The Timber Log is a quick overview of Timber Point Capital’s weekly investment meeting. If you would like to join the call or have questions about the content, please reach out to Patrick Mullin at pmullin@timberpointcapital.com

The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

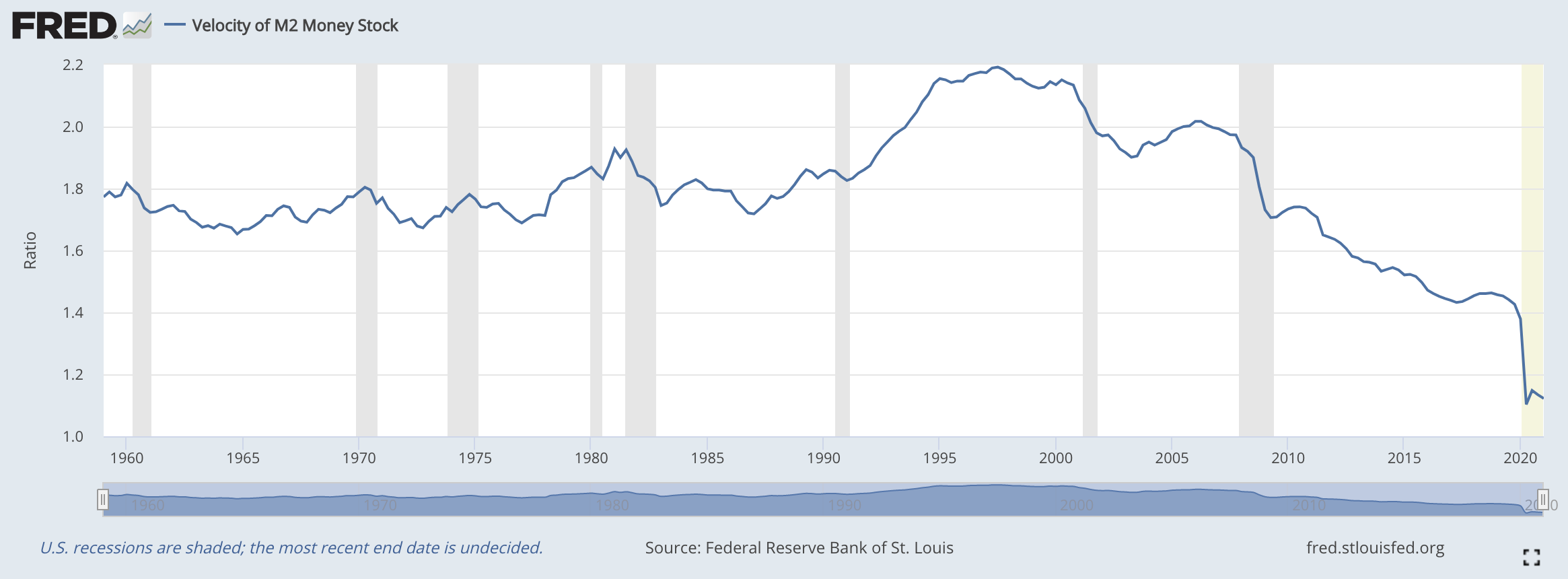

Inflation expectations and concerns are subsiding

- Velocity of money fell off cliff during 2020 and has not recovered – FRED chart

- We know money into system is large but banks sitting on cash, decreasing the velocity of money; diminishes the concern over inflation

- Recent spike in inflation attributed to logistics constraints and improved demand

- Dollar bottoming, recent strength suggests inflation fears subsiding, up 1.7% MTD

- Inflation sector beneficiaries have been weak recently, financials and materials both down 5% MTD

- Secular grower Tech has experienced recent outperformance MTD up 5%

- Our latest thoughts on inflation, click here

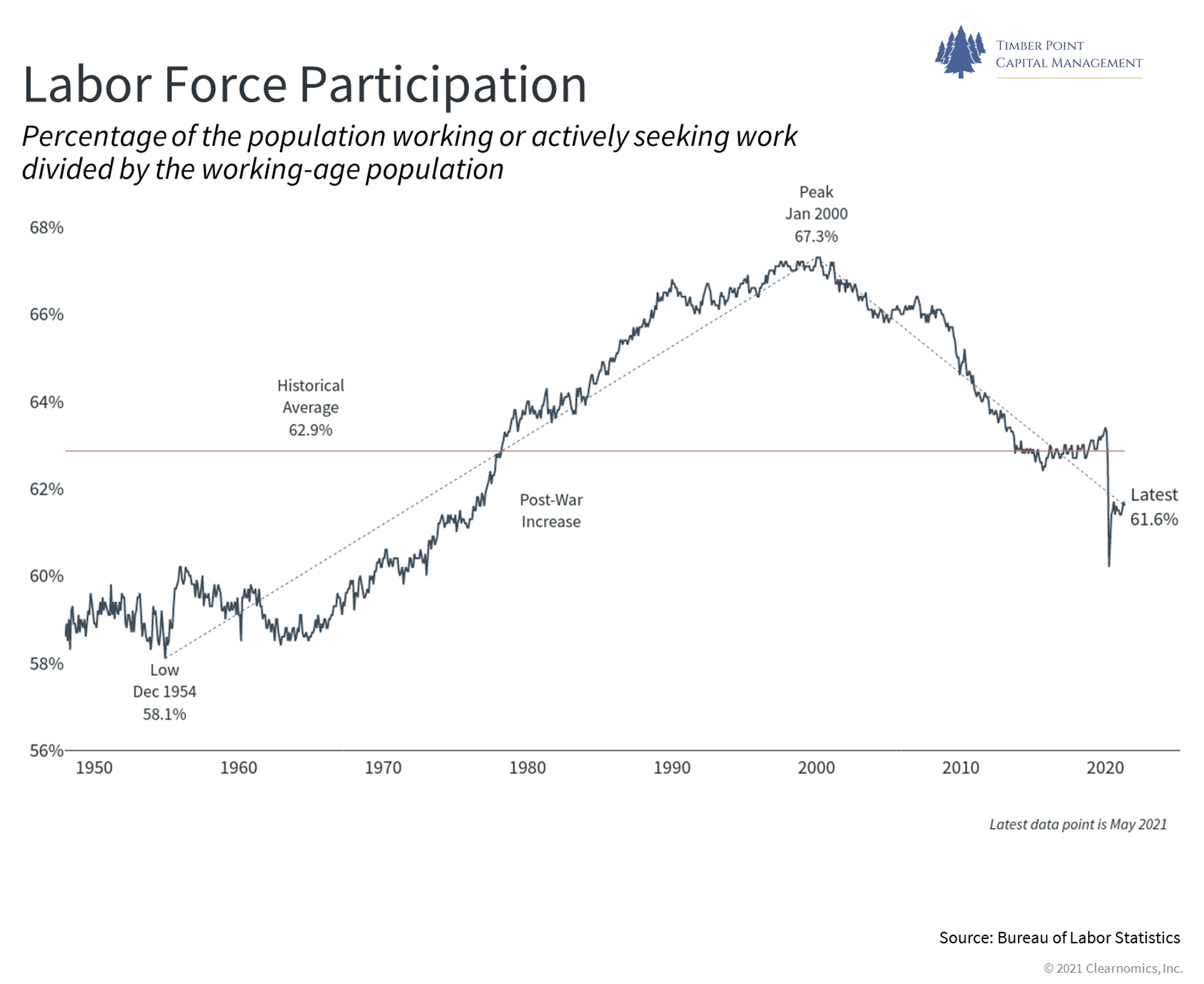

Labor market participation may not be as strong as expected

Labor market participation may not be as strong as expected

- Unemployed fell by 500k people to 9.3 million people in May; prior peak was 21.3 million people in April ‘20

- Weekly data suggest employment accelerating, especially in seasonal industries

- Labor market participation will continue to be closely watched as a key driver of reopening and continued economic growth

- Powell expecting inflation rate to decrease and unemployment to increase – we believe unemployment recovery estimates will disappoint

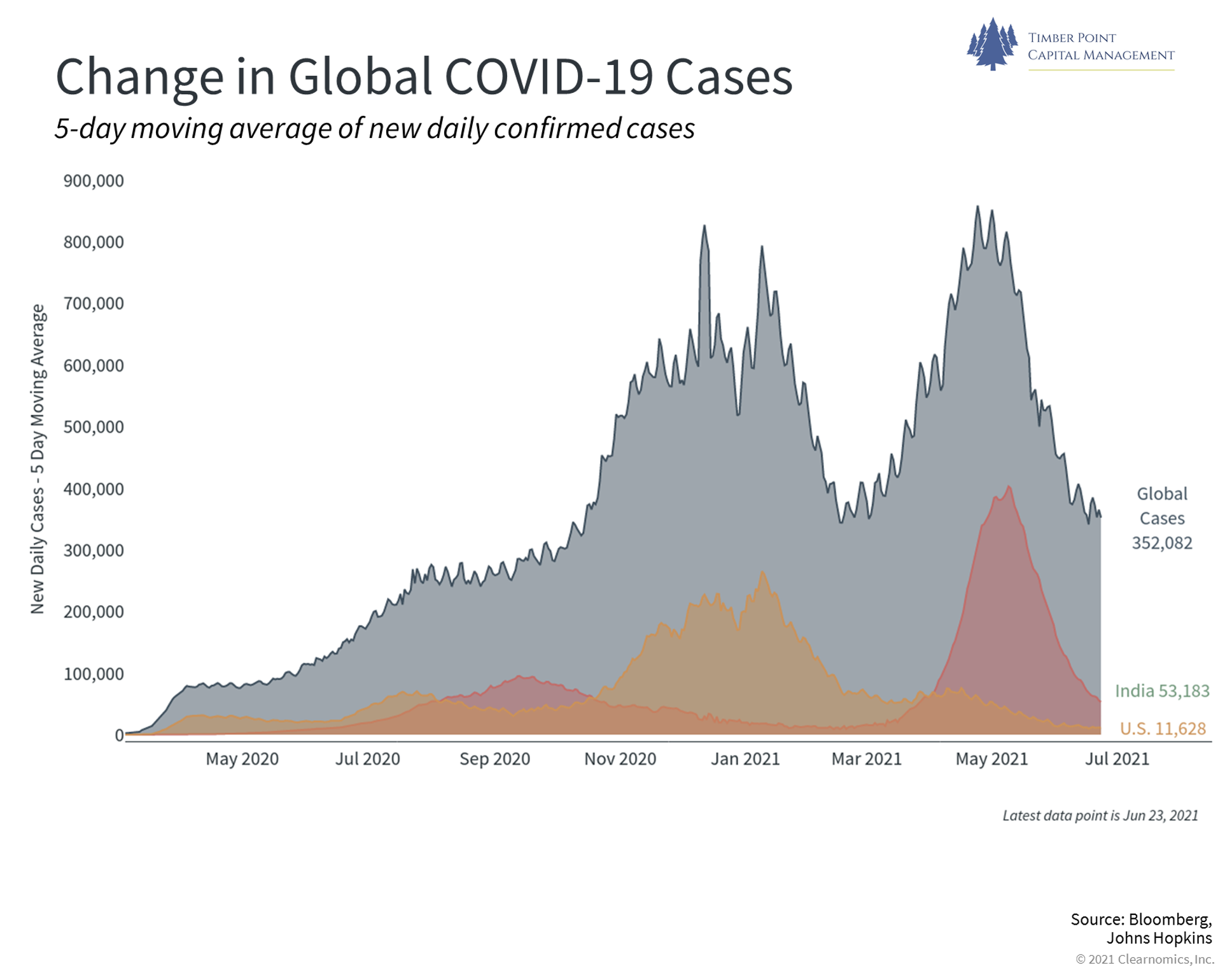

Covid-19 and vaccine rollouts are continued headwind outside of the U.S.

Covid-19 and vaccine rollouts are continued headwind outside of the U.S.

- Continue to see US outperformance as investors pursue flight to quality as ROW continue to struggle with Covid

- 30-Year prices up 6.5% QTD and 3.9% MTD, slower growth estimates and Covid worries in ROW

- Dollar is a Covid beneficiary as ROW struggles with outbreaks

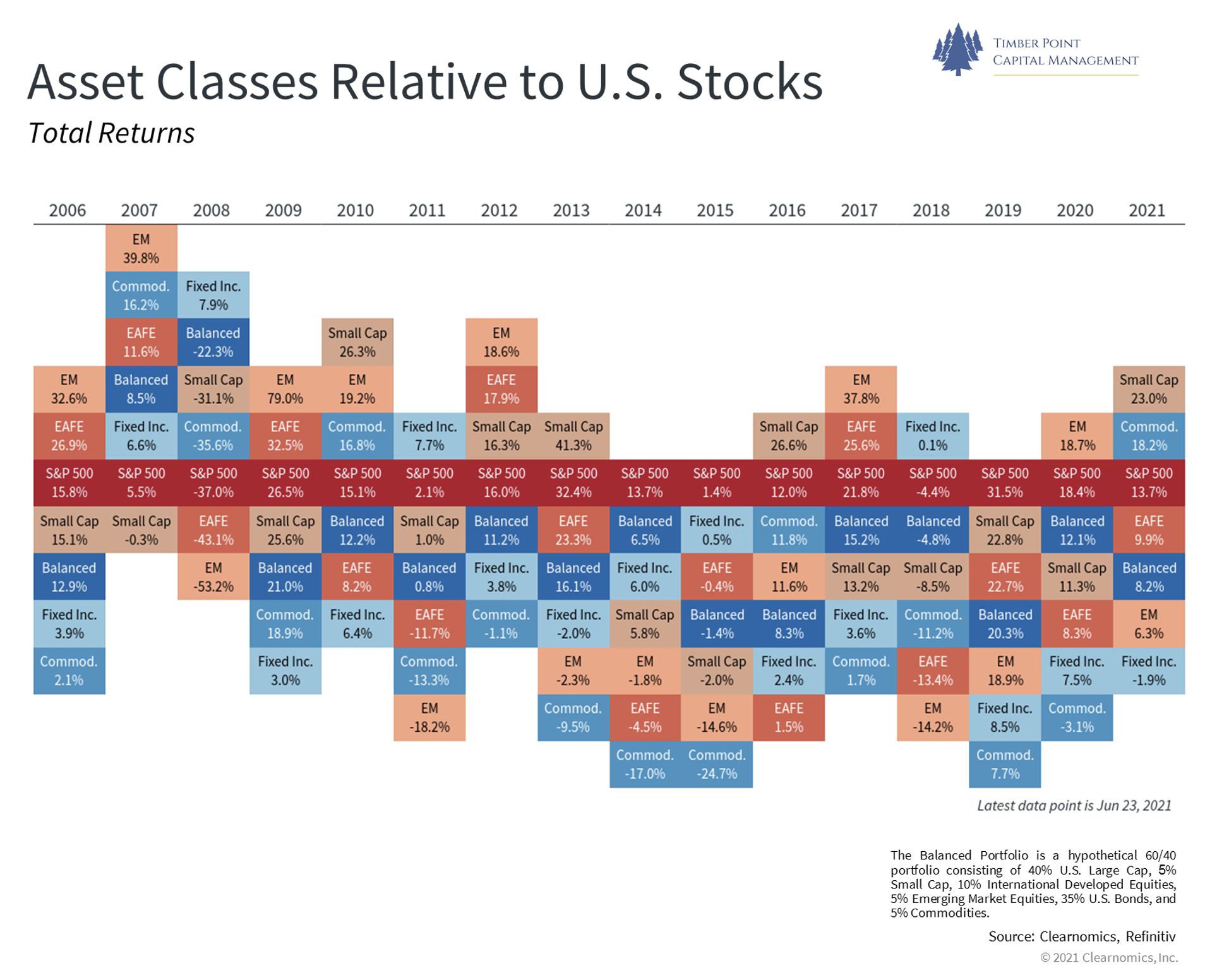

TPCM asset allocation continues to favor risk assets

TPCM asset allocation continues to favor risk assets

- Asset allocation remains overweight small caps and overweight equities

- Have been active in spread product, moving up in quality and picking spots

- Long end is not interesting, have been shortening up duration

- Active in preferred and hybrid market, mostly regulated entities

- Closed-end funds – good buys, sold way too early, some now at small premiums to NAV

- Corporate credit – are still long, and nervous as economic hiccups will hurt

- Realized volatility in portfolio is very low, now running 2%…portfolio performed well

- Bottom line – we believe most everything is expensive in the bond mkt – those out on risk spectrum will get hurt

Recent Comments