The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

All eyes on the Fed…market expectations for rate hikes in ’22 may be excessive

- Fed meeting on Wednesday largely telegraphed, we expect 50bp rate hike for Fed Funds

- Market needs to be convinced of Fed seriousness to fight inflation

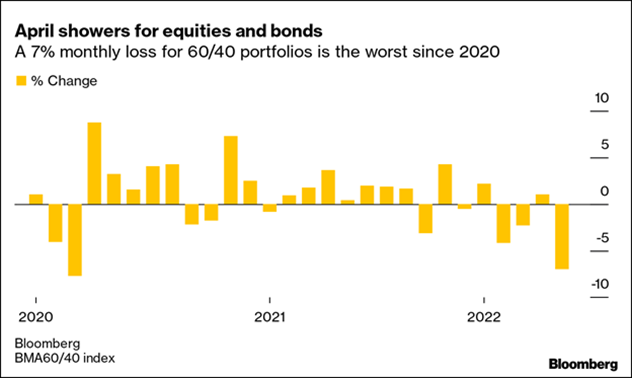

- Balanced bond (AGG) index down 10% YTD

- 30-year UST down 20% YTD…if bot April ’21 bond auction, down 30% TTM…!

- Only safe space has been cash…60/40 portfolios have not played defense

- Negative 1Q22 GDP growth number has not slowed yield increases across curve

- Higher oil prices, wage inflation, slowing globalization (deflation), supply chain all key drivers

- Also, strong employment leads investors to believe that Fed can be very aggressive on rate hikes

- 5/10 Year TIPS are off peak March ’22 levels but still at 3.3% and 2.9%…above Fed targets

- Fed continues to jawbone balance sheet reduction despite no past history…a long road back…

- $95B/month in “run-off” expected as the Fed does not reinvest the maturing proceeds

- We have argued a fair amount of bad news is baked into yields…we have been wrong so far

- What will shift sentiment that yields are overdone? More confirmation of slowing economy or supply chain normalizing…

- Non-farm payrolls and average hourly earnings on Friday will be interesting…

Is now the time to meaningfully change your portfolio’s risk profile?

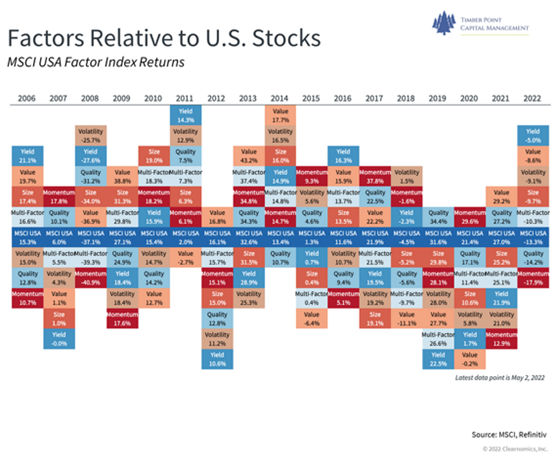

- Hedging beta risk has been very difficult…very few sectors (energy/staples) are up on the year

- Moving to the sidelines is difficult…or buying protection when believe are already too late…

- Carrying more cash can help but typically more of a plug on opportunity set vs. active decision

- In rising rate environment, what is appropriate market multiple? Hard to quantify for conviction

- Global markets have own challenges – Europe with Ukraine war and Asia with China lockdown

- FAANG (ex AAPL) headwinds have cast a pall on technology in general…what is next big thing?

- Time period comparable to ‘73/’74 Nifty Fifty era when indices were held up by few names…now air leaking out of those names

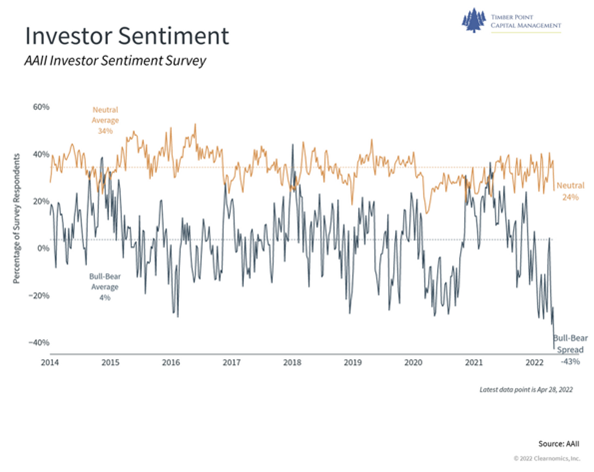

- Watch volatility…starting to see elevated levels relative to history…time for capitulatory event?

- One solution – portion of portfolio into laddered 90-360 day CD’s…every 90 days can make decision on whether to re-up CD or invest in riskier assets

Pockets of opportunity exist…Where should investors be looking?

- Investor sentiment is very negative…need to stick with your investment process and analysis

- Healthcare exposure has increased organically, not defensive move…established biotech with cash flow, multiples reasonable, pipelines strong…INCY, VRTX, HRZN on drug side…

- PE continues to funnel capital into drug, biotech services…ICON and CRL providing clinical trial research and expertise on global basis

- In FAANG, we favor GOOGL amid the “tech wreck”…digital ad spending headwinds at YouTube but reflected in valuation at 16x forward vs. mkt at 18/19x…revs up mid-high teens, big buyback

- Natural gas related names…both the commodity and infrastructure, see domestic supply security play and emergence of “clean fuel” to aid energy transition from fossil fuel…EQT, CTRA

- LNG and natural gas transport should be attractive but restrained by regulatory environment

- Global supply issues that need to be resolved – rare earth metals and metals for EV production

- We see a discouraging lack of strategic thinking in face of overwhelming evidence that supply security is lacking

- EV industry cannot grow without access to secure, trusted metal source manufactured in environmentally acceptable ways

- MP Materials (MP) providing heavy duty magnets utilized in EV motors…profitable, solid balance sheet and building own processing facility on site, have signed major deal with GM

- Lithium extraction industry is global but highly reliant on China for processing and shipping to battery makers, need secure supply…LAC is interesting name with Nevada site operational late ’22, JV in Argentina

- Linus in Australia…only existing processing capability at scale outside China…worth a look

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’ and IPIS’ opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments