Election Questions and the Soft-Landing Hope

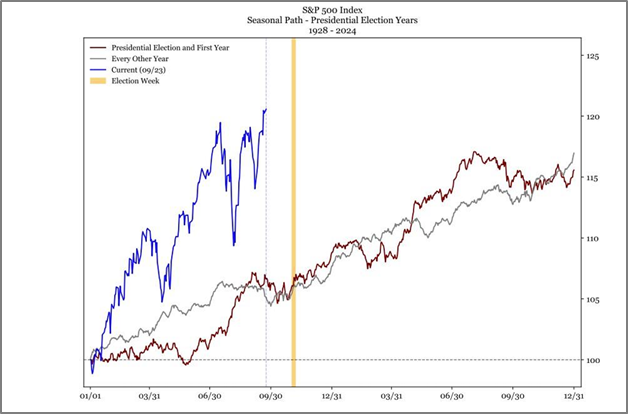

As the year approaches its final bout, the peculiar 2024 US presidential election, things are coming to a head. The race remains tight as betting markets and polls currently have Donald Trump and Kamala Harris running neck and neck. Policy uncertainty, geopolitical risks, hurricanes, port strikes and an absentee sitting President all loom as risks, yet the stock market continues to grind higher. US equity markets typically perform well in election years and thus far, 2024 has followed that playbook. In fact, the S&P 500 has sharply exceeded the pace of previous election cycles.

Source: RenMac Research

Source: RenMac Research

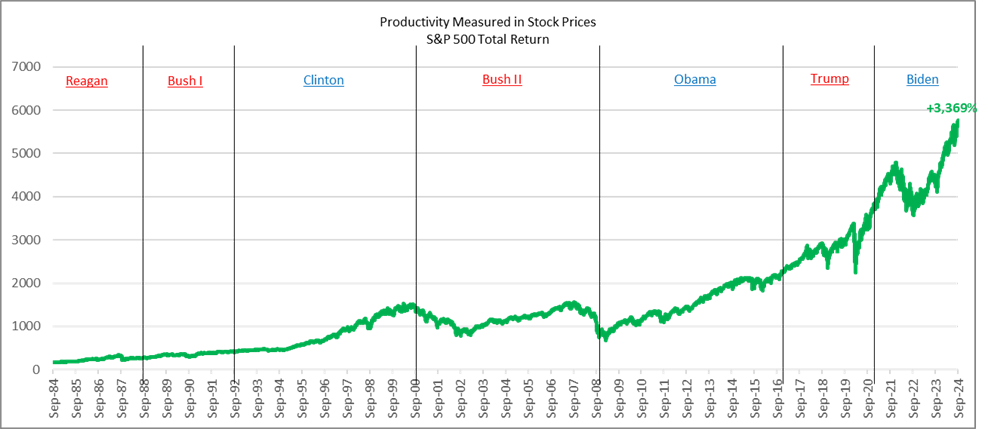

How could that be the case? As we’ve written about in the past, the current economic environment reminds us of the 1990’s…a time of robust growth and successful monetary policy maneuvering. In that era, the U.S. experienced huge technology driven, productivity enhancing economic growth, which drove stock prices higher. The Alan Greenspan Fed, concerned about potential inflation, achieved a rare feat of navigating the economy to continued growth despite monetary tightening measures. Investors today believe we are experiencing a repeat of that success, as artificial intelligence drives economic growth and Jerome Powell appears to have thread the needle of reducing inflation without causing a recession.

Today, the economy is cooling yet a recession seems to be a low likelihood event. Slowing but solid economic growth, falling inflation and interest rates seem to be leading us to a goldilocks economy which will continue to delight investors.

Changes are At Hand

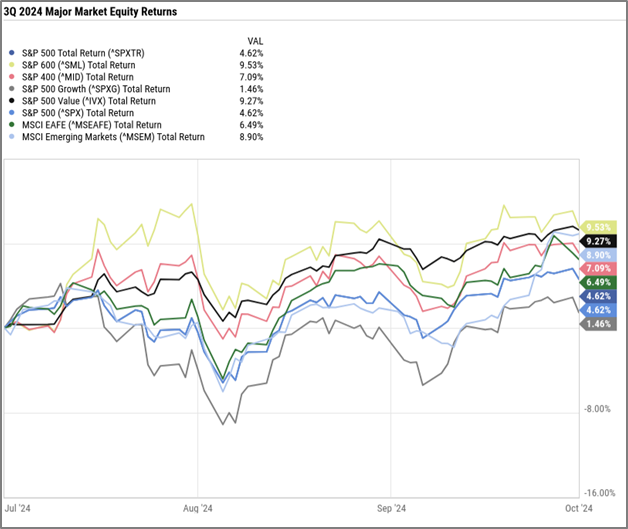

Yet, the market trajectory appears to be changing as leadership shifted over the course of the past quarter. For the better part of 15 years, large cap growth stocks have dominated returns, sharply outpacing virtually all other asset classes and investment types. Yet over the last quarter technology and growth stocks underperformed. Small caps, mid-caps and value companies all sharply outperformed growth stocks. Even international markets outperformed the US.

Source: YCharts, TPCM

Source: YCharts, TPCM

Before we get too deep into our investment outlook, we always look to our framework of key economic and investment drivers to determine if the environment will be attractive for investors and where investments will carry the best risk adjusted compensation.

4Q24 Economic and Investment Drivers

| DRIVER | STATUS | COMMENTARY | |

|---|---|---|---|

| Real Economic Growth | Stable | U.S. economic growth trajectory has remained resilient yet some slowing pressures are becoming evident. A meaningful slowdown or recession is a very low likelihood event. | |

| Inflation | Falling | Inflation has improved across virtually every metric and now is approaching the Fed's target of 2% Core PCE. Improvements should continue, yet future declines will be less pronounced. | |

| Real Interest Rates | Falling | Anticipating the recent ease by the Fed, market traded interest rates fell sharply over the recent quarter. Real interest rates remain high, however. The trajectory of future monetary policy across major central banks is towards lower interest rates. | |

| US Dollar F/X Value | Falling | The dollar has remained the king currency among global competitors yet concerns over deficit and falling rates in the US may take some of the momentum away from the greenback. | |

| Taxes & Regulations | Falling | The Supreme Court's recent decision on the Chevron Deference may significantly reduce the power of federal agencies to interpret laws, impacting how regulations are crafted and enforced. | |

| P/E Ratios | Falling | S&P 500 earnings growth is expected to slow and US large cap growth remains at very full valuations. Small cap, international and other market segments trade at meaningful discounts. | |

| Fixed Income Risk Premium | Stable | High yield spreads have tightened over the past year reflecting overall economic resilience and strong corporate balance sheets. Corporate America continues to deleverage impacting new issue supply. We expect spreads to remain narrow. | |

| Volatility | Stable | Volatility has reached cycle lows as both the economic and market environment has exceeded earlier expectations. Periodic spikes are always a risk. | |

| Source: TPCM | Bullish | Neutral | Bearish |

International Economies are Showing Some Spark

While the U.S. economy wrestles with the possibility of a soft landing, economic prospects are brightening in Europe which teetered on the brink of recession in 2023. Fundamental economic improvement and an improved borrowing environment are attracting investor’s attention. Europe is experiencing a sweet spot of moderating inflation, which is allowing the European Central Bank to shift toward cutting interest rates. However, Germany remains a weak spot due to its reliance on China for industrial growth and other structural impediments. Somewhat unusually, other nations are leading Europe’s renaissance. As Europe recovers, the ECB’s decisions on monetary policy will be vital in sustaining this momentum.

Japan, meanwhile, presents a more complex picture as economic performance is mixed. The Bank of Japan continues to raise interest rates, potentially risking past policy missteps, and there are concerns that premature tightening could hinder long-term growth before inflation stabilizes at 2%. The yen has faced pressure from carry trades, where investors borrow in low-interest currencies to invest elsewhere. This changed in late July 2024 when the BoJ unexpectedly raised rates, leading to a sharp appreciation of the yen and causing significant market turbulence, including a (temporary) 20% drop in the Tokyo Stock Price Index. Exporting companies were hit particularly hard during the yen rally. Despite a 12% appreciation against the U.S. dollar, the yen remains relatively inexpensive, and the BoJ is expected to proceed cautiously with further rate hikes.

An improving fundamental backdrop, inexpensive valuations and the possibility of a declining dollar make international investments, for the first time in quite a while, more attractive to us.

China’s Challenges and the Global Impact

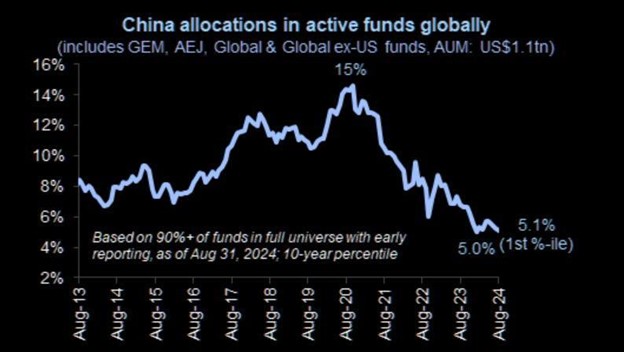

Specifically, China, once a major engine of global growth, has taken a turn for the worse over recent years, as the country continues to grapple with unresolved issues in its property market, slowing credit growth, and consumer confidence hovering near record lows. In response to its recent economic struggles, China has introduced a new stimulus package aimed at revitalizing its slowing economy. The package includes measures such as increased infrastructure spending, tax cuts for businesses, and incentives to boost consumer spending. The government is also focused on providing targeted support to the troubled property sector, offering easier financing conditions and encouraging local governments to issue special bonds for infrastructure projects. These efforts are designed to reignite growth. Yet, this is not the first time that China has implemented stimulus programs which have resulted in little success. Market sentiment and investor positioning in China is negatively one sided. Even a modest fundamental improvement could catalyze outsized investment returns. But will they last? We have our doubts that this stimulus will have the long-term efficacy that policy makers in China hope.

Source: Goldman Sachs

Source: Goldman Sachs

The U.S. Election and Market Risks

Yes, the current US economic environment is a good one that favors investors, yet risks do remain. In our opinion the greatest uncertainty is policy risk out of Washington and with the pending election these risks are to a certain degree open ended and need to be monitored closely. As mentioned above, the presidential election is currently a coin toss and down ballot election polls lead us to believe that we will ultimately have a split government in Washington. Gridlock makes investors happy and is one of the reasons for the market’s sharp rise in 2024.

Yet, Presidents do matter, and much can be achieved through executive order. Based on his previous administration, we have a template for anticipating Trump’s economic policies and market impact. Trump is not a laissez-faire politician; instead, he is an active economic interventionist who advocates for lower taxes, trade protectionism, and increased infrastructure spending. Overall, these policies benefited investors through most of his first term, though the positive momentum was disrupted by the onset of the Covid crisis in 2020. Specifically, one such risk is the ongoing debate over tariffs. While moderate tariff rates do not typically have a significant impact on economic growth, an extreme scenario—such as imposing 60% tariffs on all Chinese imports—could have more meaningful consequences for markets. Kamala Harris’ economic agenda remains extremely vague and capricious, which is a concern for investors. We can assume that her economic agenda will be similar to that of Joe Biden, but we do not fully know.

The tax cuts enacted under the Tax Cuts and Job Act of 2017 are scheduled to sunset in 2025. For individual taxpayers, many of the provisions—such as lower income tax rates, increased standard deductions, and limits on state and local tax deductions—are set to revert to pre-2017 levels. The corporate tax rate reduction, which lowered the rate from 35% to 21%, was made permanent under the TCJA and is not subject to the sunsetting provisions. Corporate tax rates are an area of concern, with candidates proposing vastly different policies. Kamala Harris has suggested raising the corporate tax rate from 21% to 28%, while Donald Trump advocates for a further reduction to 15%. These changes could impact S&P 500 earnings growth by 5-10 percentage points.

Additionally, the fiscal trajectory of the U.S. remains an area of concern. Both major political parties have run large fiscal deficits in recent years. If this trend continues, particularly under a wave election scenario where one-party controls both the presidency and Congress, U.S. Treasury yields could rise, especially if the economy remains resilient.

Another political risk involves the independence of the Federal Reserve. Historically, Fed Chairs have faced pressure from presidents to keep interest rates low. Fed Chair Jerome Powell’s term is set to expire in 2026, and his potential reappointment will be closely watched. An appointment that raises questions about the Fed’s independence could unsettle markets by de-anchoring inflation expectations and causing a steepening of the Treasury yield curve.

Outlook for Investment Markets

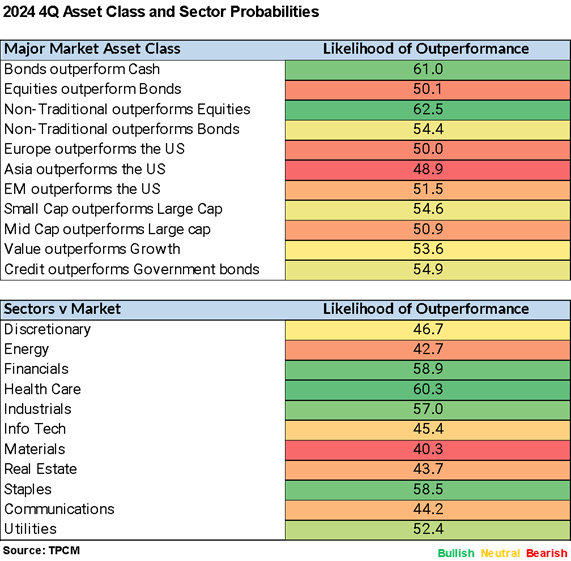

Given the above, we believe the fundamental environment is still generally positive for investors, but we need to determine where investments will be best compensated considering relative valuations and growth potential. Will down capitalization and international markets continue to outperform, or will large cap growth companies resume their long-term trend of above average returns?

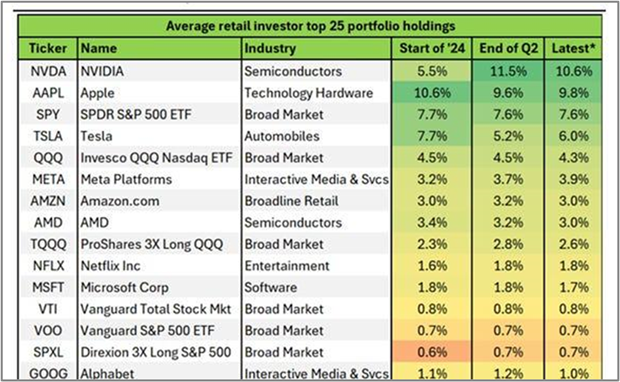

Despite a slowing economy, we continue to broadly favor stocks over bonds, as the probability of a recession remains low. While we anticipate minimal long-term impacts from the upcoming election, we believe the growing role of artificial intelligence will have a sustained positive effect on economic growth. The Federal Reserve has initiated an easing cycle, which is expected to support risk assets and enhance the appeal of equities over fixed income investments. Additionally, we believe the rotation away from large-cap growth stocks will persist, with improving fundamentals and a valuation gap favoring value stocks and smaller-cap equities in the U.S. Investors remain very overweight growth equities, particularly the mega cap, well known franchises.

Source: Vanda Research

Source: Vanda Research

International markets, particularly in Europe and Asia, also present increasingly attractive opportunities due to their relatively inexpensive valuations. A weakening dollar is likely to provide a tailwind to foreign markets, and China’s recent stimulus measures should offer an additional catalyst. While we plan to allocate more funds to foreign markets, our primary focus will remain on the U.S.

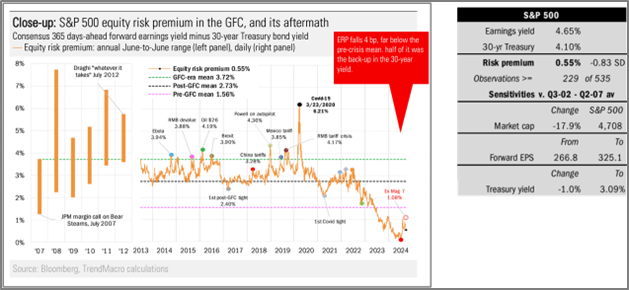

In the fixed income space, we saw a sharp rally in the third quarter as the market discounted the change in monetary policy. Yet when comparing equity valuation to bond valuation through the equity risk premium, S&P 500 stocks are rich and bonds are inexpensive. Understanding that, we continue to favor shorter-duration bonds and corporate credit over government bonds, as these sectors are better positioned to perform in the current environment.

Conclusion: Private Initiatives over Politics

The overarching feature of the US economy is its resilience and ability to adjust quickly to changing dynamics and risks. We believe that the outcome of the election next month will again prove that to be accurate, particularly in the likely event of a split government. Yet the increasing adoption of artificial intelligence in the home and workplace is a long lasting phenomena which is still in its very early stages. Adoption and efficacy will only increase and we believe will continue the virtual cycle of technologically driven productivity enhancements which drive earnings and stock prices higher.

Source: YCharts, TPCM

Source: YCharts, TPCM

Much will be made of the election, the personalities of the candidates and potential changes in policies. In the meantime, private US business decision makers will plow ahead, making decisions to improve productivity and earnings and we believe that is where investors should focus.

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. TPCM does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio.

Investment advice is offered through Fortis Capital Advisors, LLC, 7301 Mission Road, Suite 623, Prairie Village, KS 66208

Recent Comments