Trump 2.0 requires investors to evaluate the potential effect of tariffs, DOGE, budget reconciliation, Ukraine and other policy initiatives. Given this firehose of Trump Administration proposals, the policy uncertainty variable has increased and when uncertainty increases economic and market participants retreat and pullback on risk.

Turn the Dial…1Q 2025 Outlook

The US economy remains solid and there is a growing enthusiasm for the potential of Trump’s fiscal policies. While positive on the prospects of technology companies, we anticipate that economic fundamentals and valuations may favor underappreciated investments in smaller capitalization stocks along with value-oriented sectors and companies.

DJT 2.0 – A New and Better Trump Administration?

Will America be able to say in four years that we are better off than we are today? To do so, President-elect Trump must implement his economic agenda effectively, and that agenda must deliver tangible results. Given a myriad of challenges, it remains uncertain how smoothly implementation will proceed.

The Final Countdown…Q4 2024 Outlook

Today, the economy is cooling yet a recession seems to be a low likelihood event. Slowing but solid economic growth, falling inflation and interest rates seem to be leading us to a goldilocks economy which will continue to delight investors.

The Law of Large Numbers…Q3 2024 Outlook

2Q24 was driven by AI euphoria and strong corporate earnings. US stocks led, with the biggest technology stocks especially strong. The big question for investors going forward is are they too late to the AI party or will this trend of concentrated returns, largely driven by technology, continue?

Strong Like Bull…Q2 2024 Outlook

Productivity enhancements, led by AI, may be the key variable in equity price appreciation going forward. Margin benefit from AI driven activity should broaden out across the corporate sector and be reflected in the stock price appreciation across an increasing number of companies.

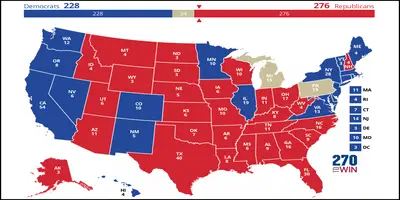

2024 Election – Political and Market Analysis

We take a look at the market impact of historical elections as well as what we can expect from the current election. Spoiler alert, expect somewhat higher volatility but the U.S. economy will continue to be the global innovation engine providing a solid foundation for the stock market.

Pervasive Fear Turns to Optimism…Q1 2024 Outlook

Despite a steady drumbeat of negativity, 2023 proved to be an extraordinarily good time for markets in the United States. In hindsight, falling inflation, strong economic growth and improving earnings are a recipe for outsized equity market performance,

Hold On! Bidenomics Will Impact 2024 Economic Growth

Higher tax rates, increased regulations, greater government intrusion and an industrial policy are not the ingredients for faster economic growth, in our opinion. We look for 2024 real GDP growth rate to be lower than 2023, more likely in the 1.5% to 2% range.

Bidenomics’ Low Approval Rating: The Messaging or the Policy?

The Democrat’s claim that bad messaging is to blame for Biden’s low approval rating. But Bidenomics as economic policy could be the real issue. Ignoring the substitution effect of tax increases will further increase the federal deficit and debt.

Trump and Biden – Two Sides of the Same Economic Coin?

Yes, Trump pursued some of Reagan’s conservative policies…However, the two leading presidential candidates economic policies are similar in other ways, especially in favoring special interest groups, and will make America worse off.

The Relentless Wave of Higher Interest Rates…Q4 2023 Outlook

The “debt ceiling” deal of May has been extraordinary leaving the U.S. with a $1 trillion deficit and a growing US Treasury issuance calendar which has global bond investors repricing what the “normalized” cost of interest should be for the U.S.

Is It Over, Yet?…Q3 2023 Outlook

On the back of terrible market performance in 2022, investors started the year fixated on inflation, Fed policy and a potential recession. Of 20 Wall Street investment strategists, only 2 had bullish forecasts going into 2023 implying low odds for any market rally…

The Fed Has Lost its Compass – The Volcker Rule

The Volcker rule was a mechanistic approach to monetary policy. Bernanke deviated from this policy and the Fed’s balance sheet continued to grow. Victor takes a look back at the past decade and how the Fed has lost its way…

The Monetary Base, M2 and the Inflation Rate

Based on lagged impact of M2, inflation should decline to 2% by the November ’24 election. We expect T-bill yields to stabilize and the economy to return to trendline growth with higher bond yields and a normalized yield curve.