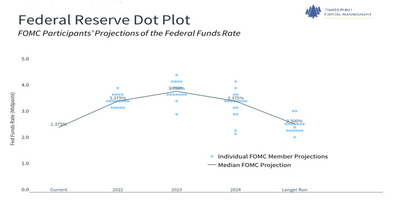

* The Fed focus in 2023…

* 60/40 strategy…tough year

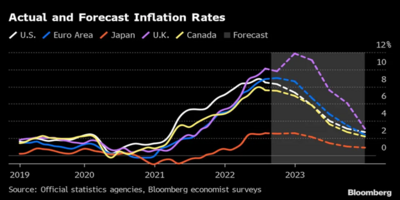

* ROW bankers play catch up

* Recession Watch – watch SCI’s…

The Timber Log – 12/8/22

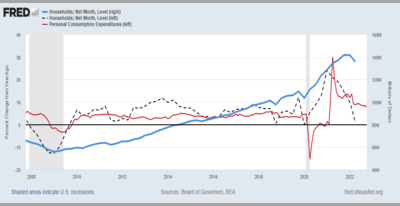

* Is the consumer “alive and well”?

* What is “SLOOS”? We take a look…

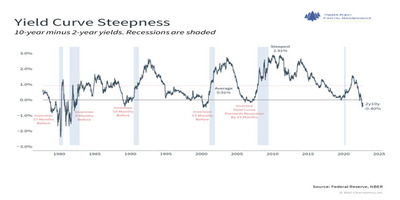

* Recession Watch…a history of

earnings revisions

The Timber Log – 11/30/22

* Our take on the Fed minutes

* Bond market rallies on CPI report

* FTX collapse…hard to look away

The Timber Log – 11/10/22

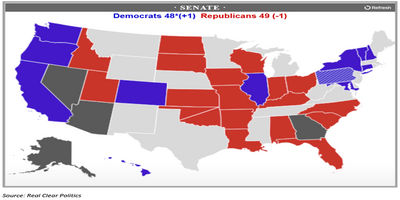

* The “red ripple” and Trump

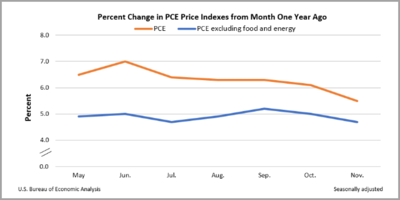

* October CPI finally brings relief

* King dollar in trend change…

* Inflation – sticky or flexible?

The Timber Log – 10/27/22

* Reasons for the recent rally

* Industrial Production is impressive

* Red wave is spreading

* Biden’s energy policy

The Timber Log – 10/14/22

* Waiting on 10/28 PCE report

* Fed policy and overseas bond markets

* What is your bull case?

* High Yield at 9%…

The Timber Log – 9/20/22

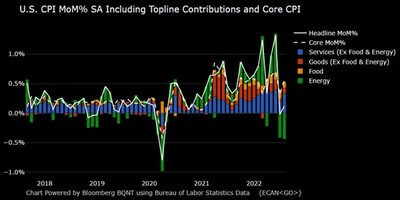

* CPI report is troubling

* PPI input increases slowing

* QT and “excess reserves”

* How is the consumer holding up?

The Timber Log – 9/13/22

* August CPI report disappoints

* QT ramps up…

* Europe’s energy issue

* Mid-term elections on the horizon

The Timber Log – 9/2/22

* Powell is talking tough, no pivot foreseen

* Sign posts for falling inflation are present

* Dollar strength a headwind for EM

The Timber Log – 8/16/22

* Inflation prints subside for the time being…

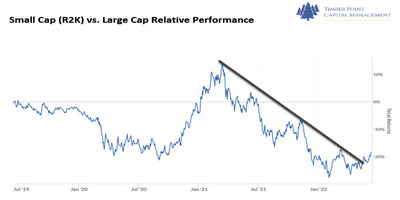

* Size and style are drivers in recent rally

* Fixed Income market sells the news of tame inflation

The Timber Log – 8/8/22

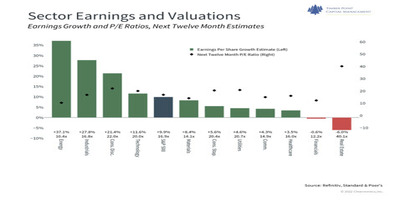

* Recession thoughts and the consumer

* The Inflation Reduction Act is a misnomer

* 2Q22 and 2023 earnings revisions

* Small caps rally as high yields contract

The Timber Log – 7/18/22

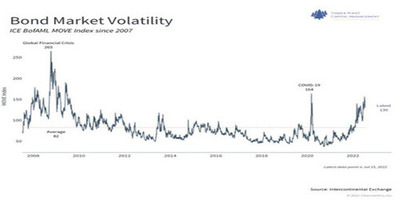

* Bond market volatility still below Covid levels

* Credit cycle is benign to date

* US $ – time to go the other way?

The Timber Log – 7/6/22

* Very few upbeat economic signals…

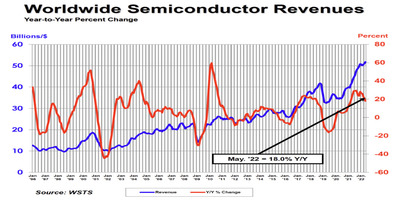

* Semi inventories may be normalizing soon

* WHAT IF…Ukraine and Russia talk peace

The Timber Log – 6/13/22

* M2 growth is moderating

* Small cap sentiment and valuation interesting

* US $ – stronger for longer?

The Timber Log – 6/7/22

* Focus on wage growth as it tracks PCE

* Energy equities valuations attractive

* US market continues to outperform ROW