The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

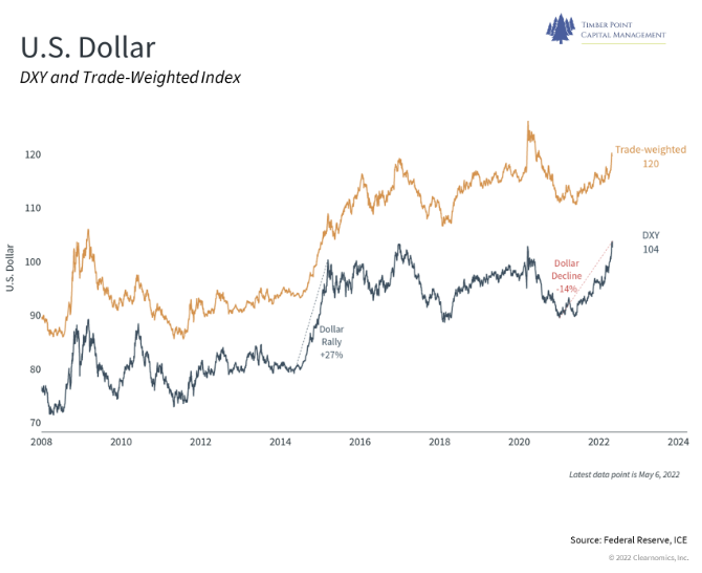

US Dollar continues to climb higher…best house in a bad neighborhood?

- US economy inflating faster as ROW economies face challenges – war, lockdown, demographics

- US central bank not acting aggressively enough for US investors but faster than ROW

- Strong dollar is opposite of 1970’s high inflation period when dollar was under pressure

- ECB moves cautiously to temper inflation upside due to growth shock from war; Euro plunges

- BOJ sees a whiff of inflation, continues to cap gov’t bond yields at .25%; Yen at 20 year low vs. $

- PBOC dealing with increasing lockdowns which spurs lower reserve requirements to aid growth

- EM economies are selectively hiking rates to fend off rising $ inflation

- Global investors are gravitating back to US to capture yield…the reverse TINA

- One currency stronger than US $? The Russian ruble…has recouped losses since invasion, significant rate hikes to offset capital flight

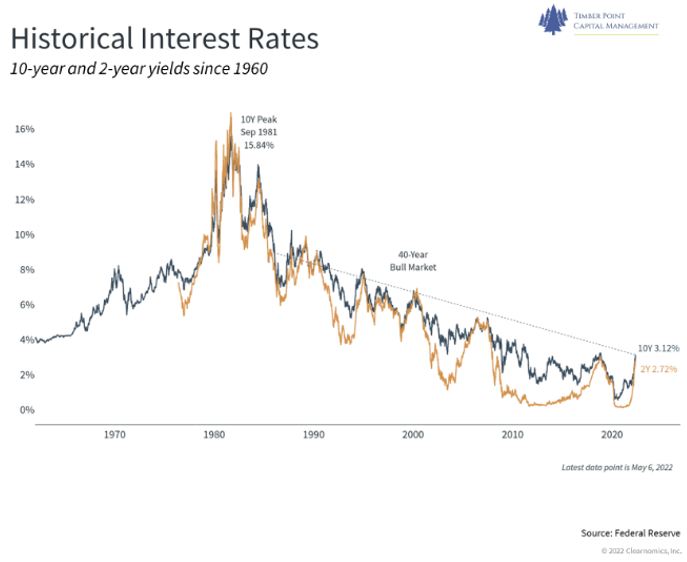

“Restoring price stability absolutely essential…”; no bazooka needed (75 bp’s…)

- 50bps Fed Funds hike, no surprise…transparency provided on future 50 bp hikes (June & July)

- Steepest increase since 2000, tells you all you need to know about recent inflation figures

- Powell gives lip service to Volcker to increase his inflation fighting bona fides

- Credit spreads widen but mostly due to rate hikes and stocks down ~ 15%, credit markets open

- Mortgage rates higher, will continue as Fed stops buying mortgages; prepayments are slowing

- Balance sheet reduction to occur by reinvesting only maturing principal payments above cap level

- Beginning June 1st, Treasury cap at $30B, $60B in September; $17.5B and $35B cap for mortgages

- Market not sold on Fed’s ability to wrestle inflation lower; initial rally post Fed meeting stalls, more selling ensues

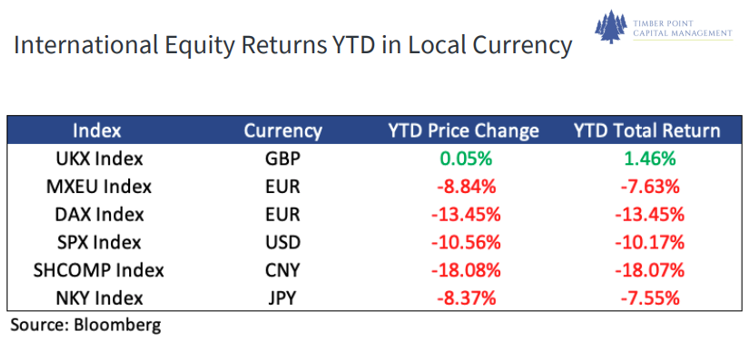

ROW markets performance in local currency is intriguing…valuations attractive

- We have long been inclined to pursue US over ROW investments given growth and innovation

- Recent local currency performance of global markets merits evaluation of our US centric outlook

- European markets (MXEU), ex Germany owing to Ukraine war, performing better than US

- UK market is flat in sterling terms, break from the EU has helped it to chart its own course

- Key question for EU is ECB action on inflation vs. concern over slowing growth due to war

- Canada has done well as should be expected owing to commodity tailwinds

- EM commodity-based markets (Brazil, even Russia) are performing well

- IF get retreat in US $, ROW opportunity set could become more attractive and gain tailwind

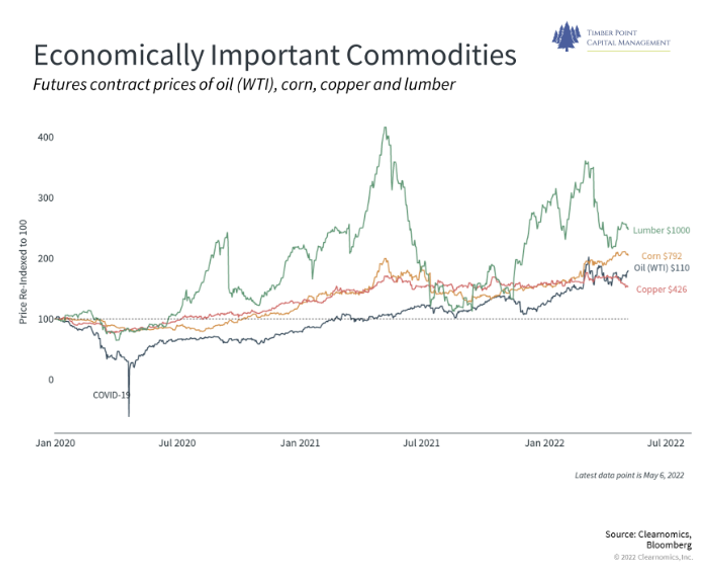

Commodities under pressure, though metals have come off the boil

- Ukraine war, Shanghai lockdown, supply chain logistics all continue to cause price pressures

- Have we seen the worst on food supply? Unlikely, Ukraine situation not getting better

- Ability of other countries to respond to food shortages a very big question mark

- Avian flu has rolled through Europe, Asia, Africa and now US…chicken, turkey, egg prices soar

- Oil prices are stable at higher levels; recent EPS calls highlight return of capital to investors while capex sufficient to grow supply at measured pace

- Oil prices will be impacted by potential Euro area deal to reject Russian oil

- Natural gas prices are surging higher as colder temperatures in US and Europe amidst depleted inventories

- Fertilizer prices are skyrocketing due to natural gas inputs, will this impact planted acres?

- Gold, silver, platinum, palladium prices all come off the boil as US dollar continues rise, real rates go positive, Fed talks tough and demand concerns surface from Asian markets

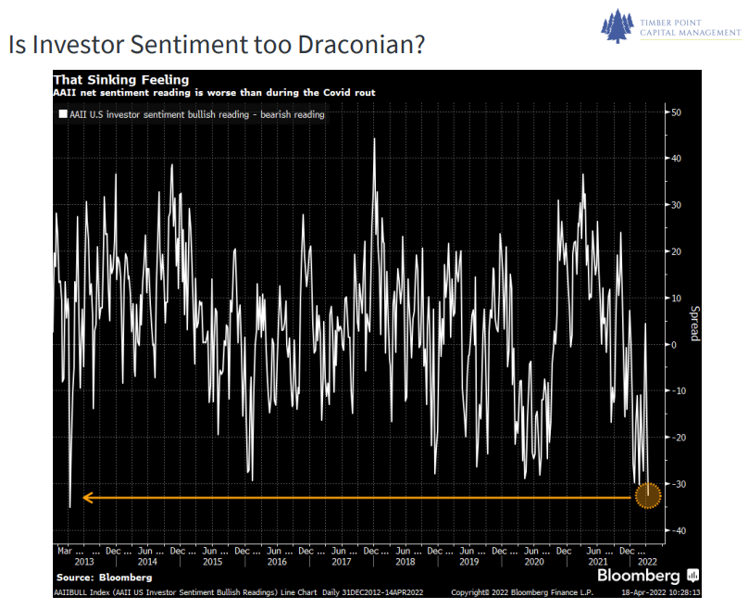

How bad is bad? AAII sentiment is lower than early Covid 2020 levels…

- How does it get worse? Concern growing over use of tactical nuclear weapons in Ukraine war

- Enough said…

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’ and IPIS’ opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments