The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

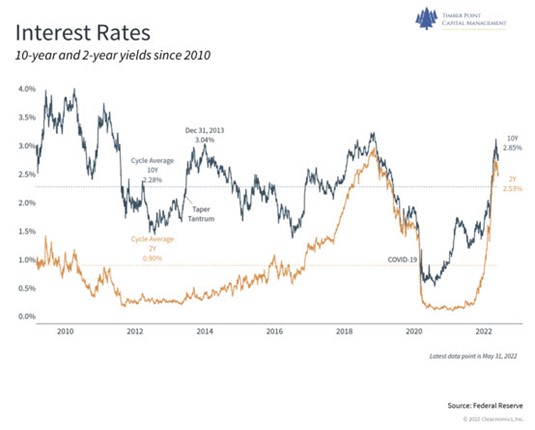

Economic slowdown on the horizon? Bond market starting to believe so…

- Sell-off in the bond market YTD has been lopsided, as we have reiterated for past two months

- 10-year bond yield has declined ~ 50bps to recent level of 2.71%

- New concerns over recession and stagflation have caused a recent sentiment shift

- Recent PCE report (ex food/energy) slowed to 4.9% y/y increase, the slowest rate in 2022

- Atlanta Fed GDPNow estimate for 2Q22 peaked at 2.5% in May, now down to 1.9%

- Uber Fed hawk Bullard talking down rates, says Fed will be responsive to economic conditions

- Stronger dollar is benefit to inflation outlook, imports inflation to other countries

- ECB now considering whether they need to raise rates – US yields not the only game in town

- We see a big opportunity over next few months to be long Treasuries as inflation improves

- Among CPI components, energy prices may have peaked, food prices likely more to go

- Lumber prices continue to trend lower, shipping rates and rental car rates lower also

- Have seen big reduction in shipping rates as economic growth slows, china lockdown, Ukraine

- Recent positive correlation between stocks and bonds now reverting to more normal negative correlation

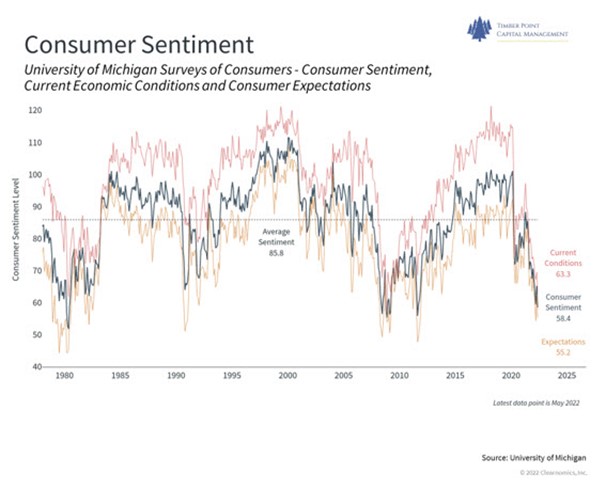

Which way for the Consumer? Lots of conflicting reports recently….

- YTD, the consumer discretionary sector is worst performing among S&P 500, down 22%

- Consumer spending is 70% of economic activity; as the consumer goes so goes the economy

- Personal Savings, after large stimulus spike, is below pre-pandemic levels, back to 2013 levels

- U of Michigan Consumer Sentiment Index probing new depths going back to 2009 and 2012

- However, Conference Board Consumer Confidence Index has remained steady, near recent peak

- Strong labor market conditions appear to be offset by inflation and future outlook concerns

- WMT, TGT and KSS reports note a more cautious consumer due to inflation and no stimulus

- Consumers are focused on more essentials and back to office/travel; less home improvement

- Retailers seeing bloated inventories (WMT + 32%, TGT +43%) and higher input costs

- BBY lowering sales estimates; HD and LOW seeing lower transactions counts

- Who is benefitting? Apparel retailers – M, COST and JWN; Dollar stores – DLTR and DG as consumers shift to lower priced consumables and recent pricing actions; Restaurants…

- With real wages declining, expect most retailers to struggle with sale growth, higher input costs and bloated inventory that could result in lower margins via markdowns

Home Sales struggle – higher prices and mortgage rates hurt demand…

- Recent sales boom abating as mortgage rates continue higher and Covid demand wanes

- Pending Home Sales are at slowest pace in a decade, generally leads Existing home sales by a month or two (NAR)

- Existing home sales are down 5.9% y/y in April, weakest sales pace in nearly two years

- Existing Home sales month supply has rebounded from Jan low of 1.6 to current 2.2

- Prices continue strong, up 15% y/y in April, benefitting from limited inventory for sale

- New Privately-Owned Housing Units started now above long term mean post GFC collapse

- Mortgage applications are now roughly 1/3 of peak 2021 levels (MBA Market Index)

- While price gains will moderate we don’t expect a housing market “crash” as employment remains strong, supply remains limited and Covid demand remains

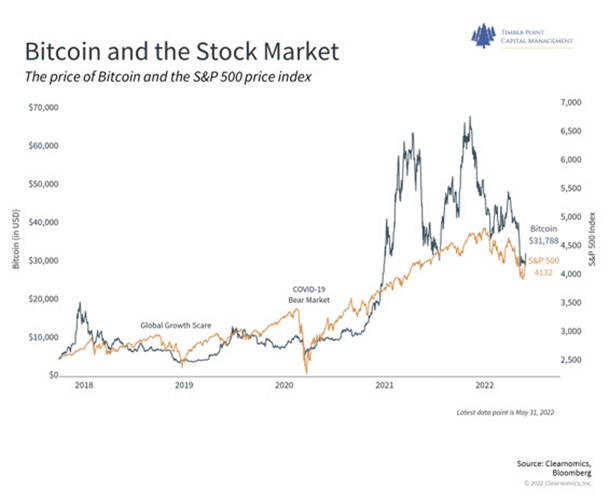

Stablecoins are not so stable…Bitcoin not proving itself as “store of value”…

- Recent Terra/Luna debacle highlights unregulated nature of stablecoin/crypto markets

- Over $40B lost as Terra/Luna crashes to pennies from $1; “algorithmic” pegs are over

- Tether and USDC have held on to their dollar peg; questions remain about Tether collateral

- Stablecoins are said to be the foundation for the metaverse, can they be trusted?

- Crypto market now worth > $1 trillion is foundation for decentralized finance for trading/lending

- Bitcoin, best known crypto, trading as though they were large cap Nasdaq stocks, down 60% YTD

- Risk capital exits crypto as interest rates have moved higher, what is intrinsic value?

- Worries over regulations abound but perhaps it is regulation that will provide solid backdrop

- Crypto assets have declined before and rebounded, is this another opportunity to own?

- Institutional and individual interest is high…will crypto’s be allowed into 401K’s…we doubt it

- We are wary but watching and learning more, will consider small allocation of portfolio

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’sand IPI’s opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments