The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

Equity market action more of the same…reaching point of max fear?

- SPX and Nasdaq have worst week since March ’20, risk off theme continues

- Growth and value factors both down; Financials down, even Energy trades off

- Hawkish Fed results in 10-yr yield breakout above resistance at ~ 1.80%

- Quantitative tightening now speculated, on top of known rate cuts and tapering

- Fed’s January two-day policy meeting starts Tuesday – look for clues on interest rate hikes – how much and when…

- Earnings season has begun – pandemic darlings, NFLX and PTON, are hit hard on slowing growth fears

- Weakness spreads beyond technology – CSX and PPG decline after flagging margin uncertainty due to higher input prices

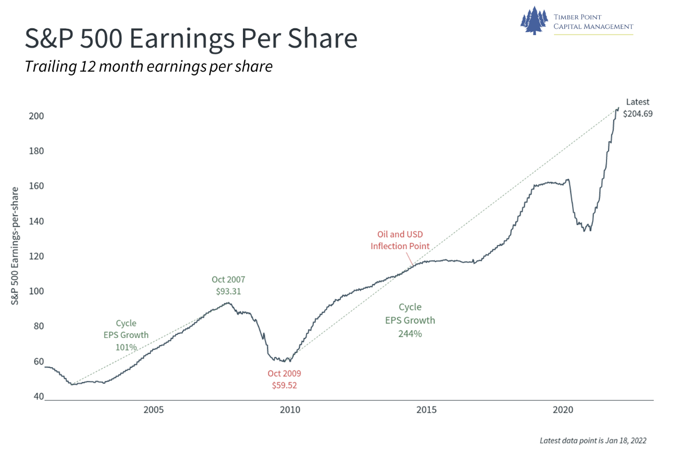

- 4Q21 SPX 500 consensus earnings growth estimate is 21.4% y/y…

- Last six quarters consensus estimates beaten by 18.4 percent points (Factset) -implies eps growth of ~ 40%!

- 2022 SPX 500 eps estimate of $225 implies 19.5x earnings multiple

- Sentiment indicators suggesting that near-term bottom may be approaching – CBOE Put/Call ratio, % Bull-Bear spread, AAII Investor Sentiment Survey

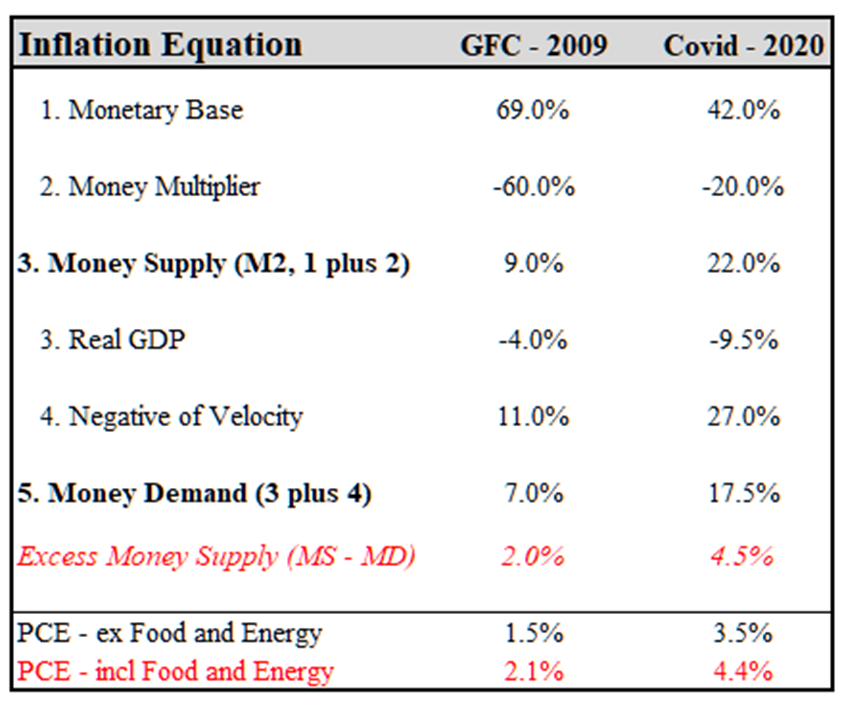

Victor’s “Inflation Equation” is just about spot on…what next for inflation?

- Monetary equilibrium requires demand and supply to be in balance

- If not, a price adjustment is needed – either inflation or deflation

- Components of money supply are the monetary base AND money multiplier

- Too many are focused just on the monetary base, net effect is important

- When money supply growth exceeds money demand, there is inflation

- PCE inflation, the Fed’s measure of inflation, is explained during GFC and Covid

- Velocity of money has collapsed; the Fed does not control that – is based on consumer expectations and opportunity cost

- If velocity starts rising, Fed could be in trouble as this would spike inflation – would require an effort to reduce monetary base to offset

- Though the Fed has zero experience in reducing its balance sheet…zero.

- Supply disruption has impacted inflation beyond what the model explains

- Our base case is that inflation figures will subside, we don’t believe economy can sustain four rate increases in ’22 as estimates currently call for

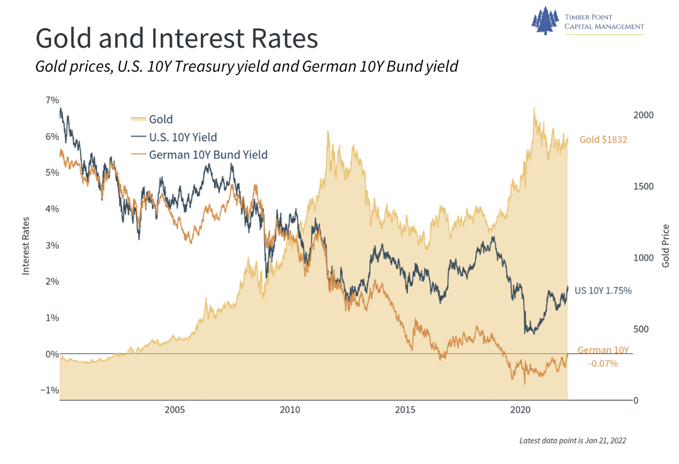

Gold and Silver – impacted by declining negative real rates?

- Gold and silver prices peaked in August ’20, ex a quick silver spike in March ‘21

- Real Treasury yields (nominal 10-year yield less inflation expectations) have spiked toward positive territory as treasury yields rise

- Typically, this would imply further downside for precious metal prices

- However, charts for both are now butting up against medium term resistance

- Why would this be? Perhaps the market is sniffing out the Fed can’t be as hawkish as it is telegraphing

- Market expectations for Fed action are likely at maximum pain point with all observers on one side of the boat

- We are long gold and are considering silver in TPCM’s alternatives sleeve

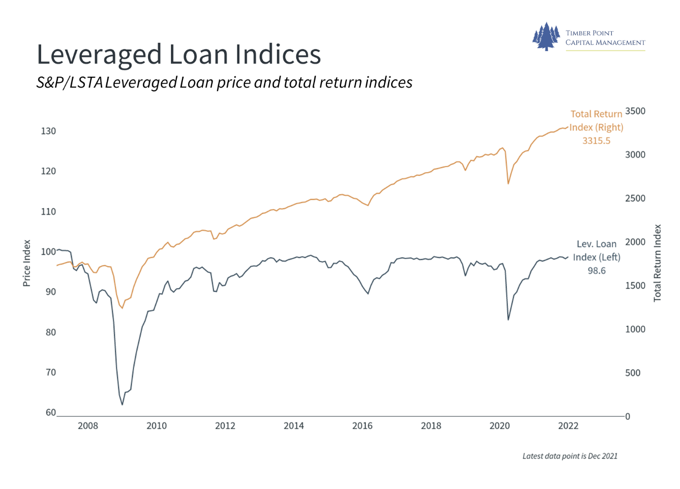

Credit issues next shoe to fall? Where will bad debt surface first?

- SEC may be fighting the last war, bank balance sheets are in great shape

- We have seen dislocations before – GFC, 2015 (crude), and Covid-19 pandemic

- Growth in private credit, i.e., non-bank credit, continues to gain share

- Private equity, hedge funds, BDC’s and even insurance companies seeking yield

- Weak rating agencies are propping up BDC lending, will it come home to roost?

- If economy slows and rating paradigms change, private credit could dislocate

- Insurance industry accesses private credit funds for diversification and yield

- Regulators (NAIC) lack transparency into non-traditional assets that may not have traditional bond-like risk

- Examples are recent music library sales – insurance co’s gobbling them up

- Prices paid are a function of media rights, NFT’s and intangibles = good collateral?

- Regulators are struggling to keep up; non-banks don’t have a regulator…

- This is something to be aware of, not suggesting imminent danger exists

Recent Comments