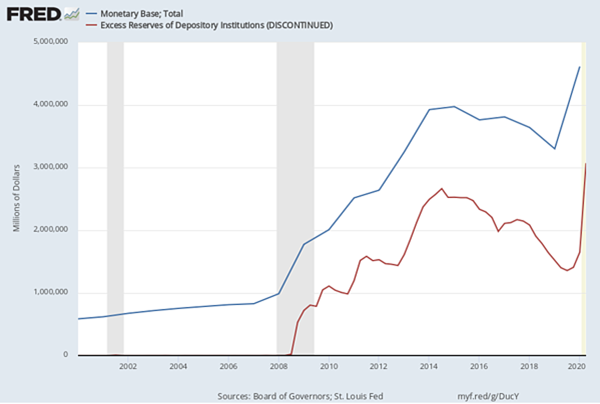

The Fed is confident that it will be able to unwind the $2.3 trillion in new lending programs after the economy recovers. Again, if past performance is indicative of future performance, there is no reason to expect that the balance sheet expansion will be reduced any faster than it was after the Financial Crisis. As can be seen below, the Fed had made only a minor reduction in the size of its balance sheet before Covid-19 precipitated further expansion.

The expanded balance sheet possesses some interesting long run issues for the Fed. Now like then, the Fed is expanding its balance sheet in response to the Covid-19 pandemic. Monetarists have argued that the expansion of the balance sheet and the corresponding increase in the monetary base would be inflationary. Yet during the financial crisis the higher inflation rate never materialized.

What did forecasters miss?

It is ironic to note that both Monetarists and Keynesians relied on the supply side to base their forecasts. The Monetarists focused on the money supply and the Keynesians on the credit supply. Both groups ignored or minimized the demand side as well as the interaction between the money and credit market. Accounting for these omissions yields a vastly different implication.

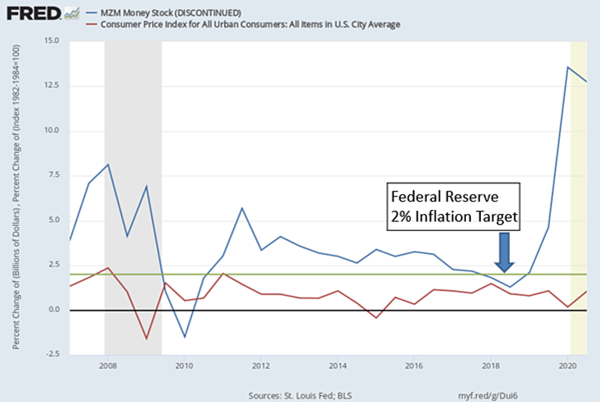

While the above chart shows a tremendous expansion of the monetary base, during the financial crisis the base expansion did not translate into a corresponding increase in the growth of the quantity of transaction money. While MZM is expanding in the mid to high single digit range, notice in the chart below that the underlying inflation rate is seemingly unaffected. This suggests that the Fed’s balance sheet expansion prevented a deflationary outbreak. Equally important is the fact that in spite of the elevated growth of MZM, the inflation rate never quite reached the Fed target inflation rate of 2%.

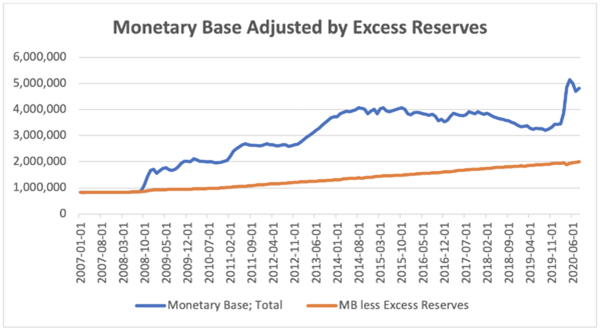

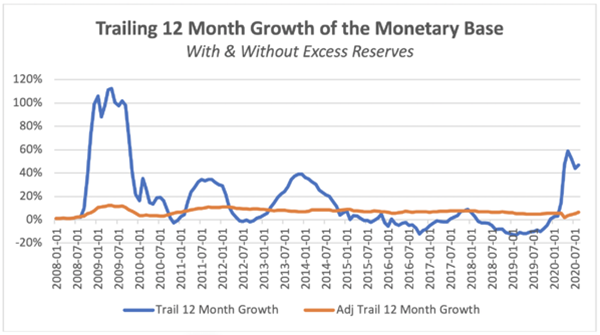

The latter result baffled the Monetarists. Yet the answer is obvious once one considers the excess reserves which were also growing. This meant that a large percentage of the Monetary Base was idle and not in circulation, so it was not being multiplied to expand MZM. Netting out the excess reserves from the reported Monetary Base, as seen below, provides a vastly different perspective on Monetary Base growth and one that should calm the inflationary fears of Monetarists.

Likewise, the raw monetary base shows an erratic behavior with large swings in its growth rate, seen below. Yet after adjusting for excess reserves, the growth in the base is much more moderate and far less volatile. The conclusion is that the financial system absorbed and took out of circulation much of the Fed balance sheet expansion. This in turn raises a new question – why weren’t the excess reserves deployed?

Our answer is a simple one. Financial repression. The Fed adopted enough measures and regulations on the back of the Financial Crisis that have “induced” financial institutions to hold excess reserves, de-lever and be cautious in extending loans to their customers.

Historical experience suggests that over time, at a cost, markets learn to get around the government restrictions. Said differently, over time the effectiveness of the restrictions decline and in order to maintain the same level of financial repression, new “repressive” measures must be adopted. That is “whatever it takes” means. The greater the degree of intervention (financial repression), the greater the degree of distortion and misallocation of resources. Eventually the economy is adversely affected which creates a major problem for the policymakers. But that is down the road…

To stimulate growth, the degree of repression must be reduced. This frees up the financial system which leads to an increase in the quantity of money and potentially a higher inflation rate, unless the Fed reduces its balance sheet, something the Fed has not been able to accomplish since the Financial Crisis. While all of this is far into the future the possible paths are clear:

1. If the balance sheet is not reduced, then an ever-increasing degree of financial repression must be imposed in the economy to keep interest rates low and in a non-inflationary environment. The “below market” interest rates reflect the distortion in the credit market created by the Fed’s policies. Slow real GDP growth and relative high multiples for the stock market that characterize this environment are a direct result of the distorted credit markets.

2. A reduction or circumvention of the financial repression regulations leads to the excess reserves filtering to the economy and resulting in an increase in the quantity of money that in turn lead leads to a higher inflation rate.

3. A reduction of the Fed balance sheet. A welcome sign for the Monetarists will also allow for the reduction in the financial repression, eliminate the distortions created by the low interest rate environment and improve the functioning of the capital markets. This remains to be seen.

Which of these three scenarios will play out will determine the rate and pace of inflation going forward and we have the tools to identify them as they materialize. For now, despite market fears of incipient inflation owing to the reopening of the economy, our belief is that the Fed will continue its course of balance sheet expansion and financial repression which will be sufficient to hold inflation in check.

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments