It goes without saying that the military conflict in the Ukraine over the past two weeks is very disconcerting and has caused great anxiety and worry to us all. The conflict remains very hot and signs of a diminishing of hostilities appear elusive. First and foremost, we hope and pray for a swift, peaceful, and just resolution of the war between Russia and Ukraine.

It further goes without saying, that this anxiety has manifested into greater volatility in investment markets. 2022 has begun poorly as inflationary concerns and expectations of Federal Reserve tightenings pushed asset prices down across virtually all major investment types. Prior to the Russian invasion, both equity and bond markets had posted sharp negative returns.

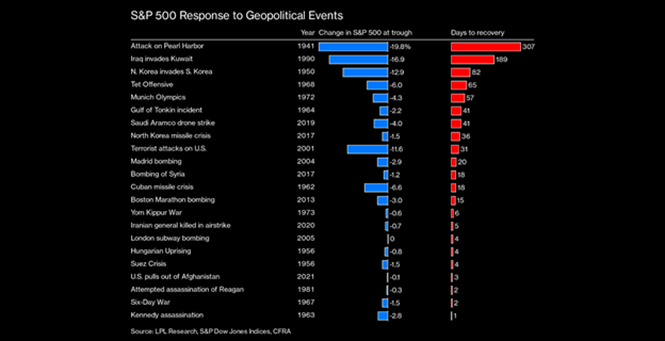

Despite the anxiety and volatility, we do believe it is important to maintain broader perspective and continue to focus on economic fundamentals which we ultimately believe will drive markets. Historically, geo-political events such as the Russia invasion, are not meaningful market disruptors.

Timber Point Capital Management does not profess to have meaningful insight on the potential military or diplomatic outcomes of this conflict. We do know that Russia remains recklessly aggressive in their actions in Ukraine and if that continues, volatility will be the norm in markets. Yet when we look beyond it and focus on the economic issues all is not bleak.

Firstly, the YTD market performance can most definitely be categorized as a correction. Corrections are never fun but an 8% decline in the S&P 500 after a 28% rise last year and a 20% rise in 2020 should not be a terrible surprise. As noted above, January was a bad month for investors and February returns were driven primarily by the worry of Russia invading Ukraine. In another case of sell the rumor and buy the news, markets have actually rallied since the invasion. For the 5-day period from Feb 24 (invasion) to month end, the S&P 500 rallied by 2%. Small Caps were up nearly 3% and long maturity Treasuries were up over 2%. In fact, small cap stocks finished February up over 1%.

Secondly, the COVID-19 crisis appears to be finally behind us, which is terrific news and should lead to further normalization of education, business, and travel. It is among the reasons which we believe small caps have begun to turn and outperform large cap stocks. Additionally, this normalization will have legs and its impact should compound through the summer months.

Thirdly, the long anticipated Federal Reserve monetary tightening cycle may again prove to be less than originally forecasted. Expectations for economic growth are falling sharply as the rise in energy prices act as a tax on the economy. The Atlanta Fed’s GDP NOW forecast for 1Q GDP is currently calling for no growth. The Fed and the market are both very aware of this fact and expectations are now for a 25bps tightening in March not a 50bps tightening. The tapering of the balance sheet will occur organically, not through asset sales. As such the US Treasury 10-year note has rallied and yields have fallen by 15bps in the last two weeks.

Risks, most definitively remain. The Ukrainian crisis remains open ended without a clear path to resolution. Geo-political risk could further increase with direct NATO intervention in the Ukraine or an emboldened China claiming control over Taiwan. Markets continue to fixate on these risks causing downward pressure on asset prices and increases in volatility.

The bi-product effect on energy markets and its further impact on availability and inflation remain a great risk. This is particularly true in Europe which depends greatly on Russia as an energy source. Additionally, Europe has increased its reliance on green energy sources, which are not entirely reliable or comprehensive. Correspondingly, continued hostilities coupled with rising oil prices will hit Europe hard. US Energy policy remains restrictive on drilling on public lands and US Energy companies have not yet appeared willing to expand capacity. OPEC could also increase capacity but has not yet committed to do so. We are a believer than the solution to high prices in commodities are high prices. Supply eventually will find its way to market thus easing prices in both oil and gas.

Another risk which investors have recently realized, is the effect of diminished liquidity and its impact on volatility. As the below chart indicates, the decline in liquidity impacts how well market prices can absorb a given change, relative to their fundamental value. Anyone who trades stocks is likely to have noticed a painful increase in price fluctuations in 2022. Modest changes in fundamentals have caused wild swings in prices. We saw anecdotal proof of that throughout the past earnings season as many stocks posted “good” numbers only to have the stock fall by 20% or more. And it is not just single stock volatility, we’ve seen overall market volatility rise in equities, interest rates, currencies, and commodities; all due to diminished liquidity. Painful.

In as much as this liquidity and volatility phenomena are likely to persist as the Fed tightens monetary policy throughout this year, it will cut both ways as recoveries too may be extreme as good news occurs.

So where does that leave us as investors? We need to continue to focus on economic and company fundamentals in order to determine longer term value across various investment opportunities and not to be entirely subject to the recent volatility which we have experienced, whether it be due to geo-politics, monetary policy or earnings.

We pray for Ukraine.

For all of humanity distorted by war.

For all the lives lost, homes seized and peace broken.

May the Spirit of comfort and compassion envelop all who dwell in fear.

-Salve Today

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments