The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

CPI and PPI reports…rinse and repeat, Fed still full steam ahead…

- Powell will continue to pursue his Volcker-esque legacy, governors continue to jawbone

- No pivot in near term, investors waiting on smaller hikes to signal progress being made

- Fed is focused on Personal Consumption Expenditures index, next release on 10/28

- Next Fed meeting starts 11/2, expect continued hawkish rhetoric into the meeting

- Price action post CPI announcement a function of short covering – don’t read too much into it

- Employment remains strong which provides cover for the Fed to be hawkish, IUC’s are stable

- Good news: NY Fed Global Supply Chain index fell for 5th consecutive month

- Bad news: Atlanta Fed Wage Growth Tracker has declined only one month (Sept) in 2022

- Interesting: WWide Semiconductor billings have been down the past two months…this is first August over July monthly decline since 2001 (SIA Global Billings History)

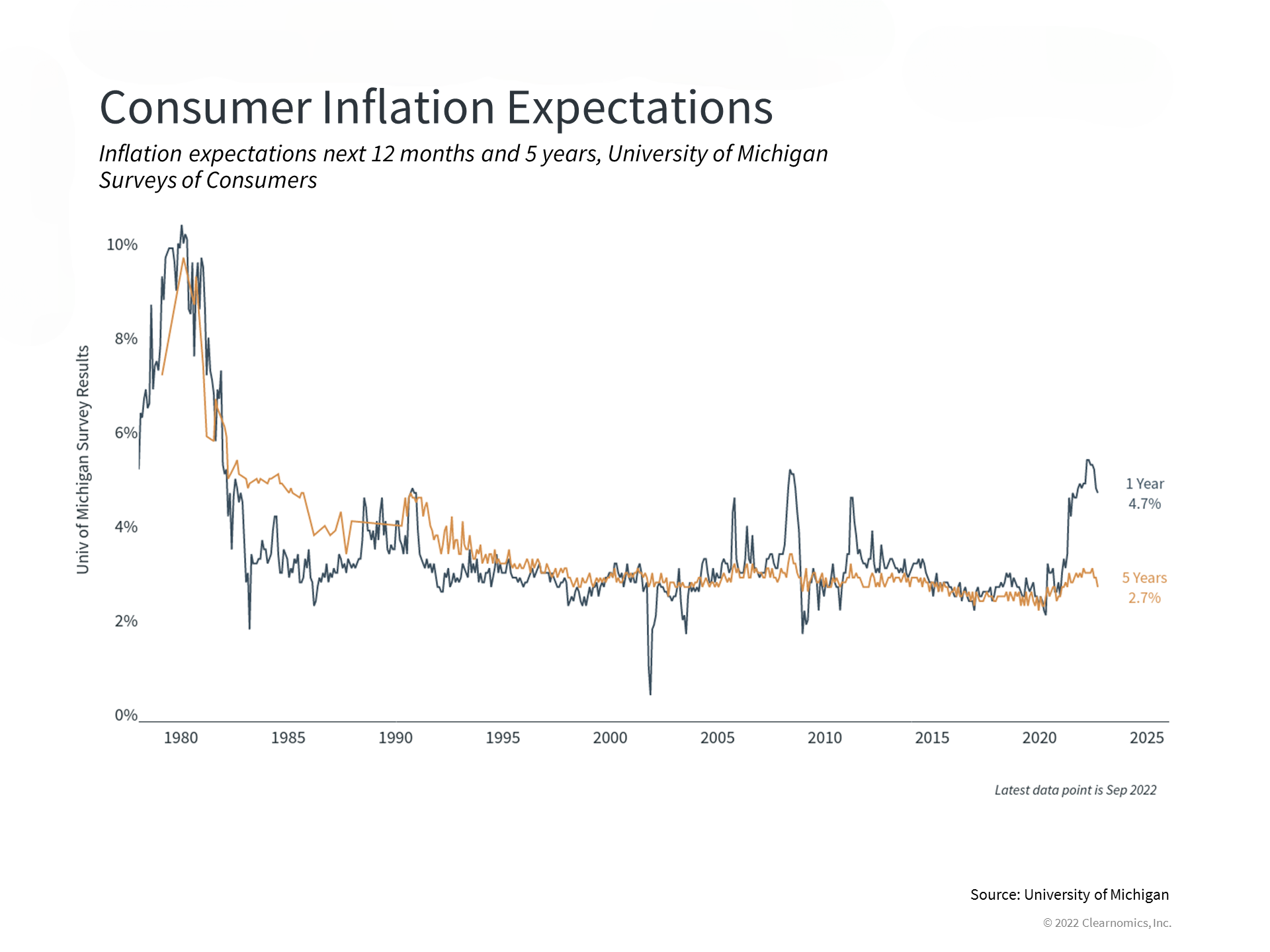

- 1 Year and 5 Year inflation expectations have receded to sub 5% and 3%, respectively, over past few weeks

Is the Fed in danger of breaking things overseas?

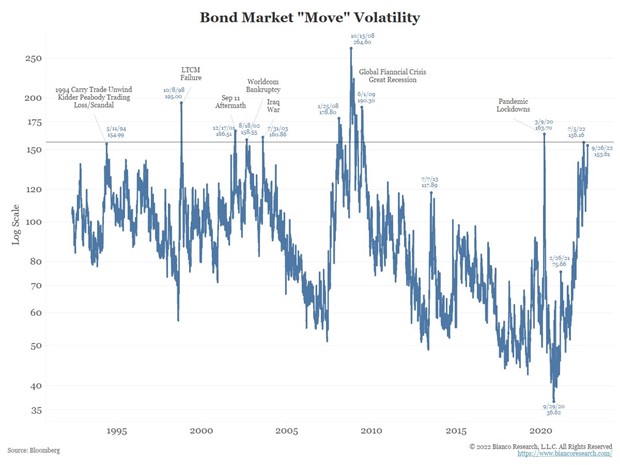

- Bond market volatility is certainly elevated but not yet at LTCM, GFC or Covid lockdown levels

- However, complications in overseas bond markets becoming evident, and are troublesome

- Stable and functioning bond markets necessary for investor confidence and ongoing financing

- Hawkish Fed means ROW needs to mirror US game plan or risk currency devaluation

- The Japanese bond market certainly isn’t global, but liquidity has dried up markedly

- BOJ has noted that it may need to take action to maintain “yield curve control”

- UK gilt market reacted negatively to tax reductions that would increase government deficits

- UK pension plans were levered and caught in selloff…until BOE bailed them out with purchases

- European energy crisis crimping economic growth, GDP gains of .6% in 1Q/2Q 2022 makes it difficult to mimic US with a cold winter in store…

- Investors still not afraid of default risk – Japan/Germany 5 year CDS at sub 30bps, Italy at 175bps

- The Fed says they are aware of global knock-on effects from hawkishness…remains to be seen

Can a bull case be made for US equity markets…what could happen?

- Mid-term elections may allow Senate to flip Republican and gridlock ensues

- Earnings hold up into 2023, valuation at ~15x will be interesting…earnings season starts NOW!

- Investor and consumer sentiment readings at multi-year lows – bad news largely discounted?

- Ukraine continues to gain back territory and China/India further isolate Putin

- US economy enters slow growth mode with declining inflation…a benefit for US small/mid caps

- We have exited recession according to Atlanta GDPNow (above)…after 1Q/2Q GDP declines

- Volatility near levels that have triggered rallies throughout 2022, > 32 handle

- Supply chain dynamics are improving which should help the Fed in its inflation fight

- Housing prices are beginning to decline which should help lessen rental rate increases in inflation readings

- Levels of insider selling are at levels (low) where prior rallies have been seen (8/02, 3/09, 12/18)

- When there appears to be no true bull case that is typically the best time to be buying…

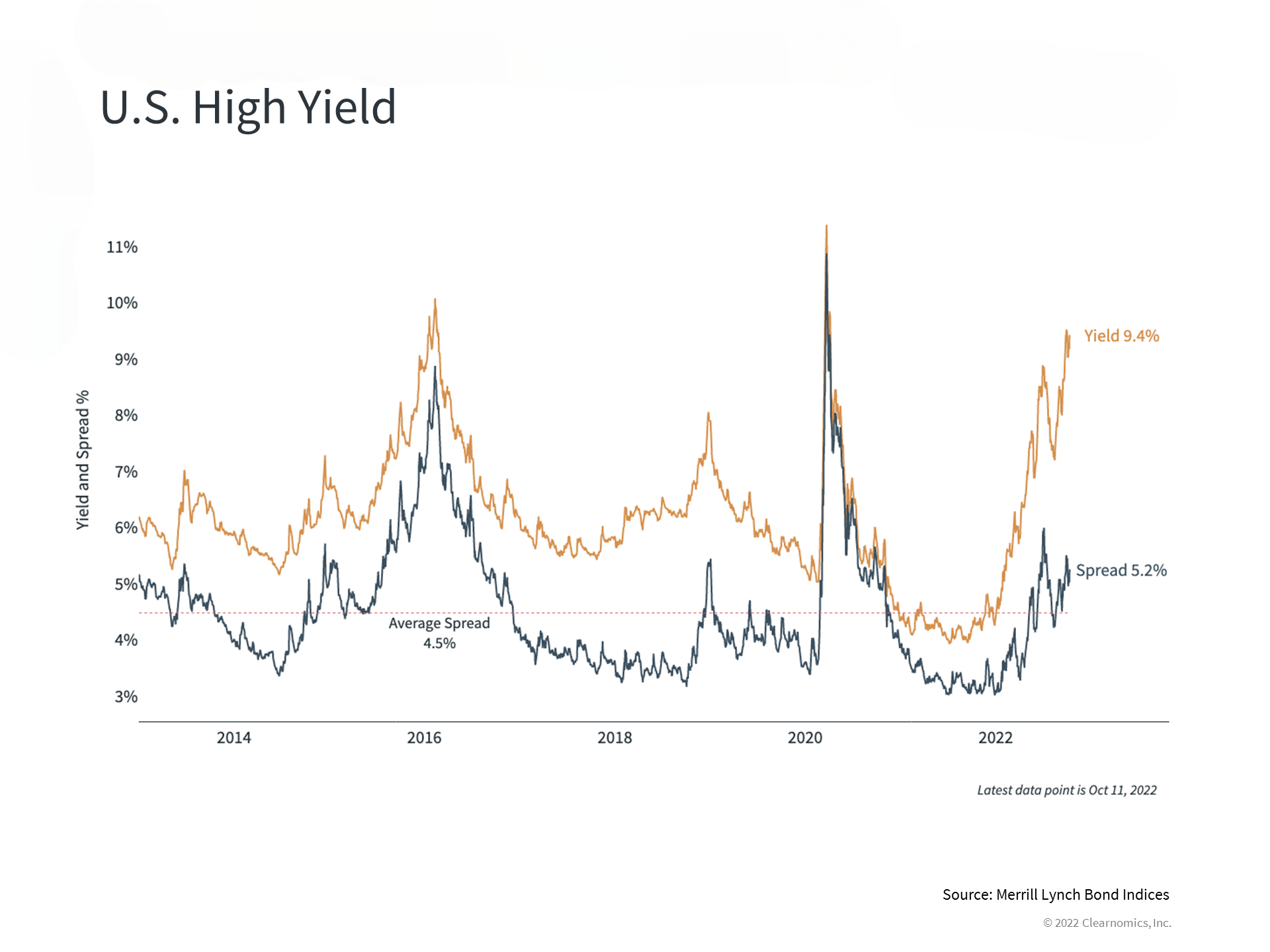

High Yield asset class is attractive…IF economy not going into recession…

- Tweener asset class…bonds with equity mkt risk….has turned to recent outperformer

- Yields are compelling at 9%+, spreads vs. Treasuries have doubled in 2022

- Past spreads > the current 500+ bps? 2016 was energy distress related, 2020 was Covid-19 panic

- Over past 25 years, have only seen yields higher post Y2K and during GFC…

- IF economy is slow grower plus some level of inflation = should drive nominal revenue growth

- Debt levels will be supported, most companies have used ZIRP to refinance and term out debt

- Defaults are not currently increasing and are at low levels

- Obama era HY did very well – though benefitted from recovery from blow out spreads post GFC

- If economy rolls over, then all bets are off…but market appears to have already discounted a mild recession here…

IMPORTANT DISCLOSURES The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s’ opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor. This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments