The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

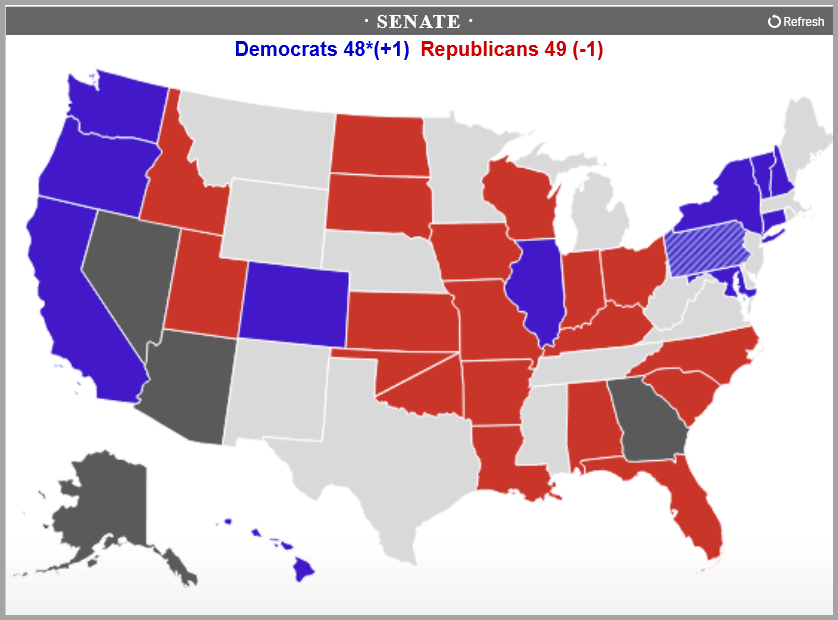

A “red ripple” replaces the wave…GA Senate run-off back in spotlight

- Republicans will be legislating with small House majority; Senate likely stays split with VP vote to Democrats

- Re: House adds…yes, it is small but remember the 2020 election narrowed Dem’s House majority by 13 from 235

- Senate status likely depends on GA runoff…again. Manchin reelection in 2024, will he deal with Biden again?

- Abortion rights passed in all 4 states – unmarried women and the “woke” youth vote fell hard for Dem’s

- ZERO doubt Biden and Dem’s will take this as affirmation economic policies are favored by U.S. citizens = no Clinton pivot

- Is the big loser Trump? GA, PA, AZ, NH Senate candidates underperform…FL and GA governors win while bucking Trump

- DeSantis getting under Trump’s skin…Trump dusts off name calling and smears playbook…2024 will be interesting

- Investment implications…monetary policy will prevail over fiscal policy as legislative agenda slows to a crawl

- Powell has acknowledged lag effect of monetary policy as well as slower pace of rate hikes but still “have some ways to go”…

- Chicago Fed President Evans communicating the same…

- No change in rhetoric on fossil fuels, watch for more executive mandates; tech sector and censorship will be explored

- Will small/mid caps prove to be more immune to the potential for increased government regulations…we think so

- Small caps (IWM) have outperformed large caps (SPY) by 600 bps since mid May…

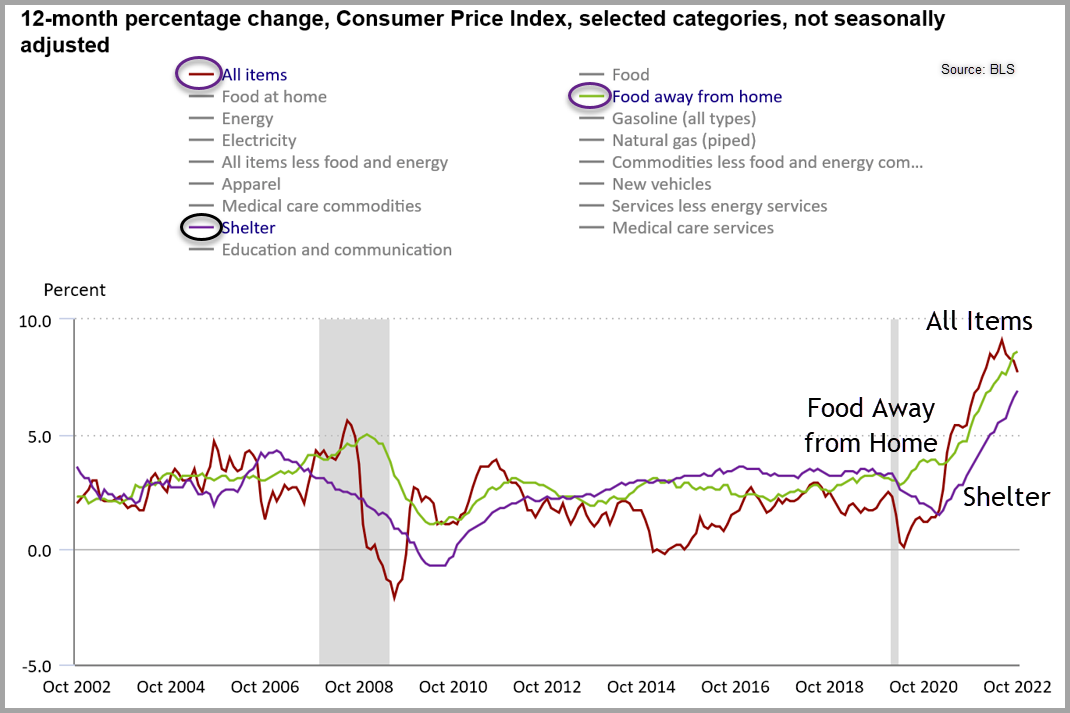

The first signs of inflation cooling driven by…pretty much everything

- 12 month CPI increase at 7.7% y/y in October, lowest increase since 7.5% in January of this year

- On y/y basis, ALL categories above have peaked, albeit some just peaked in October

- EXCEPT for Shelter and Food Away from Home which hit new highs, up 6.9% and 8.6% y/y, respectively

- Shelter includes rent and OER, is 30% of CPI, and food away from home is 6%…both are considered “sticky”, see below thoughts

- We expect rent and OER to plateau near current levels as leases only roll off every year (or so) and thus there is a lag relative to declining household prices

- Still, plateau is positive as price declines in other major categories work to bring down All Items CPI levels – as seen in October

- We wrote a bullish bonds piece in past week that we distributed to clients, click here to read

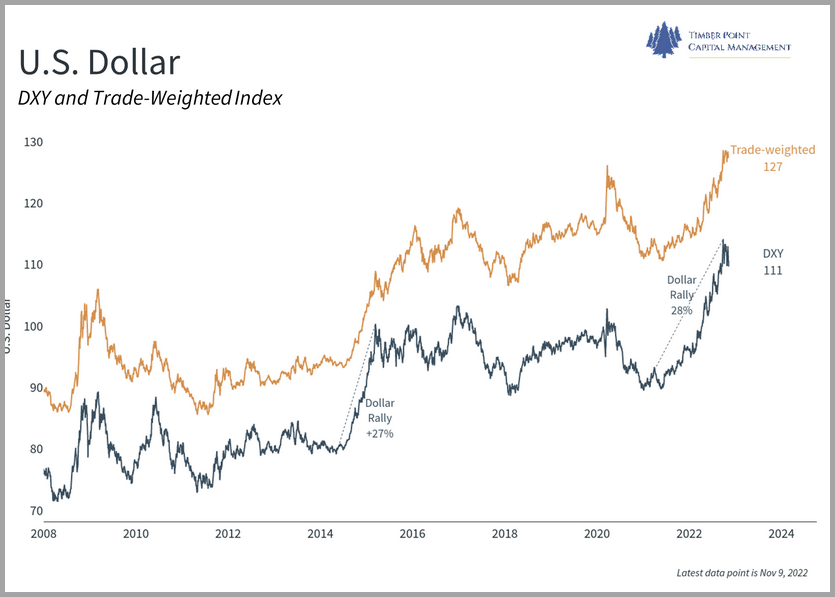

Fed action has impacted the US dollar and international markets… watching the trajectory

- US dollar (DXY) hits multi-decade high of 114 against basket of currencies at end of September

- US Treasury debt has been more appealing to foreign buyers as Fed hikes rates more aggressively than ROW

- Recent dollar decline is further evidence of investor belief that Fed will slow both the pace and extent of rate hikes

- Dollar impact beginning to be felt in US multinational earnings that price in local currencies

- Dollar rise has been a headwind for foreign markets

- Most levered to dollar decline are emerging markets – EM has rallied almost 10% since mid October bottom vs. SPX of 7%

- EM also impacted by China (33% of EEM index) owing to rumors of removing No-Covid policy…ask AAPL

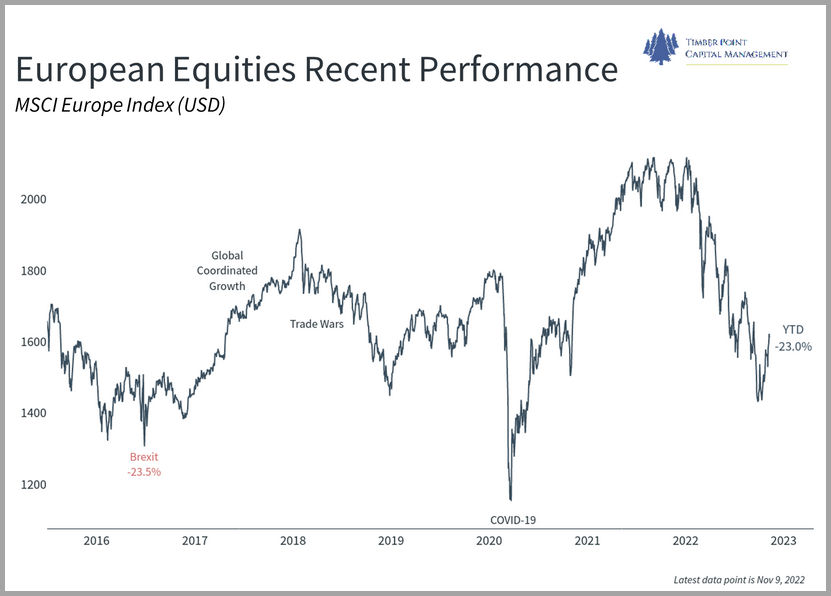

- EU equities have been even stronger performers than EM…energy crisis averted for the time as storage is full…? Ukraine?

- The declining dollar does not have to necessarily spark the commodity trade in a slow growth global economy

- Bottom line – we are watching the dollar very closely as change in trajectory could be tailwind for international markets and a differentiator in portfolio performance

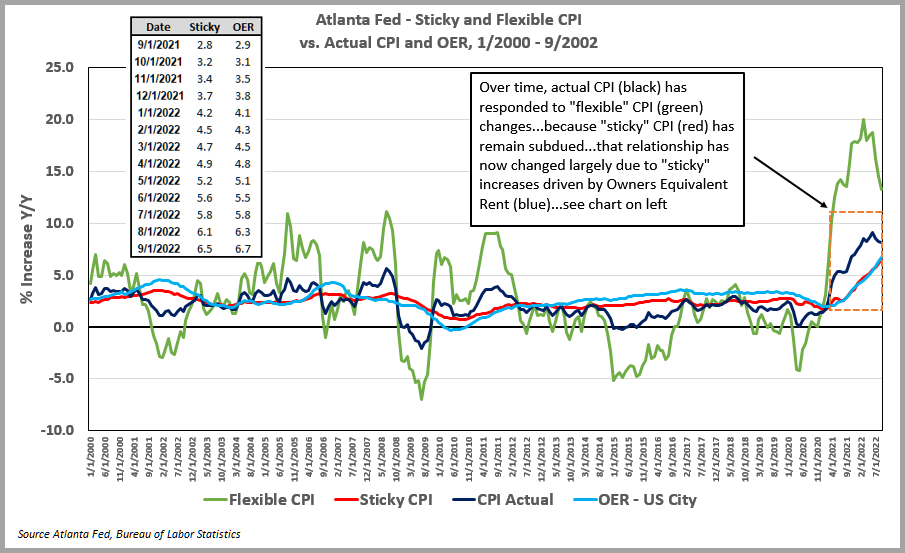

Inflation as “sticky” or “flexible”…right now sticky is in control…watch rent and Owners Equivalent Rent (OER)

- Atlanta Fed breaks down items in the CPI by frequency of price changes…median time used to classify items is 4.3 months

- Price adjustments that are “sticky” take longer than median time to change while “flexible” change in less time

- Why are some prices sticky? Changing prices can involve significant costs thus reducing the incentive to change prices

- 2010 paper (supplemental resource) found that sticky prices incorporate future inflation expectations while flexible prices respond more to economic conditions

- Sticky items include rent, OER, food away from home, recreation…sticky items are ~ 66% of CPI

- Flexible items include new vehicles, gas, motor fuel, lodging away from home, are 33% of CPI

- In the past, actual CPI (black) has moved with flexible CPI (green) as sticky CPI (red) has been subdued

- In past year, we have seen sticky CPI (red) rise to new heights, basically driven by increases in rent and OER which are 50% of sticky CPI calculation

- OER (blue) is covering sticky (red) for past year or so…they have basically moved in tandem (chart on left)

- We know many CPI inputs have fallen yet CPI remains elevated due to rent/OER and food away from home

- Bottom line, we need rent/OER to decline to see meaningful change to overall CPI…OR, need flexible price declines to start to swamp a plateauing OER/shelter which we saw in October release

IMPORTANT DISCLOSURES The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s’ opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor. This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments