This Too Shall Pass….But When?

It is very hard to believe that 60 short days ago, the US economy was humming; we were at full employment, consumer confidence was high, interest rates were low, and the stock market had hit all time highs. The sky was the limit. Investors were bidding up new economy stocks and all looked good. And then along came the coronavirus and we all know what happened and we won’t bore you recounting the details of what has been recounted a million times in the media and financial press.

Like everyone, we have been worried about the effects of the virus on the health of our community, on our families and friends and on the old and infirmed. We also have been worried about the effects on the economy and initially took a somewhat unconvinced opinion on what the impact would ultimately be. “The economic impact will painful over the short run but a V recovery would be likely was our initial view”. “Once we get past the worst of the virus, life will get back to normal”. But life has not been getting back to normal. A general shutdown of virtually all aspects of life and of economic activity is not normal by anyone’s definition.

At the depths of the Civil War, Abraham Lincoln famously said, “Time is a thickener of things”, meaning that time and patience usually win the day and that is very much our normal viewpoint when markets hit a rough patch. Our typical response to unexpected market drawdowns, for virtually any reason, is to take a calm measured viewpoint, not to overreact but to wait things out and look for new investment opportunities that inevitably develop. If a portfolio is well diversified and of an appropriate risk profile, an investor can survive downside volatility as long as one does not experience permanent impairment (bankruptcies or defaults). Investors must accept a certain level of volatility in order to achieve attractive returns, over time.

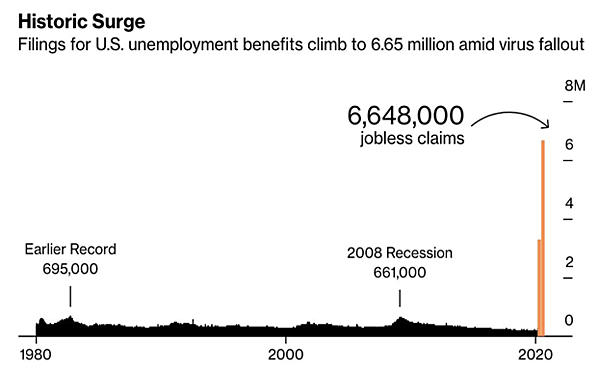

Yet, in this somewhat unprecedented environment, time is not our friend. We believe that the longer the general shutdown of the economy persists, the more meaningful the economic and financial problems will become. In fact, over the past two weeks nearly 7 million Americans have lost their jobs and have filed for unemployment benefits. That is a staggering employment statistic, the likes of which have not been seen since the depths of the Great Depression. As the Wall Street Journal summarizes, getting back to work is critical as the longer the economy remains closed and unemployment remains elevated, the correlated impact on consumers and businesses only becomes more acute. As time goes by the economic muscle of the United States will atrophy. Many small businesses will fold, and fragile corporate business models will be challenged like no other period in our lifetime.

Given this potentially dire outlook for the real economy, the US Federal Government policy response has been significant and unparalleled. The fiscal stimulus of $2.1 trillion provides a wide range of financial support to taxpayers, small businesses and corporations. Direct cash outlays to individuals, payroll protections and low interest loans to small business as well as changes in expense deductions are all among the various initiatives embedded in the newly signed Coranavirus Aid, Relief and Economic Security (CARES) Act. Additional to fiscal policy, the monetary policy response is even larger and potentially more powerful. Inclusive of the Fed’s $4 trillion stimuli are various credit and liquidity facilities ensuring needed support to banks, businesses and households. Explicit asset purchase programs have been expanded to keep interest rates low and credit markets open. For the first time, the Fed will include corporate bonds, both investment grade and high yield, as part of the asset purchase program. This is a dramatic response.

The finger pointing among politicians and the media in Washington has been acute and I believe it is fair to say that policy makers were initially slow to appropriately respond to COVID-19 risk. Yet, the policy initiatives outlined above coupled with on the ground efforts by state and local governments lead us to this point where we believe that government authorities have provided an adequate policy response to the problem as we now know it. And it is among the reasons why the stock market is up 15% from its lows. Yet, the policy response alone and the modest repricing of assets should not be taken as a sign that it is all clear for investors. Again, normalcy needs to take place particularly economic normalcy and it is very hard to see that happening until there is demonstrable improvement in the COVID-19 data.

It goes without saying that the medical professionals are true heroes putting their lives on the line through this pandemic. Ultimately, they will be economic heroes as well as their efforts in “flattening the curve” will be the true stimulus to resume normalcy and allow consumers, businesses and employees to get back to work. Beyond the medical and palliative response which the healthcare industry is providing, the data collection and development and modification of models has allowed the on the ground medical community to increasingly become more effective. Ultimately, this modeling will be the window to investors on when the markets may ultimately reach their real bottom and the effects of the multiple government stimulus plans can truly take effect.

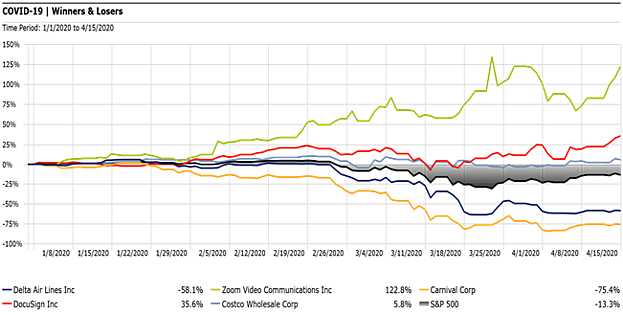

Typically, when writing investment commentaries, we seek to provide specific opinions on where the most lucrative opportunities lie and how to best access them. Given the circumstances which we now face, it is extraordinarily difficult to offer up strong recommendations. More so than anything else, we do believe that going forward, the distinction between winners and losers will be significant and active management of portfolio risks, allocations and investments will be required. Meaningful return differentiation has developed among asset classes, economic regions, industries and companies. Overleveraged companies with weak balance sheets and the inability to access the capital markets for liquidity be highly challenged….think cruise lines or oil and gas service companies. Certain municipalities with pre-existing fragile finances will be hit harder by COVID-19….think New York. Certain corporate bonds will have difficult accessing credit facilities and will need to be restructured…think airlines. Pothole avoidance will be critical once we exit this economic winter. Conversely, opportunities are being created among the nimble and the anti-fragile. Certain industries and companies will emerge with extreme competitive advantages. This coupled with more attractive valuations will create meaningful opportunities for excessive upside returns. But when? remains the question and as of this writing it is difficult to know. As such, we are recommending that investors mostly stay put. To the extent that the portfolio’s long term risk profile is appropriate, selling or hedging at this point does not make sense. But blindly buying the big dip is equally as imprudent as there remains less clarity than we’d prefer around the COVID-19 pathway to normalcy. Opportunities are developing which we are in the process of evaluating and selectively executing upon. New economy stocks involved in off-site team communications are likely to be winners in a post COVID-19 world. Select old economy stocks such as grocers and drug stores could be attractive too as sales volumes are extraordinarily strong. Not surprising valuations are more compelling and there is a wall of US Government money to provide support to the economy and markets. Yet, we need to see greater signs of a flattening of the COVID curve and normalcy prior to making a wholesale commitment to buying risk assets.

On a personal note, I am very happy to announce that we have founded and launched Timber Point Capital Management, where I will serve as President and Chief Investment Officer. Timber Point’s focus will be multi-asset, solution-oriented investing; creating and managing efficient portfolios which meet our client’s specific goals and objectives. There is no single asset class or product bias in our approach. Objective, client-centric, forward looking asset management is our primary offering and we believe that this type of service will be required by many investors. The low risk, bull market that we’ve enjoyed over the past several years is clearly over and investors will need to make very active decisions around risk, asset classes, regions, sectors and specific securities. Our long tenured experience navigating global markets lead us to believe that in spite of it all, this is a great time to be starting an investment management firm and we look forward to helping clients navigate the investment opportunities ahead.

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments