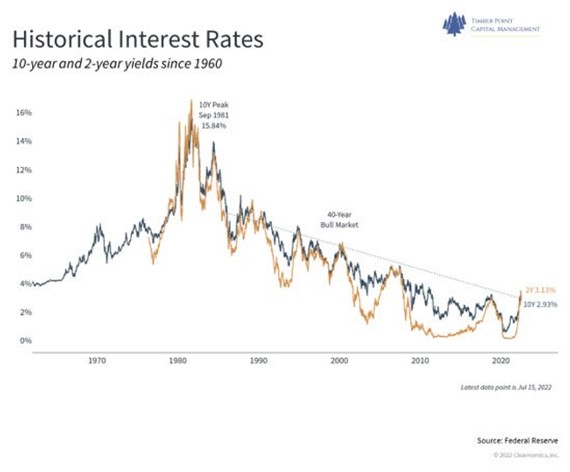

Bond market volatility rising to Covid-19 levels but still shy of GFC extremes…

Bond market volatility rising to Covid-19 levels but still shy of GFC extremes…

- Increased volatility is a function of uncertain growth outlook given mixed economic data

- Markets also anticipating the Fed taking another step back from purchases in September

- Most recent data suggests stagflation – CPI print hot, retail sales > estimated but still weak

- Employment data continues to provide the cover for the Fed to remain convicted in rate hikes

- Bond market unfazed by the CPI print as economy is slowing and CPI drivers perhaps waning

- One driver of CPI is gasoline – prices are down in July, seasonal demand lowest since 1996 (EIA)

- Fed will hike rates again in late July – 75bps was the plan, 100bps could be in the offing…

- Atlanta GDPNow continues to suggest negative 2Q22 GDP figure…

- Our belief is that the Fed doesn’t want to be responsible for long-term structural inflation

- We have extended our duration as see a slowing economy the inevitable outcome of a convicted Fed

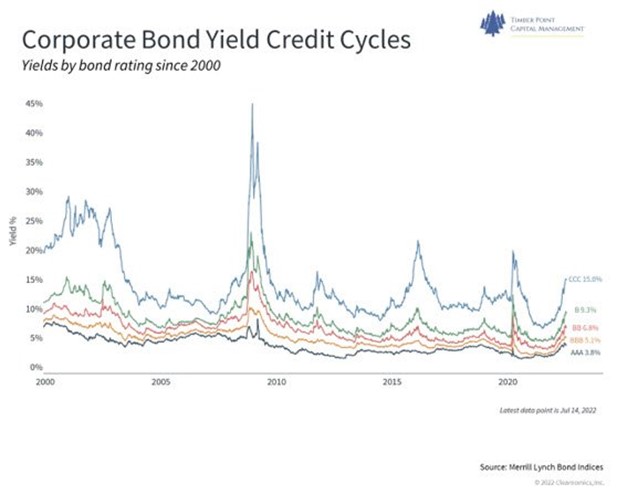

Credit cycle is benign to date – don’t expect the big banks to be the problem…

Credit cycle is benign to date – don’t expect the big banks to be the problem…

- No doubt that extraordinary monetary and fiscal policies have extended the current credit cycle

- Employment outlook remains bright, although many companies are now pulling back on hiring

- Wages are not keeping pace with inflation reducing purchasing power

- However, JPM’s Dimon comments that “the consumer right now is in great shape”…

- PNC points out that “…auto lending seems to be a bit of bubble right now…but corporate and real estate, the shift is moving back to banks to negotiate and get spread…”

- Only inkling of weakness is in low end consumer where inflation is a regressive tax (JPM)

- Banks are over-regulated post GFC and have culled books of risky loans, now exceedingly safe

- We see recession potentially highlighting issues in growing “shadow” banking system

- BDC’s and private equity have aggressively offered funding with covenant lite provisions

- Commercial real estate will be interesting as cap rates have not moved noticeably though companies are actively adjusting office space to new hybrid work structure

- CLO’s have been hit hard on growth fears, we see opportunities for nibbling

- Traditional high yield market is getting attractive if worst case economic scenario is avoided

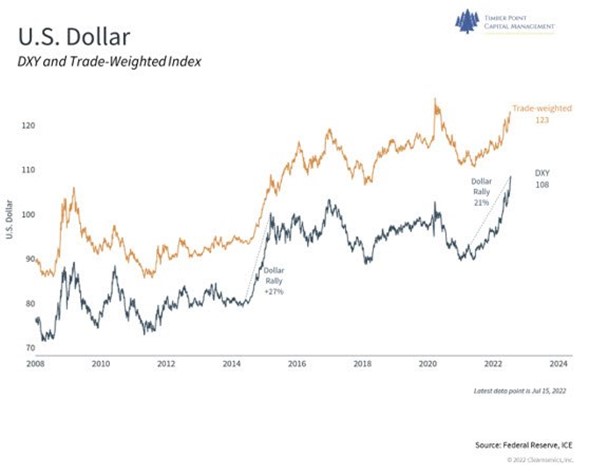

The US dollar continues its ascent…opportunity to take other side of the trade?

The US dollar continues its ascent…opportunity to take other side of the trade?

- US$ nears parity vs. the Euro for first time since 2002; the Yen tumbles through the 125 level

- Exiting the unprecedented monetary policies of past 15 years, there is a price to be paid via dollar strength

- The Fed has been far more aggressive than the ECB and the BOJ is reluctant to end rate ease

- ECB is trying to engineer its own “soft landing” of harmonizing rates across countries with vastly different fiscal policies

- Japan continues to stimulate via Abenomics and is only recently experiencing elevated inflation from imported fuel and energy prices

- What could turn the US$ tide? A tightening of rate differentials would be the key as ECB and BOJ begin serious rate hiking program

- If dollar begins to decline, this could be one driver to reignite the commodity and energy sectors

- Oil and natural gas stocks are down 25-30% in past month, we are opportunistic with leaders

- Growth stocks, which have rebounded with the 10-year yield, could continue to regain favor

- We are wary of so called “safe” stocks that support high valuations – staples and utilities could see an exodus of money

- EM and Int’l markets could catch a bid despite still structural problems – we favor more fiscally secure Germany over Italy

IMPORTANT DISCLOSURES The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s’ opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor. This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments