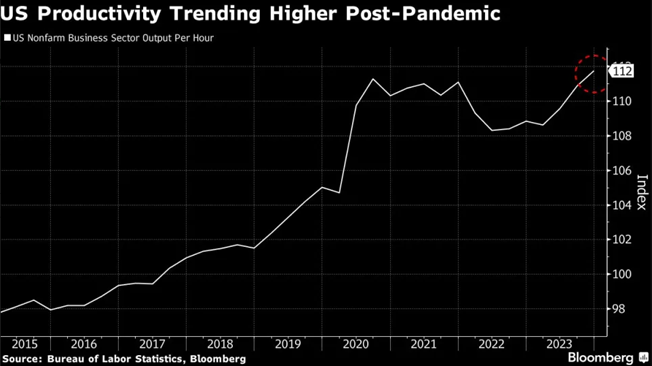

Entering 2024, unlike many other market participants who continued to focus exclusively on the restrictive elements of monetary policy, TPCM took an overall optimistic and bullish viewpoint on market opportunities. In particular, we viewed the US equity market as attractive as persistently strong economic growth and falling inflation were the core variables which drove us to want to take risks in portfolios. We found the nuanced arguments over “recession or soft landing or no landing” tiresome and were further encouraged that regardless of the actual trajectory of interest rates, monetary policy and the Fed would be a diminished variable for 2024. Yet, despite our optimism, we were surprised by the strength in the first quarter. The 10% rise in the S&P 500 was definitively outside of our hopeful expectations for returns and we believe productivity enhancements driven by artificial intelligence may be the key variable which we and many other investors may be underestimating.

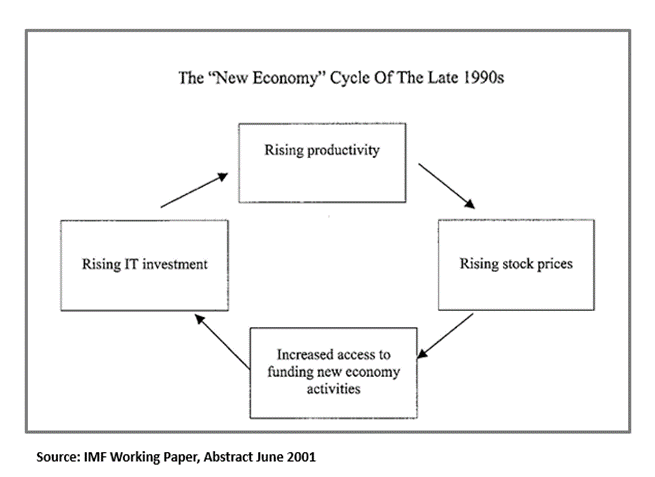

Productivity drives stock prices, and ultimately, we may be entering a prolonged positive feedback loop whereas AI driven productivity drive earnings and stock prices higher which further drives more capital spending across businesses to drive productivity enhancements….not dissimilar to the technology boom of the roaring 1990s.

Yes, we do remember how this ultimately ended, with an overinvestment in technology and a dramatic selloff in stocks. We also do believe that valuations matter, but we may be some time away from a reckoning. Alan Greenspan famously used the phrase “irrational exuberance” in 1996 when describing equity markets. Yet, it was over three years later and another 100% gain in the S&P 500 before stocks peaked in March of 2000. So, the question we believe investors need to ask themselves is “Are we in 1996 or 1999?”

Nowhere has this phenomenon been better reflected than in semiconductor stocks as the Philly Semi Index has risen over 50% over the past three years while the alpha dog in the space, NVIDIA, has risen 550%! This is the spearpoint of the productivity revolution and where capital is currently being allocated.

Source: YCharts, TPCM

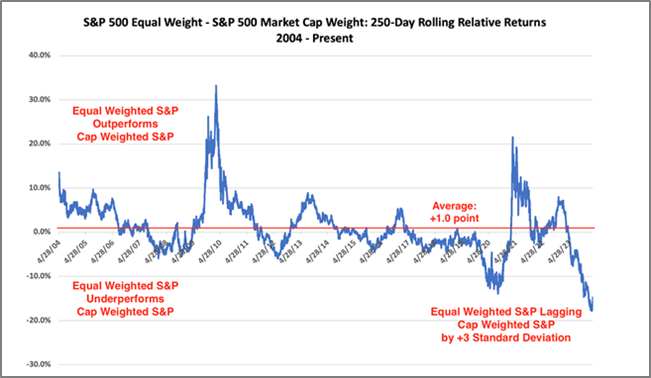

Bears will argue that this boom in semis and the general concentration of returns in a small number of mega cap growth companies, aka the Magnificent Seven (AAPL, MSFT, GOOGL, AMZN, NVDA, TSLA, META), are a sign of fragility in the overall market. Further, on a rolling, relative basis, the equal-weight S&P 500 is at its weakest levels in 20 years.

Source: Fundstrat

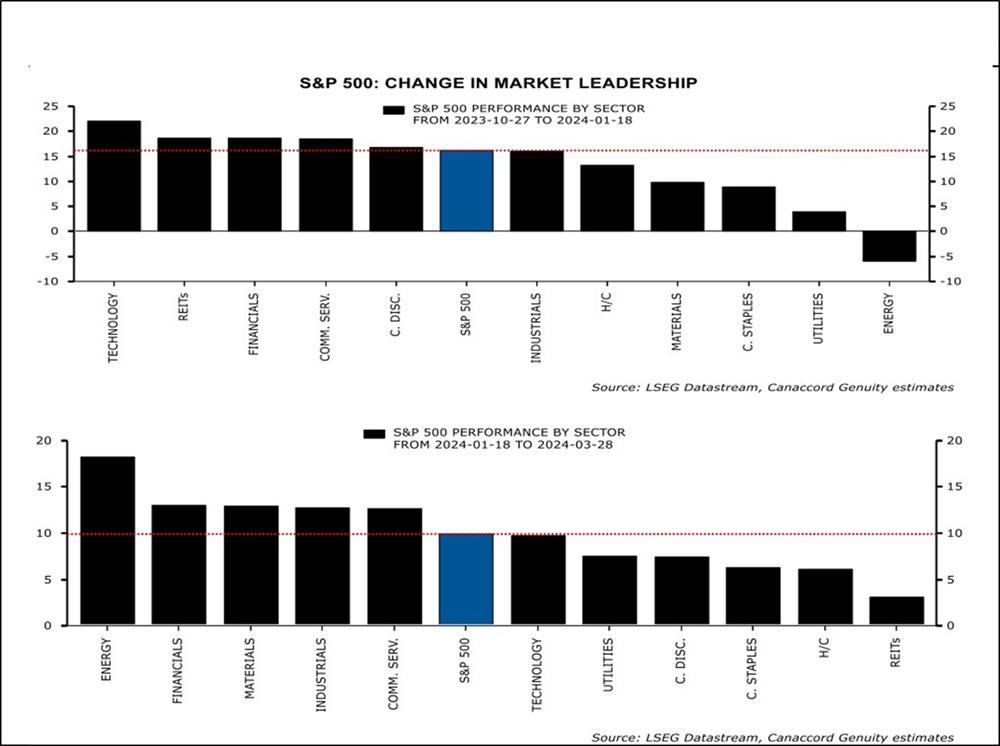

Yet, a change in market leadership may be at hand. Firstly, two of the Magnificent Seven companies are no longer so magnificent. Tesla was down 30% in the first quarter. Apple was down 10%. Both are still terrific businesses, but they are struggling from company specific issues and high valuation. In the meantime, other styles, sectors, and names are showing signs of life. The midcap growth index rose by 15% for the quarter. Financials were up 13%. A slew of industrial and energy names were up double digits in Q1. While still early it is entirely possible that the benefits of AI driven productivity are going downstream to a broader array of companies which will fuel profitability and stock valuations higher across a wider breadth of industries.

As always, before we get into specific asset allocation or portfolio implementation decisions, we first evaluate the broad economic and investment environment to see if the period ahead seems to be beneficial to taking investment risk.

2Q24 Economic and Investment Drivers

| DRIVER | STATUS | COMMENTARY | |

|---|---|---|---|

| Real Economic Growth | Rising | U.S. economic growth trajectory has remained resilient despite two years of tightening monetary policy. Technology driven productivity enhancements can further propel broad economic activity. | |

| Inflation | Falling | Over the past year, inflation has improved across virtually every metric and now is approaching the Fed's target of 2% Core PCE. Improvements should continue, yet future declines will be less pronounced. | |

| Real Interest Rates | Falling | Due to Fed rate increases and improving inflation, real interest rates are at high levels. Real rates should moderate on a going forward basis. | |

| US Dollar F/X Value | Falling | The dollar has remained the king currency among global competitors yet concerns over deficit and falling rates in the US may take some of the momentum away from the greenback. | |

| Taxes & Regulations | Rising | The Federal government continues to expand with never ending spending programs and regulatory mandates. Regardless of the outcome of this year's presidential election, the footprint of government will remain large. | |

| P/E Ratios | Rising | S&P 500 earnings are expected to increase throughout this year. US large cap growth remains at very full valuations. Small cap, international and other market segments trade at meaningful discounts. | |

| Fixed Income Risk Premium | Stable | High yield spreads have tightened over the past year reflecting overall economic resilience and strong corporate balance sheets. Corporate America continues to deleverage impacting new issue supply. We expect spreads to remain narrow. | |

| Volatility | Stable | Volatility has reached cycle lows as both the economic and market environment has exceeded earlier expectations. Periodic spikes are always a risk. | |

| Source: TPCM | Bullish | Neutral | Bearish |

Overall, we continue to view the fundamental backdrop for markets favorably and we continue to overweight risk assets broadly across portfolios. Where to commit risk assets remains the big question. Do we continue to favor what has done so well? Technology, communication services and other large cap growth sectors have led the market higher for many years. Given valuation differentials and a changing fundamental backdrop, we believe that going forward there are several opportunities apart from large cap growth that offer better risk-reward characteristics that should be increasingly emphasized in portfolios.

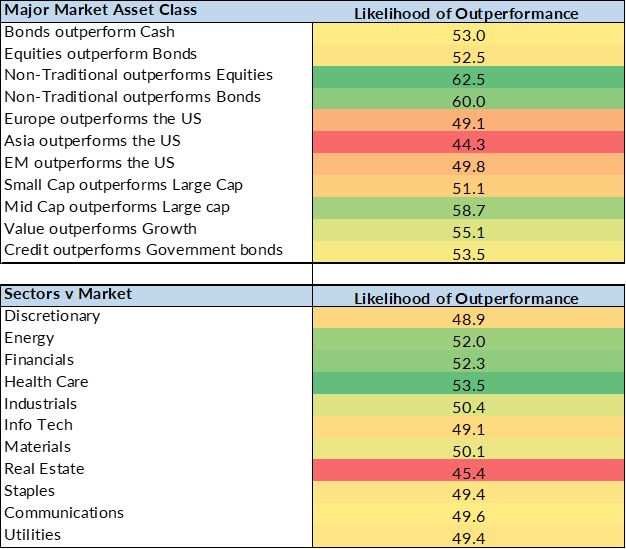

2024 2Q Asset Class and Sector Probabilities

Source: TPCM

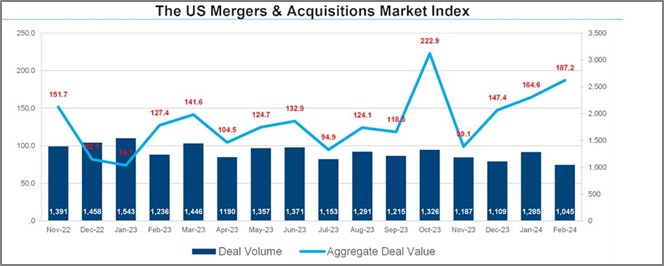

Much to our frustration, smaller cap stocks have been meaningful underperformers since the regional bank crisis of a year ago. Despite valuation discounts, investors have been concerned about the availability of credit to small growing companies. As such, institutional investors are very underweight down capitalization equities. We believe that the financing concern is overstated. Increasingly banks appear to have emerged from last year’s problems, and other sources of financing are available to smaller companies. Additionally, animal spirits seem to be rekindling and deal activity is picking up. If the public markets won’t appreciate the valuation potential of small caps maybe private transactions and M&A activity will catalyze an improvement in the space. Specifically, biotech has seen a recent pick up in deal activity.

Value oriented sectors are also showing signs of life. Despite being counted out for dead, both the financial and energy sectors, the largest component of the value index, outperformed in the first quarter.

International markets remain fairly uninteresting to us, and we continue to underweight investments overseas. International equities trade at valuation levels substantially cheaper than the S&P 500 while the economic growth trajectory has improved both in Europe and China. Yet, the opportunity set remains somewhat opaque to us relative to a broadening set of investment opportunities in the US. We prefer to take a wait and see approach on international equities at this point in time.

The last several years have been very volatile between COVID, inflation and an aggressively tightening monetary policy regime. Yet, despite it all, the US economy again proved its resiliency and US business decision makers found ways to make money propelling stock prices higher. We continue to believe that the best opportunities lie in the US. No doubt risks remain, especially after such a strong recovery from the October ’23 lows, and corrections are inevitable. Yet, as the virtuous circle of productivity enhancements hits the economy, we believe that the investment beneficiaries will be downstream, particularly smaller capitalization stocks, value-oriented companies and many other of the 493 laggards of the S&P 500. As the market broadens we believe that, much like the first quarter, investors will be pleasantly surprised by the investment results for the remainder of 2024.

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio.

Investment advice is offered through Fortis Capital Advisors, LLC, 7301 Mission Road, Suite 623, Prairie Village, KS 66208

Recent Comments