The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

Is the economy reopening, again?! Some stock prices seem to indicate yes…

- Transition from services to goods was a hallmark of the Covid pandemic – could be reversing

- WFH kept people in their homes and gov’t payments gave them cash to spend on goods

- Omicron cases are abating, mask mandates being dropped, spring weather is arriving!

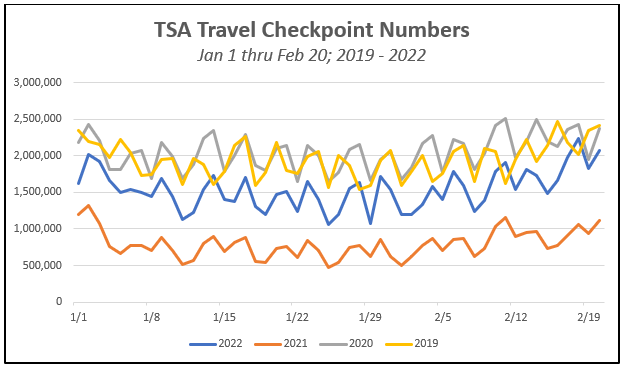

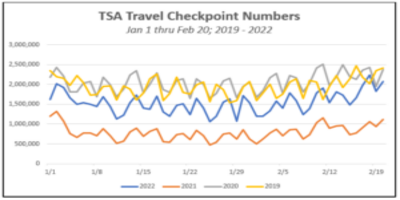

- TSA traffic approaching 2019/2020 levels, big increase in past two weeks

- 12 Month Miles Travelled almost back to pre-pandemic highs

- Hotel stocks have been quite strong – Hyatt (H), Hilton (HLT) and Marriott (MAR) at new highs

- Travel related stocks Expedia (EXPE) and Bookings (BKNG) also hitting new highs

- Airlines, cruises, other leisure stocks picking their heads up but shy of new 52-week breakouts

- May help remedy goods supply chain issues; service labor issues could result in > wage inflation

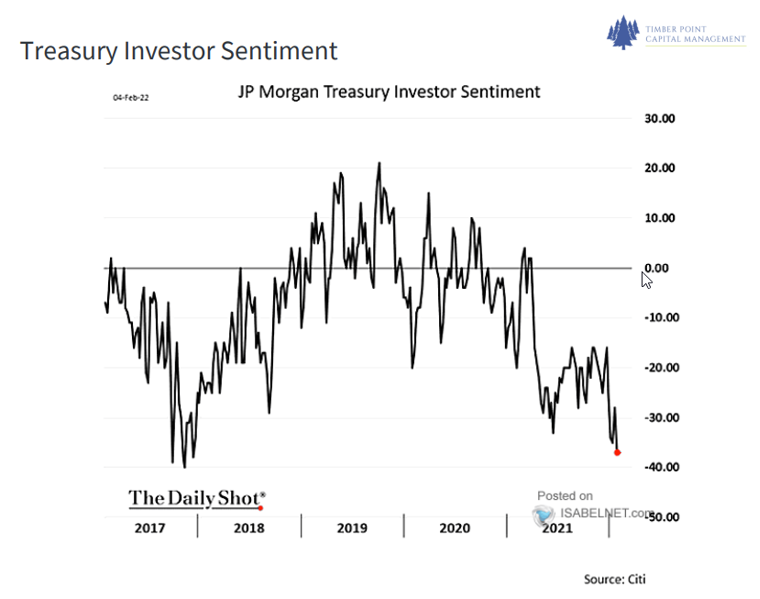

Treasury Sentiment indicator at extremes, investors piled into inflation trade…

- Sentiment very negative in treasury market, but inflation boogey man is well known

- Sentiment levels ended 2017 at similar levels, 10-year rates peaked mid-2018 at 3.06%

- Fed has one more PCE data point (January, Feb 25th) before next meeting on March 15/16

- Chinese January PPI data down vs. estimate and December figure (9.1% vs. 9.5% and 10.3%)

- Does economy reopening (see above) change inflation drivers and ease supply chain dislocations

- 50bp rate hike in March as indicated by Bullard contradicted by other Fed members

- Fed tapering acceleration is complete by end of March; bsheet reduction discussion may be a function of how economy reacts to rate hikes

- 5-Year and 10-Year inflation expectations are still subdued, Fed credibility still acknowledged

- Geopolitical issues could resurface and drive demand for US gov’t issued securities

- We have increased duration in the portfolio as believe investors are “off-sides” at the moment and any good news on inflation or bad news on economic growth could lead to bond rally

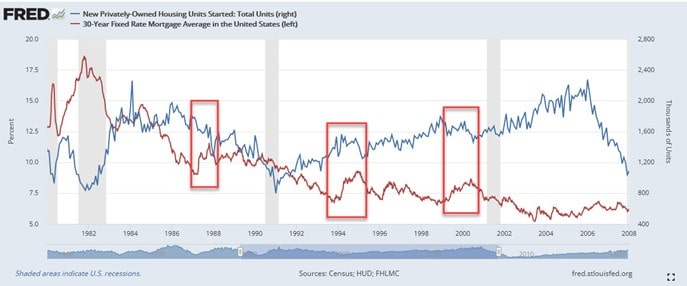

New Housing Units Started vs. 30 Year Fixed Mortgage Rate from 1980 – 2008

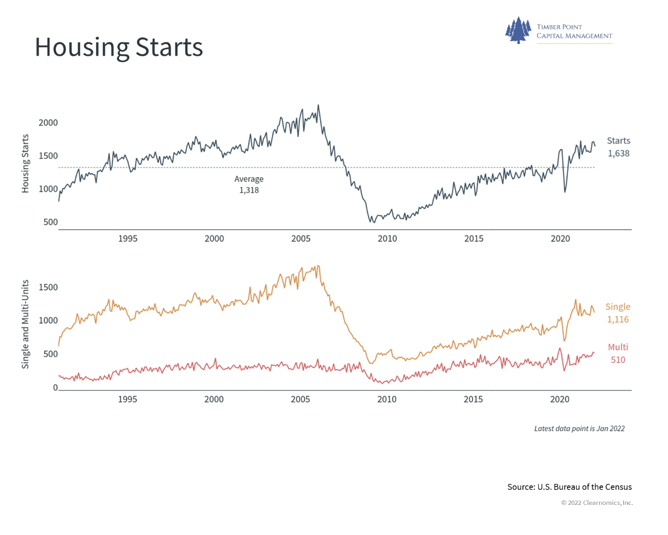

Industry spotlight on Housing: How long can the industry continue strong?

- Housing starts have rebounded from GFC and Covid levels, now above 30-year average

- Rates have been in secular decline for 40 years; have stayed low thru GFC and Covid providing supportive backdrop for home start rebound post GFC lows

- Mortgage rates moving higher with 10-year yields – 30-year fixed up 100 bps YTD to ~ 4.0%

- NAR Median Sales price* has increased 34% to $364K from 2019 level of $274K

- NAR Affordability index* (AI) has declined…Dec ’21 at 147.1 vs. 2019 level of 159.7 and recent peak of 187.8 in Jan ‘21

- NAR Pending Home Sales Index* in 12/21 declined 16.2%…tend to lead existing home sales by a month or two

- Rate increases in 30-Year fixed mortgages 1987, 1994 and 1999-2000 (red boxes above) all negatively impacted housing starts

- 1987 (market crash), 1994 (Fed aggression) and 2000 (Y2K) all complicate the analysis; rates were much higher in all situations, from 6% at nadir to 10% at peak

- Bottom line: homebuilders today are currently operating in different yield environment with reasonable affordability, but real wages are not keeping up with single family price increases; potential for Fed “mistake” negatively impacting housing starts has increased

- Housing stocks have sniffed this out, have declined +/- 25% from ’21 highs and valuations on ’22 estimates are back to multi-year lows implying peak-ish eps

- Given our belief that bond investors are on one side of the boat, we see homebuilders as a contrarian call right now.

*National Association of Realtors

Recent Comments