The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin.

The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

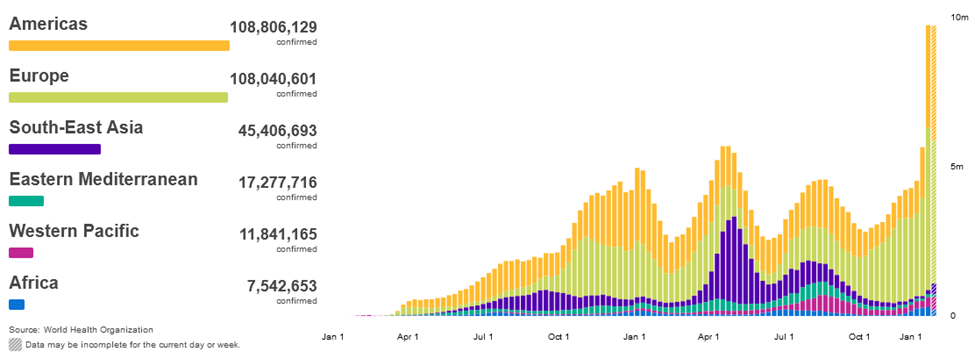

World Health Organization Coronavirus Monitor – Cases

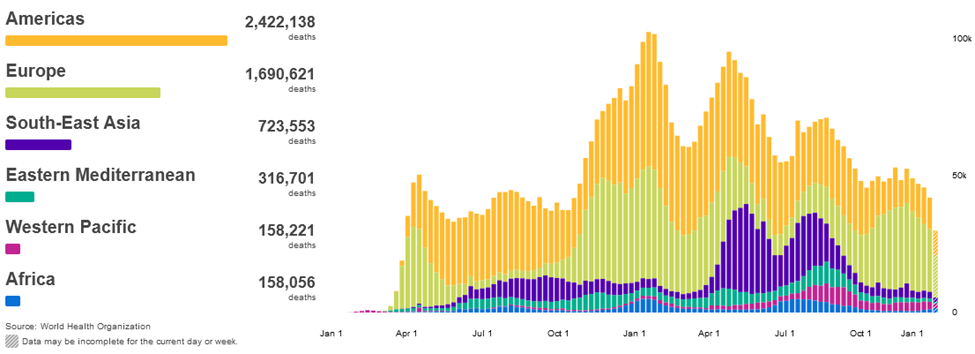

World Health Organization Coronavirus Monitor – Deaths

Happy New Year! Yes, we are talking about Covid – we promise to be quick!

- If you didn’t get the Omicron variant this past holiday period, you are one of the lucky few!

- Omicron cases continue to increase in the US and EU surpassing prior peak levels

- Deaths are down from peak levels, but Omicron transmissibility is impacting economic activity

- CDC adapting to Omicron by altering quarantine protocol to return infected workers to jobs

- Impact being felt on airlines, schools, return to work scenarios, conference schedules, etc.

- Google Trends US search volume for “omicron” began early December, peaked late December

- ~ 63% of US citizens now double vax’d; 60 mln US citizens have been infected past 2 years

- What is herd immunity level? Unsure, but the number goes higher as transmissibility increases

- South Africa experience of cases peaking 4-6 weeks out implies mid-January US case decline

- Trend Macro Social Distancing Index is at Covid-era low, people are moving on with lives

- Per our quarterly outlook, we expect slowing of cases going forward which should provide more positive economic backdrop

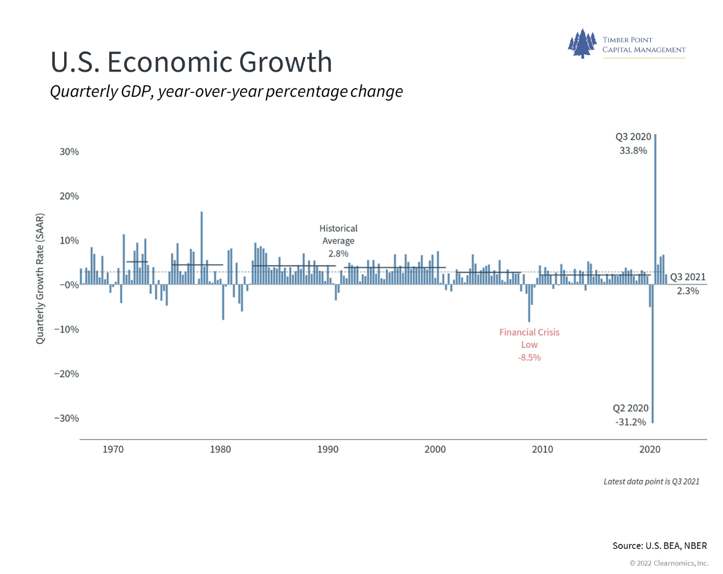

4Q21 economic growth forecasts for US have been impacted by Omicron

- Atlanta Fed GDPNow estimate of 6.7% as of 1/6/22, down from 9% level in early December

- Blue Chip Economic indicator consensus now at 6%, has ticked a bit higher over the past month

- Covid recovery impact diminishing as cycle past first year extreme containment measures

- FactSet showing greatest number of negative EPS estimate revisions since 2Q20, based on the 20% of companies that have pre-announced thus far

- We expect Omicron to subside and supply chain constraints to improve, aiding the economy

- However, based on policies in place is it reasonable to assume greater LT growth than last 20 years? No.

- Medium term, we expect economic growth to return to 2%-ish level, maybe a tad higher in 2022

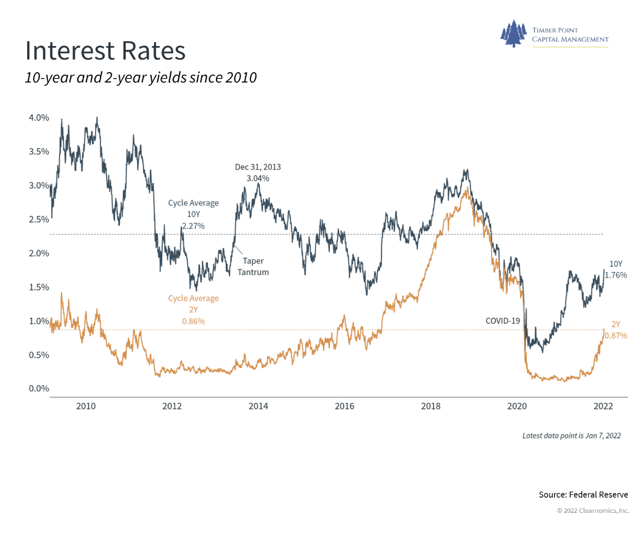

Fed minutes trigger market fall and backup in yields to start 2022…

- Surprised by quickness and pace of move with bond market (AGG) down 150 bps to start year

- Fed minutes spooked investors with expressed desire to accelerate Fed Funds hikes into March

- Fed already noted desire to accelerate open market purchases to normalize balance sheet

- Are inflation headwinds worrying the Fed or is Fed seeking flexibility in balance sheet for future op’s – we believe it is more the latter

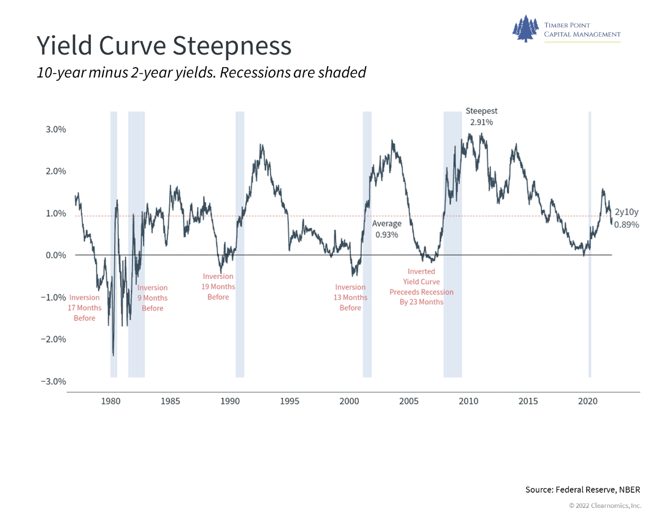

- Yield curve is steepening, but “belly” of the curve, 2’s vs. 10’s, has been flattening

- Both the 10-year note and 30-year bond rate moves have been meaningful and total returns sharply negative

- We expect yields to move higher but not alarmingly so…ongoing supply-side shocks could mitigate the pace and ultimate level as will low global yields

- TPCM has maintained underweights in fixed income broadly and low risk levels in what we own

- Our preference is to utilize alternatives as diversification tools to traditional market risks

Market rotation has been aggressive out of “growth” and into “value” names…

- Fundamentals have not really changed but willingness to pay valuations have

- What has changed is pace of Fed policy related to rate increases and tapering of balance sheet

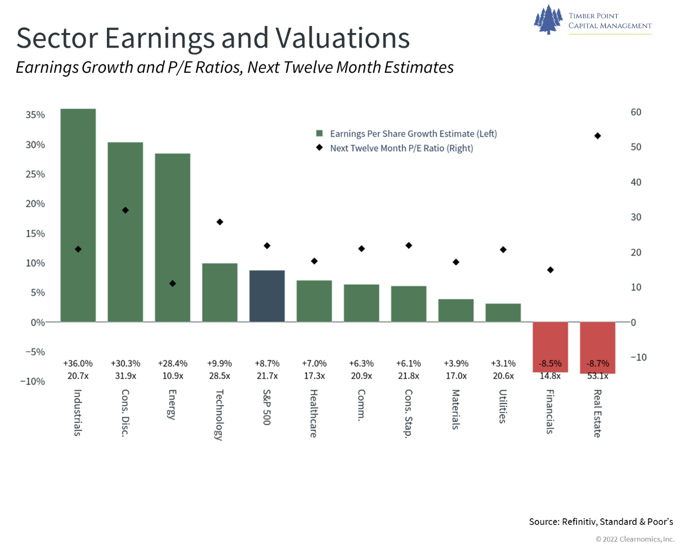

- Interesting that Consumer Discretionary now has higher valuation (P/E) than technology

- Industrials, Technology and Energy estimated to grow 3x the rate of other sectors

- What the chart above leaves out is Return on Capital (ROC) metrics…is highest in technology

- In rising rate regime, will income proxies of staples, utes and REIT’s continue to outperform…

- Investors will be keenly tuned into 4Q eps releases and commentary, we expect conservatism

- Start of year it is always different this time – time for value, int’l/EM will outperform, etc. – we are skeptical

- Cyclicals are priced dearly vs. historical metrics – case in point Deere (DE) – perhaps we don’t understand the TAM expansion based on autonomous tractors

- If economic growth moderates, secular growth should be more valuable – we see oppty’s developing

Recent Comments