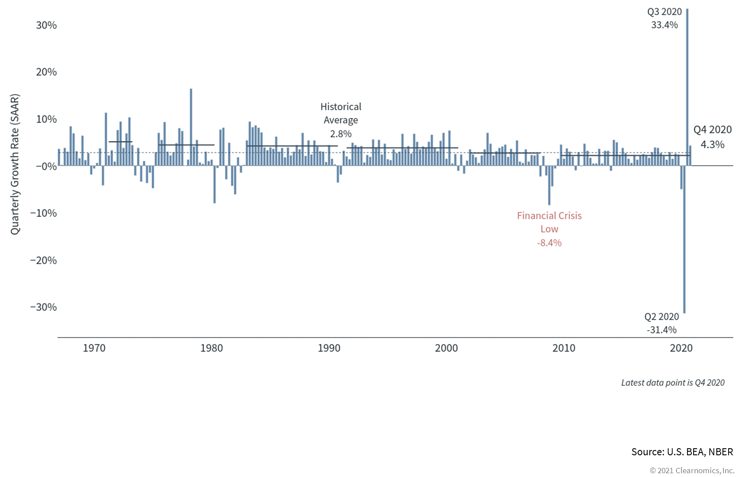

A casual observer of economics and markets could look at the first quarter of 2021 and remark that it was a very solid period with the S&P 500 rising 6% as the vaccines for COVID-19 are effectively being rolled out and the US economy has continued to re-open and show further signs of improvement.

Yet the internal dynamics of the investment marketplace proved to have several challenges and opportunities over the first three months of this year, not fully reflected in the simple topline return of the S&P 500. A continued transformation from the “normal” return patterns of the past several years and pockets of volatility proved that not all was benign across the investing landscape.

On the challenge front, firstly one needs to look at the bond market. The US bond market has only posted negative quarterly returns 30 times over the past 50 years with the worst periods being in the early 1980’s when Fed Chairman Paul Volcker was sharply raising interest rates to combat a double-digit inflation rate. The first quarter of 2021 proved to be the worst quarter since 1981 as the Bloomberg Barclays Aggregate Bond Index fell by over 3%. Long maturity treasury bonds posted a negative 14% return for this past quarter! As in 1981, inflationary concerns spooked bond investors as a very low level of nominal interest rates coupled with rising commodity and asset prices indicated that US fixed income securities may not out yield the expected inflation rate and, egads, may actually post negative returns for the year. In as much as the equity market gets all the hype, virtually all investors have exposure to the bond market and this recent turn in rates and fixed income returns is meaningful.

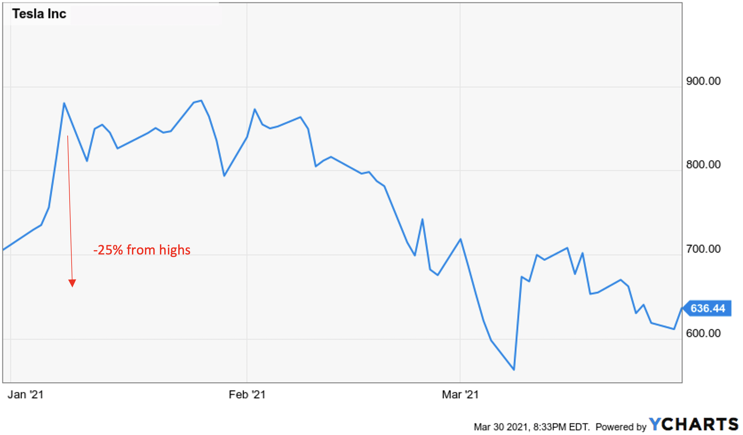

By extension, US growth stocks, particularly technology companies underperformed over the period. Over the previous ten years, US tech was the darling sector of choice for investors as disruptive companies such as Apple, Amazon and Tesla continued to post extraordinary growth in a period where many other companies struggled to grow. Yet often the earnings of these growth stories are expected to materialize in a much distant future. Therefore, the interest rate which factored into the discounting of those far away earnings has proved to be very important and the falling rate environment which we have experienced over the past 10 years was a meaningful tailwind for tech companies. Now that tailwind has reversed, and the rising rate trend has impacted not just the normal rate sensitive industries such as utilities but now also technology. Tesla is probably the best example of an extraordinary growth story which is now struggling from both high valuations, long dated earnings expectations and a rising discounting rate. For the time being, the disruptive nature of Elon Musk and his electric vehicles are much less relevant to Tesla equity holders as the stock has fallen by about 25% from its highs.

TSLA Stock Price 2021

Distant earnings discounted at a higher rate

On the opportunity side of things, small cap stocks, which had underperformed sharply over the past several years have revived quite significantly, rising over 90% from the lows of last year and 18% for the first quarter. We are all painfully aware of the negative effect that the COVID pandemic has had on small businesses and now that COVID risks are diminishing, small caps are roaring back. Additionally, other consumer businesses in “shut down” sectors are also outperforming sharply. Retailers, restaurants, airlines, casinos, and other re-opening stocks are leading the market as investors expect a surge of pent up demand from the stimulus aided US consumer. Energy and materials companies also have had a remarkable run during the first part of 2021 after underperforming for most of 2020. Increased demand and rising inflationary expectations have bolstered those sectors.

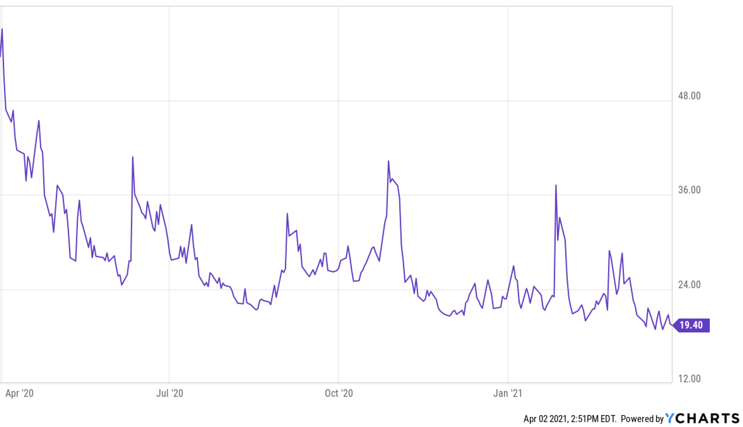

Part in parcel with the fiscal and monetary stimulus and an improving economy, leverage and speculation have increased in the marketplace causing pockets of extreme volatility. The recent Game Stop saga was one example of speculative activity which made and lost fortunes for some investors in a very short period. But it was not alone. Just prior to quarter end, Archegos Capital Management suffered an extraordinary margin call as leveraged positions in communications stocks went south, resulting in an estimated loss of $8 billion for the firm. Several Wall Street investment banks suffered meaningful losses associated with their prime brokerage relationship with Archegos. The entire SPAC phenomena and a bevy of IPOs all have been an indication that in the absence of open casinos many gamblers have found a new venue for their risk taking. Having said that, it appears as if the riskier side of the US equity market may be losing its edge. The newly created SPAC/IPO ETF has fallen by 20% from its February peak and ironically, Robinhood is planning a $40 billion IPO. This growing volatility in the go-go names is a representation of the conflicting risk dynamic in the marketplace as generic market risk as measured by the VIX is at interim lows.

CBOE S&P 500 Volatility – VIX

At 1-year lows despite notable incidents of risk

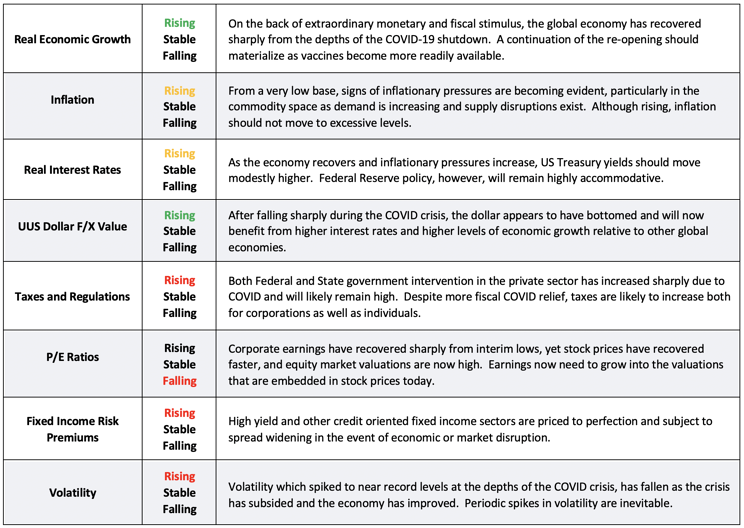

Our viewpoint on fundamental economic and market factors going into the second quarter is mixed. We remain optimistic on the economic recovery but do see some headwinds ahead; notably equity market valuations and fiscal policy.

2021 2Q Key Economic and Investment Drivers

The most important variable we evaluate is economic growth and as you can see, we remain confident that the COVID crisis is diminishing, and a re-opening of the economy is inevitable. This coupled with continued monetary and fiscal policy stimulus should further propel broad economic growth in the US.

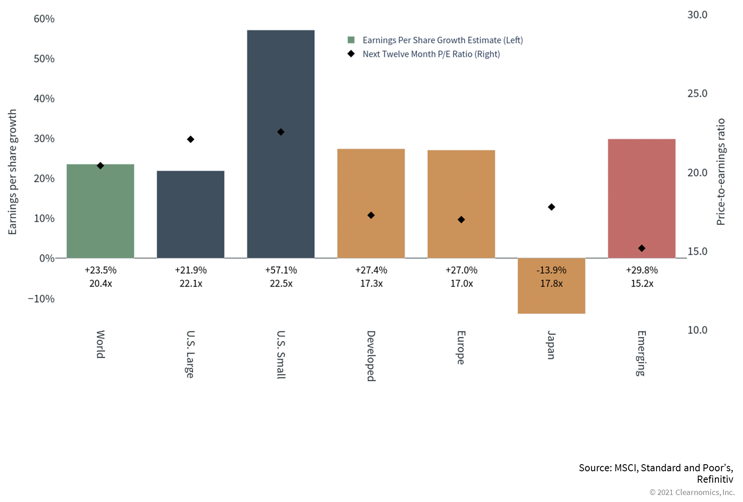

Yet to a great extent, the stock market has fully discounted this phenomenon. Equity market valuations are high, and we may be entering a period where the real economy outperforms the stock market. But following the V shaped recovery in the economy, we are now possibly experiencing a V shaped recovery in earnings, as well. From the interim summer lows, S&P 500 earnings have risen by 15% and have exceeded analysts’ previous expectations. 1Q 2022 forward earnings expectations represent a 40% increase from today. The question is can US large cap stocks grow earnings adequately to justify today’s lofty valuations?

U.S. Total Market Capitalization as a % of GDP

Stock Market Valuations

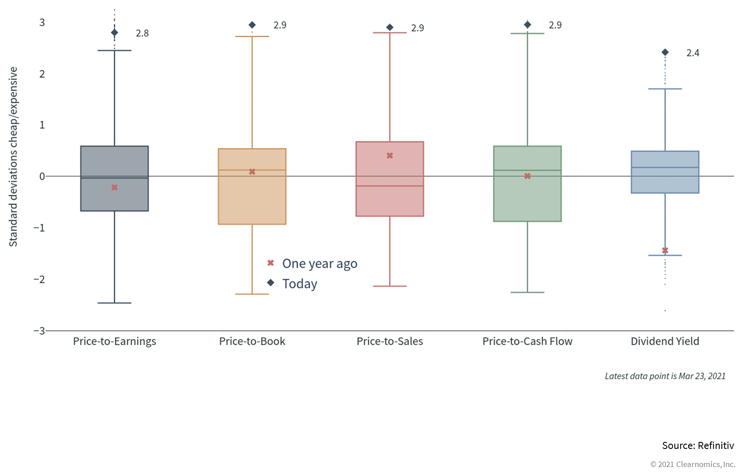

S&P 500 Index valuations today, one year ago, and ranges since 2003

Yet, looking at the US large cap sector alone as a proxy for equity market valuation is inadequate. Below you can see a broader viewpoint of equity valuation across a global universe where valuations are more of a mixed bag. As noted above, US large cap is rich and additionally has relatively modest growth expectations. Smaller capitalization stocks, which we have favored for some time, are also expensive yet have higher levels of expected earnings growth, consistent with the anticipated post- COVID recovery.

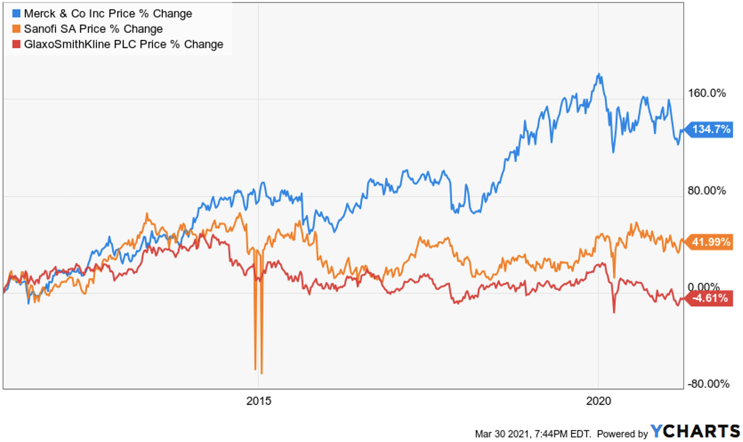

As often is the case, overseas markets are trading cheap to the US yet as the saying goes, “they’re cheap for a reason”. Firstly, the US dollar after consolidating through most of 2020, appears to have bottomed. The rising interest rate environment in the US has created resurgent demand for dollars as both Europe and Japan continue to have interest rate regimes that foster extraordinarily low to negative yields. The 1.7% US 10-year note is a high yielder among global bond markets and the corresponding dollar strength creates a headwind for international investing. Secondly, economic and fiscal policy in Europe and Japan remains anti-growth which fosters a distrust among global investors to pay a premium multiple for a company which may never reach potential due to the tax and regulatory framework of its home country. Sadly, many leading global brands trade at meaningful discounts due to this policy arbitrage. See Merck v Sanofi v Glaxo.

Global Health Care Rivals

Emerging markets remain an enigma. Outside of China most of the companies in Emerging Markets also suffer from poor policy regimes and outright political uncertainty. Think YPF. For over 20 years the South American oil company has been utilized as a pawn to the politicians in Argentina and the company has experienced a nationalization, restructurings, and multiple threats of default. This may be an extreme example of poor EM governance, but it is not unusual. EM remains a huge opportunity due to strong demographic growth and a vast supply of commodities. Yet, the promise of emerging market investing has been more hype than reality. Poor historical returns have led to low valuations but the catalyst for change remains elusive. Possibly a further resurgence of commodity prices will lead to better EM equity returns. Possibly.

China is somewhat of a different animal as it really is not an emerging market as it has fully emerged to become the world’s second largest economy with globally competitive companies. Today, China represents 40% of the EM Index so it is extremely meaningful . Although stable, rule of law, intellectual property rights and human rights create a challenge for foreign investors.

As indicated above we believe that the economic policy frameworks which governments establish are critical in determining the likelihood of a company and a market’s potential for success. For decades, the United States has benefited from fiscal and tax policy which has favored economic growth and wealth creation. This remains the case yet markets are made at the margin and the newly elected Biden administration is proposing tax increases on wealthy individuals and corporations which could impact the economic trajectory and investment risk taking all at a time when valuations are quite high. It’s important, however, not to hit the panic button because of taxes. A reversion to the Obama era tax rates would imply an Obama like economy and markets. Over the course of the Obama years, the S&P 500 rose nearly 200% or 14% per year and small cap stocks rose 250%. Impressive, yet, the starting point for the Obama economy occurred during the bottom of the financial crisis when valuations were at multi decade lows.

Despite concerns, the investment implications to our outlook continue to favor risk assets, particularly small cap US equities. As noted above, the key variable to our outlook lies in economic growth and that variable is strong and improving. The re-opening of the US economy will favor smaller business and correspondingly we are overweight small caps and other re-opening sectors and companies such as airlines and casinos.

We remain underweight international equity markets despite meaningful valuation discounts. Overall, the opportunity set is uninteresting given poor economic policies resulting in continued sluggish economic growth and profitability expectations. Additionally, the COVID crisis in Europe remains acute, further hindering growth there. Relative valuation may attract investors, but we continue to think the best equity opportunities lie in the US.

Fixed income investments generally remain unattractive to us as well and we are maintaining meaningful underweights to bonds. Despite moving higher over the past several months, interest rates remain low and will not likely compensate investors adequately for growing inflation risk. Additionally, credit spreads are at very tight levels making corporate bonds additionally unappealing. As an asset class, bonds offer diversification and correlation benefits relative to equities and thus serve an important role in portfolio construction. Yet, that insurance policy is currently very expensive and there are other ways to hedge market risks.

In lieu of bonds, we continue to overweight alternative investment strategies as important risk mitigation tools in portfolio construction. Often investors utilize alternatives to enhance returns yet the most beneficial attributes lie in correlation and risk diversification. Alternatives can benefit portfolios by applying a broad investment opportunity set, an absolute return orientation and a strong risk management framework which can help smooth returns when volatility inevitably impacts markets. Given our concerns over valuation, we believe these types of strategies are critical as they should provide flexibility and downside protection if markets become challenging.

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments