Well, that was not fun. The second quarter of 2022 proved to be a much more difficult investing environment than we had initially anticipated. Inflation which we believed would begin to show signs of improvement, never improved. In fact, it got worse. The April and May price reports exceeded expectations and markets swooned. Despite, some fundamental and cyclical signs of improvement, the headline inflation prints of 8% to 9%, were too much for the market to bear.

Given this rapid change in the inflation trajectory, Fed policy has made a 180 degree turn going from record easing to record tightening. Despite not being included in the Fed’s preferred inflation measure of core PCE, food and energy prices have moved persistently higher and are now acting as a regressive tax on the economy, shifting the market’s concerns from inflation to recession or structural stagflation as the economy is beginning to show signs of weakness.

The effect on equity markets has been significant as the S&P 500 has fallen roughly 16% for the quarter. Even energy companies, the sole source of positive contribution among sectors in 2022, rolled over hard in June. Over three weeks, the energy sector fell roughly 25% from their early June peak. No place to hide.

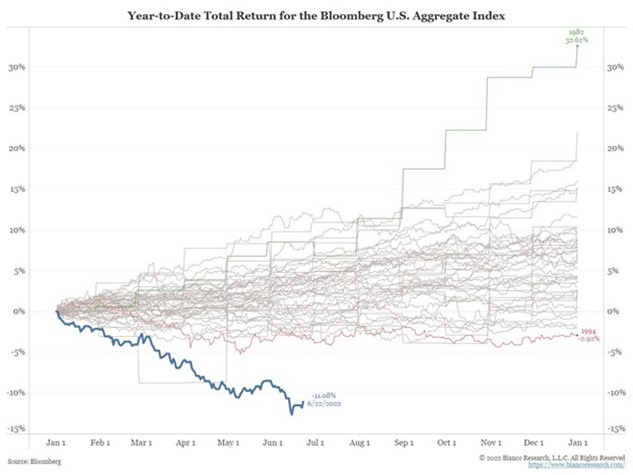

We have all experienced investing environments where “correlations go to one” and risk assets sell off due to one economic concern or another. But correlations typically did not go to one. Historically, there had been one asset class which always provided a safe haven, namely fixed income, particularly US Treasuries. 2022 however has been an exception to that rule as bonds have sold off sharply due to higher inflation and the change in Fed policy, quantitative tightening and interest rate hikes. In fact, 2022 is on pace to be, by far, the worst year for fixed income performance since the creation of the Bloomberg Aggregate Bond Index in 1976.

As multi-asset investors, much of what we rely on to reduce volatility are structural diversification benefits across asset classes and central to that thesis is the natural hedge that the bond market provides to equities and vice versa. We are not alone in that viewpoint and much of the pain investors have experienced this year is based on the sharp sell off in fixed income at the time that equities markets accelerated their decline. Much of this was not a surprise as we had maintained a dim view on the prospects for fixed income as an asset class particularly given the change in monetary policy. The magnitude of the decline has been a surprise, however. Even during the financial crisis of 2008, with a multitude of market liquidity and fragmentation problems, the bond market rose roughly 6% while stocks sold off over 35%.

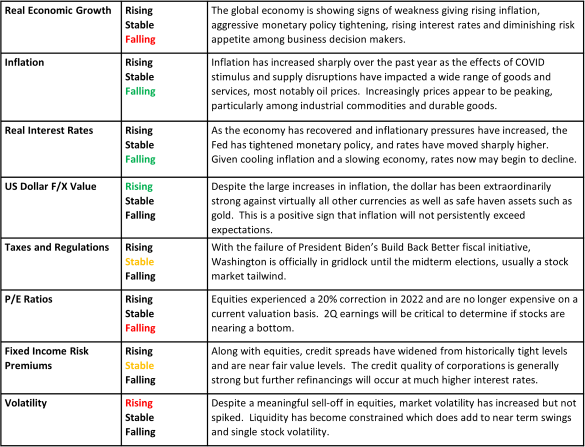

Going into the third quarter, our fundamental viewpoint of key economic and market variables has clearly become more cautious but not entirely bearish.

Both economic and market stability appear to be contingent on a suppressing of inflationary pressures. OK we admit it, we have been in the transitory camp, positing that we are not entering a period like the 1970’s where excessive inflation was persistent for nearly a decade. If not now, when will we begin to see signs of improvement? Potentially very soon. We referenced above that the Fed’s favorite measure of inflation is core PCE and by that measure, inflation is moderating. Core PCE peaked in February at 5.3% annual rate and most recently posted a 4.7% increase. Far from the Fed target of 2% but improving, nonetheless.

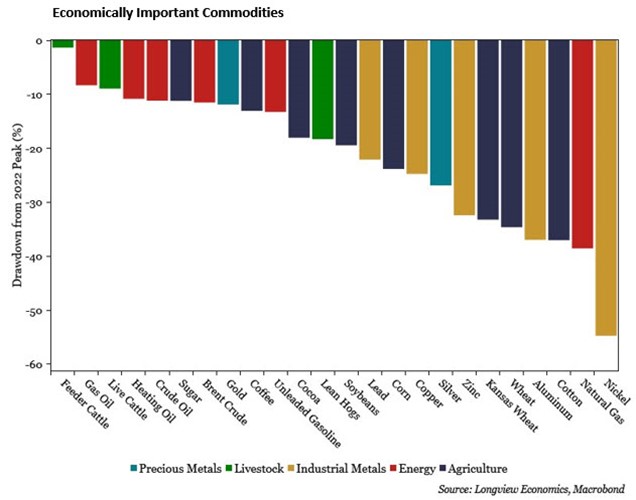

Additionally, we are beginning to see a rollover in broad commodity prices particularly among industrial commodities, indicating that demand is cooling due to the high price effect. Oil prices remain stubbornly high but that has as much to do with Federal energy policy, capacity, and supply constraints as it does with monetary driven inflation.

Yet even an improvement in inflation may not curtail the pending economic weakness that is developing. According to the Atlanta Fed and their GDPNow estimates, real economic activity for the second quarter will post negative growth as rising inflation and rates are harshly impacting economic expectations.

If this confluence of improving inflation statistics and declining economic growth rates does materialize, it could alter the trajectory of monetary policy as the Fed may become less aggressive in its tightening throughout the remainder of 2022. Improvement in inflation however is key and we will look to the next couple of month’s CPI, PPI and PCE reports for validation of this viewpoint. Without that improvement the Fed would not likely alter policy trajectory as they would rather live with a temporary recession than structural inflation.

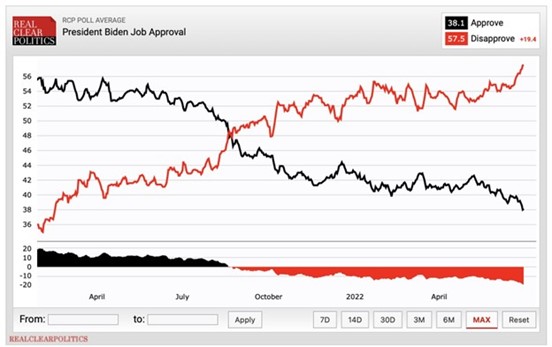

As monetary policy may begin to change for the positive, so may fiscal policy as the midterm elections will soon begin to be discounted by the investors and markets. At this point, the Biden Administration and its policies have been roundly panned by the investment community and the electorate at large. Most notable has been the president’s stubborn, illogical and restrictive energy policies which have been a major contributing factor to the persistently high level of oil prices. Correspondingly, Republicans are likely to sweep both the Congress and the Senate in the midterms which may lead to more constructive economic policies going forward.

2022 has several parallels to 1994. In addition to an aggressively tightening Fed and falling bond and equity markets, 1994 was also a midterm election year and Bill Clinton got throttled, with the Democrats losing 8 senate seats and 54 house seats. To his credit, Bill Clinton then pivoted his policies and worked with the newly empowered Republicans on the Contract with America, which led to an economic boom that lasted throughout the next six years of the Clinton presidency. Whether Joe Biden follows Bill Clinton’s playbook is yet to be seen. Yet, the end of Bidenomics is likely over and investors should ultimately benefit for it.

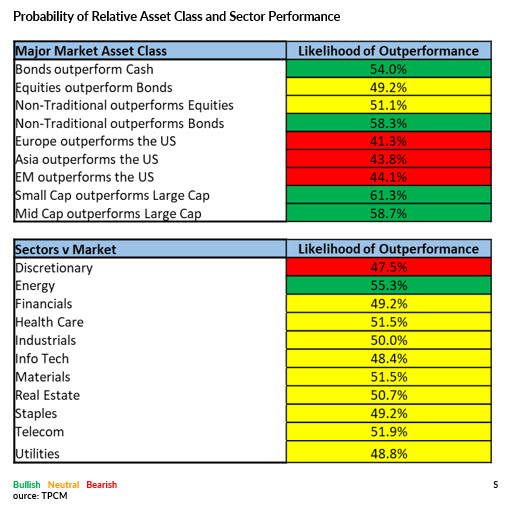

Consistent with our fundamental outlook, the expectations for relative asset class performance is also mixed with a few notable outliers.

One notable change is for the first time in nearly two years, we are optimistic on the prospects for the high-grade bond market. As mentioned above, the bond market has been routed in 2002 and nominal rates are now meaningfully higher and real rates are positive. Given the slowing economy and potential for less restrictive monetary policy, the bond market has room to run and importantly should regain its status as an effective portfolio diversification tool relative to equities.

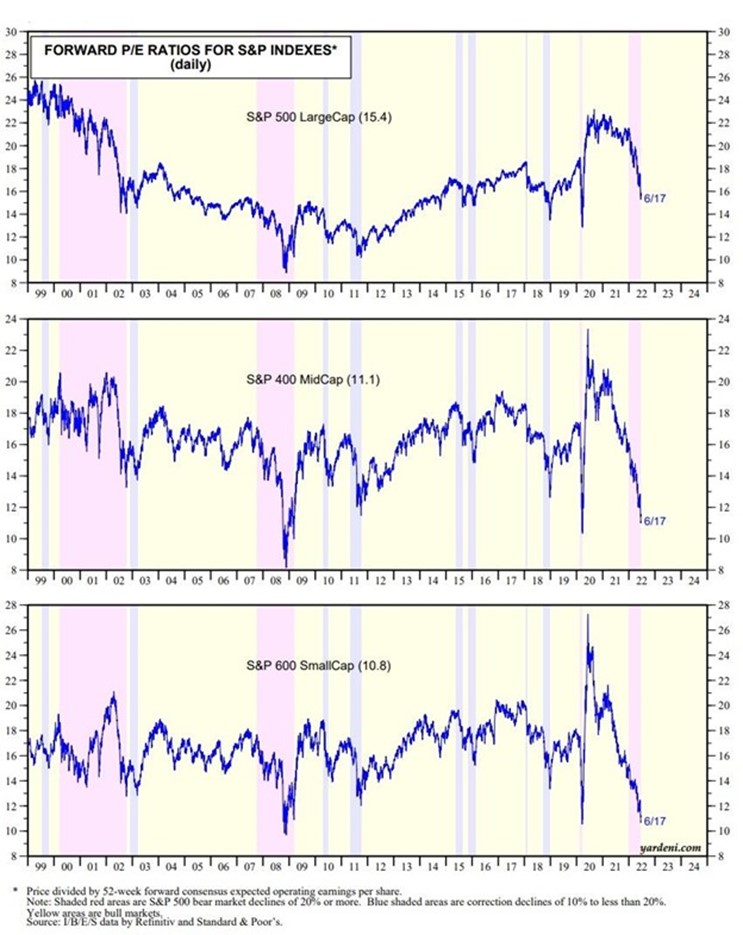

We remain positive on US small cap equities as valuations are compelling relative to history as well as relative to large cap stocks. In fact, small cap stocks are now trading at valuations not last seen since the depths of the COVID crisis in March 2022. Beyond valuation, small caps historically have been good inflation hedges. During the inflationary 1970’s, small caps averaged over a 9% annual return while large caps only rose by 5%.

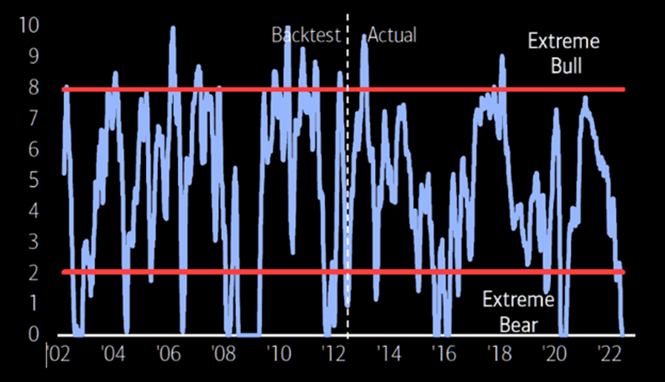

Lastly, we’ll conclude with one more chart. Possibly, the best of the recent bad news. According to a recent Bank of America survey among 266 institutional investors who have $747 billion under management, bullish sentiment has reached rock bottom. We do recognize that sentiment is just that but, as history has proven, bottomed out sentiment levels may lead to a return to more fun times for investors in the months ahead.

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments