The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

Why the recent market rally? A host of reasons…

- Because this is what bear markets do…create enthusiasm and then fail…could be #1 reason

- Atlanta GDPNow showing growth in 3Q22…led by net exports and gov’t, offset by residential investment

- Atlanta Fed “sticky inflation” measure receding…positive for future inflation readings…?

- PredictIt shows Republicans gaining ground in mid-terms, especially in the Senate…

- Fed “pause” on horizon? Perhaps Nov 1st is last 75 bps hike…fwiw, this is a pause, not a pivot

- Citi Economic Surprise Index is surprising us…aggregate economic data better than estimated

- Earnings…so far, so good, still early…again, expectations game has been ratcheted down

- Seasonality – 4Q is typically seasonally strong, especially in election year…and begins seasonally strong period

- Sentiment measures remain low…investors could be “offsides” with positioning

- Valuations are cheap…perhaps. Earnings estimates need to be confirmed with 3Q22 reports

- USD may be peaking…Fed “pause” post Nov meeting could see USD come off the boil helping international sales

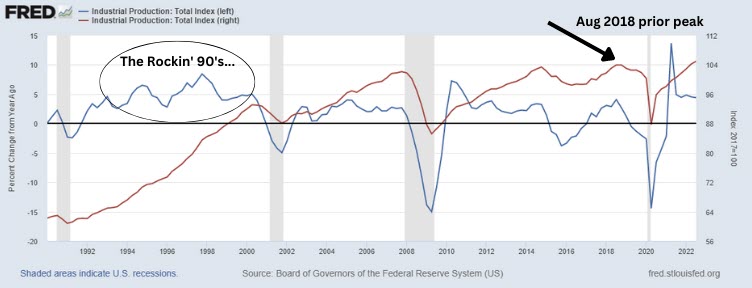

Industrial production (IP) index is hanging in there…

- September figures were up 5.3% y/y and up 1% from prior peak in August 2018

- IP measures manufacturing, mining, electric and gas utility activity vs. base year in 2017

- Construction supplies largest gain, up 1.1% m/m; business supplies the only decliner, down .2%

- Consumer goods output up .6% m/m in Sept…but down .6% on annual rate vs. up 3.1% in 2Q

- Overall, fairly remarkable given strength of USD…speaks to ongoing US competitiveness vs. ROW

- 5% growth is deceleration from unsustainably high pandemic fueled levels

- Prior two decades rarely saw 5% growth levels, though the 90’s did see fairly sustained 5% growth levels

- European energy/inflation issues and China zero covid policies not impacting numbers…strange

- Is re-shoring for real? We believe yes but cannot be helping IP so soon

- Are ramping military expenditures for Ukraine being caught in the IP number to help sustain…?

- Consumption activity still 66% of US GDP but industrial economy activity still important

- XLI (Industrials) acting relatively well in current market, up 10% since recent CPI “whoosh” vs. 7% for SPX

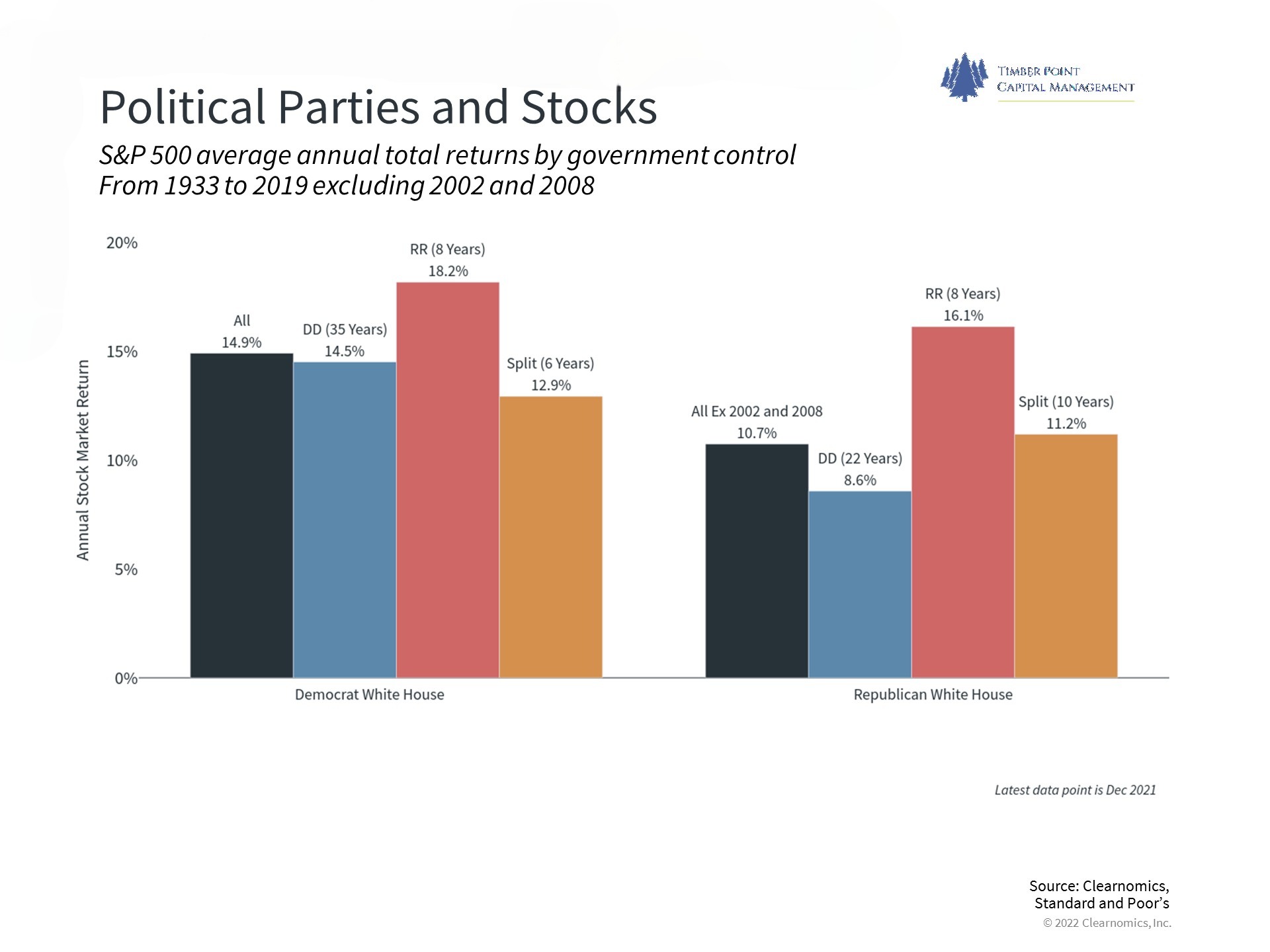

Coincidence that the market started rallying on red wave news…or not…

- Probably not…data shows market does best with Democratic President and Republican Congress

- Market bottomed on 10/13, when the CPI released spooked investors…but turned intra-day…

- PredictIT went to > 50% odds on 10/13 of the Senate going Republican…

- Tightest Senate races will likely boil down to GA, AZ, OH, NV…PA appears to be Oz’s post debate

- Suddenly many “lost” races are now back on the table…look at New Hampshire

- If Senate goes red: the filibuster will remain, no Supreme Court stacking, regulations should ease

- What does Republicans control of Congress portend? Hearings and more hearings…Hunter Biden, Jan 6th, election interference, etc…it goes on and on

- However, Republicans will need to advance an agenda as they look to 2024 Presidential election

- KISS (economy), border security, Ukraine funding, technology transfer to China, increasing incentives for labor force participation

- Power of the purse will be key to slow Biden/progressive agenda…it won’t happen without a fight

- Executive actions will be justified under prior programs, re: student loan forgiveness using Heroes Act

Biden’s energy policy and American energy independence…

- Biden admin appears hell bent on removing fossil fuels from U.S. energy production stream

- Inflation Reduction Act is a subsidy for the renewable energy industry…$400B over 10 years

- U.S. fossil fuels provide 78% of primary energy production; renewables 14% and nuclear 8% (charts link)

- Total fossil fuel production stagnated between 1970 and 2010…then increased by 30% starting in late 2000’s

- Current crude production down 5% from 2019 peak, up marginally versus 2020 and 2021 levels

- Renewables have essentially doubled over the past 40 years…growth led by wind and solar

- Nuclear grew by 33% between 1990 and 2000 but has since stagnated, down as % of production

- The U.S. is an energy exporter of total energy products led by natural gas and petroleum products

- U.S. does import crude oil, less than 5% of current production…has been halved past 15 years

- Biden “transition” period to renewables to be sourced from abroad – Saudi, Venezuela and Iran

- OPEC+ is marching to its own drummer as Saudi and Iran thumbing their noses at the U.S.

- Recent pre-election SPR release could come back to bite the U.S. when it needs to replenish

- Domestic oil/gas producers have heeded the signals from the Admin, are limiting capex/drilling

- Energy shares have been rebounding, we expect oil and natural gas prices to remain firm through 2022

IMPORTANT DISCLOSURES The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s’ opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor. This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments