We have argued that inflation is a monetary phenomenon and thus we need to focus on the monetary aggregates in order to get a handle on the inflation rate. Since the Fed plays a large role in the determination of the money supply, it follows that the Fed has an outsized role to play. As of late, Mr. Powell has shown a great deal of resolve and has announced a two-pronged approach to fight the US inflation rate. One being a reduction of its balance sheet, and the other via increases in the fed fund rates. While both of these actions will tend to reduce the quantity of money circulating in the economy and thus the inflation rate, they will each have a different impact on the banking system credit creation.

In spite of Mr. Powell’s recent resolve, the inflation rate persists. We contend that the progress on the inflation front will be slow during the early going. To understand why, we need to consider the short term and long-term effectiveness of the Fed monetary actions, i.e., its impact on the monetary aggregates.

The Fed balance sheet and the monetary base are two sides of the same coin. The Fed assets consists of securities it has acquired. The list includes government bonds, mortgage-backed securities, etc. In turn, the Fed paid for these securities by printing money, i.e., greenbacks. The double entry bookkeeping requires that the Fed assets, i.e., the bonds it holds, match its liabilities, i.e., the money it has printed which is effectively the monetary base.

The double entry bookkeeping affords us two distinct ways to track the Fed balance sheet actions. One being the securities held by the Fed, i.e., the assets, the other being the monetary base, i.e., the Fed liabilities. Information on the latter is readily available and much more pertinent to our analysis of the economy monetary conditions and inflation rate. Hence our focus on the monetary base.

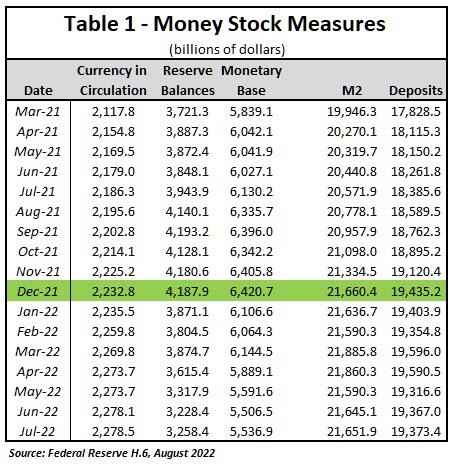

Balance sheet reduction is one of the policies tools the Fed is utilizing to combat the inflation rate. The presumption being that a reduction in the balance sheet leads to a reduction in the quantity of money, M2. Looking at the information presented below in Table 1, the data shows that the Fed has diligently followed through on its promise to reduce its balance sheet. The monetary base stood at $6.4 trillion at the end of 2021 and since then it has declined to $5.5 trillion in July of 2022. Nearly a trillion dollars in balance sheet reduction has already occurred, or approximately a 13.5% reduction of its balance sheet. The balance sheet reduction implies a corresponding reduction in the monetary base circulating in the economy. The Fed needs to be commended for its resolve. However, what matters to the inflation fight is the impact that this action may have on the monetary aggregates.

Given that the monetary base has two different uses, one as currency in circulation and the other as reserves backing demand deposits, how the reduction in the monetary base is affected matters a great deal. A reduction in the currency in circulation reduces M2 on a one-to-one basis. In contrast the reduction in reserves has a much wider range of possibilities. If the reduction is affected through a reduction in required reserves, then demand deposits and hence the quantity of M2 will decline by a multiple of the required reserve reduction. The multiple being the inverse of the Reserve Requirement. On the other hand, if the reduction is affected through a reduction in excess reserves there will be no impact on the deposit creation of the banking system. Although part of the monetary base, the cxcess reserves are idle reserve that are not used as either currency in circulation or backing demand deposits, therefore they are not part of M2.

Looking again at the data in Table 1, Column 2 it is apparent that during the December 2021 to July 2022 the economy’s holding of currency in circulation was essentially unchanged. Therefore, the reduction in the balance sheet was completely affected through a reduction in the bank reserve balances which declined to $3.258 trillion from $4.187 trillion during that time. Normally one would expect that the decline in reserves backing deposits would result in a decline in the deposits and loan creation on the part of the bank. Hence a reduction in the reserves would result in a potential tightening or reduction in the credit creation ability of the banking system. This would also result in a reduction in the quantity of M2 circulating in the economy. Hence would expect a lower quantity of money M2 and a tighter credit. According to the monetary view, the outcome would be a lower inflation rate and a higher price of credit, i.e., interest rates. But that is not what happened during this time period. M2 and the banking system deposit creation remained unchanged during the December 2021 to July 2022 period in spite of the trillion-dollar reduction in the balance sheet. What gives? The answer lies with the excess reserves and then banking system balance sheet.

Again, double entry booking is of some help here. The banks liabilities are nothing more than the deposits that they hold. On the other side of the ledger, the assets consist of the loans that the banks make plus the reserves that they hold, be it required or excess reserves.

All else the same, a reduction in required reserves results in a reduction in the deposits and loans created by the banks. On the other hand, a reduction in excess reserves has no impact on the deposit and or credit creation (loans) on the part of the banks. Looking at the monetary statistics during the December 2021 to July 2022 period we are statistics are able to make inferences as to how the banking system is accommodating the reduction in the Fed’s balance sheet.

We know that M2 is nothing more than the sum of demand deposits plus currency in circulation, hence knowledge of the currency in circulation and M2 allows us to determine the total amount of demand deposits. Then the fact that currency in circulation and M2 have remained unchanged allows us to conclude that demand deposits have also remained unchanged. This in turn leads to the conclusion that the reserves required to back up the deposits and the bank credit creation also remained unchanged. All of this suggests that the balance sheet reduction would have no impact on the inflation rate or interest rates.

But does this mean that the balance sheet reduction is an ineffective tool to fight an inflation rate? In order to retain the monetary view of inflation we need an explanation as to why the monetary aggregates remained unchanged. We need to reconcile the unchanged monetary aggregates – currency in circulation, M2 and demand deposits—and bank credit creation, i.e., loans, with a reduction in the banking system reserves.

We believe that the answer lies on the fact that reserves have two uses, one being a required reserves backing deposits and the other being as excess reserves collecting interest form the Fed. While the latter are part of the monetary base, they are not part of the currency in circulation, nor are they part of the demand deposits. Hence the excess reserves are not part of M2. Therefore, a reduction in cxcess reserves has no impact on these monetary aggregates and thus the inflation rate. Hence the only way the balance sheet reduction will lower the inflation rate is if the reduction in the balance sheet is affected through a reduction in the banking system required reserves.

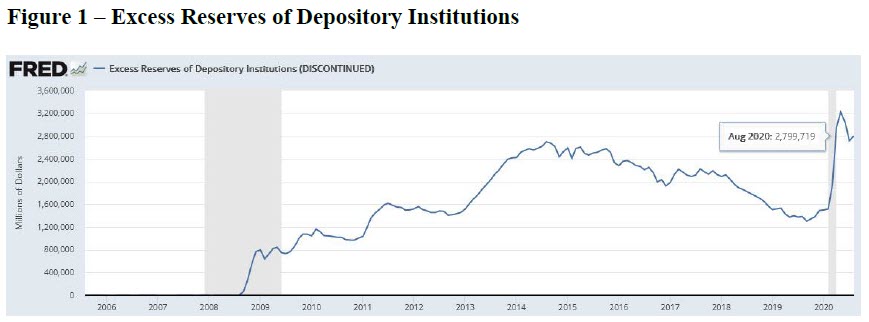

The banking system large excess reserves is a new phenomenon dating to the policies enacted by Ben Bernanke during and in the aftermath of the Financial Crisis. Prior to the Financial Crisis, the excess reserves were an insignificant component of the monetary base, as seen in Figure 1 below.

Conclusion

We have identified the relationship between the assets and liabilities of the Fed and the banking system balance sheets. Incorporating the uses of the monetary base as either bank reserves or currency in circulation combined with the components of M2 (sum of the currency in circulation plus the demand deposits) allow us to show that the reduction in the Fed balance sheet is being affected through a reduction in the banking system cxcess reserves.

Our analysis yields some interesting implications. The first one being that as long as the balance sheet reduction continues to be affected through excess reserves, the reduction will have no impact on the monetary aggregates and or the banking system credit creation. Hence the balance sheet reduction will have no impact on inflation and or interest rates. The second implication is that once the excess reserves are exhausted, a continued reduction in the Fed balance sheet will reduce the monetary aggregate, M2, and thus the inflation rate. At that point the Fed rate hike will reduce the banking system money multiplier stifling the banking system credit creation thereby reinforcing the impact balance sheet reduction on the monetary aggregates, lowering the inflation rate while making bank credit scarcer.

Our analysis suggests that the initial effect of the balance sheet reduction on the inflation rate will be muted, but as time goes on and the excess reserves are extinguished the impact of the Fed’s balance sheet reduction on the monetary aggregates and the inflation rate will steadily increase. Based on this we suspect that the Fed will continue to act aggressively but that to tame the inflation rate it will take longer than the monetarists or the Fed model predicts.

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments