It goes without saying that 2020 was a historic year. The COVID-19 crisis which increasingly swept the world, had a dramatic impact across all aspects of society and life including economic life; resulting in the most bewildering and astonishing year reflected in the most amazing and extraordinary chart I’ve seen in my 30 odd years of following economies and markets. How about that for hyperbole?!?

But it’s not hyperbole as the next several paragraphs will discuss 2020 events and trends in the economy and markets that were truly unprecedented and generally out of the realm of anyone’s reasonable expectations.

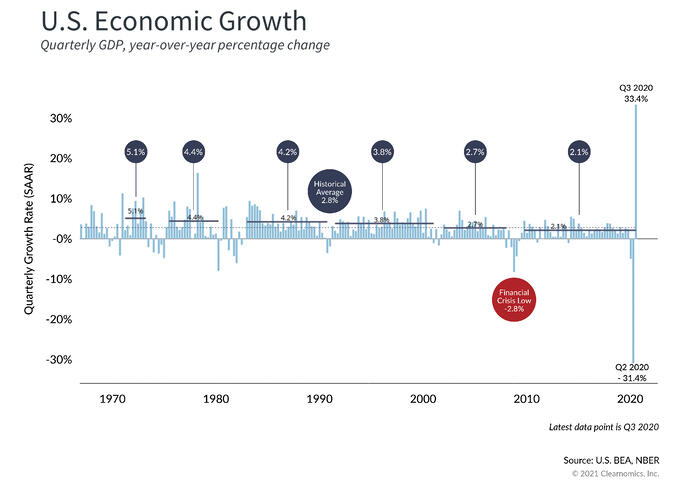

Never before in the history of mankind did society and the global economy shutdown. Outside of the most necessary activities, the world stopped operating late last winter. Done, shut, closed. And the economic results were somewhat predictable as US GDP fell a shocking 31% during the second quarter. As you can see, no other period equates, even the Global Financial Crisis pales in comparison. But again, what would you expect if everything was closed? Yet, in my humble opinion the extraordinary and astonishing part of this chart is not the second quarter decline, it’s the third quarter rebound! Despite a multitude of significant headwinds and impairments, the resilience of the US economy proved itself yet again. Economic theory holds that the bigger the drawdown, the bigger the bounce and that proved itself true during the third quarter. At the beginning of July, a 33% recovery in economic activity seemed highly unlikely even to the most optimistic of people. A second COVID wave, unemployment, commercial real estate, et al were all major risks facing businesses and markets at that time. Yet policy makers were acutely aware of these risks and responded in an unprecedented way.

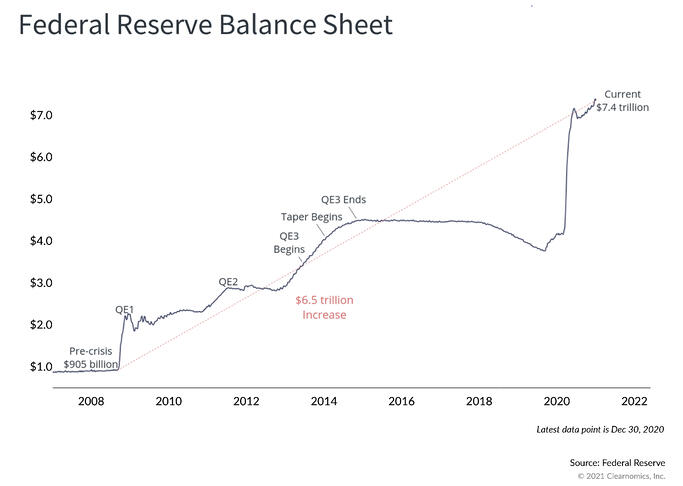

Firstly, monetary policy became extraordinarily accommodative as the Fed increased the size of its balance sheet by over $3 trillion. Additionally, the scope of the balance sheet expanded as corporate bonds, both high grade and high yield, became available for purchase by the Fed. These accommodations lowered interest rates and kept capital markets open which allowed fragile companies to refinance and bide time until more normal business activity resumed.

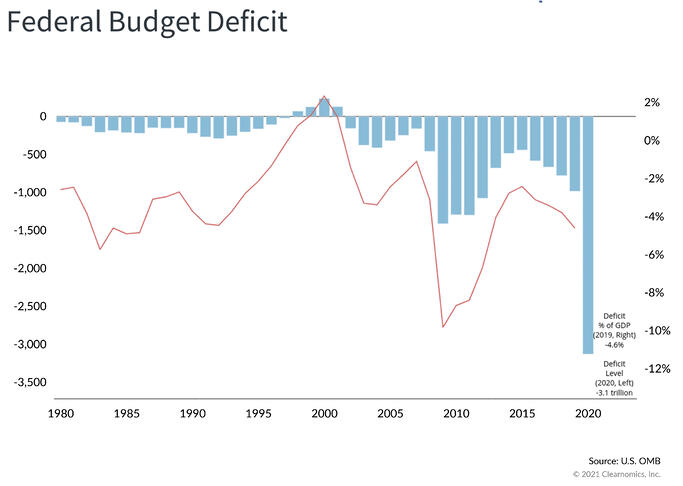

Additionally, fiscal policy expanded at a pace not seen since World War II. The $2.2 trillion CARES (Coronavirus Aid, Relief and Economic Security) Act passed in March, provided business and families a wide range of support through direct cash outlays, increased unemployment benefits, loans and other economic protections. Correspondingly, deficits rose to historic levels yet to policy makers there was no choice but to offer this relief. Deficits would be a problem for another day. Interest rates were low and the world’s demand for US government bonds seemed insatiable.

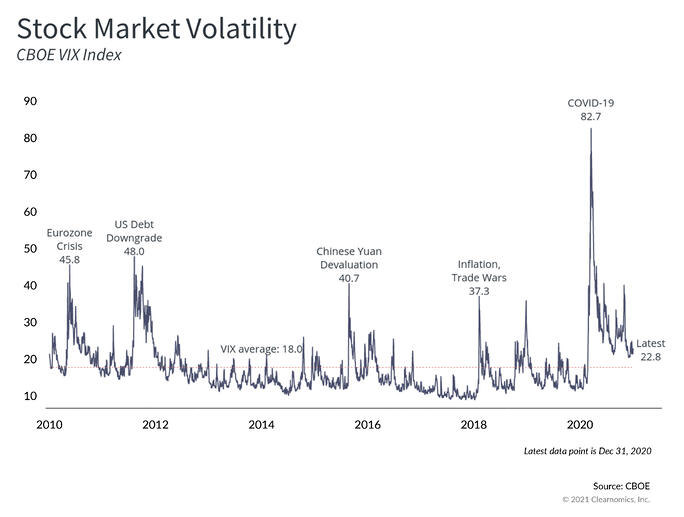

Given all this stimulus, markets responded accordingly. Anticipating the V-shaped economic recovery that ultimately occurred during the third quarter, volatility moderated from extremely elevated levels, credit spreads narrowed, and the stock market roared, gaining nearly 70% from the March lows and ultimately posting a widely unexpected 18% total return for 2020! As we pointed out in our third quarter outlook, investor leadership seemed to emanate from an unlikely source, retail investors. While many institutional investors fretted over COVID-19 statistics, retail investors saw bargains in the stock market and those investors proved to be an early positive source of liquidity in an otherwise ugly market.

Much recognition is due to government policy for the economic and market recovery. But it is important to note that private sector innovation also enabled our lives to awkwardly proceed. We are all aware of the ground-breaking market leaders that offered new services which allowed us to best operate during this pandemic. Zoom, Docusign, Peleton, Netflix and others all proved to be crucially important technology-based services which filled the void when we couldn’t meet, go to the gym or socialize outside the home. Additionally, big tech continued to expand its influence on the global economy. As such, the technology sector continued to lead the equity market through the pandemic and into the third quarter to the point where the technology proportion in the S&P 500 reached historically high levels.

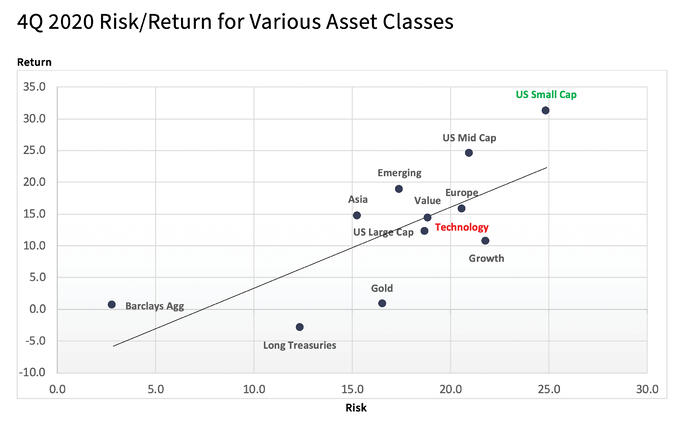

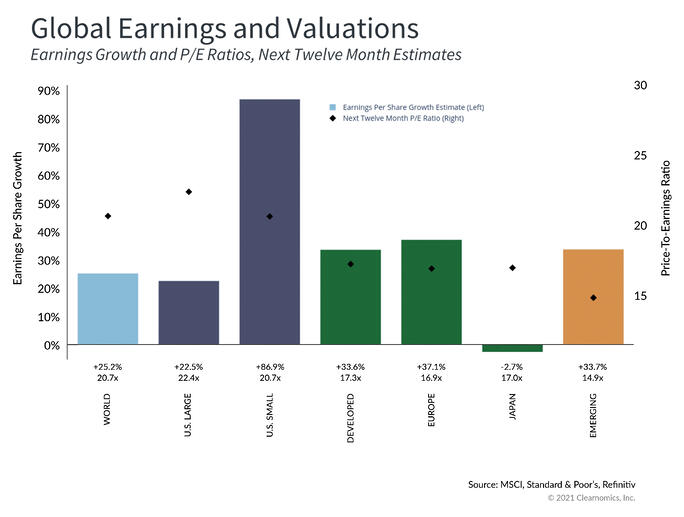

Yet, it wasn’t just technology companies which offered robust investing opportunities. Throughout the summer, we increasingly believed that as the COVID-19 crisis waned a growing universe of re-opening stocks would provide outsized opportunities to investors. Ultimately, entering into the fourth quarter, our fundamental outlook evolved, leading us to believe that a rotation away from US Large Cap and technology companies was likely and that the better investment opportunities were in smaller cap, value stocks and even international equities. That viewpoint proved prescient as small cap equities outperformed sharply and a series of re-opening companies posted strong returns upon the news of a pending COVID-19 vaccine

As we enter 2021, the obvious question is can this extraordinarily good investing environment continue?

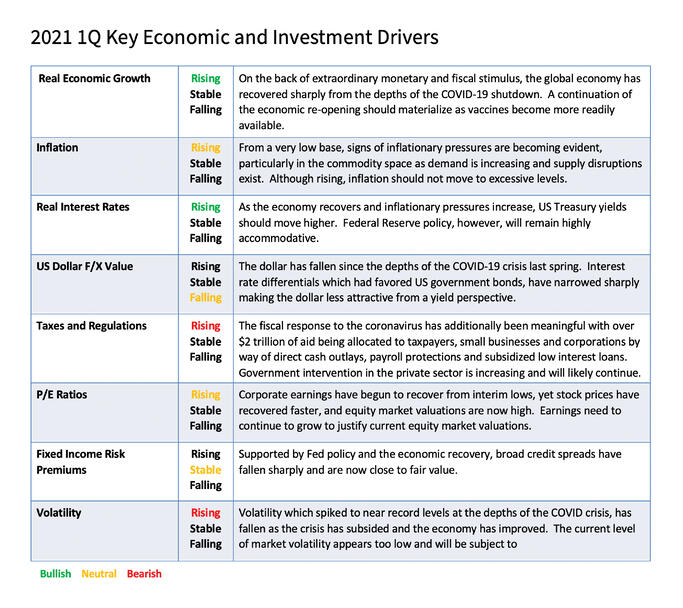

Going into the new year, our evaluation of key economic variables is mixed but the overall viewpoint remains constructive. As mentioned above, despite renewed concerns over COVID-19, the economy is re-opening and growing. We continue to believe that a full re-opening is inevitable, particularly as the vaccine is now being implemented across the country and the world. Setbacks will occur and the media will happily pass along COVID updates of infection, hospitalization and death rates. Yet, investors should look past these concerns and focus on the good news associated with the vaccine and the resilience of US and global economic growth. That should be the primary focus of investors.

Both fiscal and monetary policy remain accommodative and that too is a source of optimism as there is plenty of liquidity in the marketplace to support asset prices in the event of bad news and market volatility. Yet, policy is a two-sided coin and there are near term concerns and longer term issues associated with the current policy regime. Firstly, US fiscal policy will not likely remain static. As of this writing, the anticipated political alignment in Washington is a split government with the Presidency and the House in Democratic hands and the Senate in Republican hands. Upon the back of the November election, markets celebrated that result. Yet, within a few days the Georgia special Senate election will occur which may change the expected political mix. To the extent that the Democrats win and ultimately control both the Congress and the White House, investors can expect a more dramatic change in fiscal policy, which may include meaningful tax increases. Additionally, regardless of who wins the special election, one of the longer-term effects of the COVID crisis is likely to be greater government intervention in the private sector. We’ve all already experienced the impact of growing regulations and rules in our daily lives. Smaller businesses, in particular, have struggled under the weight of ever-changing regulatory burden due to COVID. This has had and will likely continue to have a negative economic impact and is a factor which concerns us. Longer term, the size of the Federal debt and deficits will have to be dealt with in one way, shape or form. As long as US Treasuries remain the default, safe-haven asset class, the deficit remains a problem for another day. Yet, it is a risk factor which needs to be considered and monitored.

Monetary policy too is a net positive variable going into 2021 but there are secondary effects to the current monetary regime which need to be considered. For more than 10 years inflation has been virtually non-existent throughout the world. This has allowed Central Bankers to be aggressive in using monetary policy tools to attempt a cure to a wide range of economic and fiscal problems. Correspondingly government bond rates have fallen around the world to the point that nearly $18 trillion of bonds have negative yields. To the extent that inflation remains low, this again is a problem for another day. Yet, recently we have seen a strong resurgence in commodity prices and market expectations for future inflation are increasing. We don’t yet believe that inflation is a meaningful problem, but it could have a destabilizing effect to markets if inflation breaks out to the upside.

Additionally, the current monetary regime clearly has had an impact on the dollar as the greenback is no longer the king among major market currencies. Interest rate differentials which had meaningfully favored the dollar, have narrowed sharply and the dollar has reversed course. In and of itself this is not an outright bearish variable, but it does argue the case for rotation away from investments which have benefited from a strong dollar regime such as US large cap growth stocks.

Going into the first quarter, the investment implications from our outlook are generally skewed towards risk assets and continue to favor rotation themes. US equity market valuations are high, and both our fundamental backdrop and the state of relative valuations lead us to want to own a wide range of investments away from large cap stocks. Small cap stocks remain particularly attractive to us.

Moreover, we believe that this environment will be ripe for active management. Over the past 10 years, the easiest and best thing for investors to have done was to own the S&P 500 ETF and sleep well at night. Virtually all else underperformed. Going forward, we do believe the fundamentals argue that it may be very different, and an active viewpoint will be required to achieve attractive risk adjusted returns.

Typically, when you hear active management you think of stock picking. Yet, active management on the fixed income side of portfolios is likely to be of very high importance going forward. Similar to the phenomena of equities, over the past 10 years, long term Treasuries have also been a very attractive risk adjusted investment to have held. Yet, interest rates have gotten to levels where one can characterize the asset class as “return free risk”. US Treasuries will always be an important asset class and do serve a purpose in portfolio construction. Yet, one needs to actively manage interest rate risk appropriately and provide fixed income diversification tools to hedge the risk of rising rates.

A new year is upon us and in as much as we are still contending with COVID and its effects on society and economies, we believe that things are fundamentally improving and that markets can again post strong returns over the next twelve months. Hopefully with less drama and sadness than we experienced over the past year. 2020…good bye and good riddance. Hello 2021.

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments