After encouraging economic signs throughout the first seven months of 2023, where inflation exceeded expectations to the downside and growth exceeded expectations to the upside, investment markets took a sharp turn downwards in August and September. The primary culprit for this drawdown remains the same one which we’ve struggled with for over two years…interest rate volatility. Despite a good start, market returns finished the quarter sharply lower with both broad equity and bond indices falling between 3% and 4%. A notable underperformer over the period were long term US Treasury bonds with a 13% decline!

Yet, the cause of this rate volatility seems to be shifting from purely inflation increases and monetary policy tightening, like we saw throughout 2022, to the lag effects of the rate increases and its impact on banks, credit, real estate etc. Fundamental cracks are certainly materializing in the consumer and corporate markets. Regional banks remain a problem and commercial real estate is structurally challenged. Not new concerns at all (see March regional bank crisis) as bears have been forecasting a non-occurring recession for over a year. Yet the cumulative impact is increasingly challenging to markets on a going forward basis.

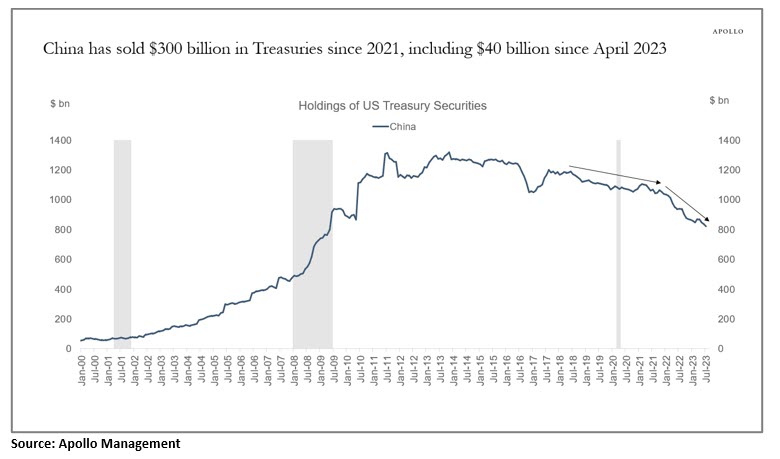

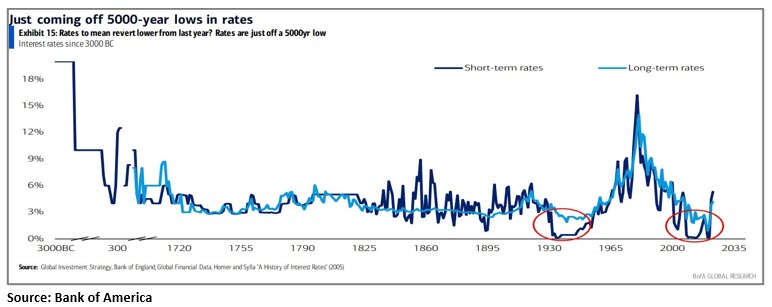

Additionally, investors are increasingly focused on US fiscal policy and its secular impact on interest rates. Washington has been excessively spending for over 30 years but what has gone on since the “debt ceiling” deal of May has been extraordinary. Another government shutdown threat, Federal debt at 120% of GDP, a growing US Treasury issuance calendar and annual interest expense which is now projected to exceed $1 trillion. What this all means for the bond market is that global bond investors are now repricing what the cost of interest should be for a heavily indebted country. For example, Jamie Dimon has recently publicly pondered an environment with 7% interest rates. The benefits of being the world’s reserve currency are substantial and widespread and will likely prevent any sort of crash in bonds. Yet markets are priced at the margin and investors continue to reprice Treasury rates higher with long rates moving the most over the quarter as the yield curve steepened by 75bps over the past three months.

On a going forward basis, we evaluate eight key economic and market variables and going into the fourth quarter our fundamental viewpoint is decidedly mixed.

4Q23 Economic and Investment Drivers

| Driver | Condition | Commentary | |

|---|---|---|---|

| Real Economic Growth | Stable | US economic growth trajectory has remained resilient despite ever tightening monetary policy. Yet growth expectations are falling. Several warning signs exist, notably rising rates and an inverted yield curve. | |

| Inflation | Falling | Over the past year, inflation has improved across virtually every metric and now is approaching the Fed's target of 2% Core PCE. Improvements should continue, yet future declines will be less pronounced. | |

| Real Interest Rates | Falling | As the Fed has raised rates and inflation has improved, real interest rates are now at very high levels. Slowing growth combined with future falling inflation argues for falling real rates on a going forward basis. | |

| US Dollar F/X Value | Rising | In the zero sum game of currencies, the dollar remains king relative to the rest of the world as growth prospects overseas have diminished and Europe, China and Japan additionally struggle with their own debt issues. | |

| Taxes & Regulations | Rising | Since passing the Fiscal Responsibility Act in May, D.C. politicians have added $1 trillion to the Federal Debt putting further upward pressure on interest rates. | |

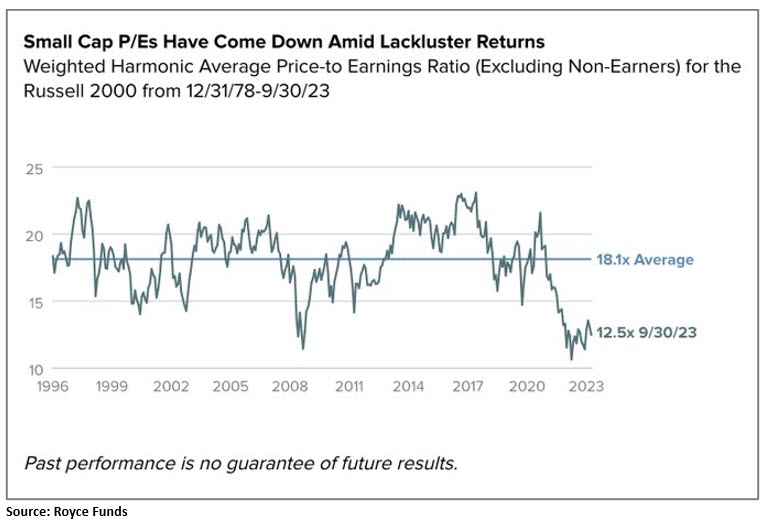

| P/E Ratios | Falling | S&P 500 earnings have rebounded from early 2023 lows and now are near cycle highs. Further increases will likely moderate and valuations remain full. Small caps and other market segments trade at meaningful discounts. | |

| Fixed Income Risk Premium | Stable | High yield spreads have tightened throughout 2023 reflecting overall economic resilience and strong corporate balance sheets. Increasing signs of fundamental credit stress will act as a headwind and likely prevent further tightening. | |

| Volatility | Rising | Volatility has increased modestly from cycle lows and will grind higher if economic and market conditions deteriorate. | |

| Source: TPCM | Bullish | Neutral | Bearish |

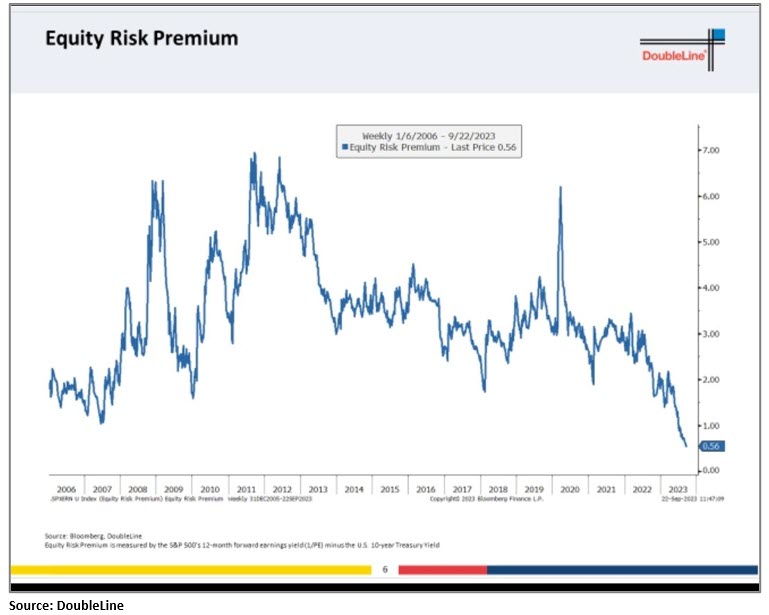

The back up in interest rates and a more challenging earnings environment have pushed the equity risk premium for the S&P 500 to its lowest level in over 15 years possibly indicating a more attractive valuation and favorable environment to purchase bonds today relative to equities.

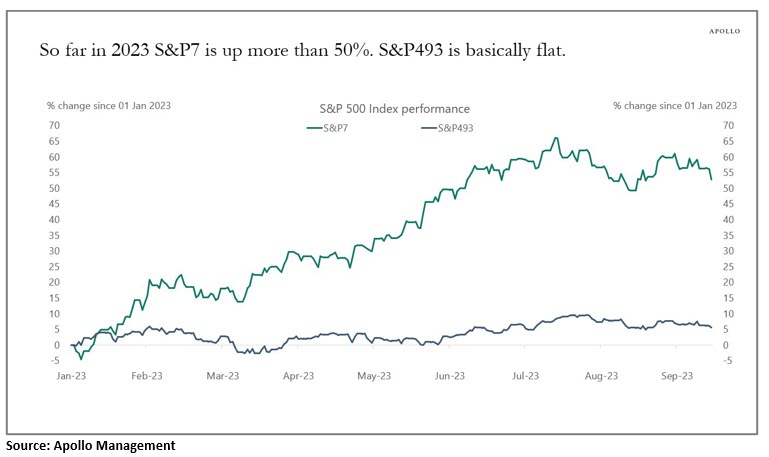

General equity market risk increased over the past two months yet over the course of this year the bifurcated nature of returns has additionally been a risk factor. Mega cap growth companies (S&P 7: AAPL, MSFT, GOOG, AMZN, NVDA, TSLA, META) have sharply outperformed everything else reflecting increasing risk on the capital starved and debt hungry. The common feature among these 7 large cap growth companies is their strong financial condition and modest reliance on borrowing as a source of capital. Conversely small cap stocks, for example, typically rely heavily on borrowing, particularly bank borrowing. So, rate volatility rears its ugly head again and is a major contributor why small caps have sharply underperformed since the regional bank crisis in March.

Given this outperformance, large valuation discrepancies have developed. More so than in other periods, when someone says, “The market is rich” you need to ask “Which market?”

While it is true that the S&P 500 trades at a full multiple at roughly 18.5x forward earnings, it is almost entirely driven again by the S&P 7, which trade at a very full 26x. The remainder of the index trades at a more modest 16.5x. The evaluation is more pronounced when looking down cap, where small cap stocks have already priced in a fair amount of bad news and are now trading at levels which reflect extreme economic weakness.

Valuation is always tricky and not as blunt of an indicator as these charts may indicate. Nuances exist and need to be considered. For example, in addition to being debt reliant, the small cap index (S&P 600) is comprised roughly of 16% in financials with a large component of struggling regional banks. This has obviously impacted the recent return trends as well as valuation metrics.

Timing is also difficult as many have seen these valuation discrepancies months ago only to see performance trends become more intensified. Yet at the extremes these valuation spreads need to be considered and may be the driver of excess returns going forward.

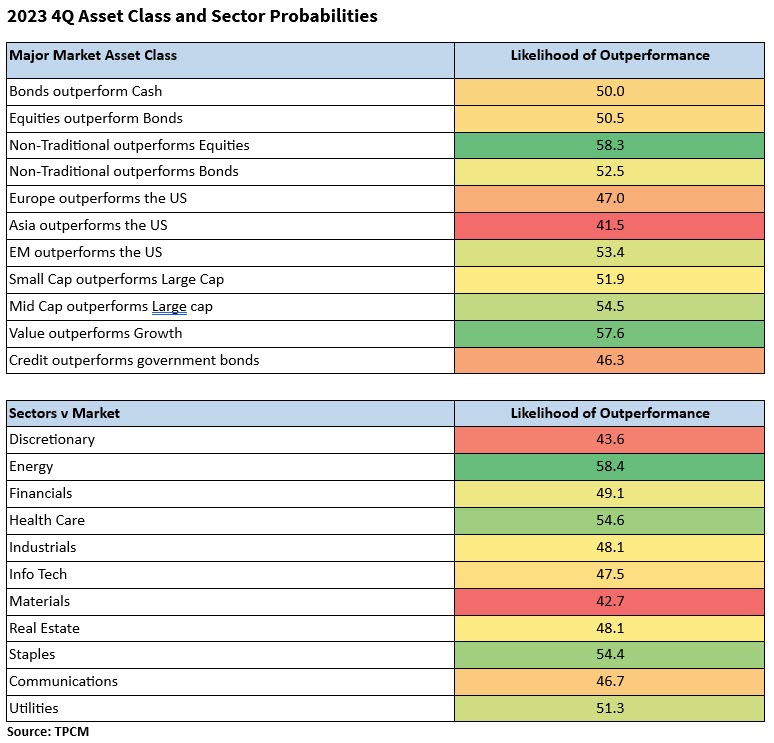

Given all of the above, our viewpoints on specific asset classes has become somewhat more defensive and more modestly skewed towards bonds and more defensive sectors. Small and mid-cap stocks are cheap and should be overweighted within equities. International stocks are also cheap, but we have become less optimistic due to growing overseas economic weakness and a strong dollar. As large cap growth is very expensive, value appears more attractive to us, specifically energy stocks. Also, health care and interest rate sensitive utilities should be considered.

As we started this discussion, much of the global investment markets’ pathways will be determined by the continued normalization of interest rates from historically low levels.

Over the near term, markets may be oversold and could experience a fourth quarter bounce. Yet over the longer term, the relative value of equites and other investments will be rationally determined by a premium over the risk-free rate. The greatest feature of the American capitalist system is our collective ability to quickly reprice risks and operate within a new regime. We are experiencing that now as interest rates get repriced to a more normal level relative to history and the current economic environment. Re-pricings can be painful, yet the economy and markets have survived and thrived in various different rate regimes, and we continue to believe that will be the case going forward.

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments