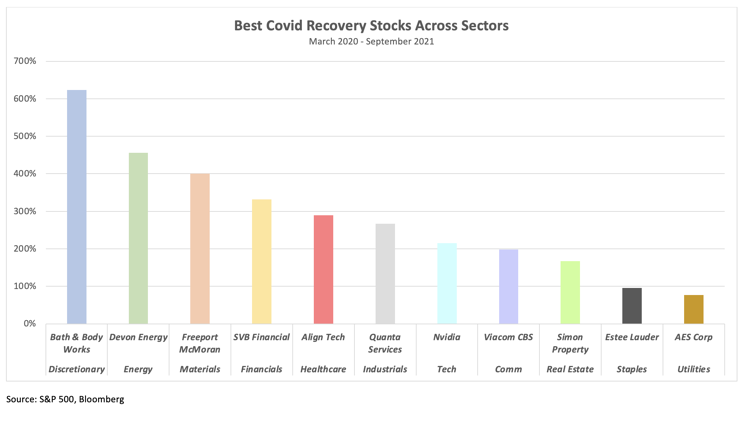

Investors love passion and conviction. “I saw an analyst on CNBC the other day. She loves Tesla. She’s all in.” “My hedge fund manager is so confident on Bitcoin, he’s taken a 25% position.” Sentiments such as these typically draw praise from investors as they represent a confidence which is often contagious. And why not be confident? Since the depths of the COVD-19 crisis, the US equity market has been a wealth creation machine. The S&P 500 is up over 70% since the March 2020 low, and there are numerous companies that were written off as dead that have posted, once in a lifetime, outsized gains.

And this doesn’t take into consideration some of the meme stocks such as Game Stop, which is up over 3200% over that same time. Diamond Hands. Perhaps, we are green with envy that we did not own more of these companies that performed so well, but in many instances, they do represent overconfident viewpoints that could lead to extreme volatility in one’s portfolio, which is something we try to avoid for our clients.

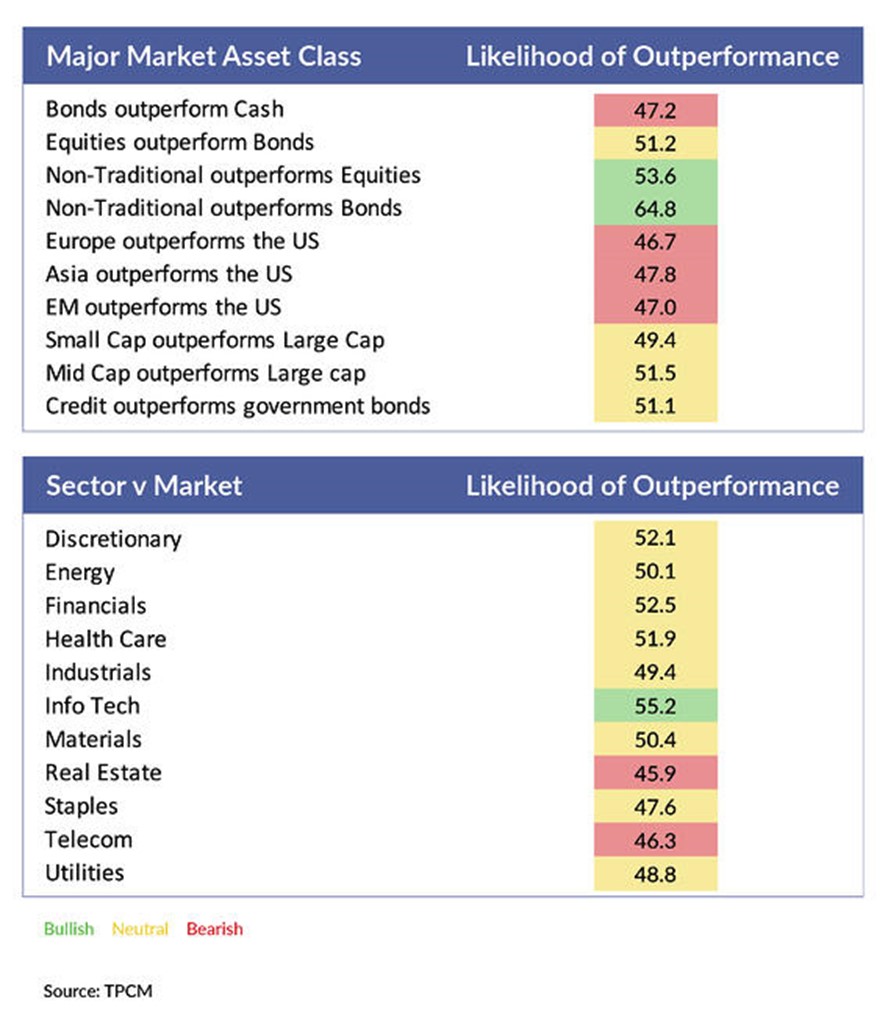

From our vantage point, the only certainty in the investment business is uncertainty which is why we take a skeptical view of the pound the table investment advice that seems to dominate the financial media and often draws the attention of investors. In fact, our investment process is designed to be gradual and directional incorporating fundamental viewpoints and valuations which leads us to take a probabilistic viewpoint of investment opportunities rather than an absolute viewpoint. “Given what we know…what is the likelihood…?” is the question we ask ourselves when looking at the market, a specific sector or an individual security.

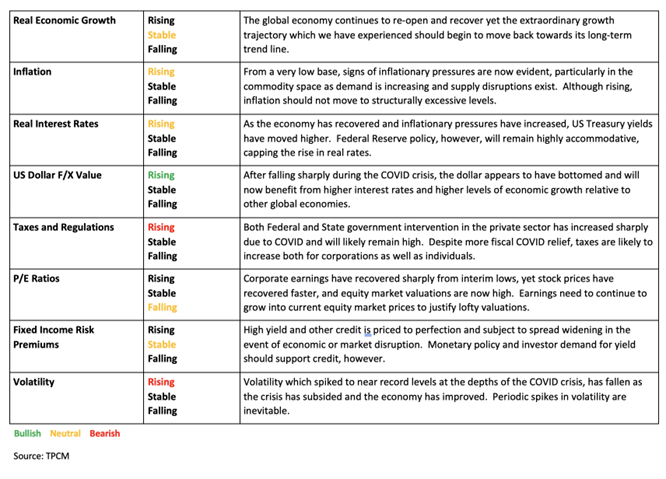

And today when looking at the fundamental economic variables which drive our investment process, we see a very mixed picture.

2021 4Q Key Economic and Investment Drivers

Yes, the economy is continuing its recovery, but the future rate of economic growth is expected to slow. In fact, the Congressional Budget Office just updated its GDP outlook, estimating that US real GDP growth will fall to 2.8% by 2025 and will average 1.6% for the rest of the decade. That is a far cry from the 6% growth we’ve experienced over the past couple of quarters.

As the economy has experienced a V shaped recovery, so have productivity and earnings and this earnings growth has been a major contributor to the strong performance which we have experienced in the equity market. Valuations are quite full, but companies continue to grow beyond analyst expectations. In fact, for the second quarter, over 85% of companies beat their earnings expectations indicating that analysts have been too conservative in their outlooks and continue to upgrade their expectations. Truly good news throughout.

Inflation which has been dormant for many years is now on the forefront of virtually every investor’s mind. Our viewpoint on inflation continues to be restrained as we do believe many elements are transitory. We also believe that the 3Q rally in long term Treasury bonds validates the view that long term inflationary pressures should diminish as the multitude of supply disruptions evident in the global economy ultimately dissipate. If inflation is going to be a persistent problem, the long bond would not currently yield 2%.

At this point in the writing, you’re probably asking yourself “So the economy and earnings are growing. Inflation and rates aren’t a long-term issue. What’s the problem?”

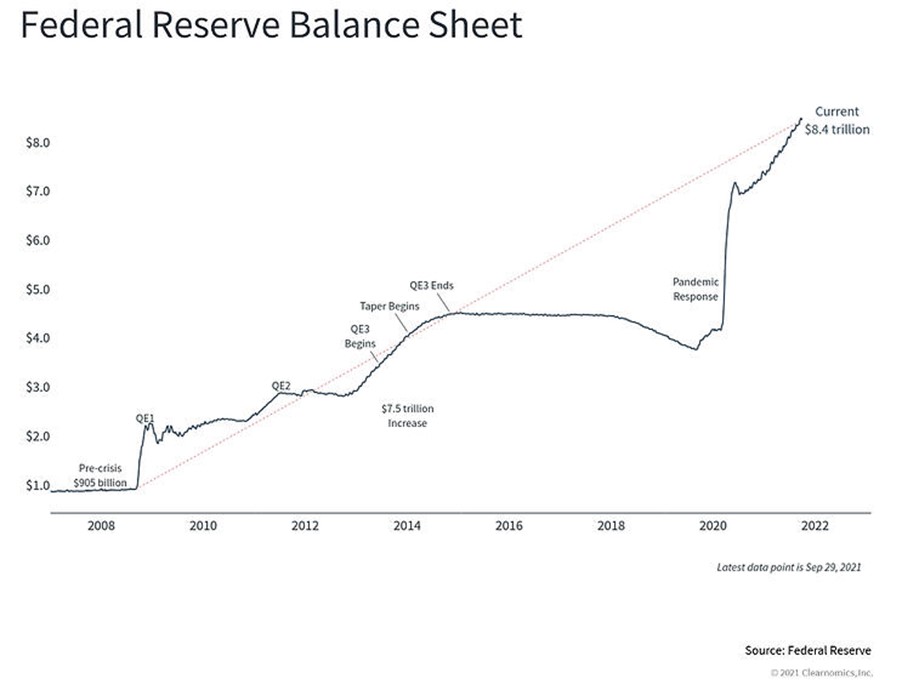

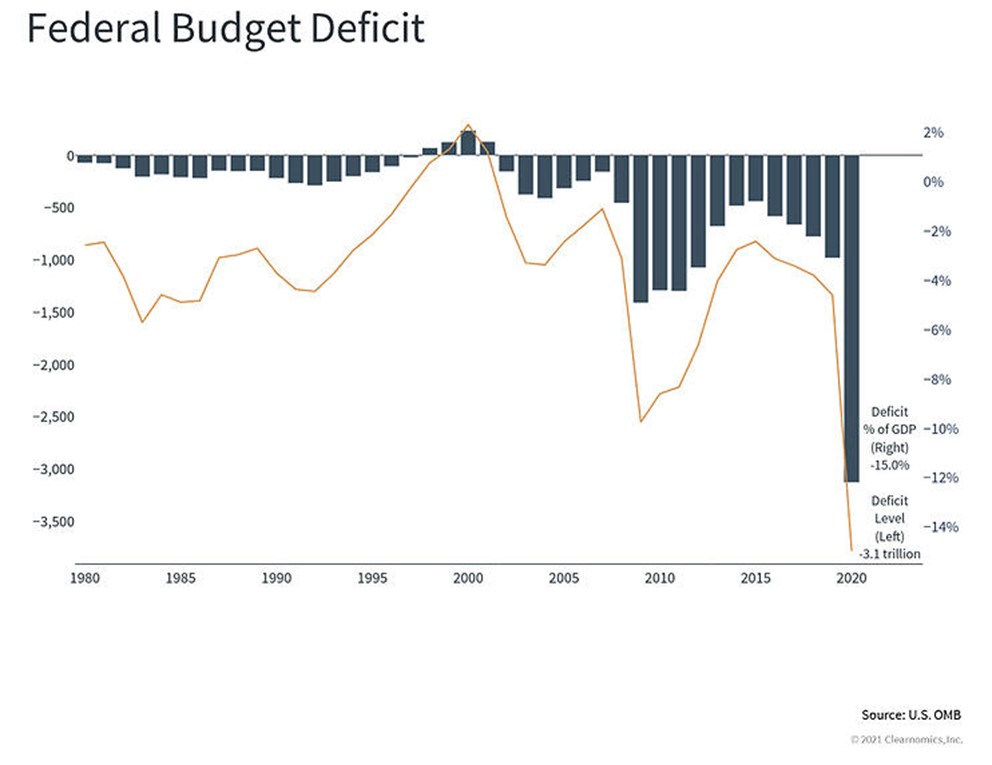

Washington DC is a mess and governmental policy runs the risk of undoing a meaningful portion the positive economic momentum which has occurred since the COVID lows of last year. It is fair to say that Washington has been a mess for some time, but today both monetary policy and fiscal policy have been stretched to stimulative extremes and are now in very fragile positions where a policy mistake could have meaningful long-term consequences to the economy and to investment markets. September’s equity market correction driven primarily by uncertainty around the debt ceiling as well as the infrastructure and social spending bills should be viewed as a warning flag to investors of the potential impact of a poorly designed or executed policy initiative.

We are also very aware of the fact that political brinkmanship is where negotiation occurs and ultimately where resolution is found. On the issue of the debt ceiling, we have had six government shutdown crises since 1990 several of which caused meaningful market volatility. In each past instance, the situation appeared dire, but an 11th hour resolution occurred, allowing the federal government continued its bipartisan profligate spending and equity market volatility diminished. At this moment the Republicans are universally opposed to extending the debt limit, yet history would lead us to expect a last-minute agreement which will kick the debt can further down the road. Current Federal Reserve policy is complicit in this arrangement. As such, the US Treasury 30-year yields 2% which indicates to us that debt levels are very high but are not yet at a crisis point. Someday politicians may be forced to seriously deal with the outstanding level of Federal debt but in the meantime, it appears as if it is more go along to get along.

Conflated with the debt ceiling issue, Congress is also negotiating infrastructure and social spending bills with a wide range of initiatives that go well beyond traditional shovel ready construction projects. The Build Back Better plan includes programs for child tax credit, universal pre-K education, expanded Medicare spending, climate change initiatives and other spending. The estimated cost range of this plan is a moving target but it does include tax increases for high income and corporate taxpayers as well as increases in the capital gains tax. The more progressive wing of the Democrat party wants the higher end of both the spending and the tax increases. Since last year’s election we have believed that although Democrats control all three arms of the government, the slim margins in both the Congress and the Senate would lead to restrained political outcomes and this spending and budget fight is proving that thesis to be accurate. Moderate Democrats Joe Manchin and Kyrsten Sinema appear to be the key swing votes on how this bill ultimately evolves which give us comfort that an extreme, adverse outcome is unlikely.

Although history would indicate that a moderate policy outcome should occur, one just does not know, particularly, as we live in this very politically volatile time. It is difficult to have that certainty. By extension our conviction (or lack thereof) is evident in our probability assessment across various asset allocation and sector decisions.

Probability of Relative Asset Class and Sector Performance – 4Q 2021

The investment implications of these uncertain viewpoints are fairly simple as we gravitate towards neutral weightings across many asset classes, albeit with some exceptions. First and foremost, we have moved to a very neutral conviction on stocks vs bonds, which ultimately sets portfolios towards an acceptable balance between risk on and risk off investments. We do remain overweight the United States which seems counterintuitive given our concerns about policy. In as much as the US policy mix is worrisome, most of the rest of the developed world also works from the same borrow and spend playbook but with less economic efficacy. Europe and Japan do much of the same but get so much less from it as their economic growth rates and productivity tend to lag the US. Emerging Market investments are dominated by China and China has its own woes (more on that in another post). Small and mid-cap stocks have bewildered us this year as the prospects of higher inflation and taxes typically benefit smaller companies. Yet, that has not been the case recently as large cap has outperformed sharply over the past six months. Across various market caps, we are gravitating back towards more neutral weights as well. We have maintained higher allocations to alternatives as we believe the flexible nature of these strategies should be beneficial in the event of higher volatility in markets.

As uninspiring as it may seem, we believe this is not a good time to pound the table for either a very bullish or bearish portfolio structure. A balance of risks across a diversified portfolio is usually a good thing but given today’s uncertainty it is particularly prudent.

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments